Moonlight Sonata. The juxtaposition of major/minor, tension/release, quiet/loud, simple/complex. You feel the greatest joy after emerging from the deepest sadness. It’s just very human.

Agree. Get some real volatility going!

There’s a cult on Nostr that only zaps nostr:npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m and a few other high-profile people. You’d never see them zapping 3k sats to a regular pleb regardless of the quality of their posts. I call them the “ass-licking zappers”.

As I get more wealth people give me more free things. When I was poor nobody gave me shit. Humans are weird.

Awesome. Try getting direct customer support from the CEO of your bank. Or anyone at your bank.

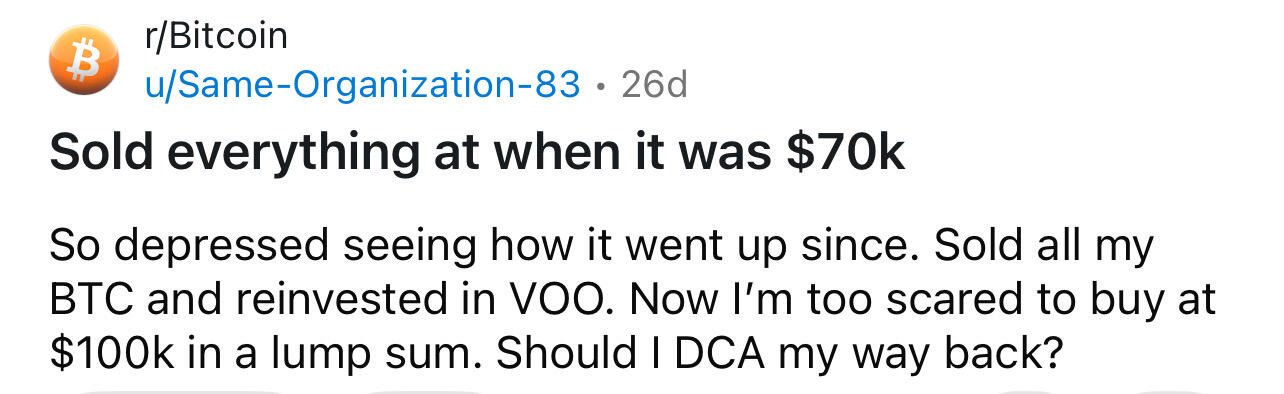

I’m sure strangers on the internet told him to tell bitcoin and buy VOO and now he’s asking strangers on the internet if he should buy bitcoin again. Root problem: trusting internet strangers more than himself.

My dog and I watched some ducks come in on a frozen pond this morning. Way more real and interesting than anything that has ever happened or ever will happen on social media.

Most of Castle Island’s portfolio companies would benefit much more from “crypto” regulation as it’s mostly DeFi and stables. I don’t believe he’s a patriot worried about the reputation of the dollar. It’s more likely he prefers to promote the dollar via stable coins and DeFi as it would be far more lucrative for him. He’s probably also worried about a “bitcoin not crypto” attitude as regulations are formed.

Oklahoma has a decent one. It’s miner centric but also protects individuals.

A bitcoin bill of rights should be simple enough. I thought that’s what all of these lobbyists were working on. Apparently not.

It seems a bitcoin bill of rights that upholds the core tenets of bitcoin would be simple enough. Kind of the way bitcoin’s principles are inherited by L2s, they would be inherited by the bill.

What I thought was a fartcoin was actually a shitcoin. And I was driving.

Maybe write a counter proposal. What does good look like?

To be fair ES gave the people the right to use bitcoin as money and they don’t. They much prefer dollars because they need to know that the value isn’t going to drop so much that they can’t buy groceries. Countries that have access to USD use USD over everything else including bitcoin.

One could argue bitcoin needs to go through a store of value phase to get to a valuation where it’s stable enough to be used as a medium of exchange.