The time for scooping up one or a few #Bitcoin is gone for most.

Just like I have been telling for some 8 years now that would happen.

Right now most can still buy one.

No not just like that.

They will need to mortgage their house, put in their life savings, sell a kidney. Etc.

Nothing compared to what they will have to do in a few years time to get one 🤷♂️

I don't make the rules, I try to explain the implications.

Saw this headline:

"#BITCOIN 'decoupling' story ends as stocks follow #Bitcoins rally"

On its own it is pretty neat...

But it doesn't work that way.

Stocks have a pathetic attempt to keep up with #Bitcoin.

A decoupling doesn't happen instantly, it takes time, there is resistance.

The fact #Bitcoin resisted and showed its save heaven function is what matters.

It won't stop here.

It will outdo Golds recent performance and leave both Gold and stocks in the dust.

The thing that really matters:

What participant are you ?

Will you lose or gain ?

The current coinbase is 3.125 #Bitcoin a block.

Next halving it will be1.5624.

That will be the last 4 year you can earn more than a whole #Bitcoin as block reward.

A whole, world wide, industrie is chasing those block rewards.

After that it will be less than a whole coin !

It will go to zero !

One company is buying a substantial part of all #Bitcoin RIGHT now.

Owning a full #Bitcoin is, but definitely will be a rarity.

This will for 99% of the population the last chance to get one...

Even at $100,000 it will be extremely hard for most.

What will you tell your kids ?

The greath wealth shift is actually happening.

Imagine one company being able to gather some 5% of everything...,in just a year 🤪😶🌫️

Not having any or selling is just insane at this moment 🤷♂️

#Bitcoin

The numbers don't make sense for some years or so.

As demand is way bigger than what is mined.

No clue where supply is coming from ?

Paper supply, or just regular plebs selling for profit .

We can all do this math, so who is selling ?

GM:

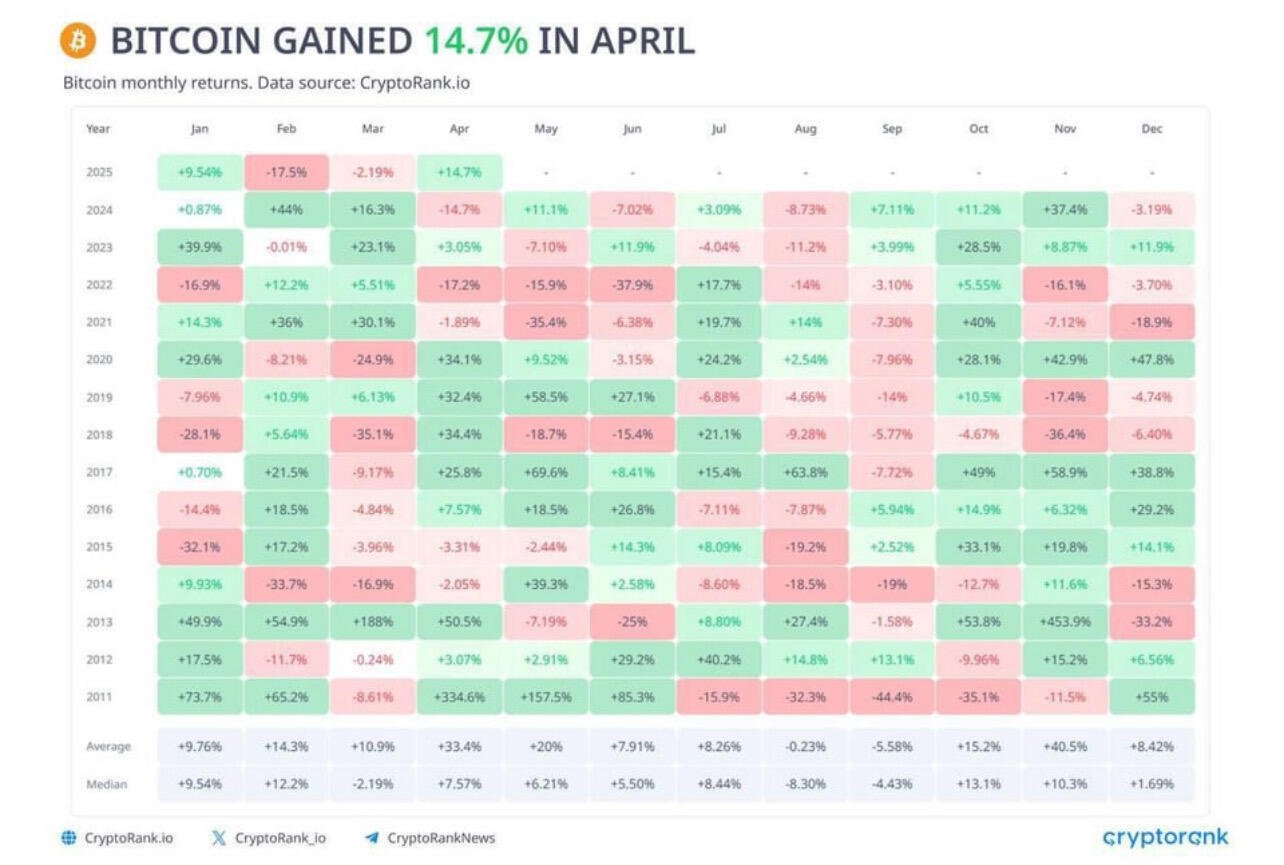

I'm ready for some BIG GREEN candles !

