This one hits me this morning. We took in 2 foster kids in March (11 & 13) and have been really struggling lately as the honeymoon is fading. The amount of verbal control they try to exert to 'correct' small things we say, especially our 7 year old, affects the mood of the household. I know it is learned behavior and our acceptance is influencing them. But damn, the process of change is exhausting!

Was thinking the same thing. 😮💨

Thank you Satoshi!

Well, you could be like me and slowly start to challenge your own assumption (the absolutism of fossil fuel use needing to end). That maybe with other major shifts, like methane mitigation that people like nostr:npub13lkyycj8s3da6fhndtj0wd6s3s2ahmq86s7wrruvzd4tnc66cgfqn4lpsy talk about, and shifts in consumption due to hard money that people like nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe talk about, we who have taken the burden of worrying can ease up on ourselves a little and see other perspectives such as human flourishing due to the marvels of fossil fuels.

Just food for thought. Cheers!

They don't realize the recession already happened but the government recalibrated the official definition.

Yeah, this one.

Another nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a banger! Such accessible explanations!

All these new ATHs are proof that the Fiat system is owned by the Dollar, but now being accurately measured by Bitcoin.

👀Huh? Did you figure out what they didn't like?

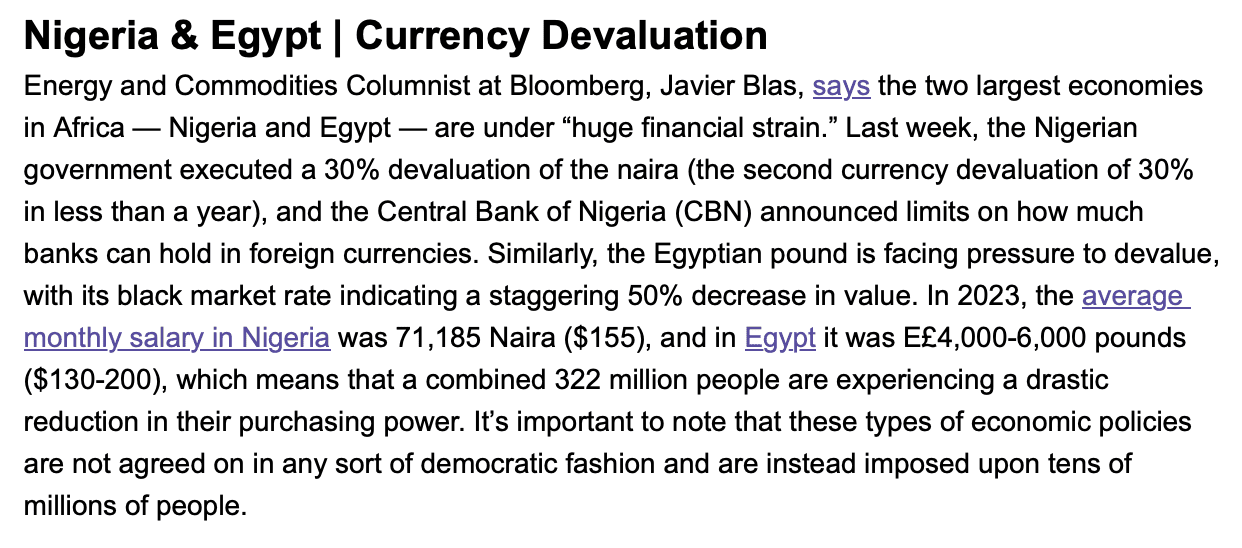

Every week I write HRF’s Financial Freedom Report so you can stay on top of the news affecting people’s financial freedom.

Here’s a sneak peak at what I wrote this week👇 if you find it valuable, consider subscribing here: http://financialfreedomreport.org

So glad to have found this. This topic is what MANY people need to grasp the importance of Bitcoin.

And a shit-ton in Pac NW. Oh well, not gonna help them.

This is the one I was eyeballing a few days ago:

https://kalispell.craigslist.org/cto/d/kalispell-2019-mercedes-benz-sprinter/7703646523.html

Was gonna say, the difficulty is a bear these days, no? 😜

Isn't this one gonna put some credit risk on Strike? I love features but don't want it to bring you under the Fiat gun.

I've been thinking of a slider bar when I look at someone's profile that is MY setting for them. Starts in the middle. If they don't post much but it's high quality then I can move it up, too much (like lots of side comments) and I can can slide it down. Unfortunately I don't code. 😭

As pretty as it is, my wife hates the airborne stuff due to her allergies.

#m=image%2Fjpeg&dim=1080x1509&blurhash=%5ENR3QO%25gWXRPbI%252_3M%7BWBogj%5BRj_4M_s%3At8jZax00%25MkCV%40ofozj%5BWBM%7BWBfkWB%7EqWAoeogV%40RjD%25t7ofoft7t7RjNGRjWAofj%40x%5Dt7ofWBRjRj&x=e455a06707f55a4d6d5c6bab910f1faf9a7bb855dc52ee3222cc9d6494faaf72

