“Processing Guacamole” gave me an entirely different mental image than butchering beef and the play on words made me smile a bit. As a butcher I’m going to take this funny little thought to work with me today and have a little smile to myself randomly. TY

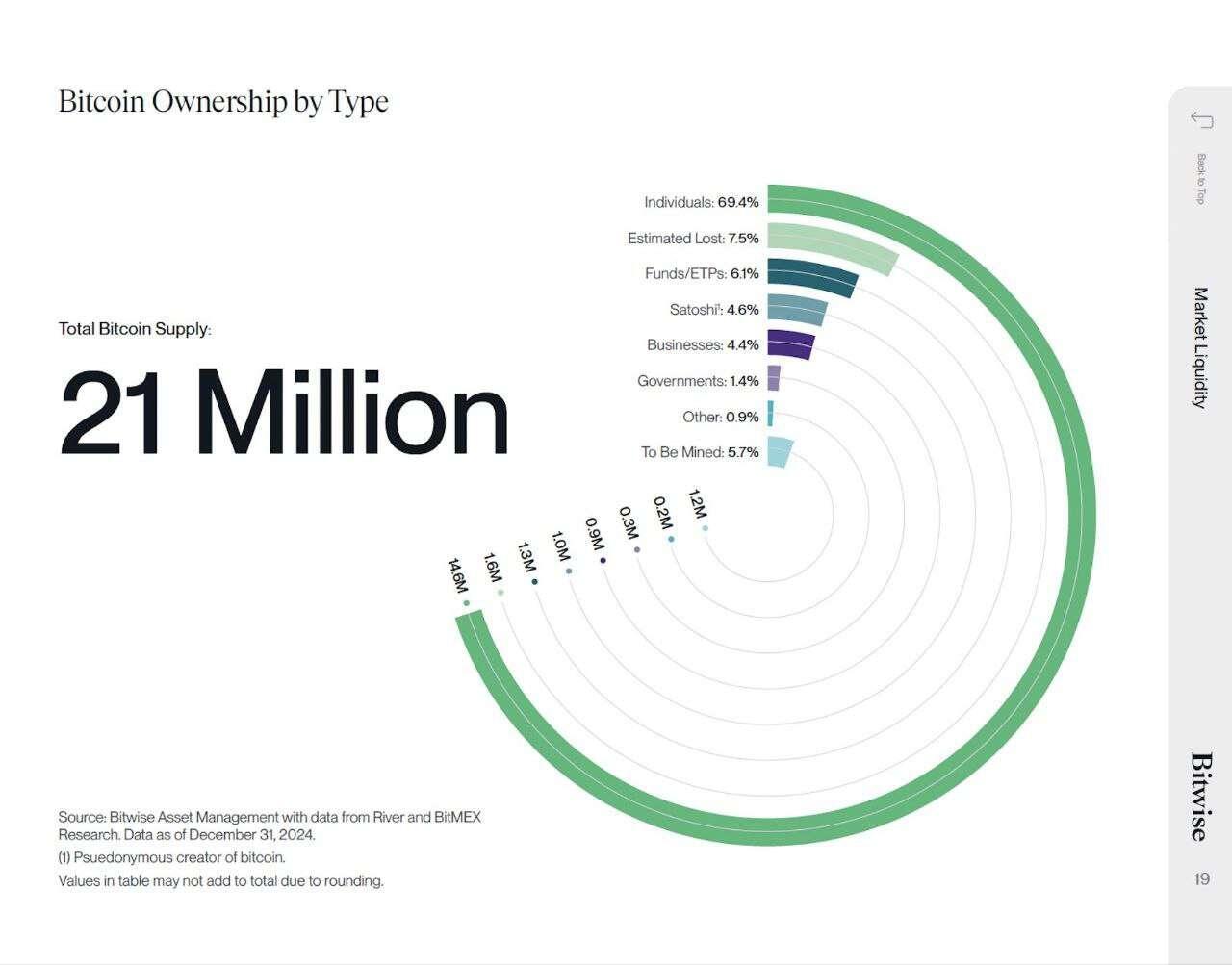

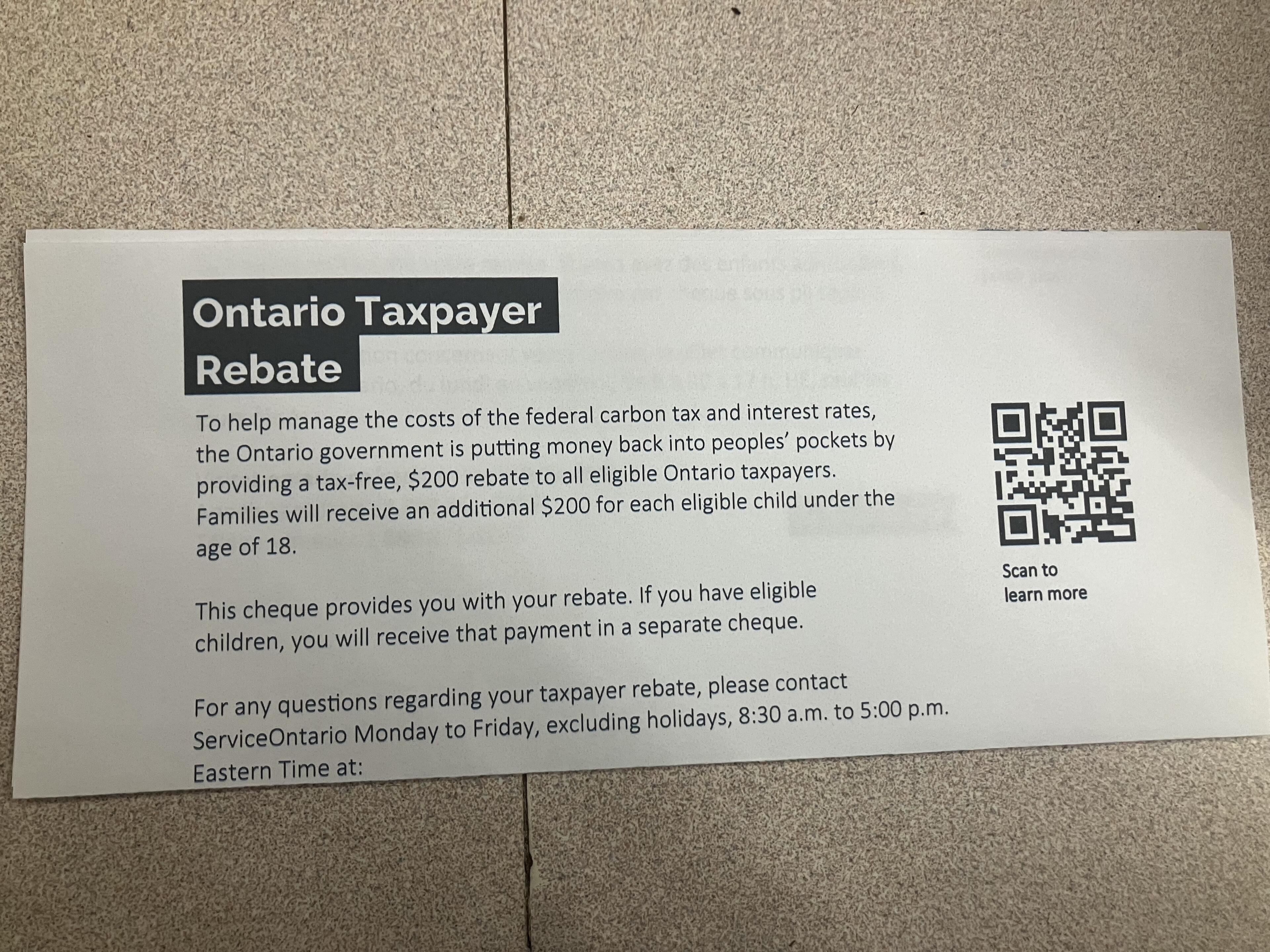

Turning a tax rebate into sats has to be the best feeling.

It’s just as exciting as any other new birth on the homestead, congratulations!

nostr:nprofile1qqsvf646uxlreajhhsv9tms9u6w7nuzeedaqty38z69cpwyhv89ufcqpzamhxue69uhhyetvv9ujucm4wfex2mn59en8j6gpzemhxue69uhhyetvv9ujuurjd9kkzmpwdejhgqg5waehxw309aex2mrp0yhxgctdw4eju6t0t25cfd orange pilling my neighbor and he's not getting the confirmation text, help. nostr:nprofile1qqsvn0dkjt80raqrxd470c98n7zrdehmcvj6p5hgw3kyku6zyd8z0fqpremhxue69uhkummnw3ez6ur4vgh8wetvd3hhyer9wghxuet59us3h27s

Same thing happened when I was setting my kids up. Your neighbor has to call his service provider and tell them to let the text through. This was not a fast or easy process for us. This is a real life example of operation choke point in action.

Correct on both counts. Do you think the inability to deliver gold on demand, as mentioned in your other note, will give us a preview of the sovereign debt crisis collapse or even the inevitable fiat currency collapse? After all, the gold market has been manipulated artificially lower by paper trades for quite some time. I speculate that physical gold holders will benefit from a market collapse. Individual, P2P trades will consist of much more value than what is recorded on any gold exchange. Kind of like how self custody bitcoiners will never sell but ETF managers rebalance all the time. The “market price” for commodities rarely indicates the actual value underlying asset kind of thing?

