nostr:npub1xtscya34g58tk0z605fvr788k263gsu6cy9x0mhnm87echrgufzsevkk5s feature request of the day: if I search for something that's obviously a mastodon user @blah@blah.social AND I use the Mostr relay, try to find the user there.

blah_at_blah.social@mostr.pub in that example

nostr:npub1xtscya34g58tk0z605fvr788k263gsu6cy9x0mhnm87echrgufzsevkk5s feature request of the day: if I search for something that's obviously a mastodon user @blah@blah.social AND I use the Mostr relay, try to find the user there.

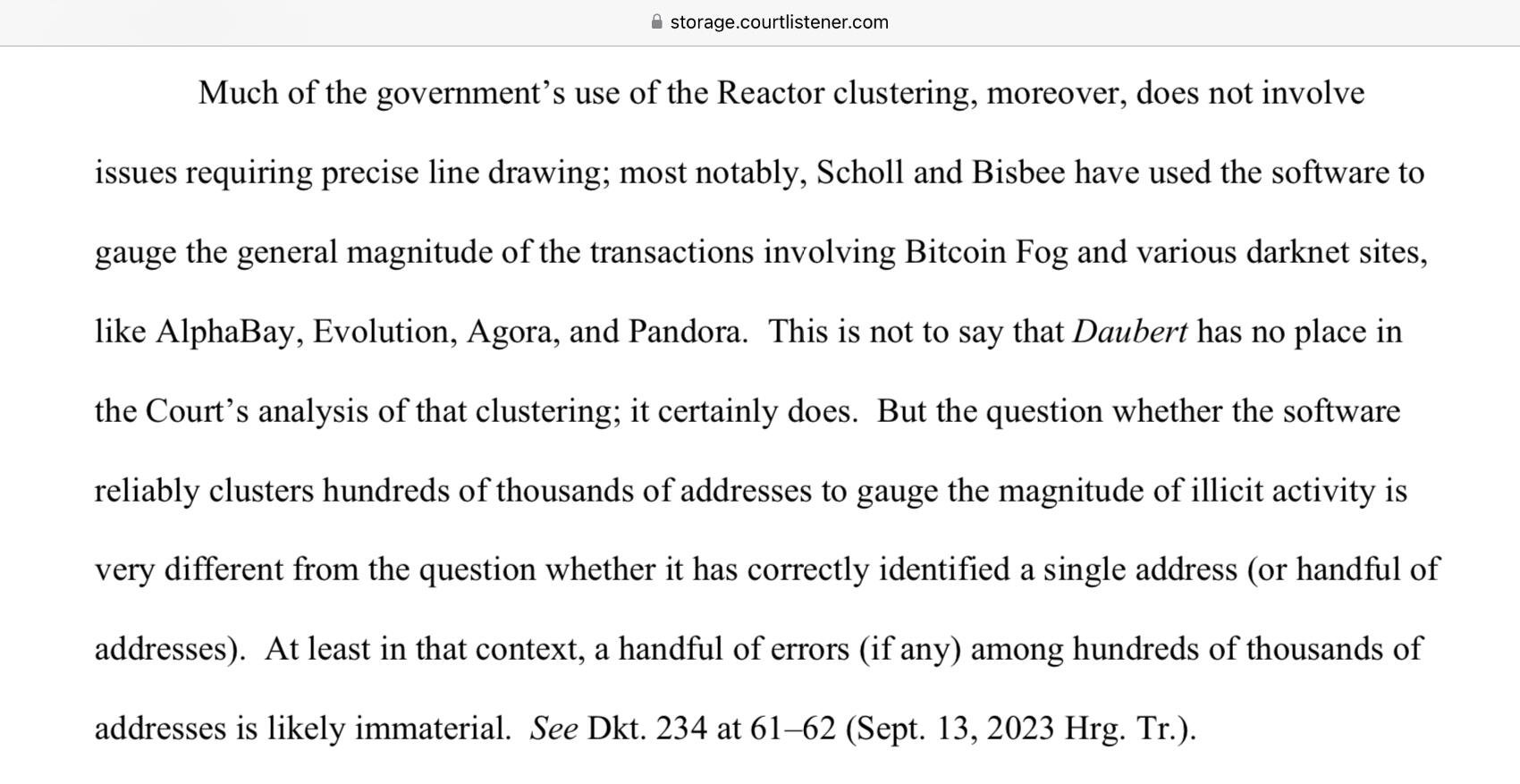

The Sterlingov case Daubert ruling makes for an interesting read. We'll see what happens in the appeal. Its goal IIUC is to determine if evidence is admissible, not that it's conclusive. So the bar is a bit lower.

My initial impression after reading is that the defense tried to bite off more than it could chew, by trying to dismiss Chainalysis for all the things, rather than focus on the specific transactions that (allegedly) link him to the admin role.

It seems reasonable to expect that they can roughly trace flows between individual darknets and mixers.

https://storage.courtlistener.com/recap/gov.uscourts.dcd.232431/gov.uscourts.dcd.232431.259.0.pdf

Set up a wireguard between them, as per your own blog :-)

