What content would you like to see?

Writing the whitepaper in plain language was halted right before the last part, which is the more technical part of the paper. I wanted to see if there was overall interest before continuing with this more challenging section.

I also have started another series, that explains money in plain language. I draw from the traditional rules of money:

-medium of exchange

-unit of account

-portable

-durable

-divisible

-fungible (interchangeable)

-store of value

Should we continue with the whitepaper? Or would you like to see the money paper?

The tools available to the rich are also available to those who aren't rich. The difference is the mindset and the individual education. Sadly, most Americans cannot get off the hamster wheel to take time and study even basic bookkeeping.

We need open source cars.

https://podcast.firewallsdontstopdragons.com/2024/02/19/car-privacy-is-horrid/

This would be an interesting thought exercise. Imagine nostr:npub1a7fud3f9lzr862pfsfzsqqkmtx3q7r0qp093lz279fqldv264srqfv3hp3 producing the hardware. Then, giving the option for POP OS or Ubuntu OS to be installed in the car. Included would be USB touch stick for 2FA before starting the engine.

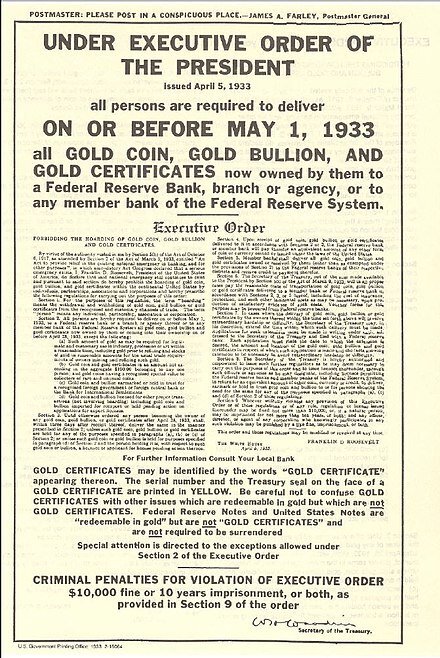

Don't forget one of the largest confiscations of dollars today: Social Security.

The Social Security Act was enacted August 14, 1935. The Act was drafted during President Franklin D. Roosevelt's first term by the President's Committee on Economic Security, under Frances Perkins, and passed by Congress as part of the New Deal. The Act was an attempt to limit what were seen as dangers in the modern American life, including old age, poverty, unemployment, and the burdens of widows and fatherless children. By signing this Act on August 14, 1935, President Roosevelt became the first president to advocate federal assistance for the elderly.

Today, when I speak to older people, I ask them to roughly calculate the dollar amount that was taken for Social Security, and calculate the amount they receive now as a percentage. It always gets a laugh. Even without adjusting for inflation, this exercise works out like a ponzi scheme.

#ponzi #socialsecurity #fdr #president #government

Recently learned about a fairly new feature in the mempool: Mempool Goggles.

This lets the user target certain blocks, and activity within those blocks, such as a coinjoin.

As freedom tech evolves, the cat and mouse game continues.

This article explores Mempool Goggles: https://www.nobsbitcoin.com/introducing-mempool-goggles/

This article explores bitcoin fungibility in an increasingly surveilled environment: https://sethforprivacy.com/posts/fungibility-graveyard/

Thanks to the following for an enlightening and civilized discussion: nostr:npub1ppjkfvk0ek3g584gp7qp9d3znwdznadchet7q2aez9r27620n9zs45xvx2 nostr:npub14a6q6xvt4wuv0wpdpfr336e4fweldtu6np3ehpw55h83xuw2h2zsgyz6rn nostr:npub1tr4dstaptd2sp98h7hlysp8qle6mw7wmauhfkgz3rmxdd8ndprusnw2y5g

EZ at nobsbitcoin.com

#privacy #security #surveillance #censorship #government #freedomtech #nobsbitcoin #monero #bitcoin #coinjoin #mempool #google

I've always said privacy and security are two different practices. Just as one hand washes the other, both wash the face. To address your examples, with which practice applies most:

-$5 wrench attacks - security

-Public knowledge of your spending habits - privacy

-Price discrimination - privacy

-Avoid targeted advertising and manipulation - privacy

-Business competitors seeing your financials and who you interact with - privacy and security

On a pure technical level, without human intervention such as censorship and surveillance tech built on top of the monetary system, tainted bitcoin would technically still work. If humans create an environment, such as a parallel economy, where censorship doesn't exist, it is equivalent to spending cash that may have been used in an illegal act. You personally did not commit the crime, and if your environment is one of censorship resistance, you are only guilty when proven guilty.

