Just moved some bitcoin on-chain for the first time in a while. Used sparrow instead of HWW software for the first time. This technology still blows my mind every time! Moved unconfiscatable money on a Sunday afternoon, for 340 sats. Wild!

Thanks for clarifying. I totally agree. CF is a great way to stay in shape and will improve overall fitness and athleticism. But I would NEVER consistently train CF if I was an amateur or professional athlete in a sport (other than CF).

Not sure I agree or maybe I’m missing the nuance to your argument. If CrossFit improves your core, leg and shoulder strength, and increases your cardiovascular capacity, you will be better at whatever sport you play. Of course you will still need to develop sport-specific skills

This might be the strangest thing I’ve ever posted on #nostr.

Biden, a Catholic, became a Master Mason with a Black lodge in North Carolina on his second last day as President.

Dafuq?

https://www.conferenceofgrandmasterspha.org/news-events-scholarships

It’s in South Carolina. Super strange

I pay $80 regularly to ship it to my house. It’s that good

I recognize that beef! nostr:npub12pl4h7pk0svg8ug4mhu7a90hn6nf83eqadd94pccgsafn73s392qpt42wq K&C

The top shelf stuff

Who did he say he worked for?

NEW: 🟠 Bitcoiner Tom McCarthy testifies in favor of a ‘Strategic Bitcoin Reserve' to New Hampshire House 💪

https://video.nostr.build/a3c31421b2909a9a9789b8b556a488e56018aa963250cf0e223249b177301c8c.mp4

Satoshi Action Fund

I preheat my stainless steel pans, the water beads and my food still sticks like crazy. Am I just using bad pans?

Hope this improves over time and you can get back to the heavy weight. But glad you can at least lift again!

GOOD MORNING NOSTR.

LIVE FREE. 🫡

https://cdn.satellite.earth/97074119a291234f0121630eb2ae8691ae38ca4320bef778da5663cd48fc38b1.mp4

GM - the slow grind continues, but path to freedom much clearer than in days past. Thanks for your commitment and signal

What knee trauma did you deal with (if don’t mind me asking)? I’m a CF’er too and dealing with a hole in my knee cartilage that is causing a lot of pain and limitation. Interested if I can learn from your experience

How can a bitcoiner be anything but utterly disgusted by Trump enriching himself and his cronies by using his own coin with these kind of pre-mine dynamics. I know this is a free market, but I’m sick to my stomach.

If there’s another angle to this I’m missing, I’m all ears.

This is alarming, but you’d also need to look at national assets for each country. For a company, sometimes you lend off cash flow. Other times, you lend off assets. I actually don’t know how the US looks on assets, but I bet it’s substantial with all the land and national parks.

Either way, we’re in an awful position. Interest + current entitlement obligations exceeding tax receipts is a bad signal, and even if we could sell assets to pay off debt…who has $36T of capital to buy our assets?

I get it. Fun analysis and lots of possibilities depending on what you’re trying to show

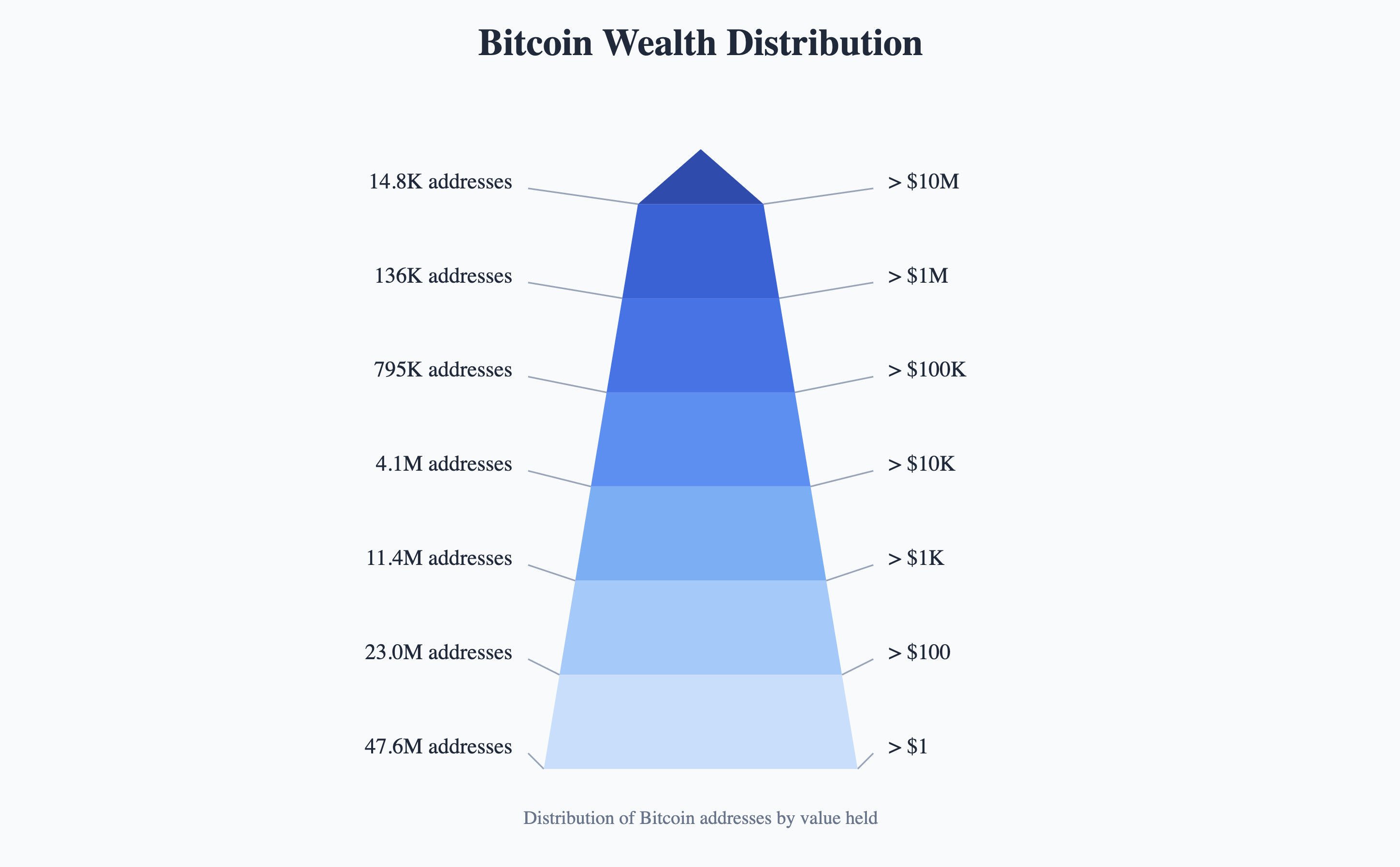

Interesting. I’m thinking even simpler terms, just size the blocks in the tower according to volume of addresses. Would show how few addresses hold big amounts and how fragmented the distribution is.

I would play around with how this is sized. Bigger blocks for more addresses to show accurate distribution.