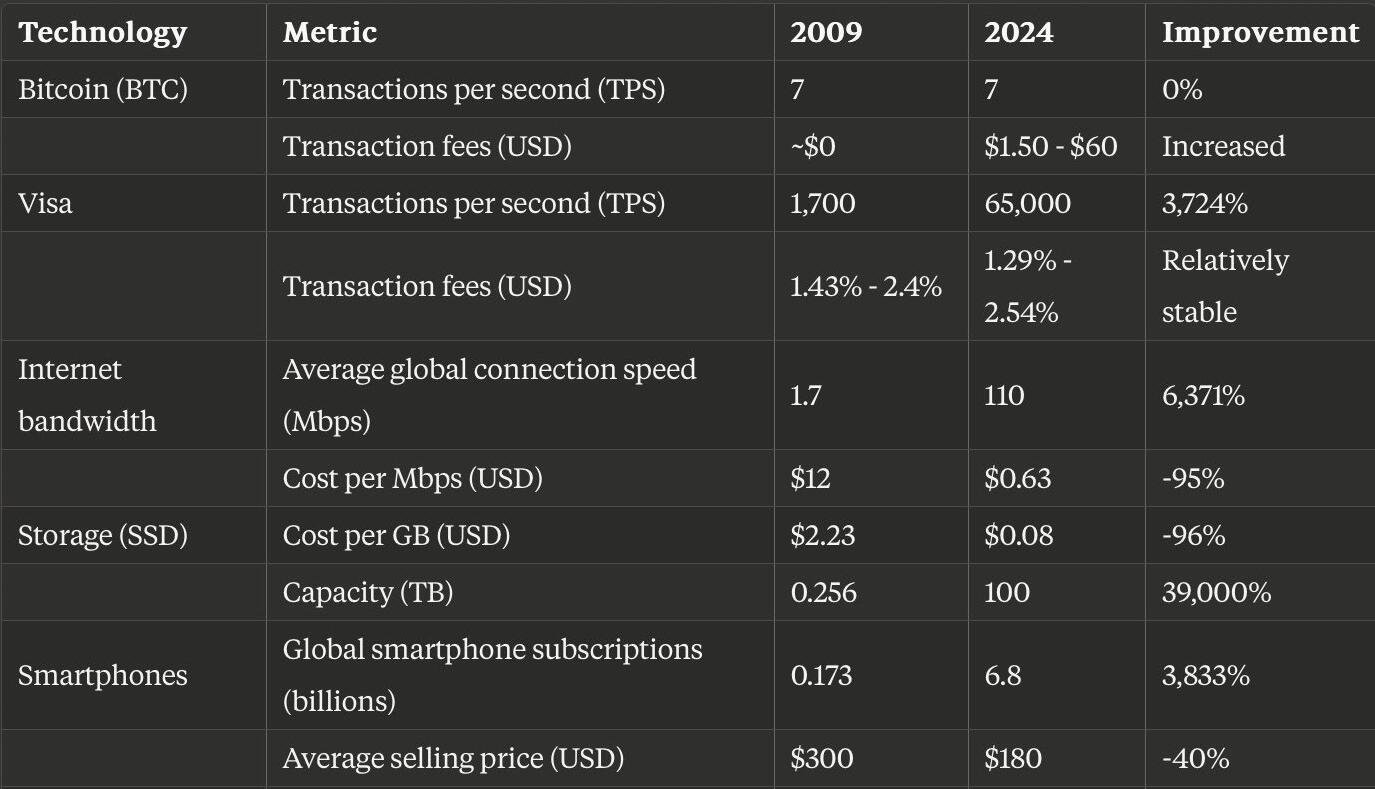

Transactions rarely cost more than a few dollars. We need better ways to trustlessly share UTXOs so that they can cost $1000+ because they probably will at some point.

The ~4mb limit has nothing to do with the cost of a harddrive.

It already costs a couple hundred dollars to buy the hardware needed to run a node. Storage & computational demands have grown & will continue to do so.

Lopp has written about past efforts to sync an ETH node from zero, which took weeks when everything went right & it repeatedly failed. Do you understand how fragile the network becomes if downloading & verifying everything takes that long & any significant number of nodes gets wiped out?

If only Google & Visa can run nodes then we have just recreated the Fed banks. They can change the rules & the supply however they see fit.

The cost of running a node gets exponentially larger as the number of nodes shrinks. Everyone who uses bitcoin has to connect to a node, what happens when the number of leechers massively outweighs the number of seeders? What does that do to the cost of seeding info?

When only BTC rich people can use it in a self sovereign way, we just recreated the banking system.

Why should everybody suffer high transaction fees, even for lighning onboarding, because some dude with a shitty internet connection wants to run a full node out of his moms basement on a raspberry pie?

What does that do to the cost of a transaction?

It's a provably honest court system for ownership of wealth. It's not for everyday transactions. The base layer offers millions of dollars worth of security with just a couple of confirmations. Nothing you do where you would throw away the receipt should ever be done onchain.

Pi hardware already isn't great for running a node. My node was $1500. How much do you think it should cost?

Thread collapsed

Thread collapsed