Super helpful roundup nostr:npub1pvgcusxk7006hvtlyx555erhq8c5pk9svw57snlxujpkgnkup89sekdx8c.

Of course, once Jocko's voice gets into your head and starts saying "get up get after it" when you're lazy, or just "good" when something bad happens.... there's no turning back. 😂

i'm glad its helpful, and yea, Jocko has been a decent contributor in getting me to tone up =)

i like that he loves to figure out how to learn better, including his debates on knowledge based contributions on AI - but is there a metadata tech development portion I am missing out or is this more of a principle oriented approach ?

Has anyone trained AI-driven feedback systems using metadata through federated learning, homomorphic encryption, or differential privacy (with noise injection)? Would love to hear your thoughts on the development and infra complexities

I started this year with a footprint on personal empowerment. I couldn't help but notice how different these philosophical ideas are next to each other, but as a whole, it's a nice balance.

Buddhist Teachings (Thích Nhất Hạnh, Dalai Lama) - ego and attachment to desires causes suffering. True happiness comes from selflessness.

My take - I love this, and agree entirely, but love yourself first, so that you can be whole as you love others.

Napoleon Hill (Think and Grow Rich) - tap into your inner ego. Align purpose with actions.

My take - Over the years I’ve realised that good intention is more important than anything else.

Marcus Aurelius (Stoicism) - accept what we cannot control, and strengthen resilience when facing challenges. Virtue and rationality are core Stoic principles.

My take - I’ve grown to appreciate the wisdom of emotional detachment. It’s not about suppressing love or your deepest desires and drive but ensuring you don’t succumb to emotional prison that carries destructive emotions like anxiety, fear, and insecurity - as it can rule you and ruin your relationship with those around you.

The Secret (Law of Attraction) - visualise and live in a positive bubble with gratitude, till it becomes real.

My take - manifestation is great BUT those who manifest without reality check can be imposing, manipulative and egoistic.

Rhonda Byrne, in The Secret - our thoughts shape our reality

My Take - it leans towards the mystical part of manifestation, not my cup of tea.

Prayer (Christianity) - manifestation with a reality check (God’s will is the arch)

Reality transurfing - let the universe decide. Tweak your thoughts and intentions so that you can shift your energy and awareness to align with parallel realities

My take : I love the energy and universe concept, but I also believe you determine your own destiny.

Gabby Bernstein - don’t trust the universe. Trust faith, fate and divine energy

My take : I love the romantic notion of fate, but not one out of despondency. And I also deeply believe that our actions and choices shape our destiny, and this is how your soul’s call to greatness is defined.

Faith-Based Self-Help (e.g., Zig Ziglar, Norman Vincent Peale, The Power of Positive Thinking) - trust in faith and miracles without tangible evidence.

My take : I am my father’s daughter and believe in the strength of faith especially as it provides a sense of purpose and resilience during challenging times. But faith also changes the structure of your brain so I am more realistic than mythical about it.

Tony Robbins - you decide and act on it.

My take : makes me want to run a marathon after listening to it.

David Goggins - you are 100% responsible for your life.

My take : Absolutely. But it comes with the understanding that everyone has different levels of challenges.

Jocko Willink (Discipline Equals Freedom) - rigid discipline for daily structure and self control is non-negotiable.

My take : this is my 6am - 8am motivation for pilates and sunrise walks.

Eckhart Tolle (The power of now) - live in the present, discard ego’s obsession over past or future

My take : agreed, but reflection and striving makes you whole.

Marie Kondo (The Life-Changing Magic of Tidying Up) - keep what “sparks joy” .

My take : Agreed. We all should definitely declutter life every now and then - remove noise or ambivalence that drains us and focus on the signal

Rational Emotive Behavior Therapy (REMT - Albert Ellis) - logical thinking improves emotional responses.

My take : I love this. It sets the stage for modern concepts of “reframing” and “mindfulness”

Atomic Habits (James Clear) - on small, incremental improvements.

My take : I find this to be most helpful when you go through an extreme period of pain and you find it hard to carry on and so you start with small shifts until you gradually see yourself getting better.

Overall these books have similar goals - empowering yourself, strengthening your mind, resilience, growth. It depends on what you need when, for example :

self awareness & compassion - Buddhist teaching, stoicism

moments of crisis - Atomic habits, stoicism

long-term goals - think and grow rich, Tony Robbins

clarity and balance - Marie Kondo

positive mind - faith based, the secret

discipline - jocko

spirituality - Gabby Bernstein, prayer

relationship & teamwork - REBT

For all other times, a balance of these philosophies can be pretty powerful (but with a reality check)

Stalemate is an interesting tactic. You avoid it when you're winning, but go for it when you're losing. It reminds me of life, where people sometimes settle for whatever they can get, either out of fear of losing more or a lack of belief in something better.

