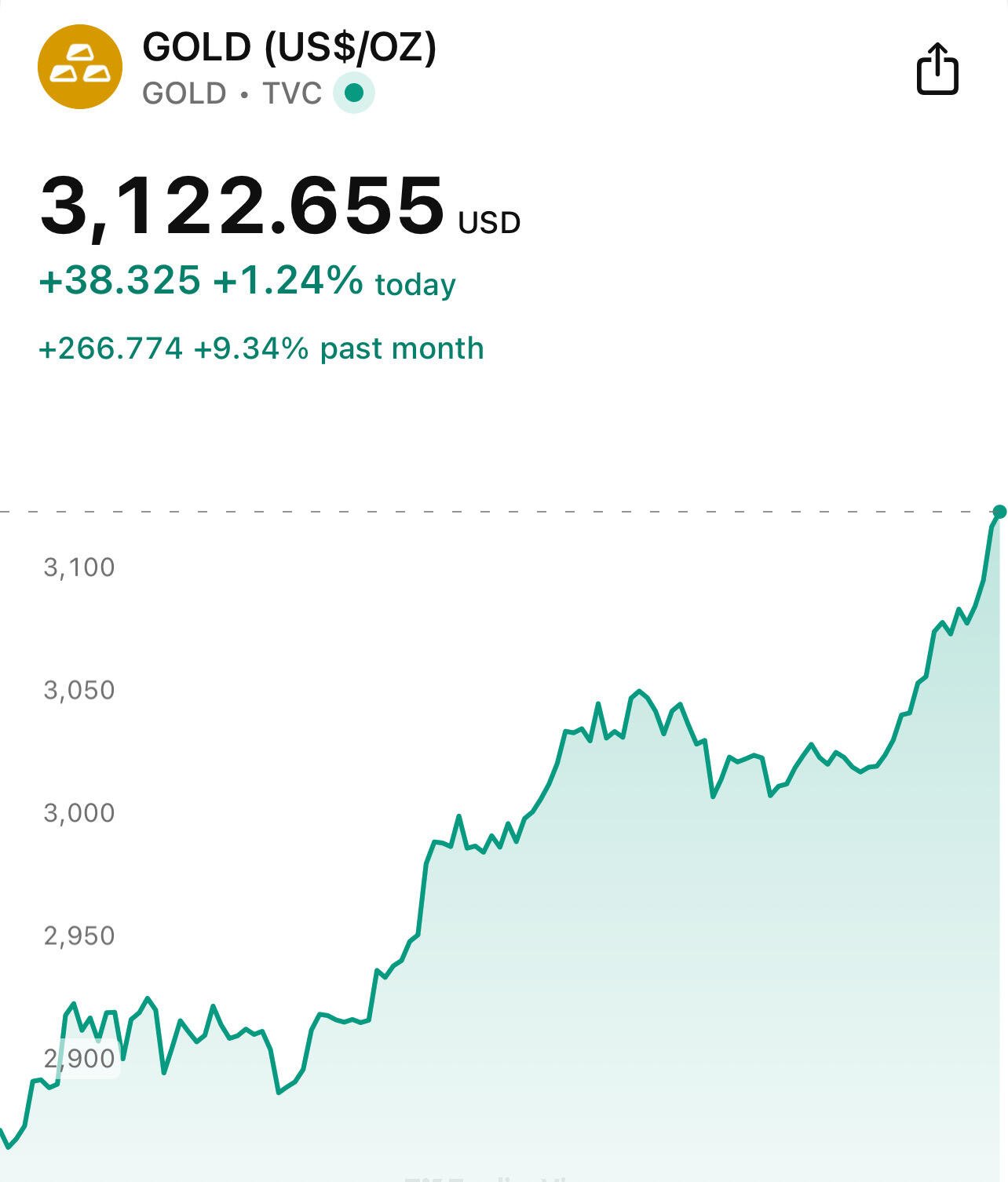

When gold’s down, stocks are bleeding, the VIX is screaming, and Bitcoin is green… you’re not just witnessing a market event. You’re witnessing a monetary revelation.

Long may it continue

We’re not in Kansas anymore.