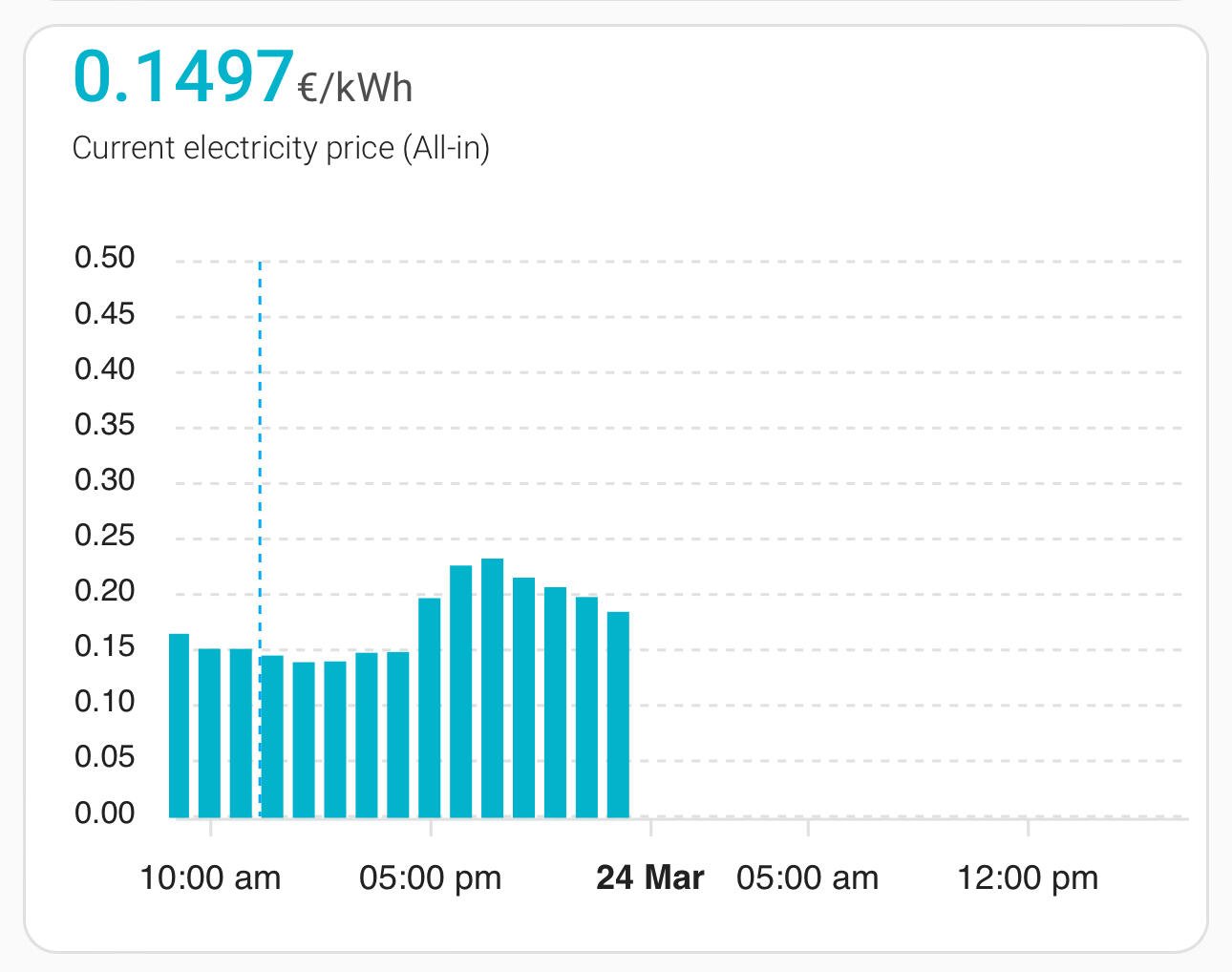

That looks wrong. It was around €0.15 / kWh last year. But there's also a fixed deduction independent of use, so perhaps this is the net tax?

If by "we" you mean bitcoiners, then perhaps yes. But if you mean the Dutch then you should realize that this proposal could have been vetoed by the Dutch government. Instead they probably lobbied FOR it.

Trying Iris for a bit, but I would like the ability to filter notifications to show replies only. Otherwise it's hard to find stuff with all the likes and zaps! #humblebrag

You're still assuming presumption of innocence exists. It doesn't for AML/KYC. You're presumed guilty if they can't fully trace your coins.

They wouldn't be. But let's say you buy Bitcoin and then open a channel. You might get annoying compliance question, because they can't surveil you anymore. They might close your account. This can lead to self-censorship.

In that sense lightning has similar properties "anonimity-enhanced" coins. Which is good! (plus politically speaking, it's hard for them to argue against "I use it because it's cheaper and faster, it just happens to also be more private")

In other words: the duty to do compliance stuff is not retroactive. But the compliance people can look as far back in history as they see fit.

Laws are generally not retroactive. But here's the thing: if you mix your coins now and send them to an exchange in 5 years, they might freeze them and ask annoying questions - because that's what that law forces them to do. That's already a risk today.

Don't count on that. 99% of the population does not give a fuck about privacy. Probably 80% doesn't truly care about democracy, they merely have a preference for it. Freedom has always been a minority obsession and fight.

Wonderful. Though I like* to alternate and only do morning caffeine one or two days per week.

* = which often fails, especially if I'm stocked up on Club Mate nostr:note1zqvz8a449qlpfw9vlws538thl76qk0lcen4zdddcd8h4p3lxfzpq56c224

* haven't had to use

"unfortunately" this winter has been so mild and my house is so well insulated that I only got to run it three times in January. Since then I've had to use *any* heating.

I use Home Assistant and this: https://github.com/Schnitzel/hass-miner

The fun part is that you can program an S9 to act as a space heater at the cheapest hours. Especially if your home is well insulated and it doesn't matter at what time of day you do the heating.

nostr:note1ahym4d29uwssxe6llj9fcasdqsmd52g63q72kp4rkguy6wwa6mmsag9laz

Yeah it's crazy. It's gradually going down over the next few years. The most perverse part of this tax is that it's regressive: industrial users pay almost nothing.

A number of energy companies offer "dynamic" contracts. They announce the price for each hour the day before, which is based on some European auction system. Most people however still prefer a fixed price contract. Right now those go for €0.23 - €0.34 per kWh including tax, depending on how long you want the price fixed (e.g. one month, one year, three years).

Those contracts used to be the norm so the government tax wasn't as obviously weird. Now suddenly you have to PAY taxes to consume negatively priced electricity.

I often look at the price of electricity instead of the weather forecast. Low price often means lots of sun. But it can also mean lots wind (and rain), oops.

Prices in the chart below include a €0.13 / kWh tax and about €0.02 / kWh margin for the power company. Otherwise it would be zero or negative.