#Bitcoin

(Just in case someone needed a signal 😇🤣)

Why not ?

I always considered it the biggest attack vector !

Anyone can be corrupted or blackmailed.....

Folow the facts, they are out there....

Want to know how important their beloved fiat is to them ?

Check the punishments on financial crimes, like that counterfeiting 😬

Most of the things are not ok to do like murder, torture, theft, etc.

But want to upset them..., financial crime 🤑

Nothing is punished harder.

#Bitcoin

That ain't no safe seed 😇

😇 Short term price action is only confusing to most.

Just stack whatever you can.

Take the long way home.

Money creation seems inevitable by many.

The problem is that everytime every crisis that is solved that way means the next one will need even more money creation.

I don't know how long this can continue, I thought 2008 was the trigger, and than thought the Covid stimulus would do it, but here we are.

What most don't see or realize or want to know, are the things that have changed.

Inflation has shown what ot can do.

In Europe the whole financial system is overhauled and we have buy in regulation, meaning the next crisis will be plastered over with our money and not governments stepping in.

Governments stepping in is also our money or in case of debt a burden on the future, but this time the whole of Europe will get a direct haircut like Cyprus had in 2012.

Next Ursula has also put a claim on savings accounts to defend Europe, read spend on military.

Let's just say saving accounts are spoken for.

Depending on how things work out they have prepared some other steps.

Look at those filled pension funds....

They won't take them that blunt, no they will give you a nice CBDC IOU.

Things starting to make sense ?

They know there will be a next crisis.

They are preparing for years for it.

Slowly getting people to accept funny stuff.

This will continue untill things start to break.

That can be hyperinflation, people not accepting things any more, whatever.

That is when they will get serious, war, martial art, society breakdown, another great depression?

Timing I don't know.

If you don't believe in #Bitcoin get some Gold.

Ignoring it all seems to work even better so far..

#Bitcoin has to grow up.

We are becoming the world reserve currency.

This means the protocol needs to be up and running and stable above everything else.

Adding new things must have an agreed upon rational , and be a tested solution.

Known issues are better than potential new issues.

We must assume there are bad actors with plenty of money willingly to disrupt Bitcoin if possible.

These discussion can be exhausting but than we have to put a layering in place.

We can't just ignore questions or potential problems due to "we don't have time or the energy to address them all".

Spoofing orders is used a lot unfortunately.

It is simple to write a program that places these orders but retract them when price closes in.

Not sure what happens if someone would place a big buy order above those prices, I guess that is the risk of playing those games ?

You are mixing those two things in afterlife up....😇

Not increasing block size, but does increase blockchain needed to download during the sync of a node ?

Still a not wanted negative I think.

Your first lines are not unconventional, I agree...

But you continue with arguing Bitcoin will selfregulate to enforce smallest transactions due to cost efficiency?

To argue it is up to the user what is worth transmitting on chain, and that the user should have the freedom to transmit larger transactions than minimally needed (multi sig).

But the core problem is the blockchain size is a performance aspect, just as block size is.

And the bigger the blocks I've or blockchain the less decentralized Bitcoin will become (potentially)..

So as I have learned from the blocksize war decentralized is the most important feature.

Thus we have to limit the blocksize and blockchain to a minimal but workable size.

So functional requirements (multi sig) ahould be allowed, while adding pictures is not functional (and some will disagree to that since it was very profitable to do so for a while).

So we can't surpass the need to define what is allowed/makes sense. And better error to the low side to extent it if needed.

To state Bitcoin is a self regulating system based on efficiency ignores bad actors that can spend endless money to disrupt Bitcoin ?

I'm a bit stuck.

#Bitcoin is money/payment system.

Including whatever data on-chain is hampering that function.

But if money is no issue filling the blockchain with spam transactions is also possible.

The miners could filter these, but filter on what is useless data or not, is not always clear and neither is what are spam transactions or not ?

We have been through the block-size war and the outcome is clear, small blocks rule.

Let's take that as basis and not introduce ways to increase block size or onchain data ?

If needed we need to find alternative ways.

Fast fixes are not the way to go.

I'm in favor of strictly limiting onchain data.

So I would vote to not allow stuff like NFT's.

But would like to keep open a smart contact path.

No idea yet how to distinguish between that kind of data ?

Should it be a different storage than onchain?

I'm ignorant sorry!

Why do we need to download all the data, including OP_RETURNs ?

Why can't we when we sync a fres node select to ignore that data ?

Or make that the default sync mechanism?

#Bitcoin's value discovery, is a rather limited phase.

It is impossible to say what a final value will be and when it will be reached.

The first real target was and still is the Market Capitalization of Gold.

That means another 10 times in value.

By no means that will be the end, but it is my first 'short term' target.

If a 10 fold as starter doesn't impress you please tell me what other investments you see 😇🤑

Rich and bored...

I don't agree on the bored aspect..

But even than there are way worse situations to be in ?

😁

Please make it stupid simple 🙏

Are you talking about storing #Bitcoin on exchanges, owning strategy, ETF exposure, all of them even more ?

Especially the 'rehypothecation machine" is causing question marks with me ?

Also because I stay far away from them so I don't spend much time digging 🤗

Ok it is about potential inclusion of unneeded/unwanted data onchain, with all unwanted side effects.

https://coingape.com/bitcoin-core-under-threat-top-developer-flags-incoming-codebase-update/

Interesting !