Try to find someone with similar goals. Honesty, trust, morals are obviously very important. Be careful with high maintenance individuals. Remember the golden rule. Even choosing wisely being lucky comes into play. Some people grow closer. Some apart. Under the best of circumstances, it takes work, compromise, give and take. I got lucky and found someone who put up with me for 31 years and counting. I'm very grateful. Hasn't been easy but worth it. It's good to have someone to hang on to. nostr:npub16eumpaxffppswucpeysysrya9uk39j06d5gr2tsnf6cupq3f4jdqyft6jc is my best friend. We made it to the good times. Arguments happen but don't last too long. I usually end up apologizing because it's my fault. Life's too short. I hope everyone finds the peace of mind I have. 🙏

this is beautiful

When it comes to global finance, countries often suffer when currencies clash with political instability and economic uncertainty. In the traditional economic system that has currency dominance or trade hegemony, when gov’ts struggle to defend currency pegs or manage foreign debts & investments, economies become fragile. A part of my interest is understanding at a deeper level how Bitcoin could play a role in creating a more equitable global financial system.

In 1994, Mexico’s interest rate ballooned to nearly 100%. This was during the Tequila Crisis of 1994-1995, when Mexico's peso was pegged to the USD and was overvalued.

The country’s economy was heavily dependent on foreign capital and was destabilized by the rising political unrest, especially after the assassination of Colosio (who vowed to eliminate corruption from all sectors and was often likened to JFK).

In order to remain pegged, Mexico had to buy pesos on the open market whenever speculative pressures arose - but their foreign currency reserve was depleting.

So they issued short term bonds (Tesobonos) to attract foreign investment, and these values reflected the huge amount of debts Mexico had.

Foreign investors were getting nervous about repayment, so the Mexican government devalued the Peso by 15% from 2.9 pesos to 3.4 Pesos to a dollar.

When it comes to devaluation, for foreign investors it should seem like Mexican assets are cheaper in terms of USD, and would produce higher returns once the economy stabilises so the Mexican govt was banking on a positive boost. But instead the devaluation signaled desperation and uncertainty about the government's ability to manage the crisis, causing a dramatic free fall of selling Peso in the open market. Peso lost 50% of its value within a few weeks.

To attract investors back, the central bank drastically increased interest rates up to 80% - 100% . Borrowers, businesses and consumers, struggled to repay loans (as they had to pay 2x). Thousands of businesses went bankrupt and millions lost their jobs.

Mexico went into severe recession with GDP contracting by 6.2%. Bill Clinton and the IMF sent a ~$40B loan to bailout Mexico. Today the exchange rate is at 20 Pesos to 1 US dollar.

A high exchange rate like this makes it more expensive to buy in USD - hence making import harder, while increasing demand in exports for Mexico. This was something Mexico wasn't ready for and couldn't handle.

But the reverse also holds true. I remember watching a documentary on China that came under scrutiny for "currency manipulation" , devaluing its Renminbi to boost exports to the US and reduce imports (which fosters internal circulation).

While China gained massive trade advantages, many small businesses lost out, especially in SEA and globally. Devaluing currency or artificial currency was part of China’s economic strategy in the 90s and 2000s. It was also once pegged to the US from ‘94 - ‘05 but it has been a floating currency since and its ties with BRICS encourages more trades in RMB.

The Mexican Peso crisis might sound very similar to the 1997 Asian Financial Crisis.

I remember George Soros was a key figure in making speculative attacks that SEA’s strong trade will collapse - we never will know if it's due to him that everyone pulled out or he was right, but the Thai baht, pegged to the USD, could not withstand these speculative pressures. The gov’t lacked sufficient foreign reserves and had high foreign debt, which led to the decision to float the baht, resulting in its massive devaluation. And then the collapse spread like dominoes.

I also remember reading about the impact of the rise of interest rates by the US federal reserve which also played a key role in the 1997 Asian Financial crisis.

As U.S. interest rates increased, foreign investors pulled out their capital from emerging markets like Thailand in hopes for returns in the U.S. This capital outflow created a vacuum, fueling speculative attacks on these countries' currencies. Defending currency pegs became increasingly expensive because of the higher interest rates. It was a loss-loss situation. Indonesia and the Philippines were also affected.