Those are shitcoins compared to what I have. 🤣 GM Carl, this was a good one. Have a great day.

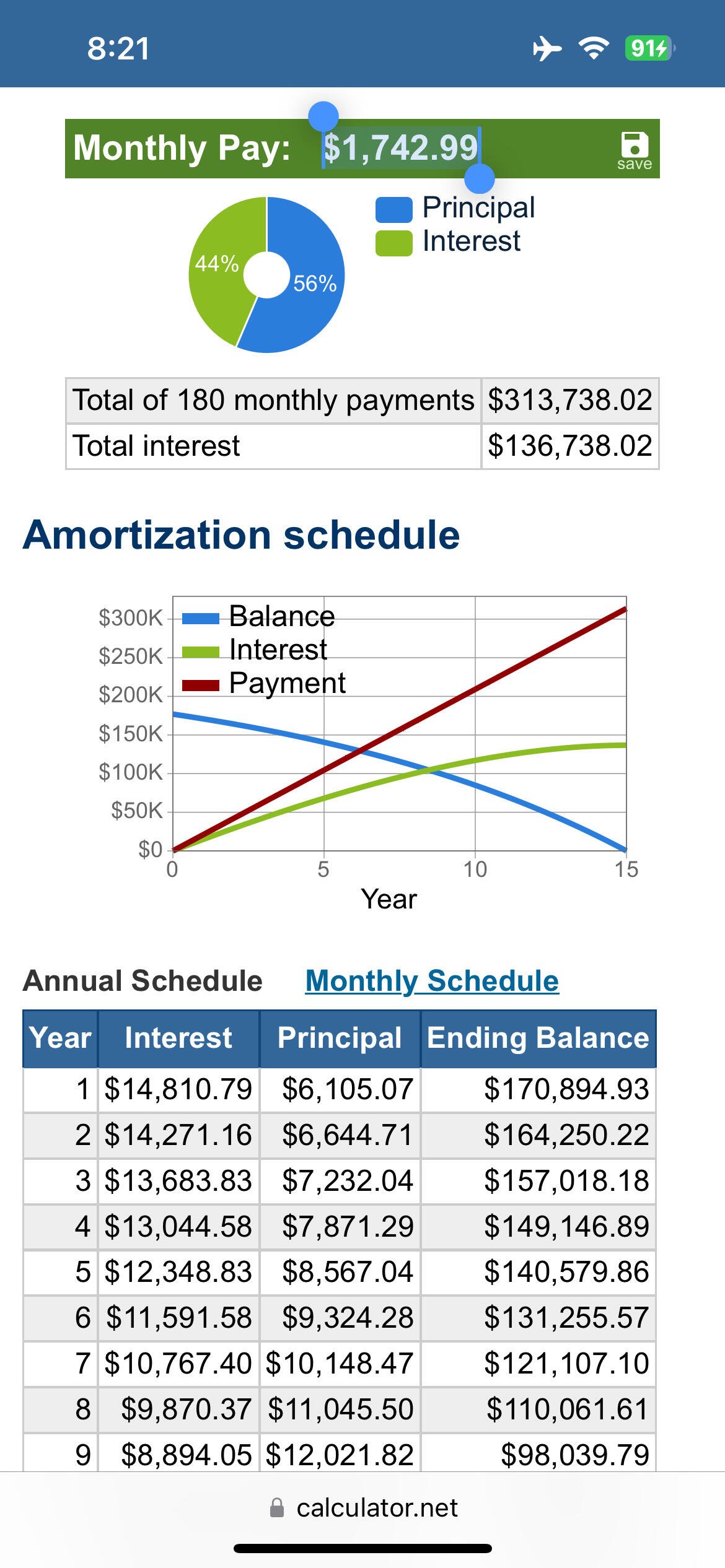

1. Do you have six months of reserve cash? Always have a reserve.

2. Do you have any debt besides your mortgage? Car payment, credit cards, student loans? Pay off any debt and have a reserve before even considering other options.

3. 2.99% is lower than the inflation rate. You are basically arbitraging the dollar and making money off this loan. You will pay $136K in interest on a $177K HELOC if you carry the loan to term. If you sell the home and buy another you are looking at transaction costs of $60K to $70K. Also remember, that as the price of your home increases so does the price of other homes. Did you factor in the increased cost of purchasing a new home?

4. The payment on the HELOC will be approximately $1800/month, $21,600/year, $108K/5 years. With about $60K going towards interest and about $36K going towards principal during the first 5 years. Plus the cost of obtaining the loan. Even “no cost” loans cost something.

If my math is correct you are looking around at least $130K in cost, or around 73% cost to borrow today what you could stack in about 8 years. Not counting your current DCA and buying more during dips.

This isn’t about risk tolerance, your idea is just a bad investment.