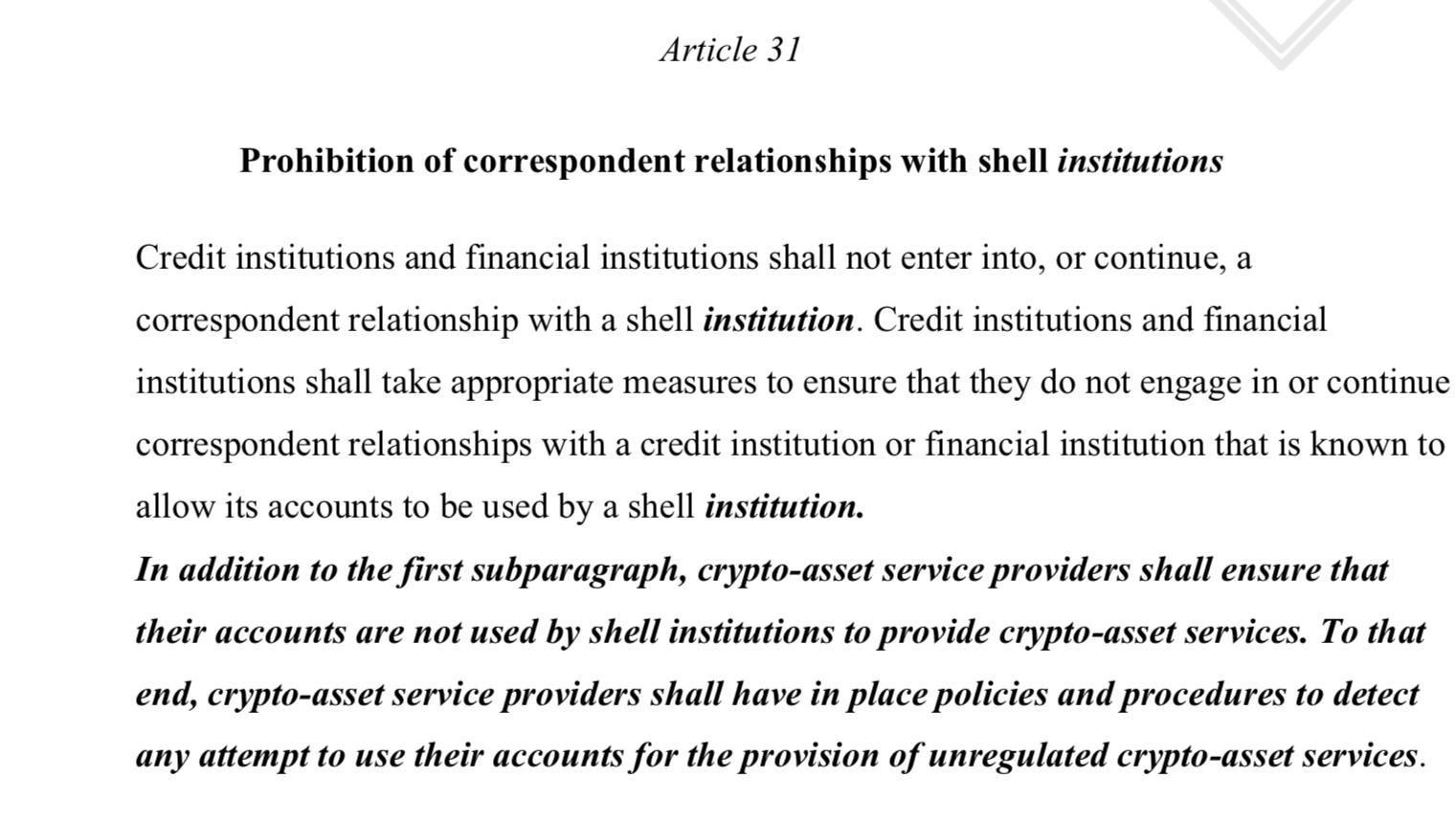

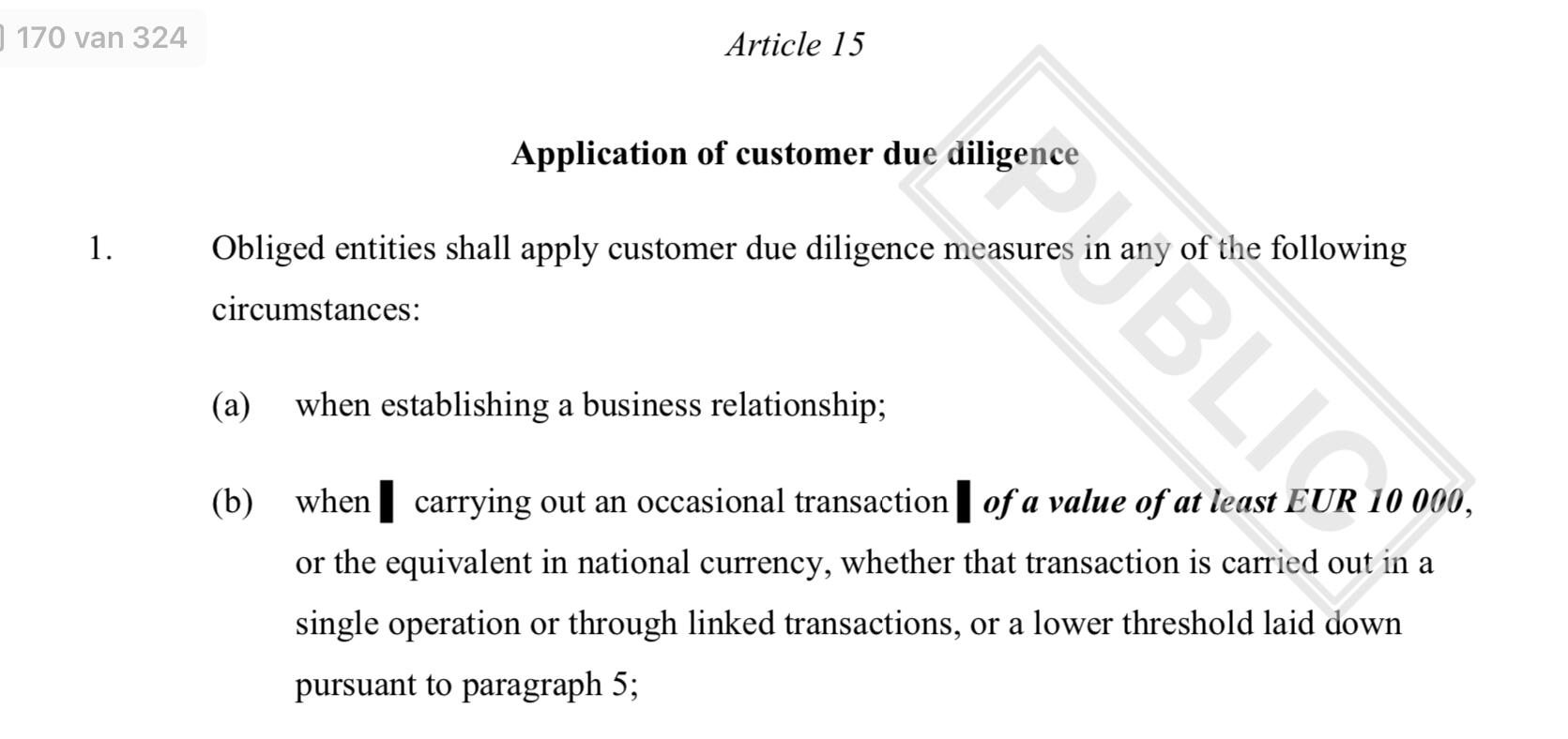

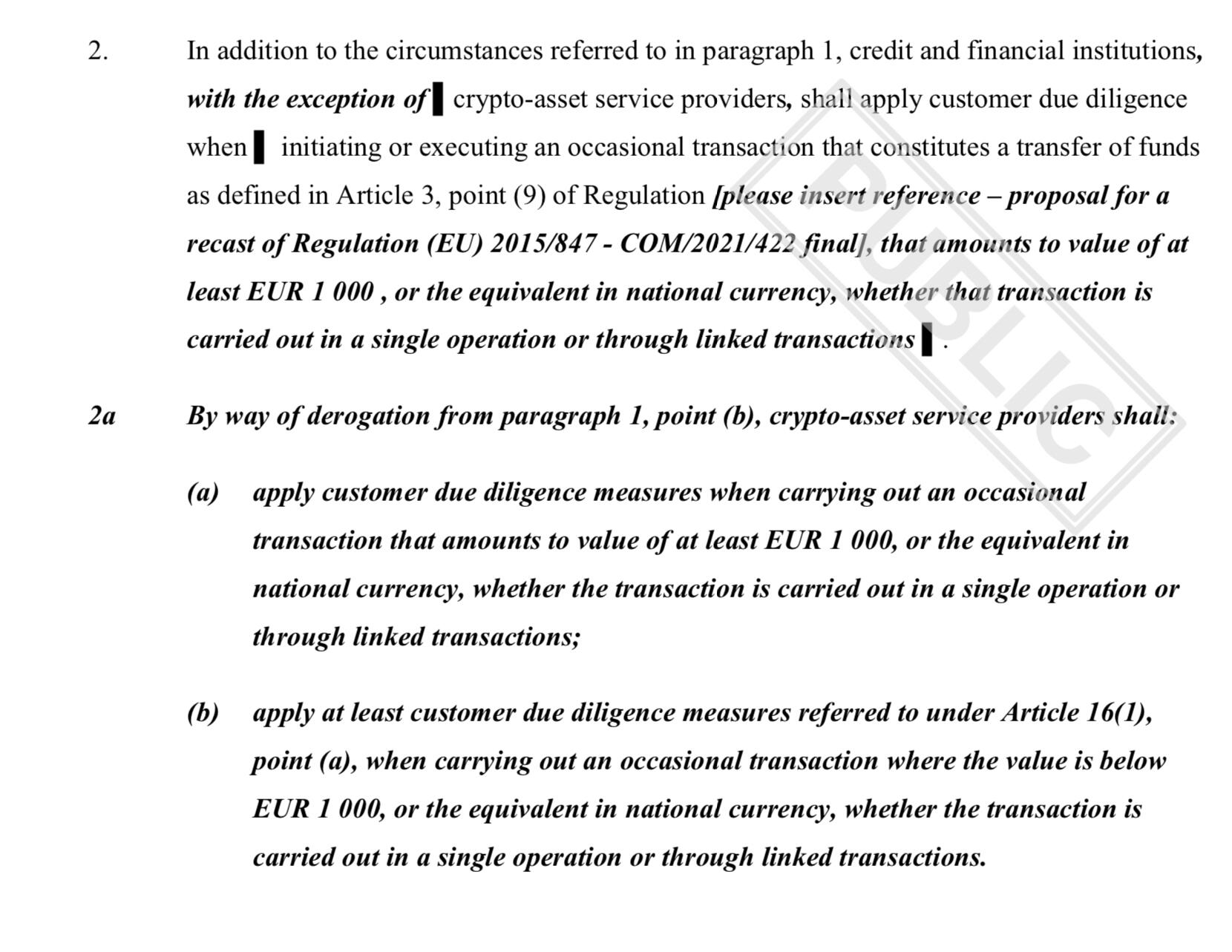

I don't see anything that directly impacts p2p either, just the on and off ramps. There does seem to be a requirement of surveillance of what coins do before and after which can have a chilling effect. That's not new, just worse because it's the law rather than 'voluntary' (arguably illegal, because GDPR) behavior by exchanges.

31b is new in the same sense: some companies already demanded address verification but this is illegal under GDPR because you can't collect data without a legal basis. Bitonic was forced to do this by the Dutch central bank. They went to court and won. Other companies are to cowardly to do the same and the privacy regulators don't have time to fine them for knowingly violating GDPR. The difference is that this new law provides the missing legal basis.

Anyway that's my understanding so far which could be wrong.