#Bitcoin #Decoupling #EventHorizon

For a TL:DR take in an Orwellian tone 👇🏻

“ProtectEU”: A Bureaucratic Utopia of Total Safety

Or: How I Learned to Stop Worrying and Love the Surveillance

Presented by the Directorate for Harmonised Fear Management (DHFM)

Broadcast via the Ministry of Homeland Unity (MoHU), 2025 Edition

⸻

Introduction: War Is Security, Fear Is Unity

In this pivotal year, as the lines between “hybrid warfare” and reality TV blur, the European Commission has graciously unveiled ProtectEU — a sweeping internal security doctrine to ensure you are never alone, never unobserved, and never not safe.

All freedoms will henceforth be protected through collective vigilance, biometric tracking, encrypted backdoors, and a mild algorithmic nudge when you wander from Party-approved narratives.

⸻

Chapter 1: A Cultural Shift Towards Permanent Preparedness

Old Way: Trust among people.

New Way: Trust in the centralized fusion of law enforcement, AI, and risk analytics.

To protect our democracy, we must:

• Embed security thinking into every policy, even ones that have nothing to do with security.

• Train every EU official to spot threats, draft legislation with surveillance potential, and drink their biometric lattes in full compliance with the NIS2 Directive.

⸻

Chapter 2: The Panopticon Upgraded — Interoperability for Peace

A single surveillance structure is no longer dystopian, it’s efficient.

• All EU databases — DNA, facial scans, financial records, travel itineraries, VPN logs — will now interoperate seamlessly.

• Law enforcement will gain access to encrypted communications through “lawful” and “balanced” means (trust us, we won’t abuse it, promise).

• AI tools and real-time decryption frameworks are being developed to enhance our understanding of you.

This will be done “with full respect for fundamental rights” — notably the right to be watched responsibly.

⸻

Chapter 3: Europol 2.0 – Now with Teeth

Previously: Europol supported investigations.

Now: Europol becomes the Empire’s Strike Team.

• Expanded mandate to cover sabotage, hybrid threats, and information manipulation (aka tweets).

• Direct involvement in cross-border police ops.

• Intelligence-sharing becomes not optional — it is the price of peace.

⸻

Chapter 4: Frontex – Fortress Europe Gets Lasers

External threats are now internal feelings of discomfort.

• Frontex’s army will triple.

• Armed with drones, Earth-observation satellites, biometric gates, and AI heat maps of threat vectors (translation: migrants and suspicious dissent).

• A digital “Multiple Identity Detector” will ensure no one accidentally has free movement or privacy.

⸻

Chapter 5: The Cyber Holy Grail – Safety from Your Own Router

The strategy warns us that “children, minorities, and democracy” are at constant risk… online. Hence:

• Quantum-safe encryption… for the State (you may still use Gmail).

• Post-Quantum Cryptography and EuroQCI to ensure elite communication is uncrackable while yours remains responsibly decryptable.

• Ransomware, misinformation, and meme threats will be neutralized through EU-certified content flows.

Everything will be “encrypted,” unless requested by the proper authorities. Then it won’t.

⸻

Chapter 6: Hybrid Threats and Digital Extremism – Think Safe

Disinformation is now defined as anything that weakens “societal cohesion.”

So:

• FIMI (Foreign Information Manipulation and Interference) will be tracked and flagged.

• Platforms must auto-censor under DSA risk frameworks.

• “Very Large Online Platforms” (translation: anything you use) must respond to crisis narratives in real time.

Coming soon: an AI-generated truth benchmark.

⸻

Chapter 7: Weaponised Migration – The Border is Psychological

• Migration, once a humanitarian concern, is now a hybrid act of war.

• The Commission pledges to track, filter, and return those weaponized bodies.

• Asset freezes and sanctions will be applied to smugglers — and possibly their digital sympathizers.

⸻

Chapter 8: Follow the Money – Because You’re Probably a Launderer

• Parallel financial systems (read: crypto) are enabling crime. Therefore:

• EU-wide crypto tracking tools under development.

• Financial Intelligence Units (FIUs) will be encouraged to share more, faster, deeper.

• AMLA will “crossmatch” your holdings against Europol’s lists — no hit? You’re fine. One hit? You’re… interesting.

All this in the name of fighting drug cartels and terror — definitely not financial freedom or non-compliance with inflation.

⸻

Closing Reflections: You Are Free… Inside the Framework

“ProtectEU” is a masterpiece in securitized federalism. With a seamless blend of:

• Digital identity,

• Quantum communication,

• Border militarization,

• Platform censorship,

• And cyber sovereignty,

…the EU is finally building its Safety State — equal parts benevolent shepherd and watchful eye.

