Good take!

When we analyze whether a particular region is a free market, or to get a sense of the degree to which it is a free market, I think we can start with a few basic prerequisites:

1. The user/owner of the means of production or the goods produced with them is able to exchange what he owns or produced with other people - land, capital, resources, raw materials, consumer goods, production goods, etc.

2. This exchange happens at prices that both parties agree upon

3. The user/owner has the ultimate say in how his means of production is used - he decides what to produce, or not produce, when to produce, and in what quantity

4. Property titles and contracts regarding property titles are honoured and restitution mechanisms exist in case of violations

5. The money - medium of exchange - that people use holds its value/purchasing power over a long period of time and is easily exchangeable. And when it doesn't, people have the ability to shift to something else.

6. The ultimate form of ownership - ownership of self - is respected. One's body and fruits of one's labour exerted with one's body is safe from harm or being expropriated. And people have the ultimate say in what endeavour they choose to engage in with their selves.

Of course, no country or industry has this state of affairs to the fullest extent. But the degree to which these perquisites exist in a particular region, country or industry - big or small, private or public, capitalist, socialist or communist, democracy, oligarchy or autocracy - whatever the name is attached to it by narratives and storytelling by the media, is the degree to which it is a free market

Basically, lot of words to say that the degree to which property rights are respected determines how much of a free market a particular region is.

And it will also determine the degree to which we see economic growth, productivity and an increase in standard of living in that country or industry.

Oh yeah, the way we carry ourselves and go about our lives can certainly have an impact on how people around us perceive Bitcoin

Before I discovered Bitcoin, I thought Hamilton was based because of that play. I'm not an American as well so I didn't have any context.

Now I think Jefferson is the based one.

All said, it's great work by Lin-Manuel Miranda.

Bitcoin has a bad rep in the eyes of many in my circles. They might have softened their stance because I work full time in the industry. But I still avoid explicitly talking about it all the time.

Like you, I do have conversations about the second and third order effects of fiat like reducing standards and increasing costs of living despite technological progress, growing bureaucracy and public debt, and everything else we all know.

That way, when the time comes, they'll be able to put all the pieces together.

But when I'm asked 'Do I buy Bitcoin?' without the person having all this context, I say: 'Yes, but only if you're willing to hold for a minimum of 4-5 years, take the time learn about it and buy it in small amounts periodically. Else, it's probably better to stay away'.

Fair point

Other similar introductory sites tend to be quite technical in explaining Nostr as well

Do you know anyone who has done it perfectly in a way that's accessible for non-devs?

GM 🌞🏝️

nostr:nprofile1qqst0mtgkp3du662ztj3l4fgts0purksu5fgek5n4vgmg9gt2hkn9lqpypmhxue69uhkummnw3ezuetfde6kuer6wasku7nfvuh8xurpvdjj7qghwaehxw309aex2mrp0yhxz7n6v9kk7tnwv46z7pxxtmh killed it here at Africa Bitcoin Conference! 👏

It’s been so cool talking to so many builders about Marmot this week.

Hahaha that's a cute logo

YakiHonne just keeps getting better 🤌

Opening it way more often nowadays

You can usually tell when someone is close to rage-quitting Bitcoin

DO NOT CONCEAL YOUR BALLS!

#grapheneos

https://video.nostr.build/f1d814cd1dbbdf52019b93ce0866bbe0907212e41679bb8c221979f73c996f10.mp4

😂😂😂

The key is to go deeper.

It's about questioning the method of science, rather than science itself.

That's where these people get all hoity-toity and claim that anything that doesn't follow their method is 'anti-scientific'.

It's a slow process. First talk about how the system works. Create the dots.

And then slowly help connect them. Would prefer it if they had full conviction, slowly developed of their own accord.

Tbh, all of my friends and family members. That'd be more than enough for me.

