Not necessarily. There seems to have been a pivot from the Progressive Era on toward trusting government as a problem-solver.

Think antitrust laws, labor protections, and the State stepping in when markets and individuals supposedly "fail".

It's not clear that history books are emphasizeing the skepticism toward centralized government, rooted in the American Revolution's origins.

The State appears to have positioned itself as a savior of the people, irrespective of any real world results to the contrary.

How'd it manage that, if not through a reimagining in the textbooks of American history through the lense of a statist?

Unsupported and oversimplified take. All the same, understanding sentiment and the various perspectives on current events is always fascinating.

“Доверяй, но проверяй” (Doveryay, no proveryay) —Russian proverb

…translates to “Trust, but verify”. It’s a practical piece of wisdom that balances faith in others with a healthy dose of skepticism.

Hard to scale anything without some degree of trust.

Loopy cunts, the whole lot of these university admins, these days.

That’s interesting to learn. What stateside providers, if any, would you say come closest to Canadian quality beef?

Hilarious.

That’s an interesting observation. Weird bit of cultural signaling if true.

As of April 4, 2025, the M2 money supply in the United States is showing signs of gradual expansion following a period of contraction. M2, which includes cash, checking deposits, savings deposits, money market securities, and other near-money assets, is a key indicator of the money available in the economy.

Recent data indicates that M2 increased to $21,447.6 billion in November 2024, up from $21,311.2 billion in October 2024, reflecting a month-over-month growth. On a year-over-year basis, M2 growth was reported at 3.9% in January 2025, compared to 3.8% in December 2024, suggesting a slow but steady upward trend. This follows a notable decline that began in mid-2022, where M2 dropped significantly—by over $530 billion from March 2022 to December 2023—marking the first recorded annual decrease in decades. That contraction was largely driven by the Federal Reserve's efforts to combat inflation through aggressive monetary tightening, including raising interest rates and reducing liquidity.

The current expansion appears to signal a shift. After bottoming out in 2023, M2 has been creeping upward, possibly reflecting a loosening of monetary conditions or a response to economic stabilization efforts. Historically, M2 growth has been tied to economic activity—rising during expansions to support growth and falling during tightening cycles to curb inflation. The sharp increase during the COVID-19 pandemic (a 40% surge from early 2020 to early 2022) was driven by unprecedented stimulus, followed by the Fed’s pivot to contraction as inflation spiked. Now, with inflation pressures easing somewhat, the modest uptick in M2 could indicate a return to more accommodative policies or simply a natural rebound in liquidity.

However, interpreting M2’s movements isn’t straightforward. Some argue it’s a lagging indicator, influenced by factors like the Eurodollar system—offshore dollar creation not fully captured in M2 stats—which could mean actual liquidity is higher than reported. Others note that while M2 growth often correlates with asset price increases (like stocks or cryptocurrencies), short-term fluctuations don’t always reflect real-time economic conditions. For now, the data suggests M2 is in a phase of cautious recovery, but whether this persists or accelerates depends on the Fed’s next moves and broader global liquidity trends.

Grok Query Result

I get a followed notification from this account and a few others every day.

What's going on?

https://primal.net/p/nprofile1qqsf24u42d2ltugavnwpcttazdk4syvsflw9j254pj6qj8g9g9llhgg898jnk

Same here.

nostr:nprofile1qqs87rnyk5h026lv9dvg63s0cccjtat8mvkqzng7en5qdkx4kssfutsppemhxue69uhkummn9ekx7mp0qyfhwumn8ghj7ur4wfcxcetsv9njuetn9up9hjx7 , nostr:npub1j4te25647hc36exurskh6ymdtqgeqn7uty4f2r95pyws2stllwsswnc8ed , and nostr:npub1yvn4pn774esfxmkrtc342t6mt0z9qj9y9em58cy75u83zc3th06q6gncv9 , among others follow/unfollow me every time I do anything on this platform.

I’m fairly certain they’re bots. Just understand what they’re meant to achieve besides triggering a notification.

Good.

Confusion is the enemy. We need to cut through the fog and pursue clarity across all dimensions.

Clarity prevents the slow rot of assumptions and resentment from festering in the gaps. Without it, we're stuck reacting to a distorted version of reality.