#m=image%2Fjpeg&dim=1080x1509&blurhash=%5ENR3QO%25gWXRPbI%252_3M%7BWBogj%5BRj_4M_s%3At8jZax00%25MkCV%40ofozj%5BWBM%7BWBfkWB%7EqWAoeogV%40RjD%25t7ofoft7t7RjNGRjWAofj%40x%5Dt7ofWBRjRj&x=e455a06707f55a4d6d5c6bab910f1faf9a7bb855dc52ee3222cc9d6494faaf72 #m=image%2Fjpeg&dim=1080x1312&blurhash=_wJk%3DhM%7Bt7t7off7ofxwofWBj%5BWBj%5BWBnzxaa%7EWCt7j%5Bof-RM%7Cj%3FkCWAazWB-%3BWBofofa%23ayoM%25%25ozj%5Bj%3FWVf6j%3FtQj%3FkCfRayj%40a%23jcj%3Dj%5Ba%7DjsbHj%5BaJWEWCfRayayay&x=7d5e40ab69cf058ec7cbb034ae3f1bb37c28822b25f654d7fd6cac59caf8b0e9

#m=image%2Fjpeg&dim=1080x1312&blurhash=_wJk%3DhM%7Bt7t7off7ofxwofWBj%5BWBj%5BWBnzxaa%7EWCt7j%5Bof-RM%7Cj%3FkCWAazWB-%3BWBofofa%23ayoM%25%25ozj%5Bj%3FWVf6j%3FtQj%3FkCfRayj%40a%23jcj%3Dj%5Ba%7DjsbHj%5BaJWEWCfRayayay&x=7d5e40ab69cf058ec7cbb034ae3f1bb37c28822b25f654d7fd6cac59caf8b0e9 #m=image%2Fjpeg&dim=1080x994&blurhash=%3B%5EN11CocWBj%5Dazj%5BaejsWBIoa%23oLj%3FoeayoffQj%5B_NR*j%5Bj%5Bj%5Bj%5BkCbHj%5B%25MfPaxj%5BWBj%5BayayaxV%40oMofayj%3Faxoef6j%5Bf5j%3FWBa%23fRbHayj%5BayWBj%5BWBayj%5Bj%5Bazj%5Bf6M%7Bj%5Dayayj%5Bf6fPa%7Cj%40&x=2045291cc6481a21e7c58e389757c6cf40e3f6460204efee9382375e9e689d6f

#m=image%2Fjpeg&dim=1080x994&blurhash=%3B%5EN11CocWBj%5Dazj%5BaejsWBIoa%23oLj%3FoeayoffQj%5B_NR*j%5Bj%5Bj%5Bj%5BkCbHj%5B%25MfPaxj%5BWBj%5BayayaxV%40oMofayj%3Faxoef6j%5Bf5j%3FWBa%23fRbHayj%5BayWBj%5BWBayj%5Bj%5Bazj%5Bf6M%7Bj%5Dayayj%5Bf6fPa%7Cj%40&x=2045291cc6481a21e7c58e389757c6cf40e3f6460204efee9382375e9e689d6f #m=image%2Fjpeg&dim=1080x1069&blurhash=%7CBMaYC%3FcMwt7bI9F-ptSIU0000%25N%252ITxuM%7CjY%25MW8%7EWRj9Gx%5DxaWAWVR*9D%25L9Zj%3DxttRRkoJj%5D00M%7Cxst6WXV%40xuRjM%7C00-qM%7CxaaeR*WBj%5DoL%253D%24%3FbIoIoxuWAWBxuslt7NGt7WBM%7BkCt6f5E2kCMxxtofM%7BxaozM%7B&x=f4b72cbca4813f20015dec8421ea940739d039ef99863dc06d8714837a1202e3

#m=image%2Fjpeg&dim=1080x1069&blurhash=%7CBMaYC%3FcMwt7bI9F-ptSIU0000%25N%252ITxuM%7CjY%25MW8%7EWRj9Gx%5DxaWAWVR*9D%25L9Zj%3DxttRRkoJj%5D00M%7Cxst6WXV%40xuRjM%7C00-qM%7CxaaeR*WBj%5DoL%253D%24%3FbIoIoxuWAWBxuslt7NGt7WBM%7BkCt6f5E2kCMxxtofM%7BxaozM%7B&x=f4b72cbca4813f20015dec8421ea940739d039ef99863dc06d8714837a1202e3 #m=image%2Fjpeg&dim=1080x1084&blurhash=%7C5QmCs9E%3Fbt7-%3B%25Mxu%25M%25M00xuWEM%7BRQWBa%23f6ay00%25LRkWAIVRiWBWBWA00t6RkRjV%5BWBj%5Dj%5Bj%5B00axIUofayWBj%5Bayj%5B00t7xuRjt7WBt7ayWB00t7t7RjayWBj%5Bj%5BfQofIUs%3At7WBxuWBoft7%7EqWBkCoLofofWBayay&x=04dce41ed02180be373da7e5ee7798ba2065a57c086f8088697115702d0a175a

#m=image%2Fjpeg&dim=1080x1084&blurhash=%7C5QmCs9E%3Fbt7-%3B%25Mxu%25M%25M00xuWEM%7BRQWBa%23f6ay00%25LRkWAIVRiWBWBWA00t6RkRjV%5BWBj%5Dj%5Bj%5B00axIUofayWBj%5Bayj%5B00t7xuRjt7WBt7ayWB00t7t7RjayWBj%5Bj%5BfQofIUs%3At7WBxuWBoft7%7EqWBkCoLofofWBayay&x=04dce41ed02180be373da7e5ee7798ba2065a57c086f8088697115702d0a175a