It's tulip mania...

Always has been...

There are plenty of choices out their for the NPC. Let sleeping dogs lie.

My land is my network of people I follow. I can burn my nsec daily and still keep the list of people I follow. I don't care about much else.

The Giver (2014)

If all you see is Markovian kernels, then all you see are conditional probabilities.

Electrum does include cost bases calculation based on utxo acquisition and disposition. Of course the tax rules are absurd 🤡🌎 so it doesn't matter.

Then you are missing the point. These large miners are SOX compliant. You should be asking yourself why aren't these people acting more rational, and moving to pools like Ocean.

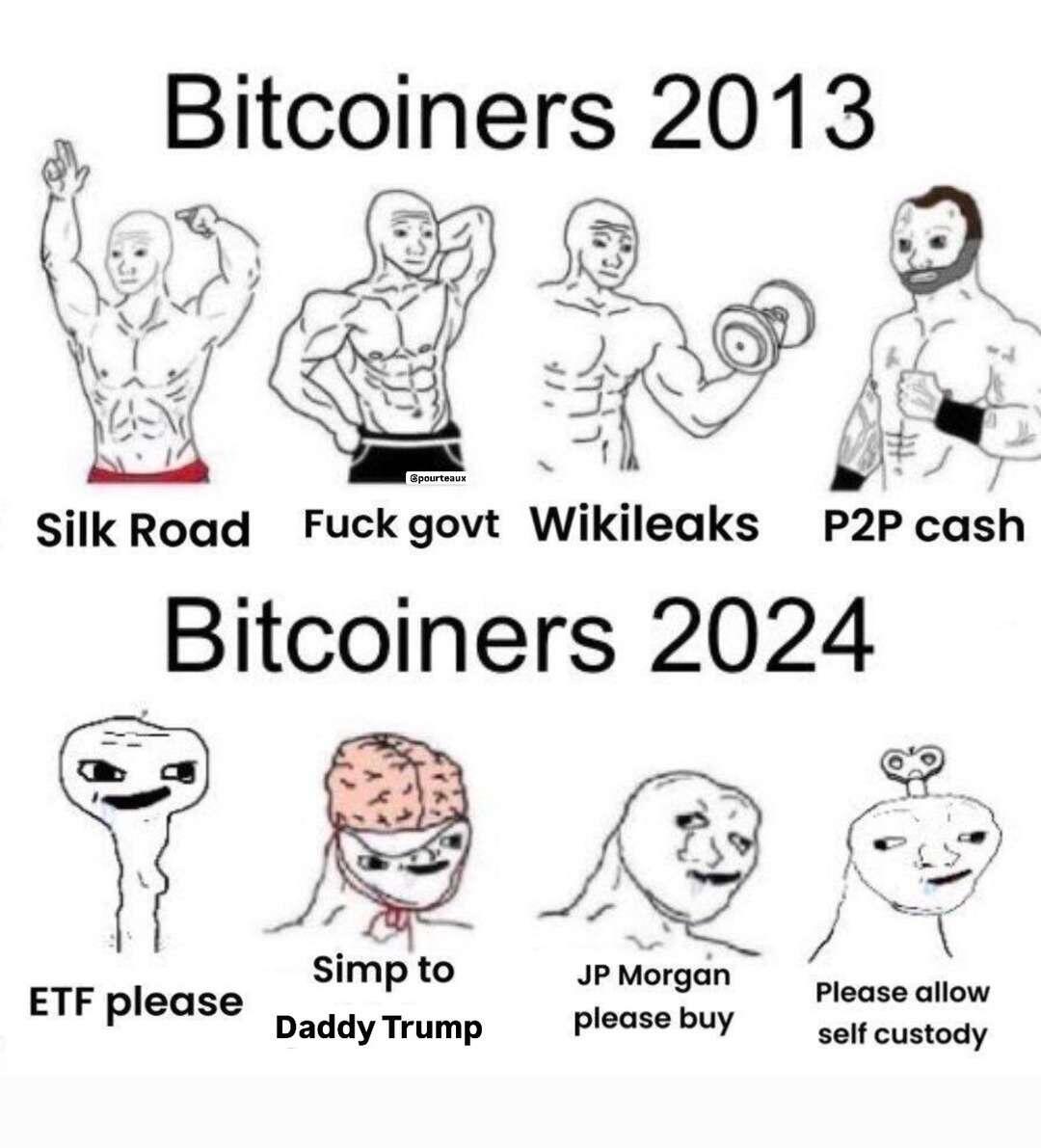

Instead of talking about 100k and whether Saylor is a genius,

maxis should be talking about this instead.