If you are in an environment, where surveillance exists, you are correct that every person that used that cash will be targeted.

In today's environment, this is such a specific situation, that it is highly unlikely to happen to the common person.

We are a niche, within another niche, within another niche: cryptocurency > bitcoin/monero > privacy tools. So these conversations are great for thought experiments, content generation, and to develop ideas and make the tech better. Only time will tell if these tools are even going to be truly necessary.

nostr:npub1tr4dstaptd2sp98h7hlysp8qle6mw7wmauhfkgz3rmxdd8ndprusnw2y5g this is enough content for an Opt Out Podcast, to include nostr:npub1ppjkfvk0ek3g584gp7qp9d3znwdznadchet7q2aez9r27620n9zs45xvx2 and nostr:npub14a6q6xvt4wuv0wpdpfr336e4fweldtu6np3ehpw55h83xuw2h2zsgyz6rn

Serendipitous example. Not good for fungibility that this is even possible. Also bad because miners are able to apply targeted censorship.

https://iris.to/note1tvlpadyxm8m6dcs93z9wus6npawh9flfyzrvuusq8q39y2naa7pqrh6du6

On a pure technical level, without human interruption, I think the fungibility argument holds strong. Unfortunately, human can build technology on top of other technology that can change the fundamentals, and our perception o what is going on.

This is definitely an interesting addition to the mempool site. Are there any more articles about this?

There are monero enthusiasts here.

Monero is better or worse based on your individual situation. If you check my commentary, we have been discussing various points that you might get value from.

If you study both, you will be that much better for it. Plenty of benefits to learning and using both coins.

Before mixing came around, from my recollection, there was no need to mix or coinjoin. Privacy preserving techniques were created as a reaction to the human intervention in the system.

If governments didn't spy, monero might have not needed to be invented.

Like all good discussions, one starts out purely on a technical level, marveling at the proficiency of these great inventions. As it develops, we realize that things are the way they are because of human nature.

We can make bitcoin fungible, and private, but it needs special tools, some knowledge, and some additional cost. Monero does that by default. But bitcoin is the one that commands the higher dollar price at the moment, and that is what matters to the mainstream. Also, one must consider exactly what percentage of bitcoin has actually been used in a crime. How many of these coins are tainted? Apparently enough to make a monero maximalist drop their bitcoin. But this is the only example of bitcoin not being fungible, that has been presented to me. Unless there are other examples of bitcoin not being fungible.

A fiat currency example of this is are the Euro and Indian rupee. The Euro used to have a 500 note, and the 5000 Rupee note was recalled a few years ago by the government. Those notes were made useless. If the US government decides to eliminate the $100 note, it is the same idea. Government and humans take the fungibility away. If everyone used bitcoin on their own private wallet, even if a bitcoin was used in a crime, it is only on KYC type exchanges that is tracked.

This is why many folks will save in bitcoin, but spend in monero.

nostr:npub1tr4dstaptd2sp98h7hlysp8qle6mw7wmauhfkgz3rmxdd8ndprusnw2y5g has been a significant part of my moving from a casual user/observer of monero, to diving into the technicals as I have been doing with bitcoin.

Bitcoin isn't "this perfect" because of Satoshi. We can still only speculate, but Satoshi might have felt that he was already creating such a radical idea with inventing bitcoin, that he restrained himself on certain things, for the sake of adoption. Adoption at any level in those early days, not necessarily mass adoption.

He knew there would be alt coins, forks, knock offs, and payment layers and apps built on top of bitcoin. Maybe he wanted to leave enough room for others to do something with it.

Bitcoin can be compared to Linux. You can use Gentoo and compile from source code yourself. You can also use Ubuntu, and not even realize you are using Linux. Bitcoin is like Gentoo, and Monero is like Ubuntu.

We can agree to disagree. Civilized conversations like this benefit everyone.

The idea of tainted bitcoin not being fungible is a very strong point because it considers the fiat currency system we already live in, and the fact that human nature can disturb even the most precise mechanical and technical operations.

So it is a valid point because no matter what an individual wants, and how perfect they want bitcoin to be, we live in the real world, and it is the way it is.

