Yes! I have been grasping at this shadow for years, unable to frame it properly, but your words have nailed it. Thank you.

Privacy is about consent.

When another has to request your consent you control it. You own it.

Normies have been taught tribal group think "Privacy is only for those who have something to hide". A misdirect so a capture system can steal and sell their personal expression.

So who's legal system has jurisdiction of the internet? No one. So make protocols broad and open. The laws will either follow the code or try and capture it. Clearly the former is better than the later.

Yep, nostr published content is best at the moment.

But nostr needs to keep building otherwise it will be copied and centralized by a VC backed doofus who builds a sexy monopoly. And sadly lots of normies are happy with central trust models ...

It goes with the cycle. Same reason we don’t see and hear from much from the class of 2013. Diminishing return as you know more.

Rarely check comments, I think everyone is talking to me...

nostr:npub1h8nk2346qezka5cpm8jjh3yl5j88pf4ly2ptu7s6uu55wcfqy0wq36rpev a good friend finally conceded I was right about #bitcoin today (I felt nothing). He did however bring up a query about how credit would work on a #BTC standard. My response is fundamentally credit doesn’t work in a deflationary environment. After a few beers and crossed eyes, I still stand by this statement. But is there a possibility for credit on a Bitcoin standard in your view? I can’t see how it works?

All money is credit.

That’s the idea of a ledger that tracks unspent purchasing power in a system.

There will be those who trade their accrued purchasing power for a return, and there will always be those who need money now and are willing to pay it off.

Good book. Captured platform. You may have bought it but you don't own it. You license it.

Observing makes one a participant, judging extracts one from participation.

Use this knowledge accordingly.

The perfect bootstrap

My Bitcoin recap video also on nostr 🧡 I hope you like it.

I got all my knowledge from nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx nostr:npub1guh5grefa7vkay4ps6udxg8lrqxg2kgr3qh9n4gduxut64nfxq0q9y6hjy nostr:npub1rtlqca8r6auyaw5n5h3l5422dm4sry5dzfee4696fqe8s6qgudks7djtfs nostr:npub1hk0tv47ztd8kekngsuwwycje68umccjzqjr7xgjfqkm8ffcs53dqvv20pf nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe nostr:npub1dergggklka99wwrs92yz8wdjs952h2ux2ha2ed598ngwu9w7a6fsh9xzpc nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a nostr:npub1h8nk2346qezka5cpm8jjh3yl5j88pf4ly2ptu7s6uu55wcfqy0wq36rpev

THANK YOU!

Very inspirational. Well done.

Fiat Dust

Here is my current thinking...

Ecash becomes relevant only when businesses start to use it - p2p is at best an edge case without businesses.

In less regulated markets, business operators will look to any service provider that gives a Digital Dollar (USDT) ramp and obscurity with local government. The hurdle here for ecash is why wouldn't a USDT wallet transaction suffice? Wallet to wallet. No third party. e.g. Aqua wallet.

In western markets, Businesses that want to use ecash will look only to Regulated Mints. This will mean KYC.

Big Brands (e.g. Starbucks) may host their own as KYC is something they want - i.e. a loyalty program, where they can leverage customer data. (Loyalty and money becoming fused is a scary prospect that I hope ecash can subvert).

But regulated mints will only be able to exchange with regulated mints. The rules are designed so they can follow the money and know all the in and outs (people).

And authorities have fierce record of chasing unregulated money businesses, even offshore. As soon as real money starts to flow they cut the head off the snake.

So KYC will surveil ecash, just like it is on everything else. And I can't see any government releasing the tracking now its in place.

I would love this to not be so.

The only way out that I can see is: have mint tokens pegged to the underlying collateral (Arc), and make every wallet a mint.

I really love ecash but the use case has really been stopping me going fully in.