Asian tigers - Korea and Malaysia were impacted with the loss of foreign investment, but Malaysia was originally not pegged. Maddy made the call to peg it to prevent further loss, as its reserve currency was in abundance (few things Maddy did right)

When we go through all this global trade chaos and historical economic shocks, can Bitcoin make a difference in the future?

In countries where currencies are manipulated or subject to gov’t instability, Bitcoin could serve as a hedge, independent of local gov’t or central bank policies. Given the growing acceptance and accessibility worldwide, businesses can continually operate within the global trade environment despite currency devaluation or capital controls.

Small businesses globally will not succumb to unfair competitions like China's currency devaluation strategy to boost export resulting in loss of business to trade hegemony, if importers and exporters use Bitcoin for cross-border payments, layer 2 through lightning.

Ultimately, Bitcoin could help provide the economic restart that countries need when they are in a limbo, shifting the power back to the people and away from governments that manipulate currencies for political gain.

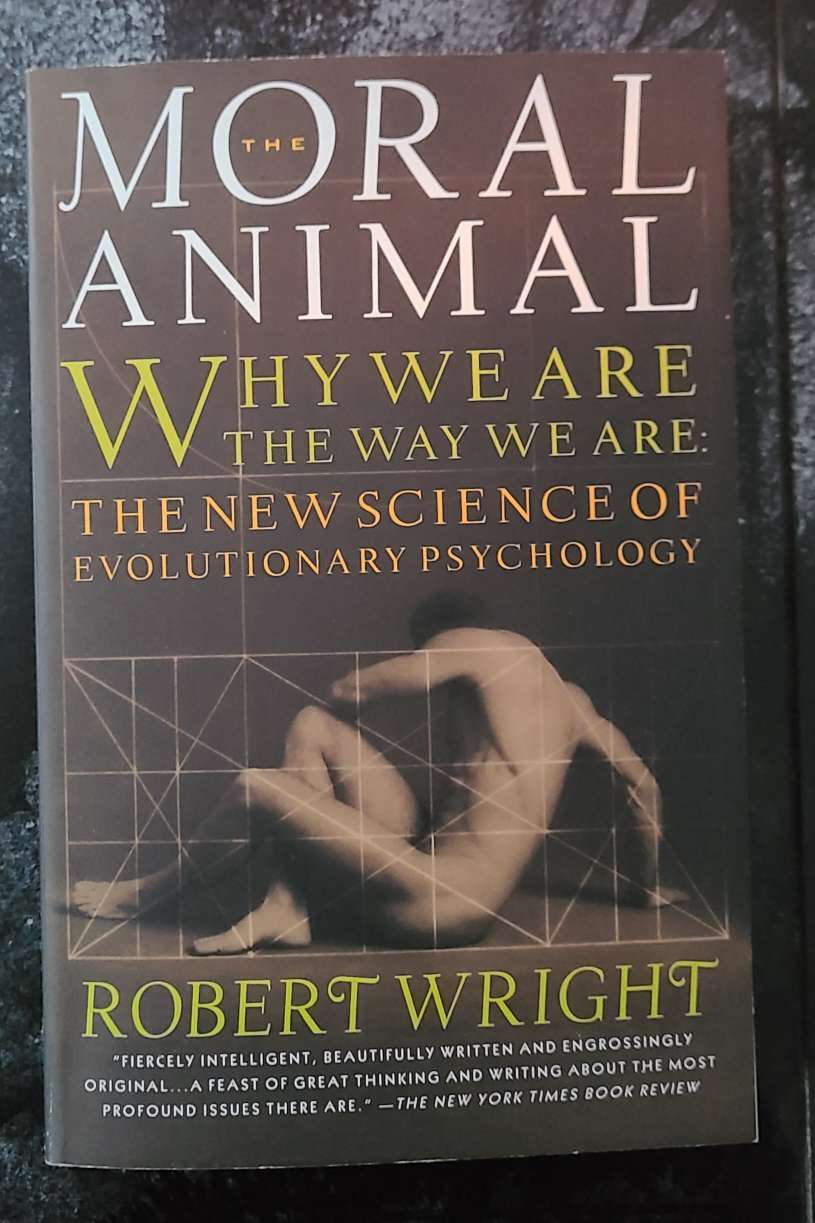

Well the first time I read it I was against it, angry even. Second time I read it years later I decided to keep an open mind and understand that there are many perspectives, researchers, interpretations of theories, I’d agree with some and not others and that's ok. I think this is a book you have to keep an open mind on while reading it.

Understanding the sexual and carnal instincts doesn’t make us a slave to them, but it is rather empowering. When we recognize that these instincts exists in ourselves and others, it can encourage open communication in relationships.