I agree that there might be more gold in the future, on some planet we will discover, or on asteroids passing by. But currently, this is what we have, and gold and silver are still good to study, and store instead of cash.

I started the Mastering Monero book as well. With Monero, I have begun a more technical dive. I started using Monero early, btu nothing on a technical level.

However, I've been brushing up on the technical side of things after I noticed the delisting from exchanges, the IRS bounty, and other events. The thing that made me want to dive more into the technical parts was the Atomic Swaps that Samourai is working on, readubg about the dust horizon, and the reason Monero favors CPU mining instead of GPU or ASIC.

The reason for mining anything is because it is profitable...under the current fiat system. In our theoretical story, we are under a hard money standard.

In the distant past, I would guess, that mining wasn't an industry. No technology, and also no reason to mine. Gold and silver was circulated as money. It crossed borders and the economies adjusted accordingly with prices. Let us assume no inflation(on a worldwide scale) because there is no mining. The only way inflation could happen would be at the local level.

For example, if one wealthy family moved into a small town, then the supply of gold and silver would increase(inflate) causing higher prices. The wealthy family would open businesses, probably pay some taxes, and generally contribute to the economy, making everyone more prosperous. Prices would rise and fall to the appropriate level without external interference like a currency printer. If the wealthy family moved out of town 10 years later, you might call that deflation because now a significant part of the money supply is gone, so prices wold adjust accordingly.

You are right about fiat currency inflation being massive. I disagree that it is centralized and unpredictable.

Literally all central banks inflate their currency, so if all do it, I would not call it centralized. Because we know they all do it, and have always done it, and will always do it, I wouldn't call it unpredictable, this makes it very predictable.

A great, and civilized, discussion. I am currently reading The Monero Standard and will eventually be able to speak about monero at the same level as bitcoin, and other topics.

Although I've known and dabbled with monero since the beginning, I have not dove into the technicals the way I have done with bitcoin. I try not to take on too many topics at once.

That aside, monero has always interested me from the beginning with the focus on privacy. It is also impressive that a whole community and podcasts have grown around it.

I believe THE major property is the store of value...both over a short period of time, and a very, very long period of time. On to the point...

Fungible basically means that one satoshi in a store can buy you a stick of gum, and another satoshi in another store can buy you a stick of gum as well. Equal units can purchase equal value of goods and services.

Unfortunately, we are on a dollar standard, so the fungibility of bitcoin only works if the store owners prices the items in bitcoin, not dollars. Because the dollar price of bitcoin fluctuates, each satoshi isn't exactly fungible.

Gold is not limitless. All the gold has already been created by nature. Humans just haven't discovered it all...yet. This discovery process is very slow, and does make a bit of inflation, but historically gold inflation has not affected the average person.

Gold is money. Gold is not considered legal tender anymore by some countries, but that is starting to change again right now.

My points are consistent with the historical definitions of money. If you would like to continue the discussion, we can do that. I am also working on a money series similar to the bitcoin series.

Unlocking Knowledge: Bitcoin in Plain Language

This series continues to translate the original white paper by Satoshi Nakamoto to plain language. The goal is to have easily shared content, reacquaint bitcoiners with Satoshi's vision, and explain things in an accessible way everyone can understand. The original content will be posted, with the plain language below.

Please show support by sharing or sending sats.

Firewall - A layer of protection in between a person, their computer, and the Internet. Firewalls can filter, block or allow certain kinds of information to be sent in, or sent out.

Multi-Input Transactions - Transactions that need to be combined to reach a certain amount of bitcoin. Like using two $100 bills for an item that costs $189, you are combining the two large bills, creating one transaction. The cashier knows you had at least $200, and so did everyone in the store that saw that transaction.

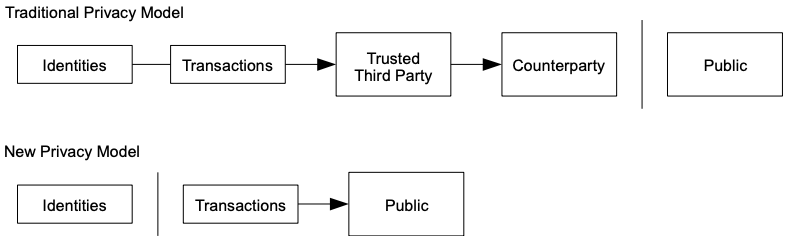

10. Privacy Paragraph 2

As an additional firewall, a new key pair should be used for each transaction to keep them from being linked to a common owner. Some linking is still unavoidable with multi-input transactions, which necessarily reveal that their inputs were owned by the same owner. The risk is that if the owner of a key is revealed, linking could reveal other transactions that belonged to the same owner.