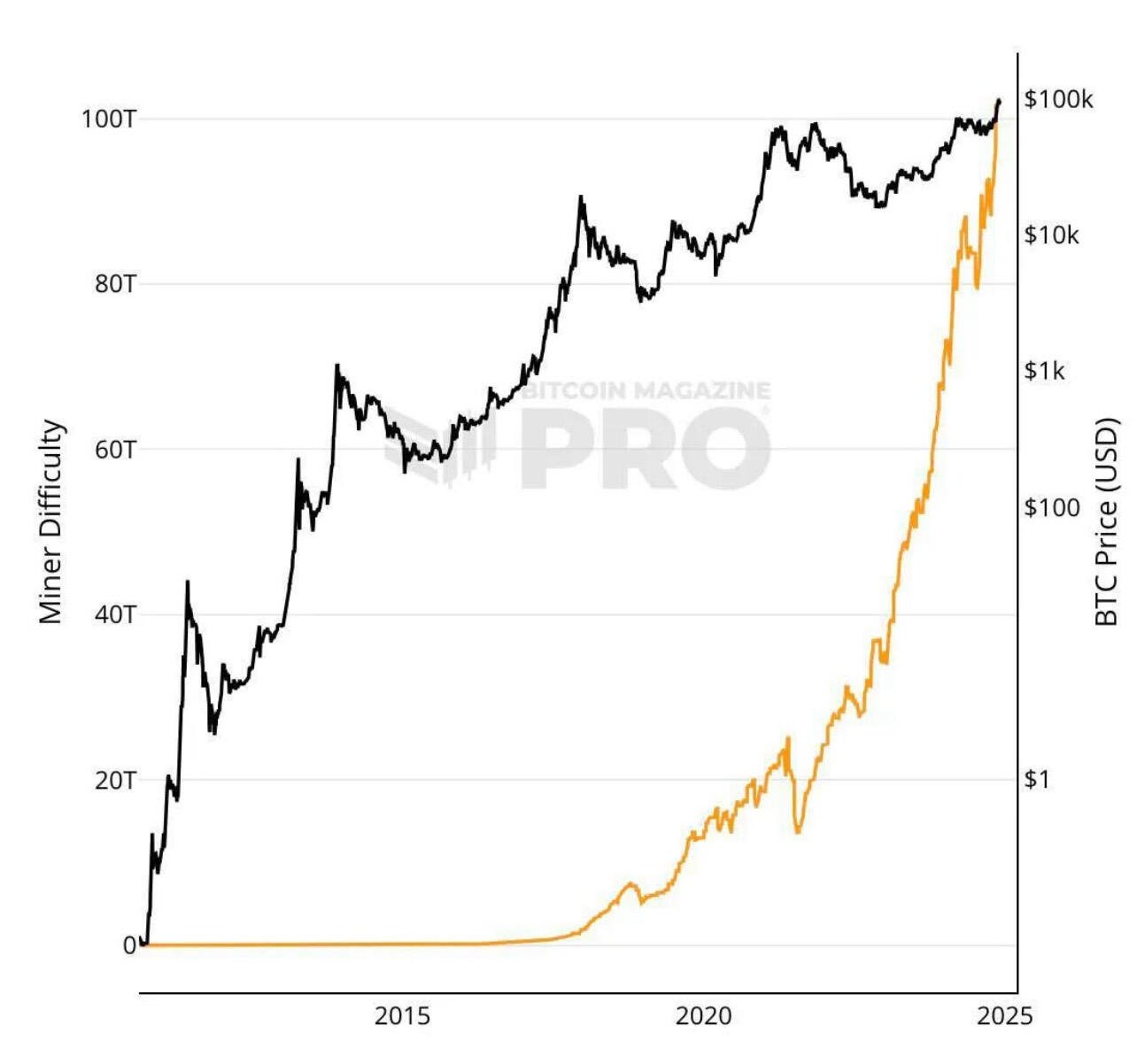

Yeah, and so did mining concentration.

Two monopolies (US, China) will control Bitcoin going forward.

Fun fact.

In 1975, the CIA unveiled the "heart attack" gun.

It operated on battery power and shot a dart made of ice, which contained a deadly shellfish toxin. Once the dart penetrated the body, it would dissolve, leaving just a tiny red mark as evidence.

https://video.nostr.build/d5ef5250d44e1ff8be1d162694fee406eebe96ac2ae69465f0ef1c35b93b4497.mp4

In no sane world can that be defended.

Great write up.

The KYC/AML rules are so ubiquitouss, ecash providers will comply because retribution (jail time for illegal money transfers) is sadly real. Only if that changes in the US will privacy be returned.

Why would I ever want to be subordinate to another man? because of title?

Dobyou mean an ecash network of mints, or clearing houses?