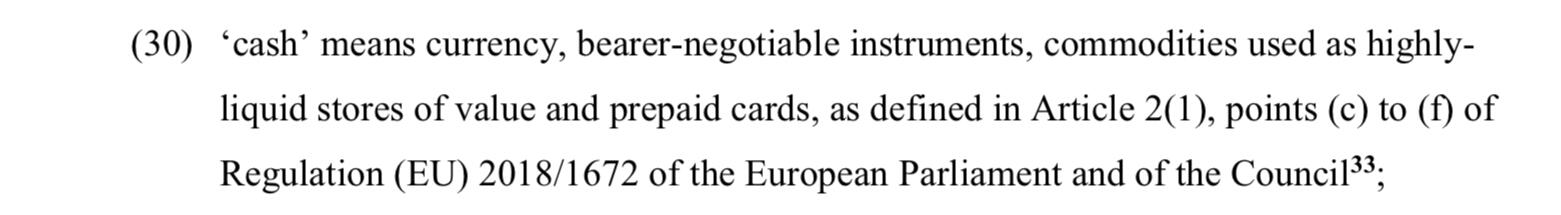

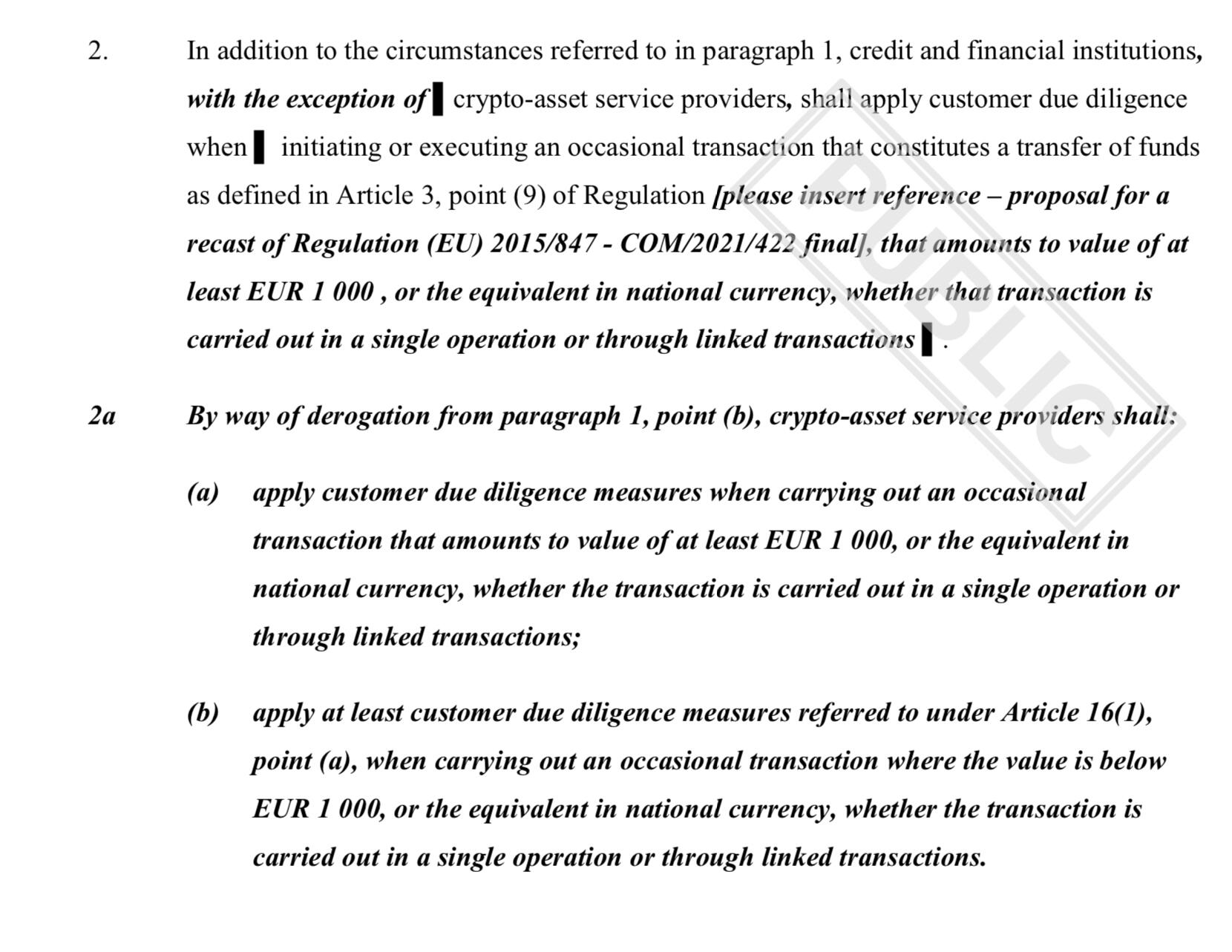

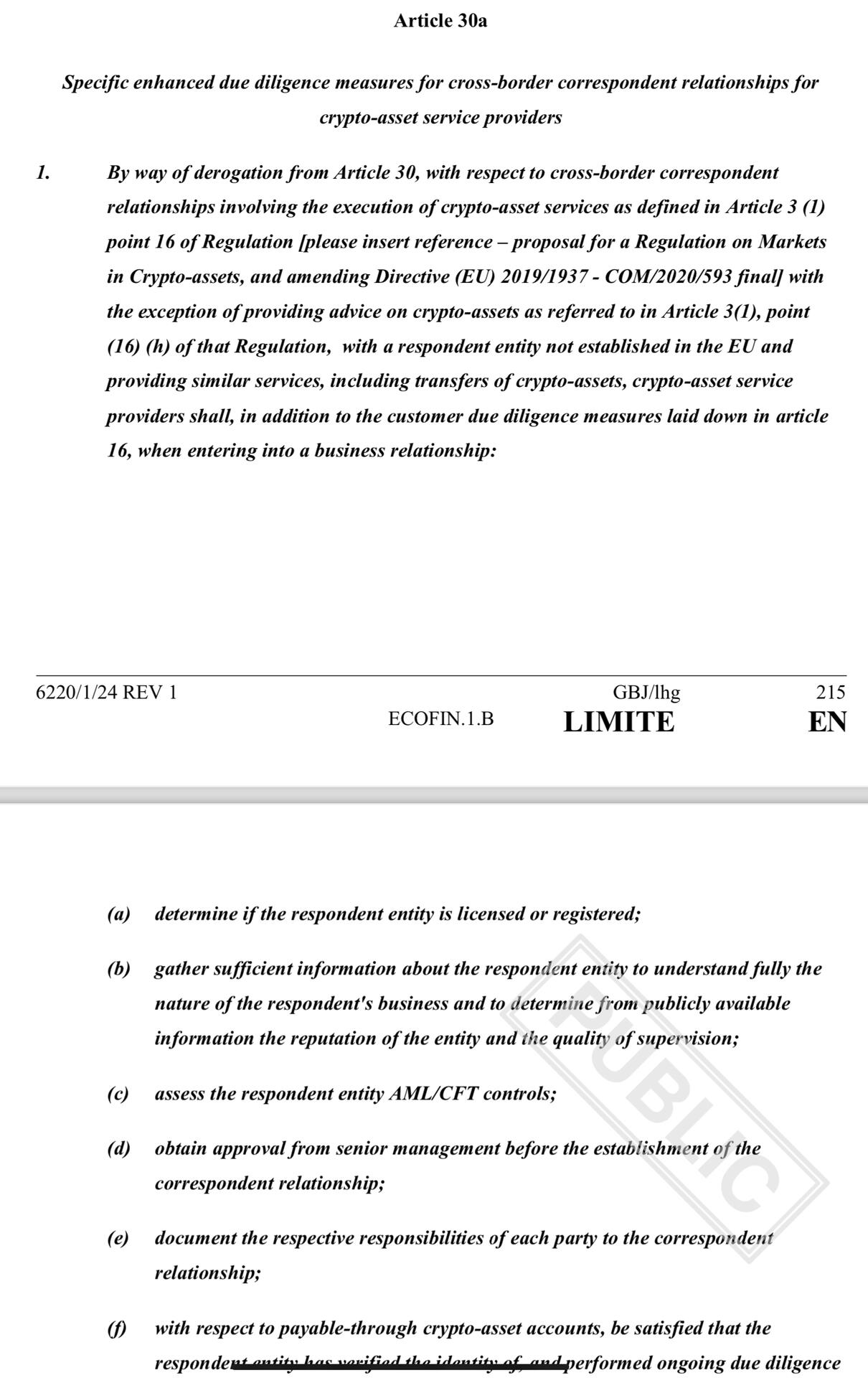

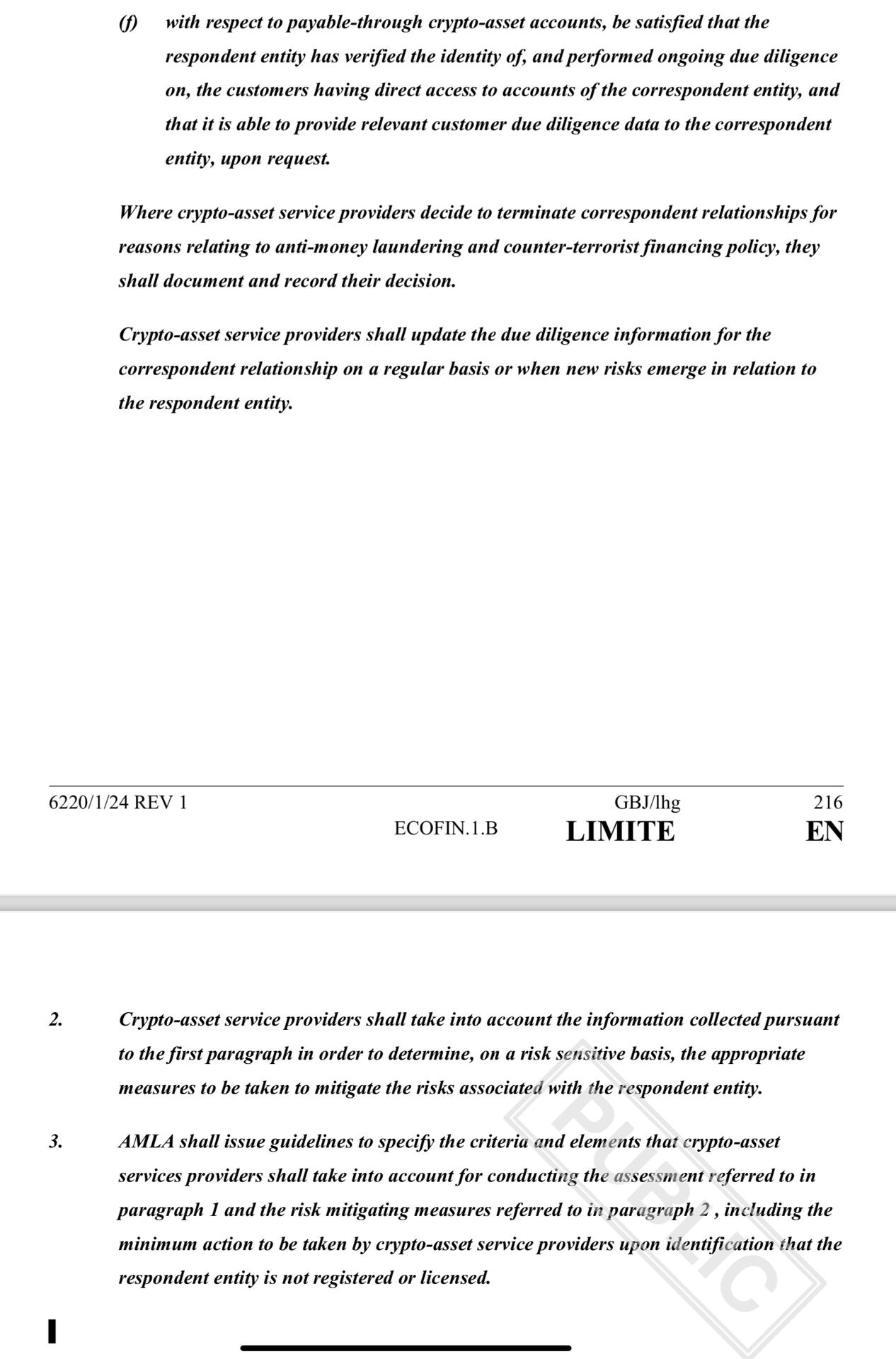

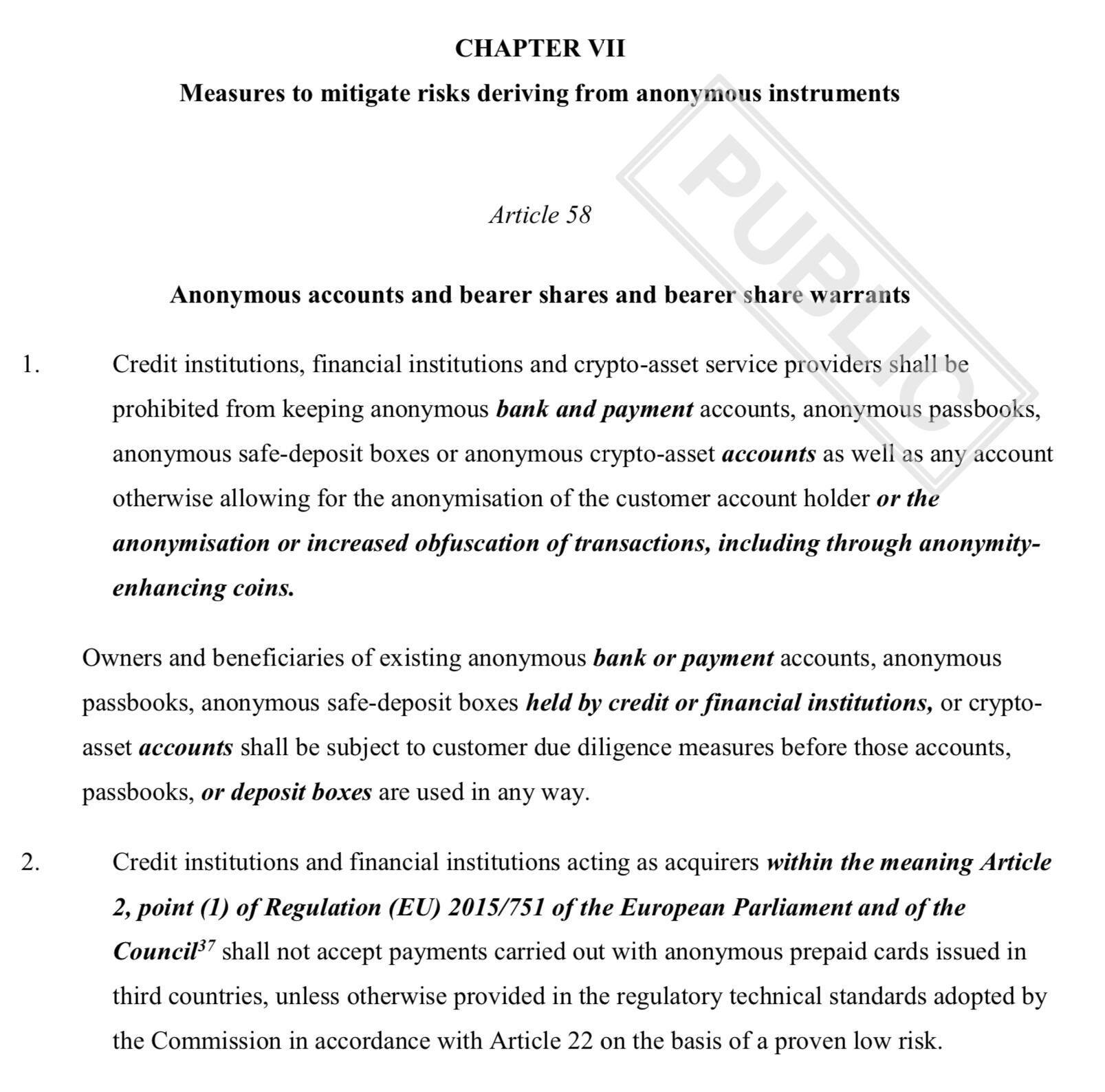

I made a quick first reading pass through the latest satanic EU thing. It's a wide ranging 324 page document, covering things like trusts, football clubs, dubious / tax optimized jurisdictions, the distinction between in house lawyers and law firms, beneficial ownership, reporting requirements, etc, etc.

https://data.consilium.europa.eu/doc/document/ST-6220-2024-REV-1/en/pdf

