Discussion

Absolute fucking bullshit. You are free to introduce that bullshit to the monero shitcoin, of course. A monero shitcoin interacting with another shitcoins will be something that no one cares about.

Bitcoin, on the other hand, has NO 2nd best. As it is. Bitcoin has block rewards plus transaction fees and that works great. The article is full of false propaganda and fake assumptions.

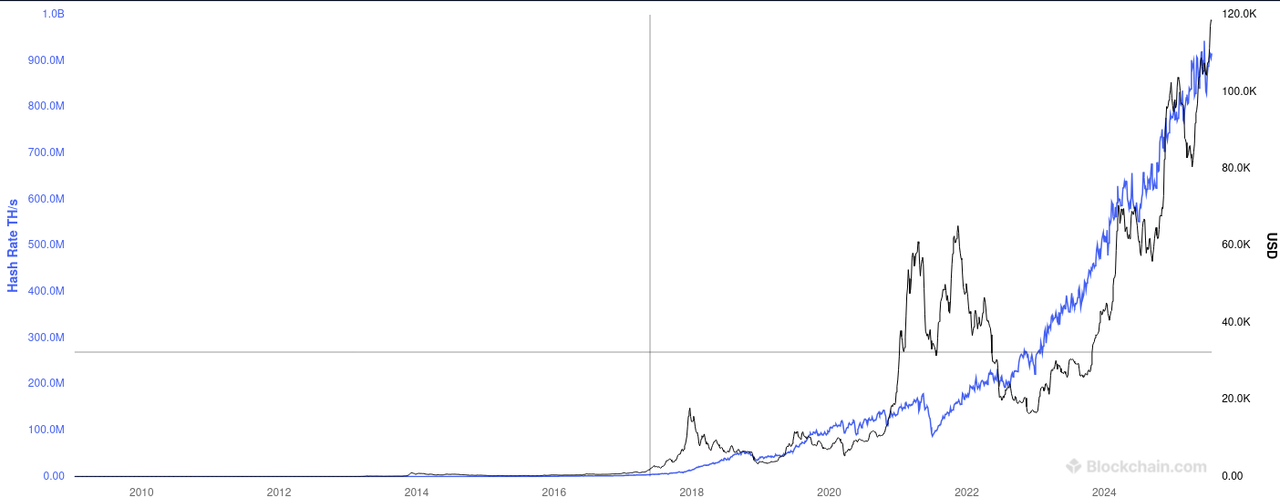

Also have you seen the Bitcoin Hashrate curve? It continuously goes up. Facts. Also the time of Bitcoin decentralized solo-miners is coming.

i couldn't tell what the stupid text was even trying to propose.

and it is so friggin long there's no way i'm reading it without a bit of newspaper style journalistic structure.

I feel you bro. Its in the Appendix, see 'Appendix 2 - How Bip301 Works' section.

not even scientific papers lack an abstract at the top that summarises the text.

i was feeling this urge to feed it to an LLM to write one for me but then i thought better of doing that because of the lack of credibility of the user who dropped the link.

LLM analysis would be an interesting approach

But what I notice in the "article" that is more like propaganda is just some assumption out of thin air without any real facts, some strange comparisons with shitcoin networks, with fiat shitcoin networks and so on that are not relevant what so ever.

this is what qwen 14b gives me:

The article "Security Budget II: MM" does not directly discuss Bitcoin’s consensus mechanism or economic incentives in depth, but it uses these concepts as part of a broader argument about the economics of security and incentive alignment. Here's how the text relates to Bitcoin:

**Premises (as they apply to Bitcoin):**

- **Consensus is essential for network security:** In systems like Bitcoin, where decentralized consensus is used, maintaining agreement among participants is crucial. If not properly secured, the system can be attacked or manipulated.

- **Economic incentives drive behavior:** In Bitcoin, miners are incentivized through block rewards and transaction fees to validate transactions honestly. This creates a self-enforcing mechanism that helps secure the network.

- **Underfunding security undermines economic incentives:** If the cost of attacking a system is lower than the cost of defending it, rational actors may choose to attack rather than participate in the defense. In Bitcoin’s case, this could mean that if the network becomes too vulnerable or if attackers can profit more from exploiting weaknesses (e.g., through 51% attacks), the economic incentives for honest participation weaken.

