Javier Milei @ #WEF Davos warns with a speech for history:

"Don't be intimidated by the political circles, by the parasites who are in power." Argentina stands by the side of entrepreneurs today.

With the cry "Long live freedom, damn it again", he disappears from the stage...

Okay, he will never be invited to the WEF again 😂, but most has been said anyway. Ursula von der Leyen can now once again devote herself fully to the exorbitant danger of free speech. 🫡

I am certain that #Argentina will welcome people and their #BITCOIN from Europe in a very friendly and understanding manner in future. And not only Bitcoiners will come.

No obligation to talk about #Bitcoin. Diversity and variety is what makes our lives exciting! Keep going and enrich our stagnant minds with fresh thoughts🫶 🤗

gains seem to decrease, so let's sell our #Bitcoin ASAP to Blackrock 😇

a few halvings in #Bitcoin will learn you; you may understand the price in the long term, but never the full potential of it as a technology🫡

like your content! great to have such stuff on nostr 💪

don't speak Japanes, but I like your support! cheers 👌

do homework and you'll find the way. You are on track💪 cheers

Laser eyes are for every Bitcoiner who wants to express his focus🚀

The difference between family and colleagues: For some you take some time every few month 💊 For others you ask back: You mean that strange magic internet money?🫠

DISCLAIMER: ETFs are simply a way, to participate in the price. You don't own #Bitcoin , if you own shares.

Now let the suits start trading their #ETF they want to buy a few SHARES. 🫡

You can rack your brain about whether to go long/short #Bitcoin on the ETF story or just let the roulette wheel spin. It's pretty much the same at the moment, the probabilities (regarding risk) are almost the same. Enjoy the show, and you know: HODL always wins. 🥃

If you zoom out, they all look the same 🫠 First pump, then dump to infinity. And it's not about the pump at the beginning, in the long run.

You get deeper and deeper into the content and inevitably get into guys like me. It's always the same, but a good way 🤗👍

I see, it will take a few more years....

Then there's just another „quick“ option - which I don't like but is popular: If you want to SAVE your VALUE like this; each his own. There are certainly good arguments in favour, that I will never raise.

The chart is youKNOW vs #Bitcoin. &Yes, they all look 'the same' - for a reason 🤫

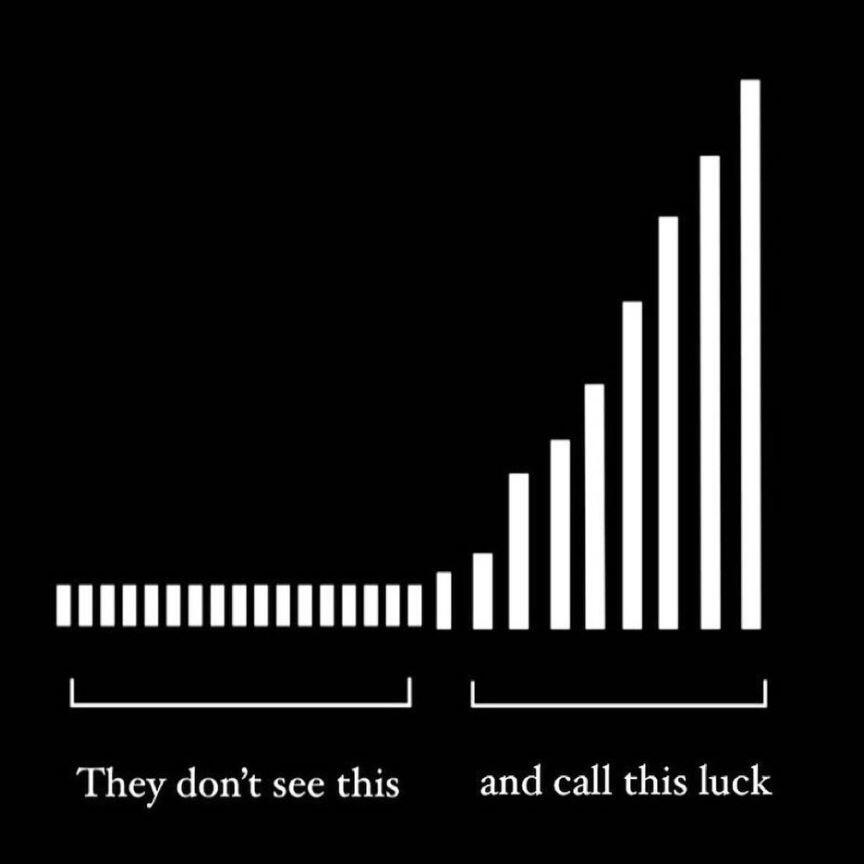

We are lucky. More lucky than anyone who was able to buy property decades ago. So lucky 😑

Utility creates demand and demand defines the price that is paid for the utility. Utility is bought and paid for when it is needed.

You don't buy 1000 vouchers for haircuts today, you pay for one, when you need it. With depreciating FIAT or scarce #Bitcoin.

MAYBE in the future you will also buy some Monero, Ethereum, ….. or whatever your heart desires in the short term. Because you MIGHT just need it quickly.

In short: Monero has great features to transport „value“ quickly and with privacy in mind. Like other technologies. ➞ #Bitcoin is value.

If necessary, you can briefly exchange Bitcoin for Monero, send Monero, then your trading partner can return it to Bitcoin to store the value in the long term.

The traceability of Bitcoin is not necessarily a bug, but I am aware that there are different opinions on this.

[Jan/3➞₿🔐] Not your keys, not your #Bitcoin. Today is proof-of-keys day; therefore make sure, you have full control over your coins at all times!

On this day, we also want to celebrate Bitcoin's 15th birthday🎉 With the invention of Bitcoin, we were given the opportunity to own and transfer real value independently of any third party. Unconfiscatable, uncensorable & free from arbitrary devaluation. Thank you Satoshi Nakamoto🥂

#m=image%2Fjpeg&dim=720x874&blurhash=_SG%2BEq-%3A9bWCIUt7of%3Fwx%5Dxtf5M%7BofWB0LkD-%3AWAofj%5BM%7BROfRNIWBt7WBWB-%3AayM%7BogogWBt7M%7Cayxtt7ogj%5BofIUWBozoft7t7ayjXWBRjj%5BozfPWBNGfjaeayofM%7BRj&x=4f60ae7bd8416f92a3152781e69d7a0c47380951b8ec1d85fcef30dc77d21059

#m=image%2Fjpeg&dim=720x874&blurhash=_SG%2BEq-%3A9bWCIUt7of%3Fwx%5Dxtf5M%7BofWB0LkD-%3AWAofj%5BM%7BROfRNIWBt7WBWB-%3AayM%7BogogWBt7M%7Cayxtt7ogj%5BofIUWBozoft7t7ayjXWBRjj%5BozfPWBNGfjaeayofM%7BRj&x=4f60ae7bd8416f92a3152781e69d7a0c47380951b8ec1d85fcef30dc77d21059

#m=image%2Fjpeg&dim=864x864&blurhash=U69H2_00of%7Eq4nIU-%3BM%7B00%7Eqay4n%7Eqt7D%25%25M&x=fd14883168f8cadcb728a14c9b917f05d5ffd1fe99efdf57f2cd63a3b010a816

#m=image%2Fjpeg&dim=864x864&blurhash=U69H2_00of%7Eq4nIU-%3BM%7B00%7Eqay4n%7Eqt7D%25%25M&x=fd14883168f8cadcb728a14c9b917f05d5ffd1fe99efdf57f2cd63a3b010a816