Nice couple of shoutouts for Bitcoin Breakdown from nostr:npub1getal6ykt05fsz5nqu4uld09nfj3y3qxmv8crys4aeut53unfvlqr80nfm and nostr:npub1kmwdmhuxvafg05dyap3qmy42jpwztrv9p0uvey3a8803ahlwtmnsnhxqk9 in the last one month 🧡

Tbf I think Keynesian ideas are accompanied in mainstream economics by ideas of other schools of thought as well, which would be useful for Bitcoiners (and people advocating for freedom) to be aware of.

They would be Neoclassical economics, Modern Monetary Theory, Behavioural economics and Public choice theory.

All of these boil down to one thing - treating human beings like lab rats.

Their method involves making hypotheses, testing their hypotheses in the 'real world', gathering evidence, identifying variables and adjusting for or trying to control these variables and then coming up with new hypothesis based on observed evidence.

This is wildly useful for studying things that are always the same throughout history and don't differ from each other based on time or location - physics, chemistry, biology. Not so much for human beings who change with time, environment, upbringing, circumstances, genetics and culture.

Despite that, this method has taken over politics, law, ethics and psychology. In fact, social sciences and humanities are dominated by this method.

According to them, reasoning and reflecting on things is unscientific, while critically thinking about things and testing them with observation and evidence is scientific.

Nothing is true and everything is just a hypothesis to be tested.

(They apply this to everything - except the very claim that nothing is true and everything is just a hypothesis to be tested. That would make that claim itself not true and just a hypothesis. So there must be some truths that don't require hypothesising and testing. But this is swept under the rug.)

Anyways,

You'll find that a lot of people who recommend, propose, implement or enforce crazy policies and ideas are often driven by this method. They believe that truth and evidence is on their side and that they are 'right'. If not, they will amend the truth and evidence to make sure that they are right.

Studying Austrian economics and the rational method would be a great way to tackle this. In addition to that, more and more people simply staying humble and stacking sats.

JUST IN: NOSTR USER SAYS WE NEED MORE ANNOUNCEMENTS ON NOSTR

IT'S HAPPENING! BULLISH!

Amazon too

Don't forget Nostr-based marketplaces!

Is Metcalfe trying to quantify value?

An overview of Bitcoin scaling solutions (with various tradeoffs of course) from a talk by Steve Lee of Spiral at Bitcoin++ Lightning Edition (5:03:00 onwards):

https://www.youtube.com/live/7UH9o6SZPhc?si=WpAegDqhkXiKnudf&t=18201

The yellow graph in the middle is the Lightning Network.

Steve Lee probably made this graphic with the intention of showcasing LDK's integration into the ecosystem haha

But that's alright.

He did miss a few important pieces like Blockstream's greenlight and others who use VLS, Strike, Zeus and its LSP, Amboss and the LSP marketplace. They're pretty well-adopted afaik.

Imo this is the best time to set up trusted p2p networks to buy and sell bitcoin directly or simply networks of trusted bitcoin communities

Would also be a great time to upgrade our own tools that we use to interact with bitcoin

Don't think focusing on onboarding normies can be given much time unless they explicitly ask

An overview of Bitcoin scaling solutions (with various tradeoffs of course) from a talk by Steve Lee of Spiral at Bitcoin++ Lightning Edition (5:03:00 onwards):

https://www.youtube.com/live/7UH9o6SZPhc?si=WpAegDqhkXiKnudf&t=18201

The yellow graph in the middle is the Lightning Network.

nostr:nprofile1qqst0mtgkp3du662ztj3l4fgts0purksu5fgek5n4vgmg9gt2hkn9lqpypmhxue69uhkummnw3ezuetfde6kuer6wasku7nfvuh8xurpvdjj7qgwwaehxw309ahx7uewd3hkctcpzamhxue69uhhyetvv9ujuct60fsk6mewdejhgtc3dn6yh nostr:nprofile1qqspwwwexlwgcrrnwz4zwkze8rq3ncjug8mvgsd96dxx6wzs8ccndmcpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhsz9mhwden5te0wfjkccte9ec8y6tdv9kzumn9wshszxrhwden5te0ve5kcar9wghxummnw3ezuamfdejj7ekel7y - wen bunker on nostr:nprofile1qqs8t4ehcdrjgugzn3zgw6enp53gg2y2gfmekkg69m2d4gwxcpl04acpzamhxue69uhhyetvv9ujuurjd9kkzmpwdejhgtcppemhxue69uhkummn9ekx7mp0w3radp? 🙏