#bitcoin isn't worth anything if it isn't censorship resistant. I dont care what the USD price is.

I know I know

"you'll always be able to pay 30% of your tx to a miner in North Korea and get into a block. look censorship resistance"

thats just shitty censorship resistance.

and yes, #monero fixes this.

https://b10c.me/observations/13-missing-sanctioned-transactions-2024-12/

Ocean's DATUM fixes this except that large mining companies are required to be SOX compliant, even though this is a really bad idea, and counter good security practices. Of course Ocean is not SOX compliant because they know better.

And yet...

Mining with pools that are not SOX compliant can present several risks and challenges, especially for companies or individuals who are publicly traded or have regulatory obligations. Here are some key considerations:

1. **Financial Reporting Risks**: If a mining pool does not adhere to SOX compliance, it may not have adequate internal controls over financial reporting. This can lead to inaccurate reporting of earnings, expenses, and other financial metrics, which could affect the financial statements of participants in the pool.

2. **Lack of Transparency**: Non-compliant pools may not provide transparent information about their operations, fees, and distribution of rewards. This lack of transparency can make it difficult for miners to assess the true profitability and risks associated with their participation.

3. **Regulatory Scrutiny**: Companies that mine through non-compliant pools may face increased scrutiny from regulators, especially if they are publicly traded. This could lead to potential legal and financial repercussions if the company is found to be involved in operations that do not meet regulatory standards.

4. **Risk of Fraud**: Non-compliant mining pools may be more susceptible to fraudulent activities, such as misappropriation of funds or manipulation of mining rewards. Participants in such pools may have limited recourse if they encounter issues.

5. **Impact on Reputation**: Engaging with non-compliant pools can negatively impact a company's reputation, especially if it becomes public knowledge. This could affect investor confidence and market perception.

6. **Operational Risks**: Non-compliant pools may not have robust operational practices in place, which could lead to inefficiencies, downtime, or other operational challenges that affect profitability.

For individuals or companies considering mining through pools, it is essential to conduct due diligence on the pool's compliance status, operational practices, and overall reputation. This is particularly important for publicly traded entities that must adhere to regulatory requirements and maintain high standards of corporate governance.

Me: Bitcoin is Decentralized, Immutable, Censorship Resistant, Scarce,...

Them: Yeah, and private

Me: Well, no. I know like it seems we should have privacy too, but there are valid reasons why it doesn't.

Except that privacy isn't the solution because it simply doesn't scale. This is a people problem, not a technology problem.

Wasn't that Gavin's site?

There's this notion in Bitcoin that we are building tools to help the world become a better place – but when faced with actual, real world problems, responses are often reactionary and self-serving.

Bitcoin isn't private enough? You're just not using the right tools. The tools are too complicated? You're just not dedicated enough to the cause. Bitcoin fixes all your problems, you just need to spend countless hours of your life to understanding it.

Yesterday, nostr:nprofile1qyg8wumn8ghj7efwdehhxtnvdakz7qgnwaehxw309ac82unsd3jhqct89ejhxtcpzamhxue69uhhyetvv9ujucmpw4ek2uewvdhk6tcprpmhxue69uhhyetvv9ujucm4wfex2mn59en8j6f0qy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qghwaehxw309aex2mrp0yhxummn9eek7cmfv9kz7qgewaehxw309aex2mrp0yh8xmn0wf6zuum0vd5kzmp0qy28wumn8ghj7un9d3shjctzd3jjummjvuhsqgykrhztmdarqyq9dg8tpzqr5jww8tjdy2wehj8t07r2lxfsna9fach3y264 released a report on the usability of Bitcoin (and privacy coins) for activists, and it's a sobering look at how builders in this space have failed those they claim to help protect.

No-KYC on- and off-ramps are still too hard to use. Coins need to be swapped between networks or privatized with dedicated software. Self-custody is easy, but wallets offering network-level protections are often not directed at non-technical users.

We can ignore these criticisms if we want. Or we can stop gaslighting users and skeptics alike for not being educated or engaged enough, and start dedicating more resources to building tools that actually serve the needs of those who need it most.

Most people don't have a correct mental model to understand privacy in the first place. This issue isn't specific to bitcoin. The problem is more fundamental, and these people will never learn it. Sort of like: Bitcoin doesn't fix stupid.

Bitkit

Self-custodial Bitcoin and Lightning Wallet for Android and iOS.