Rest easy, citizen. You’re being kept safe from threats… including yourself.

Liberation Day or Leviathan’s Last Stand?

By DownWithBigBrother | April 2, 2025

⸻

“Protectionism is not a policy—it is a symptom. And the fever has broken.”

⸻

ACT I: The Empire Strikes Tariffs

At 12:01 a.m. Eastern on April 3, 2025, the United States of America declared economic war—on the entire planet.

President Donald Trump’s “Liberation Day” tariffs are more than just a trade policy. They are a rupture. A declaration that the global economic order is over—and the U.S. intends to reshape it by force.

The opening salvo:

• 25% tariffs on all foreign-made automobiles, across every country.

• A vast schedule of “Reciprocal Tariffs”, targeting nations according to the alleged barriers and currency manipulation they impose on U.S. exports.

Framed as justice. Functioning as judgment. This is not about fairness—it’s about compliance.

⸻

ACT II: Tariffs as Tools of Submission

The White House has released a staggering series of charts—hundreds of nations, territories, and trading partners, all ranked and tariffed.

Each entry includes:

• The percentage of trade barriers allegedly imposed on the U.S.

• The new “reciprocal” U.S. tariff—discounted, we’re told, out of mercy.

Here’s what that actually looks like:

Country Barriers to U.S. U.S. Tariff

Vietnam 90% 46%

Cambodia 97% 49%

Laos 95% 48%

Lesotho 99% 50%

Madagascar 93% 47%

EU (avg) 39% 20%

China 67% 34%

India 52% 26%

United Kingdom 10% 10%

Across the charts, allies like the UK, Australia, and Israel are capped at 10%, while developing nations and strategic outliers face punitive tariffs between 20%–50%.

Some states, such as Saint Pierre and Miquelon (99%), Mauritius (80%), and Syria (81%), now face barriers that effectively lock them out of the U.S. consumer market.

⸻

ACT III: The World Reacts — Hesitation, Panic, Reshuffling

Global response has been swift—and fractured.

• The European Union warns of retaliation, but internal divisions and structural weakness limit its leverage.

• Canada is in freefall. Analysts predict a recession triggered by energy and automotive tariffs, with spillover job losses.

• Japan and South Korea, longtime allies now hit with 24–25% rates, are reevaluating U.S. manufacturing strategies.

• Ireland stands to lose €18 billion in exports and 80,000 jobs, mostly in pharmaceuticals and high-end goods.

In the Global South, panic is quieter—but deeper. Many economies don’t have the industrial leverage to fight back. This is neo-mercantilism by spreadsheet.

⸻

ACT IV: Britain’s Managed Decline Meets Shock Doctrine

Meanwhile, in the UK, the Spring Budget landed with all the excitement of a damp manila folder.

• Council tax, water, and energy bills all rose in April.

• Inflation is now forecast to average 3.2%, peaking at 3.8% mid-year.

• GDP growth downgraded to a limp 1% by the OBR.

A 6.7% increase in the National Living Wage is the only sweetener—barely enough to offset cost hikes, let alone spur growth.

Britain isn’t participating in global power plays. It’s watching the board reset from the cheap seats.

⸻

ACT V: The Global Tariff Atlas — A New World Order in Charts

With hundreds of nations included in the tariff schedules, the U.S. has redrawn the global economic map using only two colors: compliant and problematic.

The structure reveals a clear tripolar hierarchy:

1. Core Allies (10%)

Countries like the UK, Australia, Singapore, Israel, and the Gulf States are held to a symbolic floor—perhaps out of loyalty, perhaps out of usefulness.

2. Strategic Swing States (15–30%)

Nations such as Serbia, Kazakhstan, Fiji, and Tunisia are being nudged—pressured economically, but not yet punished. These are testing grounds for realignment.

3. The Noncompliant Bloc (30–50%)

Here lies the heart of the new trade war. These are the sovereignty-minded, the protectionists, and the non-aligned:

• Bangladesh (37%)

• Mauritius (40%)

• Lesotho (50%)

• Myanmar (44%)

• Reunion (37%)

• Botswana (37%)

Even the Falkland Islands now face 41% tariffs. Geography and ideology no longer matter—only obedience to the U.S.-centric model.