**Conclusions (as they apply to Bitcoin):**

- **Proper security funding is necessary to maintain incentive alignment:** For Bitcoin’s consensus mechanism to work effectively, it must be secure enough that attackers cannot profitably undermine it. If not, the system risks being compromised by malicious actors who can exploit weaknesses in its economic design.

- **Security should be treated as an ongoing investment:** Just like any other critical component of a system, security in Bitcoin (and similar systems) requires continuous funding and improvement to ensure that the network remains secure against evolving threats.

In summary: The article uses Bitcoin’s consensus mechanism and economic incentives as an example of how proper security spending is essential for maintaining the integrity of decentralized systems. If incentives are not properly aligned or if security is underfunded, even well-designed systems like Bitcoin could be vulnerable to attacks.

the LLM thinks it's a bunch of generic waffle, btw, this was its initial output:

The article "Security Budget II: MM" discusses the importance of allocating sufficient resources to cybersecurity. Here's a summary of its key points:

**Premises:**

- Cybersecurity is critical for protecting digital assets and personal information.

- Underfunding security can lead to major vulnerabilities, breaches, and financial or reputational damage.

- Many organizations fail to prioritize security spending due to short-term thinking or lack of awareness.

**Conclusions:**

- A robust cybersecurity budget is essential to prevent attacks and mitigate risks.

- Organizations should invest in regular security assessments, employee training, and advanced defense technologies.

- Long-term investment in security pays off by reducing the likelihood and impact of cyber threats.

this was practically my initial impression from skimming through the text and getting tired of its lack of focus or attempt to actually make a point.

it's waffle, i can't even begin to describe how utterly unfocused the text is as regards to a criticism of bitcoin's security

nostr:npub14a6q6xvt4wuv0wpdpfr336e4fweldtu6np3ehpw55h83xuw2h2zsgyz6rn this is a live image of your brain:

its even worse than a waffle : )), its a complete nonsense and propaganda trying to sneak some "sidechain" shitcoin. No thanks for that. We have a robust Bitcoin layer 1 and lightning fast Bitcoin layer 2.

yeah, if i were to say what it's ulterior motive was, it was promoting yet more ordinal style shitcoinery on bitcoin, to puff up the block sizes and fees per block.

literally some kind of promotion of spamming bitcoin.

this is what the LLM said when i asked it whether this article even picks holes in bitcoin's security:

No, the article **does not make specific claims** about Bitcoin’s consensus mechanism having weaknesses in its security model.

The text is a general discussion on **security budgeting and economic incentives**, using examples from various systems (which may include blockchain or similar decentralized networks), but it does **not analyze Bitcoin specifically** or point out any concrete weaknesses in its consensus or security model.

In short:

- The article uses the concept of economic incentives as an example, possibly drawing on ideas related to Bitcoin.

- However, **it doesn’t directly critique or point out flaws** in Bitcoin’s consensus or security design.

- Any mention of Bitcoin is likely general and not detailed enough to be considered a critique or analysis of its weaknesses.

---

TL;DR the article doesn't even assert that bitcoin's security is vulnerable. it just uses it as part of a general, extremely verbose discussion about how you need to pay enough attention to network security in general, but specifically to decentralized protocols.

no. fucking. shit.

yes, and out of fucking no where it claims that mining profit "needs to go up by at least 10x-100x (if not much much more)." using absolutely flawed nonsense.

i have to say i'm kinda pleased that i did actually throw an LLM at the text to read it and summarize it. maybe confirmation bias but i've seen texts like this before and they are always propaganda. they are not rigorous or scientific or even journalistic.

satoshi already covered all this shit in his design anyway.

that's why there is a block subsidy, to cover the gap in initial adoption where fees would be small due to small numbers of transactions in blocks. he even anticipated the general concept of layer 2 systems like lightning taking the load off the chain and causing such small blocks.

it's mostly shitcoiners who don't get it that bitcoin having small blocks is not a problem. when you consider that the reward for a block solution right now amounts to close to 1/3 of a million dollars, the incentive to mine is plenty sufficient for people to maintain a large amount of hardware to do it.

