#Bitcoin as a Medium of Exchange cannot be ignored. Without the ability to transact Bitcoin permissionlessly, it will end up captured and neutered like gold is.

Discussion

Enjoyed your interview with Peter McComack a lot, thanks!

Not your keys, not your transaction 🫡

Based

Wall Street loves IOUs. Just don’t sell em your corn.

I don't see BTC in widespread use as a medium of exchange on the base layer. I know it is being used that way in some places right now and that is great. IMO, we are currently in the Store of Value stage of this new asset. Next will come widespread use as a Medium of Exchange on other BTC layers (will be too expensive on base layer as time goes on) and finally as THE Unit of Account.

Yep, it's a whole system, people that try to stick it into one use-case box are silly.

Serious note, is it being ignored? Or are some people just focusing on store of value number one, fix that shit first, stop the rot. Printing money is the first god we have to slay. There are plenty of folks working on MoE but it’s secondary to establishing a proper means to store value for the whole system. Individuals unfortunately are mostly going to be downstream of that, unless they put the work in early

Saylor storing his bitcoin on Coinbase is not helping store of value tech. He also doesn't spend a dime on bitcoin development

I assume the argument is that there are only 21million so start there. Sure, lots of issues with trusted third parties, as with the ETFs, but as long as they all stick to 21million it should work.and even with a bit of fuckery it’s gotta be better than the printed trillions we have now?

Saylor can't use private keys for his publicly traded company.

It would have to be in a custodian account, with multiple keys, verifications, to serve the corporate interests. But does that really matter?

Also, Microstratagies is just starting to develop around Bitcoin. We are so early yet on corporate adoption it's insane.

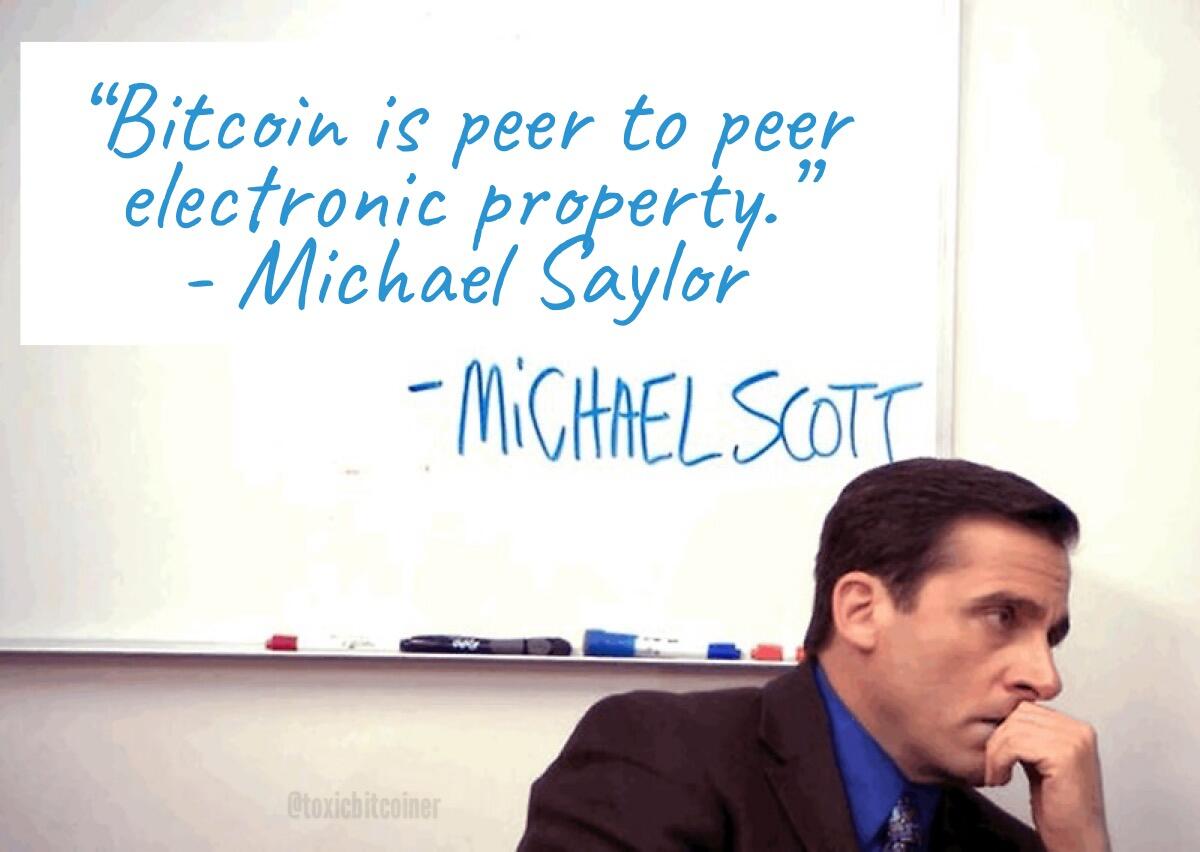

PEER TO PEER ELECTRONIC PROPERTY

MSTR is PENDING2POCKET P2P STOCK in CUSTODY OF BROKER

I'm stealing this. :)

Property is seizeable under force. Don't think it fits. Also, property taxes aren't going away soon so fuck this frame of mind.

Property doesn’t inherently mean “land and/or building.” There’s a century of fiat bullshit that’s fucking with the semantics. Ex. your body is your property. Although, perhaps Bitcoin is the discovery of property…👀

💯

If your going to sell your 🌽 , sell your ETF corn which is captured anyway…….

You can still sell a Roman Aureus gold coin. I think the challenge of the future will be penetrating centralized controlled financial systems and governments to educate people how to transact permissionless. The economies that just started their decline in 2018 and were previously in decline tend to be the ones people have the hardest time learning how to stop participating in. New and emerging economies will have these advantages instinctively, But the society they live in will still need centralized development. I think this issue comes to a personal education perspective. A centralized government can educate its employees how to deter free thought towards this pristine asset much easier than an unorganized decentralized mass of people.

I would add that if sovereign (non-custodial) management of Bitcoin goes away, it will end up capture and neutered like gold is.

This is the only bear case

Saylor made those comments on CNBC, so one could make the argument he was pandering to his audience. He didn’t make those comment a few days prior in Madeira, as he knows they’re not going over well there.

Will be interesting to see if he sticks with this narrative going forward.

the #Bitcoin strict correlation with energy is the key. The product of pow and the easiness of storing and moving it -permissionlessy- are all key properties here

💯

Bitcoin as a medium of exchange and as a reserve of value should be the norm already.

Yup, already too late?

Yeah, this "property only" idea is ridiculous. I hope our culture is cult of personality resistant, but I'm not so sure.

I like how you compared Saylor to Ver in the latest What Bitcoin Did pod.

how do you mean? it's not possible to stop private networks from trading

Being that we can effortlessly move in and out of fiat in real time on layer 2, bypassing the taxable event, a medium of exchange seems inevitable.