Onwards and upwards for Belgium and all who follow suit.

Oh man, this is no daisy at all.

I did. I actually transferred what little SATs I had to my Primal wallet. Thought you guys had lost your damn minds.

There is no new truth.

Perhaps the next consensus is what will come from the phenomenon you’re describing, but that has very little to do with truth.

Humans are absurd at the core. We make up all manner of bs to sidestep reality when it’s uncomfortable, painful, or inconvenient. We’re obsessed with the facade of control.

While the universe shrugs, the human race will continue to invent elaborate distractions and delusions. The synthesis you’re anticipating will no doubt , accelerate the beeline to maximum absurdity.

Buckle up!

I don’t indulge in maple syrup but if that changes, I will because of this post.

#Nostr Bitcoin Circular Economy intact

Thanks nostr:npub172mu27r5yny0nnmvgjqwhx055dmsesrrx7j0p5d3pxagfx6xgxfsv75p3q for the Maple Syrup

That’s 🔥

Sho nuff.

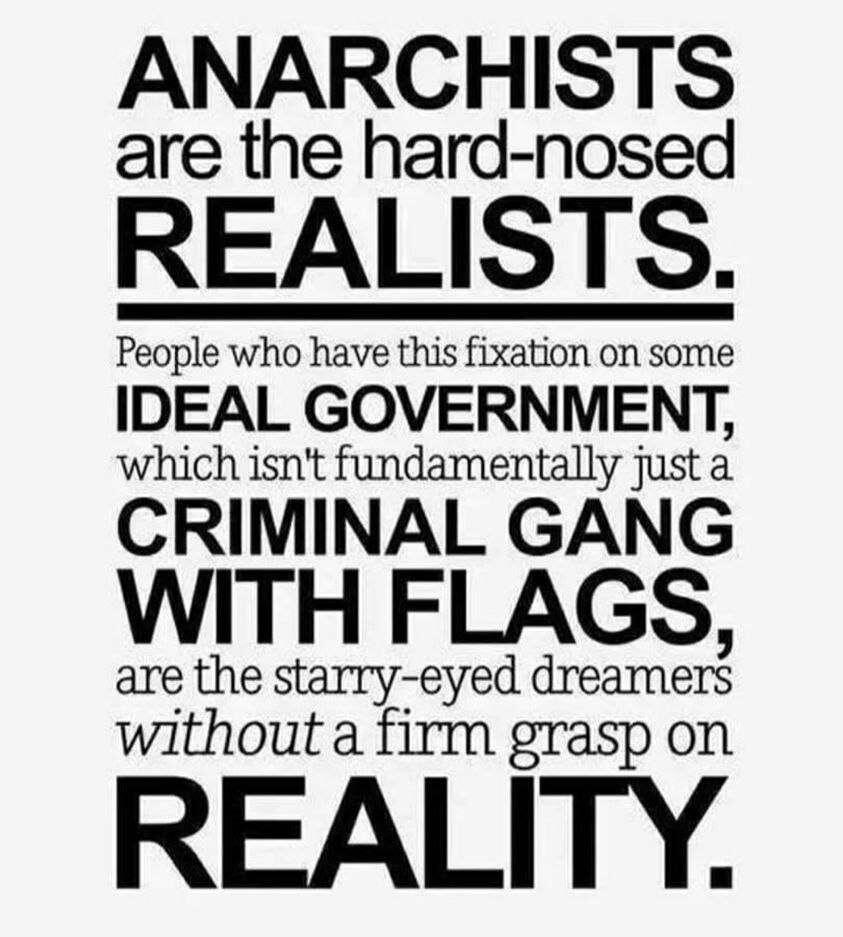

The State is an inherently coercive and parasitic institution that thrives on expropriating resources from the productive population under the guise of legitimacy.

Power and privilege for the few. Violence, propaganda, and ideology, fundamentally at odds with liberty and free markets for the many.

Legalized unaccountable gang sounds better to me. To-may-toe, to-mah-toe.

nostr:note1kwjhhlulx864ewq5quf2efqu78y4rgdr7tkdazezkyl258wxexfqwjca2p

nostr:note1kwjhhlulx864ewq5quf2efqu78y4rgdr7tkdazezkyl258wxexfqwjca2p