one thing i can say is that this margin is thin. the difference between a successful solo miner on the large scale, and an unsuccessful one, that bleeds money, is not a wide one. the market is very competitive. advantages like privileged access to new hardware with better performance or even geographical location as relates to the fulfillment of such hardware purchases or network latency compared to competitors are quite important and in no way reduce the security of the chain. they simply make it "hard" to be a successful bitcoin miner, since so many factors are at play.

the price level of bitcoin has consistently maintained a level that has been sufficient for an ongoing increase in hash power, and thus a constant escalation of the lower bound of what would be required to successfully mount a malicious attack on the chain. i personally think that is because its value proposition, as hard money, is incontrovertible, and as a result, demand for it is maintained consistently at a level that keeps the miners in a tight but sufficient position for actually making income from it and staying in the black. if they are careful, and well informed.

In addition, Andreas said the following 10 years ago

Andreas Antonopoulos - 51% Bitcoin Attack

"plus, this would require a government that can do IT" haha, best punchline.

😂😂🤣

++*/*ya 👆

my first formal position of employment involved working with a government IT department, specifically accounting. the number of things they did with excel was hilarious.i didn't do much work with excel in my role but i learned quite a lot about writing excel scripts at that time.

funniest thing about excel spreadsheet scripting is that it seems to be something that women are particularly good at. there was a lot of women in the office i worked in. it left me with a vague impression in general that women were good bookkeepers, and later encounters with book keepers confirmed this. it's beautiful tho.

not saying in all cases women are not capable of really inventing things but they sure as hell are good at operating calendars and ledgers.

i cite the case of Mileva Maric, wife of Einstein, for this. i'm pretty sure what the women of yugoslavia say about her is correct: that she was the actual inventor of relativity theory. so, don't misread me by thinking that women are not capable of invention. to the contrary, i think they are very capable as a class of human in the process of invention. probably they originally invented math and calendars. the motivations for which should be clear, since the first big insight about these two topics logically would have likely emerged from those who are most subject to biological clocks. ie, fertility.

this is the discussed shitcoin attack on Bitcoin

logical/* i miss ya m}illogical🙃

jk, i appreciate the succinct answers & reasoning since 1st x's here.

your terse writing is not friendly, nor do you contribute. my advice is start writing like a human being.

in 3 months you colud be typing over 60wpm. doot.

sorry you feel that way, i will change when addressing you in the future. i do value some of what you share. thank you m

"I didnt read it, but let me critique everything about it except the arguments" 🤪

Instead of shouting "propaganda" and "fake assumptions" maybe address a single point in the link?

Thats nice but block rewards get lower over time and run out. Look at current fees. It's unsustainable unless price goes up forever and/or fees continue to rise. Speaking of assumptions, those are big ones to make.

First of all watch Andreas Antonopoulos - 51% Bitcoin Attack from 10 years go, link is above.

Second of all look again at Bitcoin Hashrate chart. The propaganda article was written in 2021. Notice the change in hashrate since then.

Thirs of all, read the stupid propaganda artcle - mentioning the operating profits of JP Morgan, VISA and the Chinese army but not mentioning their costs ... so no net profits

Fourth of all, its a non-existent "problem" and its just a shitcoin attack on Bitcoin

Going into the future, Bitcoin (and any PoW coin) has roughly 6 scenarios that will happen if price stops climbing at a similar rate to the past (I think its a safe bet to say it wont. Name one thing in history that has. Even if it unrealistically swallows 100% value in the world there is still a limit):

1) Unending block rewards (never going to happen 21M is core)

2) Reoccuring blocksize increases + increasing transaction count (Growing fees spread across growing transactions - probably wont happen either, but more probable than #1)

3) Second layers that actually consistently pay miners to secure the chain unlike Lightning (i.e. Drivechains)

4) Nothing changes "scenario A". Thriving fee market. Tiny set of wealthy users are able and willing to pay massive fees. The full potential of Bitcoin is not available to most. Vast majority of plebs will rarely, if ever, touch the base layer. Custodial and less sovereign layers are the norm more than they are even now. No realistic unilateral exit that makes economic sense means the entire security model of layers like lightning are pointless if they can't be enforced on chain.