Some things I have different takes on, like I believe being faithful is a choice and not determined by evolutionary excuses.

But sometimes it's also not always about resisting infidelity, it’s about emotional and mental alignment. Your journey evolves as a person and it makes all the difference whether both the committed parties can grow together or not. At the honeymoon phase we think everyone is flawless and perfect, but only when we start peeling the layers, do we really love the person for everything they are.

On cultural influence, I think it’s a double-edged sword. Cultural norms can have positive influence or act as a bondage - in both shaping expectations and subconscious biases especially on taboo topics like interracial or same-sex relationships or even suits vs overalls etc.

In underserved regions for example people feel repressed because of who they are, where they come from and historical prejudice. But there is also continuous prejudice against them by others be it society, government etc (systemic inequalities). The only way to break free from this type of cultural conditioning is for both parties (the underserved and the prejudiced parties) to acknowledge and make conscious efforts to eliminate bias.

And underserved regions here are not just traditional topics like racism but also others like economically underserved regions from developed countries.

I think the book is great in understanding from an evolutionary perspective but lacks nuances of individual choices and empowerment let alone their innate traits like creativity and critical thinking that influences evolution. We don’t have to accept every argument to find value in engaging with it. But I think choice is what makes us human.

Would love your take on it, especially on the balance between instinct, choice, and cultural influence that shapes our lives

such a beautiful piece, so much of deep emotions channeled through this. Charles Lloyd's tribute to Billie Holiday

I was reading this book (‘The world for sale’ by Javier Blas and Jack Farchy) which started off on how this oil and gas trading company called Vitol provided fuel for the rebels during the Arab Spring with the protection of NATO and funding from Qatar, and it piqued my curiosity on Libya’s rebel support.

Qatar was an intermediary between Western governments and Libyan rebels. It facilitated the provision of arms and fuel through commodity traders. Vitol was a commodity trader.

Some backstory on Libya. Libya was governed by Gaddafi for a very very long time - 42 years. (I’ve written some bits on the political states of North Africa over the last few decades somewhere along these posts).

But Gaddafi’s leadership is often commented from opposite ends - One side calls him a ruthless dictator. The other side calls him the most democratic leader in Africa.

Muhammad Ali stated in his autobiography that the US and Gaddafi did not see eye to eye because of the political influence on religion. But more importantly Gaddafi controlled Libya’s oil by nationalizing it.

Nationalization swept the countries in the middle east and africa in the 70s which loosened the clutches of the global oil dominance by the infamous “Seven Sisters” . In this case, nationalizing it allowed for free trade to happen? (and in the process - petrostate was formed).

Libya is in the top 10 crude oil producers in the world. Many wanted their hands on it but it was hard when Gaddafi was controlling it.

During the Arab Spring which was a wave of uprisings across the Middle East and North Africa, including Libya, rebel factions rose against Gaddafi's regime.

I think when you run for 42 years, even if you were a good person, it prevents strong and decent opponents to rise, and instead creates a vacuum that extremist are quick to fill in. But this period marked a turning point, as both internal dissent and external interventions, including CIA’s and NATO’s involvement, led to Gaddafi's fall and the subsequent struggle for control over Libya’s oil wealth.

Back to Vitol and Qatar and funding the rebels - the only way rebels can win the war in Libya is with more fuel (if you remember the Desert Fox incident during WW2- never run out of fuel in the deserts of Africa). And the only way for global powerhouses to control oil in Libya is to fund the rebels to bring down Gaddafi.

There was a lot of competition among commodity traders to work with rebels as they barter trade fuel for crude oil through the pipelines. But nothing beats Vitol’s founder Ian Taylor who was a leading donor for the Tories party who won the project. Also ironically Washington sanctioned Gaddafi from buying fuel or selling crude oil, but waived sanction for anyone buying from Vitol’s company.

Benghazi, a key city in Libya and a hub for the oil industry, became a battleground during the civil war between rebels and Gaddafi’s government forces. It became a lawless militant state with rising death rates and poorly managed hospitals, food supply etc and people were suffering. Heavily armed youths patrolled the city (a few years down the road, a mob would break into the US consulate and murder the ambassador).

Unfortunately Gaddafi was murdered during the NATO-led intervention during the Arab Spring. I read that he was sodomised brutally by rebels with a bayonet and was beaten to death. His gruesome murder was apparently recorded on phone and broadcasted globally.

Libya grew from the poorest country - to the richest country in the continent under Gaddafi.

And now it’s back to a poor and struggling country controlled by rebels.