This is economic NATO, built not on treaties, but on tariff enforcement.

⸻

Conclusion: Fiat’s Last Fireworks

Trump’s “Liberation Day” is not a reset—it’s a repricing of global dependency. Tariffs are no longer about jobs or trade deficits. They are now tools of hegemonic calibration.

But here’s the deeper problem: the entire system still runs on debt, leverage, and fiat illusions. Shuffling tariffs in a debt-saturated, derivative-laced world doesn’t rebalance it—it breaks it faster.

This isn’t liberation.

It’s monetary triage.

⸻

Exit Strategy: The Sovereign Path Forward

If you’re watching this unfold from within the system, you’re not just at risk—you’re exposed. The solution isn’t to pick a side in a collapsing fiat chess game. It’s to opt out of the board entirely.

• Bitcoin as neutral money.

• Nostr as open speech infrastructure.

• Local production as economic moat.

• Lightning as real-time, borderless settlement.

The rules are changing.

The exits are still open.

For now.

⸻

Follow @DownWithBigBrother on Nostr for insights from the collapse, the reset, and the rise of something freer.

⸻

Liberation or Liquidity Trap? Trump’s Tariff Bomb, Bitcoin’s Repricing, and the Fiat Endgame in Europe

By DownWithBigBrother

⸻

April 2, 2025 — The United Kingdom is facing a perfect economic storm: spiralling costs, capital flight, collapsing public services, and an openly hostile tax policy towards savers. But while Britain slips deeper into managed decline and the European Union readies its Digital Euro for October, events across the Atlantic suggest the next financial earthquake will not be triggered by Europe at all—but by Washington.

On April 3rd, U.S. President Donald Trump is set to deliver what insiders are calling “Liberation Day,” a dramatic unveiling of sweeping global tariffs designed to “reclaim American manufacturing” but likely to reprice the global economy overnight.

But beneath the trade war theatrics, a deeper game is playing out: one that could radically reshape global monetary alignment—and hand Bitcoin its most powerful narrative to date.

⸻

Context: UK and EU in Structural Decline

Across Airstrip One (formerly known as the UK), economic dysfunction has gone from quiet undercurrent to unavoidable collapse. The Office for National Statistics was recently forced to revise UK household wealth down by £2.2 trillion, exposing the fragility of the private pension system just as Chancellor Rachel Reeves quietly prepares to consolidate retirement savings into state-directed “megafunds.”

Meanwhile, Birmingham is drowning in mountains of uncollected rubbish, bin strikes escalating into full-scale public health crises as rats the size of small dogs infest homes. The symbolism writes itself: decay beneath austerity, and no room left in the budget to stop the rot.

Over in the EU, things are no better. Germany narrowly dodged a recession in Q1, and energy instability still haunts the industrial base. The Digital Euro is now scheduled for launch in October 2025, promising convenience—but also programmable surveillance, expiry dates on savings, and control over how money is spent.

Trust in both Westminster and Brussels is evaporating. The old system is fraying. But from Washington, something new is being born.

⸻

Trump’s “Liberation Day” Is About More Than Tariffs

In a Forbes Digital Assets report, analysts have described Trump’s planned tariff barrage as an “atomic bomb on the current markets”—not just a trade war, but a structural reset of global financial flows.

Key points:

• Tariffs expected to hit global trade routes hard, triggering inflation fears and capital reallocation.

• Short-term forecasts show Bitcoin possibly dipping below $76,000, with Ethereum crashing toward $1,600.

• But this is likely a shakeout, not a collapse.

Behind the headlines, Trump’s crypto playbook is emerging. He’s floated plans for a U.S. Bitcoin reserve, a national crypto stockpile, and is increasing exposure via World Liberty Financial and Trump Media. That’s not just posturing—it’s monetary realignment dressed as populism.

As Mintology CEO Zach Burks noted:

“Bitcoin is the retail investor’s doomsday asset of choice, while gold remains the institutional haven. Trump holds the soft power over both narratives.”

In short, he’s shaking the table, preparing to catch what falls.

⸻

Why It Matters for Britain and Europe

In a world where savings are under siege and surveillance money is on the horizon, Bitcoin offers a lifeline—but only to those paying attention.

• In the UK, ISA allowances are frozen, capital gains tax thresholds are slashed, and HMRC is being granted powers to raid personal bank accounts without court orders.