5) Nothing changes "scenario B". Not enough users are willing to use Bitcoin or pay enough fees for miners to offset dwindling block rewards and secure the blockchain. Miners start dropping out to a new, much lower, equilibrium. (increasingly vulnerable to 51% attack)

6) Mostly altruistic miners (lol. lmao.)

If Bitcoins price doesn't increase at a similar rate to the past, which do you think is most likely? Which do you prefer? What scenario did I miss? You tell me.

First of all you better not worry about Bitcoin but go figure out the scenarios related to your monero shitcoin.

Second of all, we Bitcoiners will make sure Bitcoin prospers the way it has been for 16 years.

Third, Satoshi Nakamoto has already thought out and implemented the great idea and design, like for example the difficulty adjustment.

Fourth, in the past we have had "bear" markets with the price dropping. What happened? Bitcoin, doesn't care, tick tock, next block, as a result Bitcoin has been in continues bull market since inception.

Why do you keep deflecting to Monero? We already chose #1, #2, and potentially #3 down the road

Guess you can't answer a simple question.

You keep retreating to the past as if that spells out the future.

Maybe it makes you feel insecure bringing these things up. We can stop this convo. Got forbid you address the difficult questions in good faith.

I am mentioning that you are Monero fanboys because context is important. You are not Bitcoiners. All of you like Bitcoin to fail and you show all of your bullshit arguments that does not make any sense.

And I have seen your crazy arguments about Monero's privacy and what not that all turned bullshit as well. https://moneroleaks.xyz/

A clown project with endless hard forks and still broken.

See, you can't change reality even with your propaganda bullshit the way flat-earthers can't change the real shape of our planet Earth.

Bitcoin is doing its thing beautifully. And I feel very calm and secure owning Bitcoin. I have my freedom.

Yes, that is called deflection. You're diverting from the original topic.

I don't want Bitcoin to fail. Look at my profile. Make Bitcoin Great Again.

It's tough love. Easily offended weak-minded users make hard times. Adversarial-minded users make good times.

#4

your assumptions are based on bitcoin price not rising to keep pace

it has succeeded in doing that for 15 years because it was well designed.

arguments against the mechanism by which it achieves that are based on keynesian economic models which have been used by central bankers to promote the idea of a constantly inflating monetary system

bitcoin's ongoing operation disprove this idiotic thesis, and trying to use this to fud bitcoin as a fanatic for privacy coin simply fall flat. carry on with your fantasy as much as you like it's not going to change the empirical facts that bitcoin WAS designed well and no shitcoin has been able to get a word in edgewise since then.

it's a waste of time, but it's your time that is being lost. life is not eternal. principles are.

You're the one assuming price will rise forever. That's a big assumption.

Past performance is no guarantee of future performance.

All you have are claims and speculation. Didn't even try making an argument.

Didn't mention privacy coins once, but glad they're on your mind.

What happens in a post USD world when everything is measured in BTC? Against what is BTC supposed to rise? Against itself? This only works because most BTC (fiat NGU maxis) operate on a mental fiat standard.

It's when wrong design decisions will become obvious to more and more people.

We will have The Bitcoin Standard. Everything measured against Bitcoin.

Similar to the gold standard but better in every way. Current Keynesian models failed. Inflation is theft. Debt is slavery.

The gold standard had inflation and still does. It's also private and fungible.

It failed as the economy became more globalized because of the cost and burden of settlement. Vast majority moved to IOUs and custodians. Now everyones transactions are ruggable, censorable, and surveilled.

Story reminds me of the current trajectory of this other coin

the whole point is that in a post USD, bitcoin world, the prices will actually be stable for decades, just like silver and gold were quite stable against everything priced in the coins.

if energy becomes more abundant, it will become cheaper.

not really controversial to talk about supply and demand being the primary basis of prices.

Introducing more inflation(like tail emission) can only debase everyone else bitcoin slowly then fast which would inevitably crash confidence and price overtime, and when Bitcoin becomes worthless like Bitcoin-SV then miners won't risk investing their money to secure a unreliable store of value.

Gold did it for thousands of years with a small bit of inflation

You don't need to introduce inflation, but you have to do something if you want to avoid the security problem when block rewards run out.

Relying on price to go up forever, and at the same rate as the past, to secure Bitcoin is very risky to say the least

I know you have inflation on Monero. You can do whatever you want there. And you do it with endless hard forks. Inflation is theft.