I tried to collect the bits that might impact Bitcoin. A minuscule fraction of the paper surface area. It's not like Bitcoin or even 'virtual assets' has its own chapter: in classic design-by-commission it just pops up in random articles.

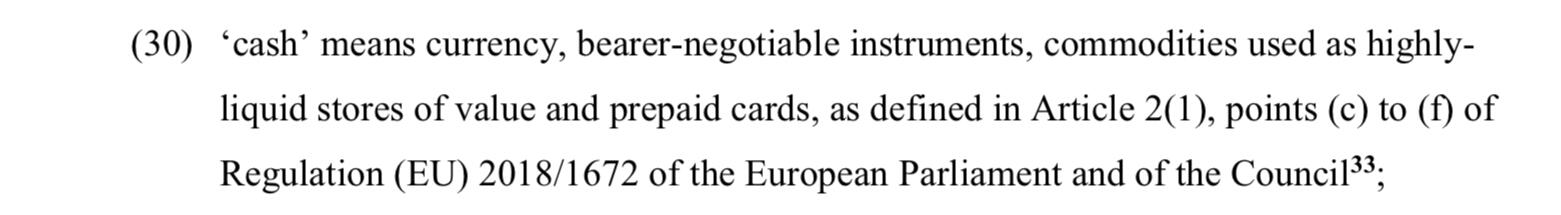

Notably I'm ignoring cash: someone else will have to save that. But beware that 'cash' is defined much more broadly than the word suggests. It doesn't explicitly cover bitcoin, but I would expect that to happen eventually.

The first 100 pages (items numbered up to 103) seem more like an introduction than actual proposed law. Some of it seems to oversell the actual legal text.

One observation is that 'virtual asset service provider' (VASP, or what Americans would roughly call custodians and exchanges) is now considered a Financial Institution(tm).

My impression now is that only _custodians_ are not allowed to:

1. Have anonymous customers (i.e. anonymous accounts): they explicitly mandate KYC rugging existing accounts, albeit with a 3+ year heads up

2. Operating a mixer

They also need to verify ownership of destination address (wallet verification), which is bad, but far from a ban on self-custody.