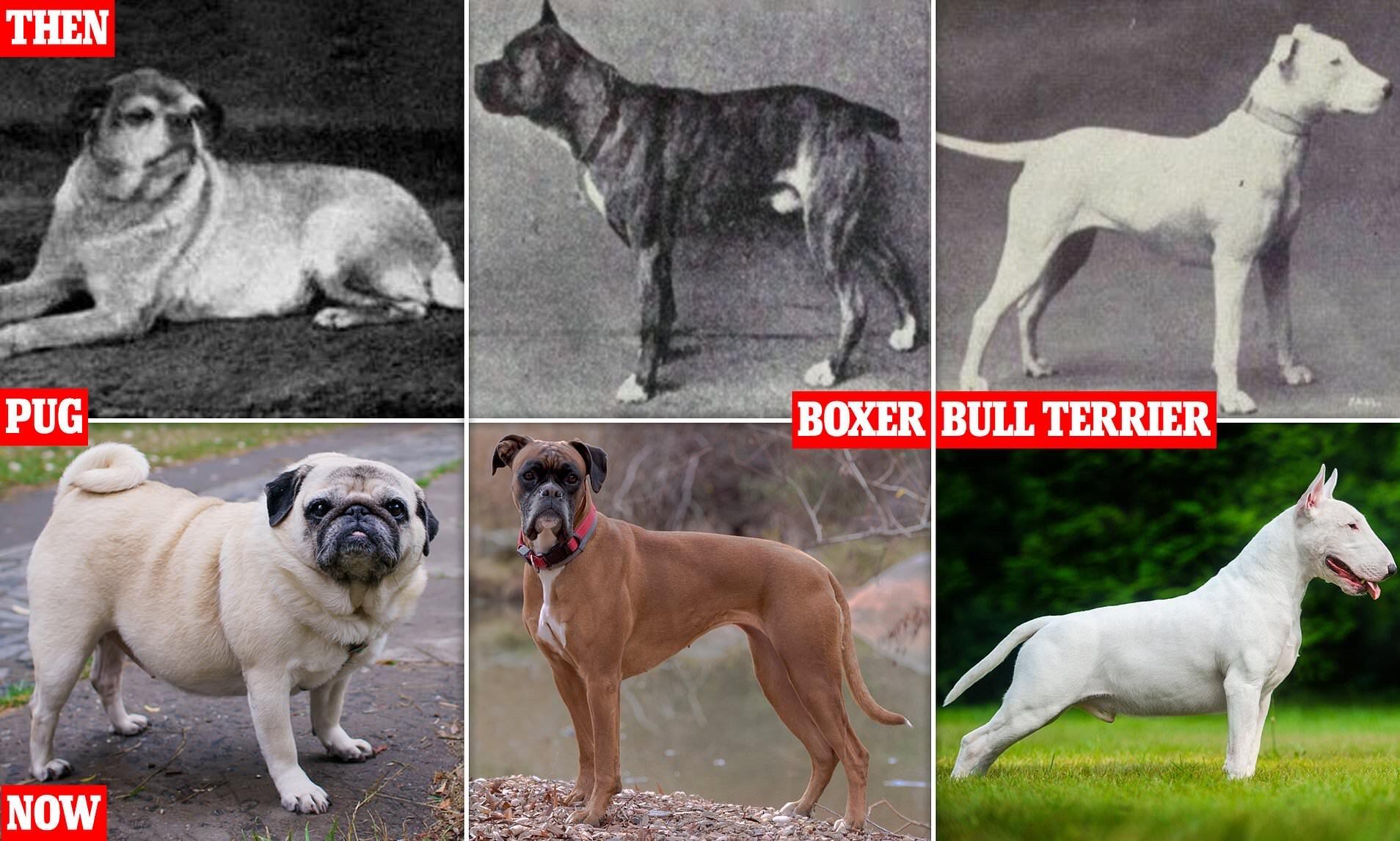

Or, return to the breed standards of 100 years ago. Humans have created genetically weak inbreeds incapable of survival without human intervention. Many modern breeds have trouble walking, giving birth and even breathing.

Trying to get on now K5FmW93fnCM-p6jTDtvfyUVB8SsgBmJ9bgJu4fplRsA

Nice, Hot wings with a nice Skunky Pilsner. Maybe an American logger or even an Amber bock.

Had a steak and a beer for dinner tonight.

Mine cost about $2.50 a dozen. Not only are they cage free, but I feed soy free, corn free, non-GMO feed.

GM Nostr! Everyone is talking about the price of eggs right now. Mine literally cost me chicken feed.

#permies #chickens #grownostr

nostr:note18wd6ltvrxf07q7qr540enqg0nrqdmvgxv00nffhe36el4qrxtxpsj4smqc

nostr:note18wd6ltvrxf07q7qr540enqg0nrqdmvgxv00nffhe36el4qrxtxpsj4smqc