• In the EU, the Digital Euro pilot includes “merchant compliance tools,” programmable payment limits, and CBDC wallets for refugees and minors—an experimental framework that could be extended to all citizens under “emergency” conditions.

• Across both regions, central banks are running out of tricks—QE has failed, interest rates can’t go much higher, and real wages are in freefall.

If Trump detonates the fiat trade model and Bitcoin is repriced as the reserve hedge of choice, then holding GBP or EUR becomes a liability—not just financially, but politically.

⸻

Bitcoin as the Lifeboat

The short-term volatility is noise. The long-term direction is clear.

• Institutions are waiting for clarity before allocating deeper into Bitcoin.

• Trump’s actions may accelerate that clarity, especially if he positions BTC as “the free market’s answer to globalist control.”

• As traditional institutions wobble, Bitcoin offers neutrality, sovereignty, and portability—a hedge not just against inflation, but against total compliance-based control.

When they say “Liberation Day,” they may be talking about tariffs—but for some of us, the real liberation is monetary.

⸻

Conclusion: You’re Not Powerless

Whether in Britain or the EU, it’s tempting to feel trapped—economically, politically, and culturally. But the rise of Bitcoin, and the destabilisation of the old financial order, flips the script.

The system is cracking. You still have time to opt out—not just financially, but spiritually. The future will be volatile. But in volatility, there is opportunity. As Churchill didn’t say (but might have tweeted):

“Never let a good fiat collapse go to waste.”

⸻

DownWithBigBrother is a pseudonymous writer tracking the collapse of fiat systems, the rise of sovereign technologies, and the path to monetary resilience. Posted only on Nostr, where freedom-tech thrives.

⸻

April 2nd, 2025

Airstrip One – Ministry of Truth (Out of Ink)

Weather: damp, grey, and slightly authoritarian

Rations: cut again, but only on paper (which is fitting, since there is no paper)

Winston’s Diary

(Redacted in triplicate)

Another day in the free and fair Democratic Technocracy of Britain, where the garbage piles rise like monuments to decline, and rats now rival small dogs in both size and apparent authority. Birmingham, the jewel of the Midlands, has become something between Children of Men and a David Attenborough documentary gone wrong. Bin men are on strike, refuse covers the streets, and the most reliable economic indicator left is Will “Rat Man” Timms, who’s clocking 170 miles a day and fighting rodents armed with the nutritional benefits of pavement kebabs.

The Party says inflation is under control — or rather, it says disinflation now, since it sounds more scientific. Nobody knows what it means. But they assure us it’s fine, even as the Office for Budget Responsibility admits most economic data now resembles a pub quiz answer scribbled on a napkin mid-pint. Labour stats? Fabricated from surveys with a 12% response rate. GDP growth? Based on revised guesses and a spreadsheet powered by hope. But don’t worry — it’s all statistically significant.

And then there’s Trump — back on the throne across the Atlantic — declaring tariff “liberation day” and slapping 25% duties on British steel, cars, and dreams. Reeves says it will hurt the economy. Starmer says diplomacy is our best weapon. The rats say: “Thanks for the extra meat.”

Amidst this backdrop of cheerful decay, the Chancellor has bravely unveiled plans for more centralisation, more megafunds, and perhaps a shiny new slogan: “Squeeze the Savers, Feed the Rodents.” It’s unclear if this is official policy or just a side effect of living in a system that punishes prudence and rewards moral hazard with repo liquidity.

Meanwhile, the populace stays distracted. One half stares into their dopamine rectangles, the other into empty fridges. The telescreen offers a choice: arthritis jelly, varicose vein milk, or £49 miracle shoes. No mention of the £2.2 trillion quietly erased from household wealth via a data trick. No mention of the Bank of England’s repo firehose. No mention of reality.

And yet — there is hope.

Beyond the smog of propaganda and the shrill wail of collapsing institutions, something incorruptible hums quietly. A network with no central node. A ledger that does not lie. A money that refuses to be printed, censored, or confiscated. Bitcoin.

In a land where rats overrun cities and numbers are forged in ministry basements, this incorruptible code is quietly becoming the real protest. Not with slogans, not with strikes, but with exit. One sat at a time.

The Party cannot inflate it. The rats cannot chew it. The Chancellor cannot tax what she cannot see.

So I write, not with despair, but with defiance.

Fix the money. Fix the smell.

Until tomorrow,

W.