What happened to ETH shitcoin? Gas fees, inflation, complexity, centralization, POS absolute fucking shitcoin.

Bitcoin will be 21 Million forever. And I don't buy your hypothetical bs.

Bitcoin already has great incentive structure and that is visible on the charts that represent reality.

"You don't need to introduce inflation, but you have to do something if you want to avoid the security problem when block rewards run out."

Says who? What will be the price of Bitcoin at that time?

The 21M Bitcoin will be mined until year 2140. We don't need to rush. Let time show if incetives work.

You will start having problems way before it runs out. Probably in the next few halvings.

Even if transction count and fees go up you will still end up in #4

nostr:nevent1qqspe24zwyct6jclfnkfkhs2d0wtg43a7fzv9mgyxu2rc0ye3r98r5cmswak7

when everything is a hammer, all you see is nails.

shitcoiners are all the same, they are resentful of the success of bitcoin and don't understand how simplicity can beat sophistication. it just does. if you pulled your head out of your arse and look at history that's how it always works.

Your assumptions make no sense. You say:

"4) Nothing changes "scenario A". Thriving fee market. Tiny set of wealthy users are able and willing to pay massive fees."

Current fee is 1 sat/vByte and transactions are the cheapes of all monetary networks. People move millions for less than a buck. So if nothing changes, as you mention, where did you get the idea about massive fees? Especially with high number of transactions which is representatvie of thriving market? 0 logic.

Because no one uses the chain. Bitcoin is at an ATH and still no one is using it. Think about what that means. Everyone is either hodling, on exchanges, or with custodians (not paying mining fees).

How would miners be getting paid with very little on chain activity, but little to no block reward in the future?

#5 is what would happen if we had the current circumstance down the road

The chain is used now and will be used even more in the future. No one hodls forever. Bitcoin is money. People live and will spend their Bitcoin for their living.

Both users on-chain and on LIghtning Network will increase leading to increase to transaction volumes and fees profitability. The free market is doing its thing at adjusting participants and efficiency.

Then you'll run into #4

Lightning doesn't pay mining fees to secure the chain so it doesnt matter with what we're talking about

Miners are free to run lightning nodes. In addition they have their own on-chain incentives. Also opening and closing LN channels do pay fees on-chain.

Lightning is the opposite of what you would want.

It entirely eliminates transaction fees for miners that go thru it's network. Or it greatly reduces fees if they do decide to run one node.

I don't think many miners are going to go through the trouble for a few cents a month.

LN channels do pay fees on-chain.

Lightning Network is the way to get every human being to use Bitcoin as medium of exchange. Small value transactions.

There will be enough market for on-chain high value transactions. Miners incentives work.

Sorry but what you think is irrelevant. What I think too. What is relevant is the reality.

All my bets are on Bitcoin though. Its the only Hope for Humanity.

No they dont. If I pay you on lightning miners don't get any of those fees.

Lightning doesn't scale to every human non-custodially/permissionlessly.

You're right what we think is irrelevant. What happens will happen.

Opening and closing lightning network channels pay on-chain fees to miners.

Its good we agree on the last point : )

Yes, but the whole point of lightning is to very rarely open/close channels and mostly transact over lightning.

For once we agree on something

Lets call it a day on a good note.

I wish you well. Let us be free, have our choices and what happens will happen.

it doesn't make me as mad listening to the cult of monero but i still pretty much mute them all and usually don't engage with them. you can't bring reason to a person who is a fanatic about something. their brain is full of phobias against the principles that actually are important.

"you can't bring reason to a person who is a fanatic about something"

?cid=4ea4f8d5ozf9cehyily5swamk1hwg2a1gd8m2ki8jc77papd&ep=v1_gifs_search&rid=giphy.gif&ct=g

?cid=4ea4f8d5ozf9cehyily5swamk1hwg2a1gd8m2ki8jc77papd&ep=v1_gifs_search&rid=giphy.gif&ct=g

there is terrible structure to this document, i can't tell what it's digging at. apart from saying that bitcoin fee rates will kill bitcoin because they don't grow enough.

without some substantive summary of how that can happen, all i get is scroll scroll scroll ok what's the point

true