Just saw their live band show for the severalith time in the desert.

Maybe because people who want to be sovereign are of the live and let live mentality?

Only 2 million? More like 40 million, but maybe only 2 million if you don't include effects of policy.

Really he just needed to be holding up a QR address.

Saw a guy on the side of the highway with a cardboard sign that said "Need frog gifs" and his kids were dancing in the background. It made me sad, but maybe it was performance art.

Then I saw the sign actually said, "Need food and gas" and his minivan was behind him and it made me more sad.

So many scientist which significantly contributed to technological development were just wack jobs.

Maybe evidence of how AI art is not art.

It was my first time back in 7 years. It has changed a lot. Still amazing. More intense. Less community.

My personal interest in the three feels the same. I struggle to describe it, but it's like order out of some anarchy or chaos.

It was a good one.

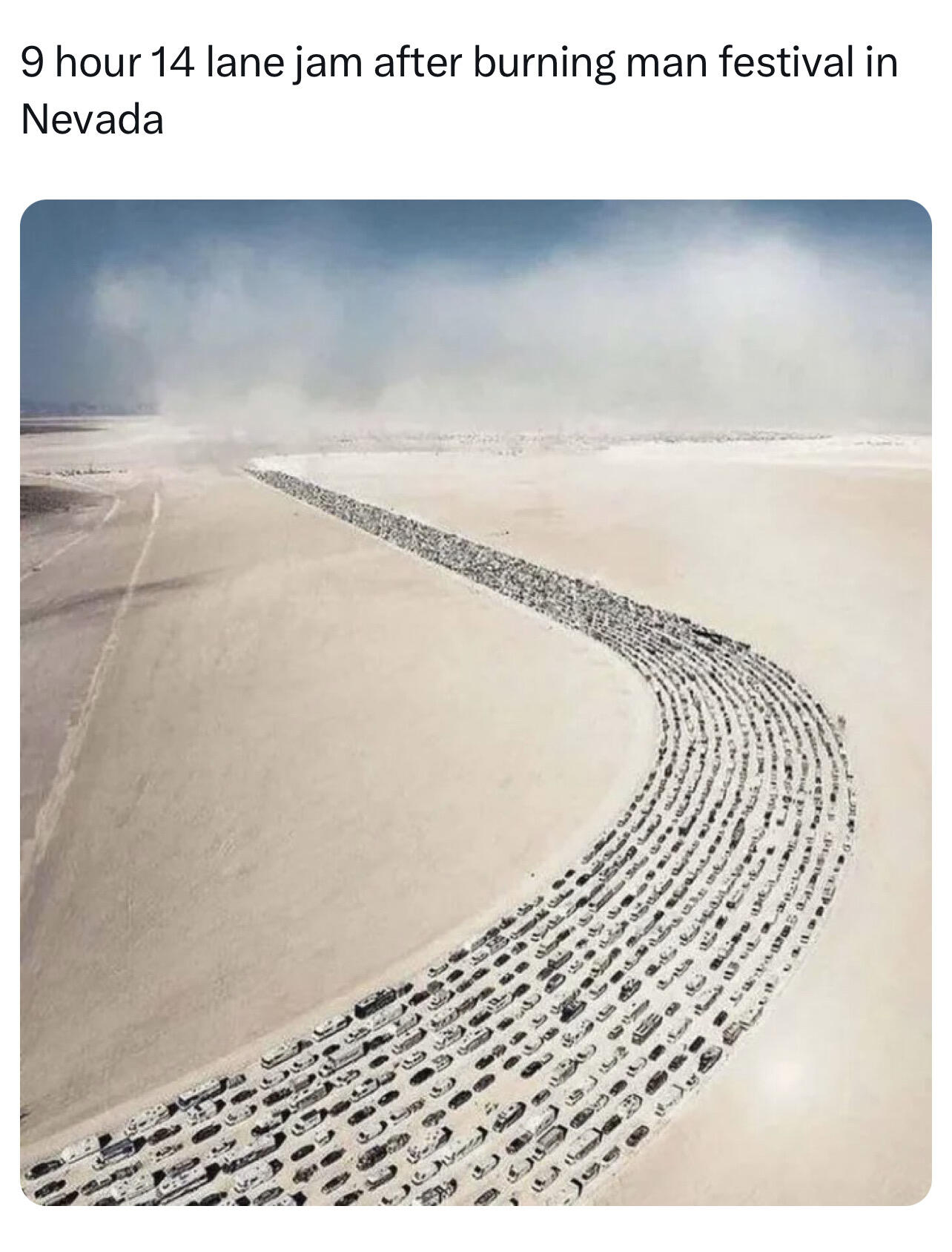

Every damn year. It doesn't matter if you leave early or late. The line is eternal.

Maybe due to the Reason mag article referencing it with many links? It was not accessible day of publishing.

Reason's commenters are the worst they they have going for them. Who would want to associate with an audience like that?

You're missing a plan to replace the bitcoin.

This probably would only work if your reputation is worth less than a bitcoin.

High profile npubs with lots of influence would have to lock larger amounts, but it's difficult to determine how much.

That looks great. It looks like it evenly anchors the net around the frame. Does it keep the net from bunching up on one side? I have a circular one that's easy to replace the net, but because it slides along the frame it gathers on one side after a few hours.

Read the article yourself: https://blog.ethereum.org/2014/11/20/bitcoin-maximalism-currency-platform-network-effects

First paragraph explains how you are wrong. Why not just admit it directly?

Really? When Vitalik first used the phrase, was he referring to devs wanting to build successful experiments on bitcoin and not eth? I don't remember the context.

People argue over what it means, but it really is just leaning into an insult ethereans came up with. It's a meme that probably means very little.

Yes, I am a maximalist. Yes, I am living a weird mountain man fantasy.

I assume you mean bip174? When I've run into incompatibilities on global keys it has been due to the device or software receiving a psbt version it is incompatible with. Last I checked, coldcard only supports v0. Maybe check if the one which won't work is a v2?

nostr:nprofile1qqsw3znfr6vdnxrujezjrhlkqqjlvpcqx79ys7gcph9mkjjsy7zsgygpr4mhxue69uhkummnw3ez6vp39eukz6mfdphkumn99e3k7mf03h6kk2 does coldcard require the "global xpub" field in a psbt to sign? Getting some weird pubkey doesn't match address error

What type of output? I don't know about the coldcard error, but there are no addresses in the output fields. Maybe the global unsigned txn field is spending to addresses not matching those generated from output fields.

NIP-05 defined the url path and response that your server must respond with in order to link your npub. A very simple server configuration can achieve this, but it does require being familiar with the basics.

You make it look effortless.

Maybe, but raspberry pis got expensive and they don't run nodes very well. What's your goal? A fully indexed archival node serving the network, or just a pruned node validating for your own benefit?

Does the self hosted nostr:npub18d4r6wanxkyrdfjdrjqzj2ukua5cas669ew2g5w7lf4a8te7awzqey6lt3 really need -txindex when Electrs is configured? https://github.com/mempool/mempool/tree/master/backend

You don't need txindex to index the blockstream-electrs fork since it reads from the block files directly. Does mempool still require it? I though it was using electrs and its own db for all api requests.

The lie that was told and everyone believed without a fight is that when you purchase something from a store based in another state, complete the sale there, and then send the product to yourself that it somehow means you bought something from your home state. Completely insane. Nothing about the sale is conducted in the buyer's remote state.