#DownWithBigBrother

#BitcoinIsHope #RatManCometh #AirstripOneUnplugged

We will win. Not because it’s easy, but because truth doesn’t need permission to exist. Sound money isn’t just an idea—it’s a lifeboat. And when the tide turns, they’ll remember who kept pointing to the signal fire. Stay strong.

I just finished reading nostr:nprofile1qqsxc56ajk5xtxerf4dqspgrfa0s5elrcr80lnz9nasldq87j3zzf0cpzamhxue69uhhyetvv9ujucm4wfex2mn59en8j6gpzemhxw309a6k6cnjv4kzumr0vdskcw358q6rsnafa54 “The Big Print.” My biggest takeaway is the more I learn about the broken system we live in, the more it breaks my heart 💔 knowing so many will face greater disparity, including those very dear to me.

I am doing my best to save as many as I can, but even I know that won’t be nearly enough. It’s one thing when you have information that everyone needs and you do not share, but it’s something different when you share that information and people completely ignore it.

I want my conscious to rest well and I want to be an honorable person so I will continue to spread the word of sound money in hopes that a handful will take heed.

So true. The hardest part is watching people cling to fiat like it’s some eternal constant, safe, stable, and permanent, when history shows it’s anything but. Every paper currency has eventually failed, yet people still treat the pound and dollar like divine law. We don’t warn because we want to be right, we warn because we care. Keep planting seeds. Some will grow when the soil turns.

The book is awesome nostr:nprofile1qqsxc56ajk5xtxerf4dqspgrfa0s5elrcr80lnz9nasldq87j3zzf0cprfmhxue69uhkummnw3ezummjv9hxwetsd9kxctnyv4mqz4mhwden5te0ve5kcar9wghxummnw3ezuamfdejj7mnsw43rzepnvc6x6wtyvamxker20phrydnsw9a8x7rwxek8qenwxuu8x7rhd3k8s7t58pkhqdekwycxzwt609uk5mrnwa58ydrcwc6sn86r currently reading and listening. Thank you so much for the work you have and continue to do.

One thing I know about sequels is, they are always shit 🤣

2008 was the preview, 2025 is the main feature. The fiat treadmill broke, the hamster’s dead, and the banks are still charging rent on the wheel. Time to exit the debt spiral—opt out with Bitcoin.

Trump’s warning to Zelensky about a rare earth deal isn’t just a throwaway threat — it’s a calculated signal. And it’s likely a direct response to the UK–Ukraine 100-year pact, signed just days before Trump returned to the White House.

The timing couldn’t be more revealing.

On January 16th, UK Prime Minister Keir Starmer visited Kyiv to sign a sweeping agreement binding Britain and Ukraine for a century. It promised military integration, economic support, and crucially — a “critical minerals strategy.” That’s rare earths, lithium, uranium — the materials that will define energy dominance and defence superiority in the 21st century.

And this is where things get geopolitical.

Over a century ago, British geostrategist Sir Halford Mackinder proposed the Heartland Theory (1904), arguing that whoever controls Eastern Europe controls the “World-Island” — the combined landmass of Europe, Asia, and Africa. Ukraine, sitting at the gateway between East and West, has always been the pivot. It’s no coincidence that both Russia and the West are vying for control of it.

The UK just made its move — not with tanks, but with treaties. While the U.S. was in presidential transition, Britain quietly secured a deal that could give it privileged access to Ukraine’s postwar resource base and strategic industries. The 100-year pact isn’t just diplomatic theatre — it’s a potential land and resource grab, sealed before Trump could reassert U.S. interests.

So when Trump warns Zelensky not to “back out of the deal,” he may be reacting to a betrayal that’s already happened. Britain might have locked in the Heartland — and the U.S. may now be fighting to claw it back.

We’re watching Mackinder play out in real time — in minerals, missiles, and memorandums.

nostr:nevent1qqsdxw2z0d7c0px36uae7qvd9gugd47xucgszvr4359y24k9l3zsyxgpp4mhxue69uhkummn9ekx7mqy372lc

Gold’s making a run, but it’s still fenced in. Bitcoin isn’t just a safe haven—it’s an escape hatch. The world is waking up. One asset is hard to move, the other moves at the speed of light. Choose wisely.