Plain Language

Continuing with our puzzle game analogy, think of each transaction as a puzzle you want to solve. Instead of using the same puzzle-solving strategy every time, you decide to use a different strategy for each new puzzle. Each time you play the game, you use a new technique to solve the puzzle, making it unique. These are the key pairs for transactions.

The tricky part: if you have a few puzzle solutions that are connected, and someone figures out how you solved one of them, they might guess how you'd solve the others. It's like if you have a series of puzzles, and each puzzle gives a clue about how you solve the next one. Transaction key pairs should be unique.

To make sure your own puzzle solving techniques stay hidden, it's a good idea to slightly change some rules for each puzzle problem...but while keeping within the general rules of the game. This way, even if someone cracks one puzzle, it won't help them figure out the solutions to the others. It's all about keeping each puzzle separate and not letting anyone connect the dots to reveal the whole picture.

Sometimes people want to have reoccurring transactions, like an automated bank withdrawal. The risk here is your information (on the blockchain) always stays the same, and everyone can see how you've accumulated a certain amount of bitcoin. Generating new information each time, or even occasionally, will make it more difficult to trace certain things back to one person.

#bitcoin #crypto #btc #blockchain #cryptocurrency #hodl #digitalgold #decentralized #satoshi #cryptonews #satoshinakamoto #whitepaper #bitcoinwhitepaper #nostr #grownostr #learnbitcoin

Sleeping joe talking about inflation 🤧 https://video.nostr.build/39484a72905f991c5196474e9cda6360a47fc137a35096190d7f5ad602fe2a85.mp4

He is talking about shrinkflation, which is different than inflation.

The businesses are only trying to survive in a broken fiat currency system. If we use a sound money system, and not fiat currency, companies can better serve customers.

Also, a man on TV "calling" for something isn't anything but someone exercising the right to free speech. This means nothing.

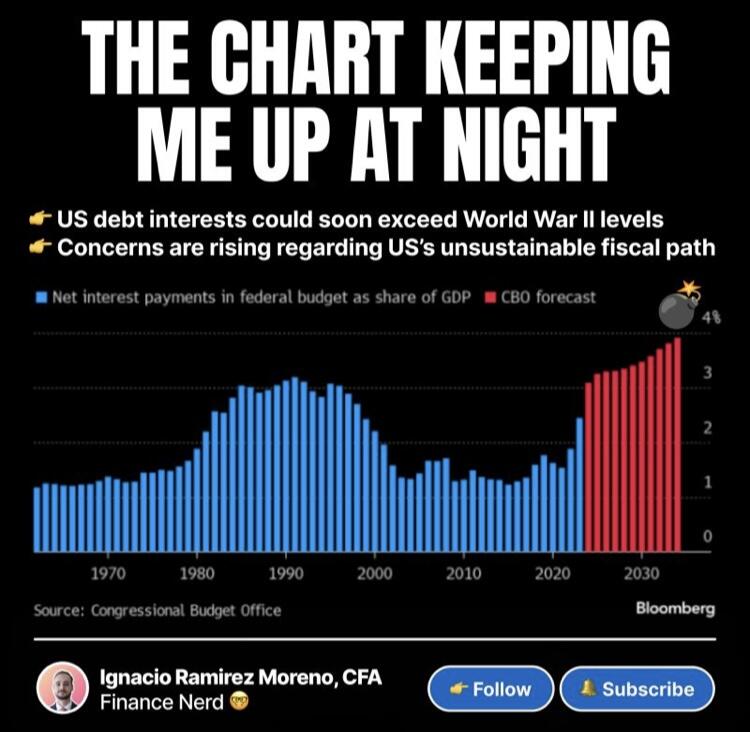

Hopefully someone willing enough to work towards a CFA will also put the work into studying the current slavery system (fiat currency) and studying the properties of bitcoin.

These two topics are enough to put someone to sleep from boredom sometimes.

But once studied, the peace of mind will have people sleeping peacefully.

Managing UTXO is something both practical, and necessary in terms of privacy. Samourai wallet and Sparrow wallet can both offer this functionality.