+1

Waiting for integration of external signers like Amber

I'd recommend keeping an eye on Marmot. It's an MLS and Nostr based protocol being worked on by Whitenoise devs to make cross-client private messaging possible. Could be big, but very early days

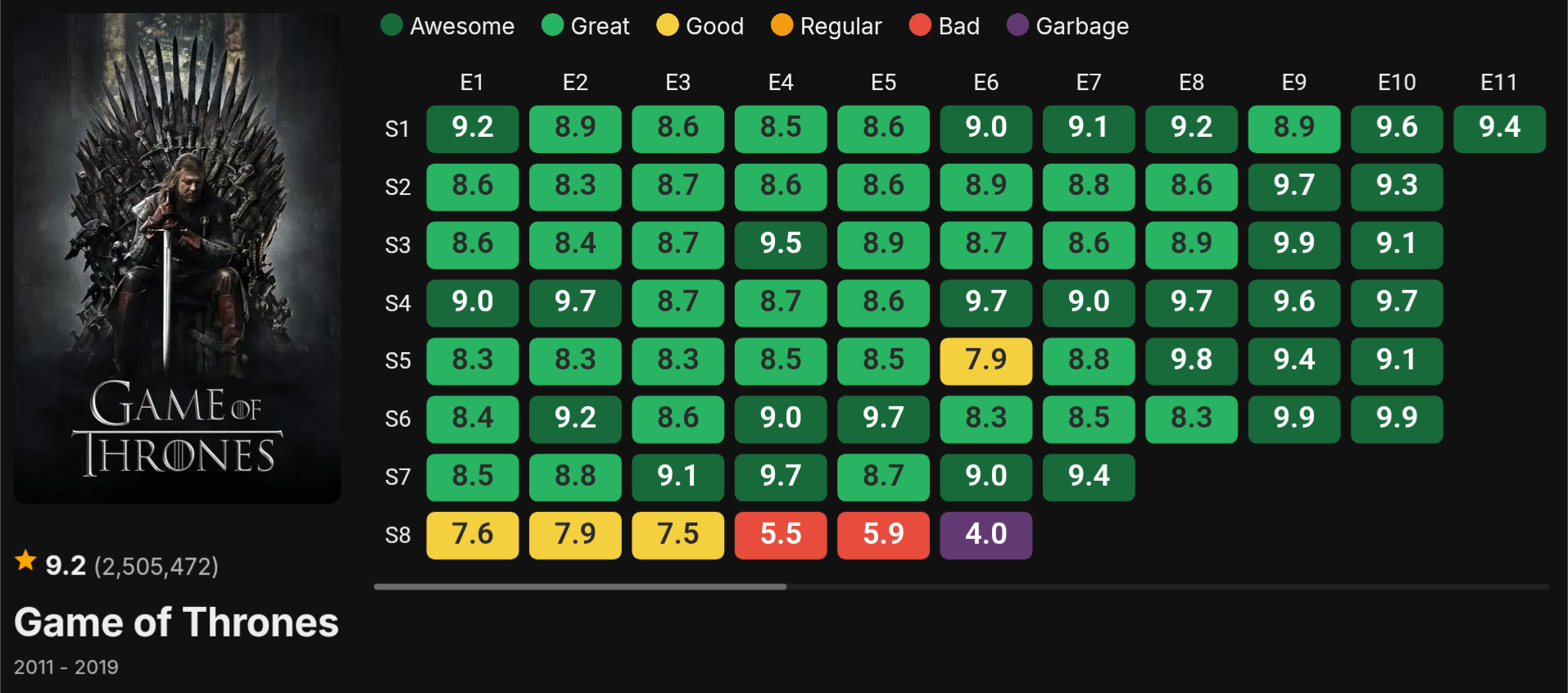

Was wondering about the 7.9 rating for s05e06 so I searched for the plot. Rating makes sense