Ah yes, pensions and war — a match made in Keynesian heaven. First they debased your currency, then they raided your savings, and now they’re using what’s left to fuel the next great defence boom. “Slightly higher risk profile” sounds a lot like “don’t worry, it’s just your future.” Meanwhile, the fiat system lurches from bailout to battlefield, and we’re all supposed to pretend this is normal capital allocation.

There’s a reason we’re opting out. Bitcoin isn’t just an asset — it’s a firewall.

I’ve used Nostr for a little while now, and while it sometimes feels like I’m talking to myself, I’ve come to see that as a feature, not a flaw. It encourages deeper reflection without the engagement traps of other platforms. I recently had my X account locked simply for sending two long DMs answering some big Bitcoin questions—that experience made me value this space even more.

Sure, it doesn’t yet match X for current events or diverse perspectives, but every cathedral starts with its foundations. Nostr has that solid base, and I’m happy to keep contributing to its growth. I’m still learning the intricacies, but I’ve decided to focus more of my energy here—sharing ideas, writing, and building something that lasts.

Thanks for articulating this so well. It really resonated.

Orange pilling normies is a challenge, they see price and can’t see past it no matter how much I explain.

Very frustrating 🤦🏻♂️

The UK’s Managed Decline of Everything: A Bureaucratic Triumph

A satirical dispatch from the Ministry of Managed Collapse

⸻

By DownWithBigBrother

March 29 - 2025

In a landmark victory for Bureaucratic Excellence, Chancellor Rachel Reeves has boldly navigated the UK further down the road of irreversible economic entropy. In a masterclass of fiscal choreography, she has managed to both raise taxes and reduce tax receipts — an achievement only possible through the most diligent application of modern Treasury logic.

The economy is flatlining, growth projections have been halved, and pensioners are about to be taxed on the very benefits they were promised for a lifetime of work. Truly, we are witnessing the full flowering of His Majesty’s Managed Decline — a centrally planned slow-motion car crash, complete with spreadsheets, sanctioned suffering, and a stiff upper lip.

The £23 Billion Black Hole (Now With Extra Hole)

After bravely increasing capital gains tax by four percentage points — while simultaneously stripping back relief for those selling businesses — Reeves was rewarded with the emergence of a surprise £23 billion black hole in the public purse. Investors, sensing what’s politely known as “an expropriation event,” rushed to sell before the new rates took effect, locking in lower taxes and depriving the Treasury of projected income.

The Office for Budget Responsibility (OBR) has since downgraded capital gains revenue for the next five years, with receipts falling from £15.7bn to £13.3bn in 2025 alone — and expected to remain billions lower for the foreseeable future. In short, a classic case of tax more, earn less. Or, as they might call it in Whitehall: a robust fiscal realignment strategy.

GDP: Schrödinger’s Recovery

While the ONS updated its growth figures for early 2024, raising GDP from 0.8% to 0.9%, this minor uptick was quickly overshadowed by stagnation. GDP in Q3 flatlined at 0.0%. The best-case revision for Q4? A stately 0.1%.

The UK’s economy, therefore, is not so much growing as it is technically not dying. Yet. For now.

ONS economists noted “slightly more strength” in early-year output, followed by what can only be described as a growth coma. This was presented in official documents as “continued resilience.” Which, in Orwellian translation, means: it hasn’t collapsed under the full weight of policy idiocy — yet.

Triple Lock or Triple Trap?

Thanks to frozen income tax thresholds and inflation-linked pension rises, pensioners are now just £46 away from being taxed on their state pensions. By 2027, the state pension will exceed the personal allowance, meaning the very people relying on it to survive will begin returning a portion of it to HMRC for safe government storage.

In this way, the pension system will complete its evolution from welfare mechanism to circular cash trap: take from the Treasury, return to the Treasury, all while retaining the illusion of support.

The Cash ISA Guillotine

Cash ISAs — long considered a sanctuary for modest savers — are also now in the Treasury’s crosshairs. Under proposed reforms, annual limits could fall from £20,000 to £4,000, nudging cautious pensioners and low-income families into higher-risk “growth-oriented” investments. The rationale? Growth must be stimulated. Your safety is inefficient.

And in a move so openly authoritarian it makes the Inland Revenue look like a cuddly mascot, HMRC is now pushing for powers to acquire full financial data from banks — including National Insurance numbers and interest earned — to adjust people’s tax codes directly. A progressive digital panopticon, disguised as a user-friendly tax improvement.