Gaddafi also had billions of dollars frozen in Western bank accounts. In September 2011, $300 million in Libyan assets in the West was unfrozen - not to aid Libyan citizens, but to settle payments owed to Vitol for supplying fuel to the rebels.

Many of these large commodity traders apparently have their offices in sleepy towns in Switzerland or New England. And they work for profit hence supporting whichever rebels or gov’ts that benefited them. From the book, it states "Their numbers have remained relatively small: a large share of the world’s traded resources is handled by just a few companies, many of them owned by just a few people."

I am attaching here another piece of article on Libya's governance under Gaddafi. It talks about how Gaddafi promoted direct democracy and was not a dictator because many of his proposals were countered by congress like him wanting home schooling, abolishing capital punishment, to give all oil profits back to the people and even wanting to eliminate the central government. Things he managed to push forth was free schooling, free hospitalisation and free electricity.

The combination of socialism and capitalism in Libya can be expanded to a topic of its own (Someday if i have the time, I will write on the historical bridges of socialism and capitalism around the world).

This article also talks about CIA interventions and how it advocated the rise of extremist militant Muslims around the world from Muslim brotherhood in Egypt to Sarekat Islam in indonesia to Jamar Al islami in Pakistan to al Qaeda and ISIS over the last 4-5 decades.

Will this be the year the CIA is abolished ? Only time would tell.

The story of Libya has always saddened me. Makes me hope more than ever for the liberalizations of people in situations like this

thank you Sophia ❤️

2024 was a lot to handle but losing my boy was my breaking point. To anyone who have lost any form of love, I wish peace fills your heart and that you find the courage to keep moving forward. Let 2025 be a year of healing and recovery.

Thinking of my boy always makes me smile. Fido was so kind in his own way. I can only hope that in everything we do, we do it with that deep level of kindness and genuine love, and have fun while at it. And I hope that the goodness that we give out to the world finds its way back to us. Happy New Year everyone.

what are you making ? I've only used it to make fruitcakes, had 2 bottles of fruits soaked in rum for over 2 years, i thought I'll do right by it this Christmas. Needless to say, it was a very drunk but otherwise delicious fruitcake

Some thoughts, or stuff I read or heard in recent weeks :

It’s easier to search for answers than it is to ask the right questions.

Start. You’ll figure it out as it goes

“I’m so sorry.” Such worthless, feeble words. But really, in such a situation, there was nothing helpful to be said (when someone passes away)

Grief is something that breaks you in ways you can’t explain

Celebrate America not out of fear but out of love (by nostr:npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m)

Grassroots innovators don’t wait for permission.

Don’t let people guilt trip you into becoming a lesser version of yourself

Timing has a lot to do with everything

The key is knowing when to walk away.

It’s one of those things you never thought you’d like but it ended up being your favourite

If you are often surrounded by people who validate your choices, then it gets harder for you to confront your flaws.

If you are in an echo chamber of adulation or excuses, it would be difficult to see the need for change.

If you are restless in relationships, it could reflect a search for something deeper that you haven't found yet.

True connection lies with those who value the entire spectrum of who you are - the success, the struggle, and everything in between

Only help someone who is willing to help themself

Love makes us vulnerable to loss, yet it gives life its greatest meaning.

sometimes love is about recognizing what's best for the other person, even if it's not what we want personally

Home is a place you grow up wanting to leave, and you grow old wanting to get back to

“It’s a house. Just a pile of stones and mortar, and a crumbling one at that. It’s meaningless without love to fill it. My home is wherever you are.”

Just a girl from the wrong side of the tracks

a Hemingway kinda wrap to the year

Tonight was my birthday https://video.nostr.build/189606bc861112eff85beb7b2437755184d4db4b139c176c3c9d68f48e273fad.mp4

happy birthday Sophia, have a great one

"You make money in free software exactly the same way you do it in proprietary software: by building a great product, marketing it with skill and imagination, looking after your customers, and thereby building a brand that stands for quality and customer service."

"You can’t compete with a monopoly by playing the game by the monopolist’s rules. The monopoly has the resources, the distribution channels, the R&D resources; in short, they just have too many strengths. You compete with a monopoly by changing the rules of the game into a set that favors your strengths."

https://www.oreilly.com/library/view/open-sources/1565925823/ch10.html

My current book - 'Imperial Reckoning, the untold story of Britain’s gulag in Kenya', on the atrocities and torture of colonizers on the Kikuyu people. The book is authored by Caroline Elkins, business econs prof from Harvard who specializes in African and African American Studies. It was a nice coincidence to read it this week alongside African Bitcoin Conf. The stories were devastating but the people are truly incredible and resilient, with an indomitable will to keep moving forward.