Authoritarianism-as-a-Service

By 2028–29, nearly 893,000 more people will be dragged into paying tax on savings. And by 2027–28, an estimated four million will pay higher income tax due to frozen thresholds — all without a single new tax law passed. It’s governance by stealth, powered by inflation and bracket creep.

Meanwhile, HMRC has pledged to increase the number of prosecutions for tax offences by 20%, promising to crack down on “noncompliance” with the enthusiastic zeal of a Stasi recruitment drive.

And who needs Parliament when you have a PAYE tax code adjustment API?

Ministry of Truth Economics

In this brave new economic order, reality is not determined by experience or consequence but by the OBR’s modelling. Where real wages decline, inflation devours purchasing power, and housing becomes a generational hallucination — but somehow, living standards are rising. (Because GDP per capita rose by 0.1% before promptly declining again. So that’s fine.)

The Resolution Foundation helpfully estimates that the UK’s poorest households are facing a real-terms hit of £500 per year under current policy. But this, we are told, is a necessary sacrifice to uphold fiscal discipline — that great Orwellian euphemism for austerity by spreadsheet.

A Government of Bureaucrats, by Bureaucrats, for Bureaucrats

The Chancellor’s real triumph is not economic performance but bureaucratic control. Tax thresholds remain frozen, tax powers expand without scrutiny, and surveillance is rebranded as “administrative efficiency.” Even death offers no reprieve — with pensions soon subject to inheritance tax and grieving families warned they may lose up to 90% of the pot.

The ONS, for its part, has become a kind of Ministry of Statistical Interpretation — updating past data while releasing reports with falling response rates, revised methodologies, and confidence intervals that feel more like prayer wheels than science.

Conclusion: Welcome to the Algorithmic Gulag

The UK, as of Spring 2025, is not in a recession — it’s in a centrally managed decline. Every lever pulled by the state tightens the collar on savers, retirees, and anyone foolish enough to play by the rules. What used to be called freedom — to own, to save, to build a future — is now “economic inefficiency” to be corrected by algorithms and behavioural nudges.

The Treasury doesn’t need to knock down the front door. It just adjusts your tax code.

There is no need for debate. The numbers have spoken. The models are clear. The decline has been calculated.

And thus, with great administrative pride, the bureaucrats have finally achieved what no invading force ever could:

The managed decline of everything.

Efficient. Inevitable. And fully tax-compliant.

⸻

In the midst of this bureaucratic entropy, a quiet resistance simmers: Bitcoin. Not a protest, but a lifeboat — mathematical, incorruptible, and outside the jurisdiction of collapsing fiat empires. But even here, the state claws at the edges.

KYC regimes ensure that even in freedom, one must first submit paperwork. The chains may be digital, the form fields compulsory. After all, in a society where saving is subversion, a decentralized ledger is dangerously close to heresy.

And so the final solution for those still searching for light is narrowing: either a quick collapse into chaos, or movement offshore — into jurisdictions not yet strangled by the nanny state’s infinite compliance matrix.

#UK #Economy #Fiat #Bitcoin

It’s true the US can’t switch off our nukes — but judging by the last two tests, neither can we switch them on. One missile veered off course and self-destructed, the other belly-flopped into the Atlantic like a soggy firework. At this point, our true deterrent might just be keeping everyone guessing whether it’s a weapon or an elaborate fireworks display.

It’s a sobering picture that only gets darker the deeper you go. The UK is in a state of managed decline, and fiat money lies at the heart of it. Decades of debt-fueled policy have gutted real productivity, hollowed out the middle class, and replaced long-term value creation with short-term speculation and government dependency.

What’s worse, nearly every key economic figure—GDP, inflation, employment, household wealth—is either distorted, selectively framed, or quietly revised years after the fact. These revisions are rarely minor and almost always paint a grimmer picture in hindsight. It suggests that the situation is not just bad, but deliberately concealed to maintain a fragile illusion of stability.

Rather than reversing course, policymakers are doubling down with even more debt, more intervention, and more narrative management. Meanwhile, public services are in freefall, basic infrastructure is crumbling, and younger generations see little chance of owning homes or building stable lives.

Until there’s a shift toward honest accounting, sound money, and real accountability—Bitcoin being the clearest path—the current trajectory points toward systemic breakdown. Collapse isn’t a possibility anymore, it’s a process already in motion.