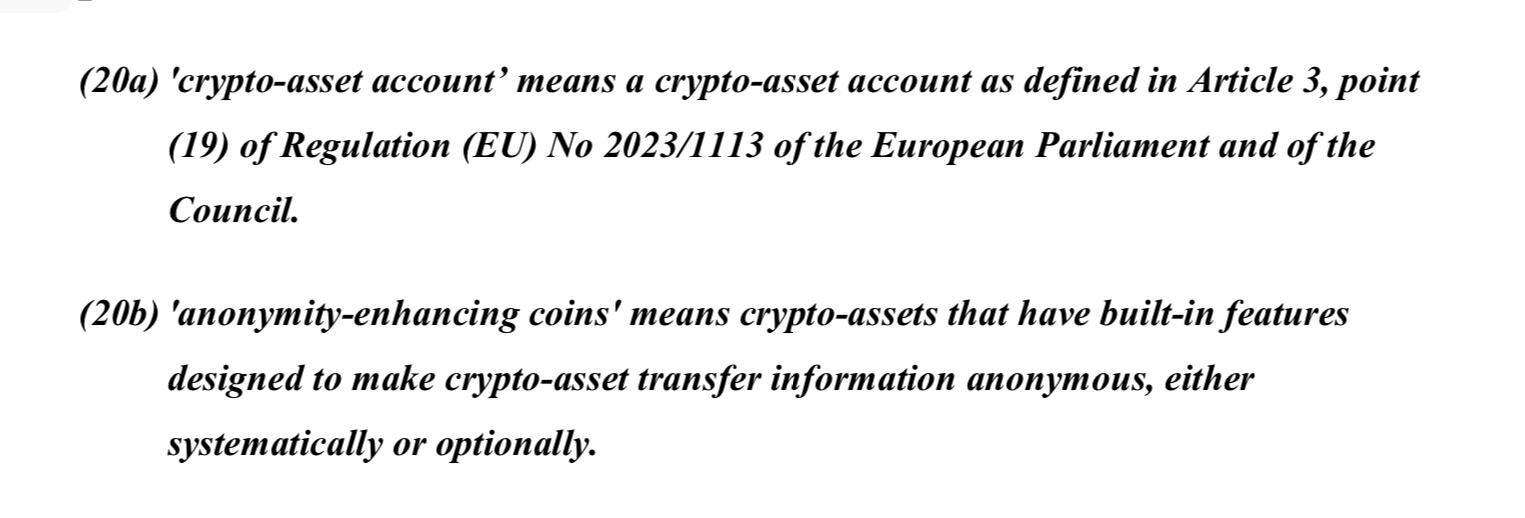

The 'intro' text mentions mixers along with anonymous coins in a way that suggests banning transactions with them. But the word 'through' makes it really unclear what they mean. In the law text they define 'anonymity-enhancing coins' in a way that obviously implies Monero and Zcash in that order. Article 58 uses the vague term 'through' again. Does it mean they can't let you withdraw to it? Or just that they're not allowed to offer a pseudo-mixing service that *uses* these coins.

Anyway I'll have to re-read this a few times to grok. Keeping in mind that the politicians who wrote this don't have the brain cells to process anything more sophisticated than "monero bad, make law with fancy words!" and then the bureaucrats who write the law have no idea what anything means either. No tech literate person was involved in this process, that's very obvious from the language. But that does make it less dangerous.

The next step for me is more deeply understand what the proposal actually says, if there's any potential direct impact on myself (which might give me legal standing - now or in five years or so when stuff has really taken effect and local judges can intervene) or if it's merely bad in general (in which case perhaps all I can do is write an angry letter).

Argh, I meant to day "does NOT make it less dangerous"

I made a quick first reading pass through the latest satanic EU thing. It's a wide ranging 324 page document, covering things like trusts, football clubs, dubious / tax optimized jurisdictions, the distinction between in house lawyers and law firms, beneficial ownership, reporting requirements, etc, etc.

https://data.consilium.europa.eu/doc/document/ST-6220-2024-REV-1/en/pdf

I tried to collect the bits that might impact Bitcoin. A minuscule fraction of the paper surface area. It's not like Bitcoin or even 'virtual assets' has its own chapter: in classic design-by-commission it just pops up in random articles.

Notably I'm ignoring cash: someone else will have to save that. But beware that 'cash' is defined much more broadly than the word suggests. It doesn't explicitly cover bitcoin, but I would expect that to happen eventually.

The first 100 pages (items numbered up to 103) seem more like an introduction than actual proposed law. Some of it seems to oversell the actual legal text.

One observation is that 'virtual asset service provider' (VASP, or what Americans would roughly call custodians and exchanges) is now considered a Financial Institution(tm).

My impression now is that only _custodians_ are not allowed to:

1. Have anonymous customers (i.e. anonymous accounts): they explicitly mandate KYC rugging existing accounts, albeit with a 3+ year heads up

2. Operating a mixer

They also need to verify ownership of destination address (wallet verification), which is bad, but far from a ban on self-custody.

The 'intro' text mentions mixers along with anonymous coins in a way that suggests banning transactions with them. But the word 'through' makes it really unclear what they mean. In the law text they define 'anonymity-enhancing coins' in a way that obviously implies Monero and Zcash in that order. Article 58 uses the vague term 'through' again. Does it mean they can't let you withdraw to it? Or just that they're not allowed to offer a pseudo-mixing service that *uses* these coins.

Anyway I'll have to re-read this a few times to grok. Keeping in mind that the politicians who wrote this don't have the brain cells to process anything more sophisticated than "monero bad, make law with fancy words!" and then the bureaucrats who write the law have no idea what anything means either. No tech literate person was involved in this process, that's very obvious from the language. But that does make it less dangerous.

The next step for me is more deeply understand what the proposal actually says, if there's any potential direct impact on myself (which might give me legal standing - now or in five years or so when stuff has really taken effect and local judges can intervene) or if it's merely bad in general (in which case perhaps all I can do is write an angry letter).

And you don't even have to throw the nuts *at* the podcaster. If they're pubkey locked anyway you can just toss them anywhere. Eventually they'll get to the host. Either because their wallet crawls the web or their friend finds it on nostr and forwards it.

You could add a "has this been claimed yet" API call to mints so when software encounters a nut somewhere they can decide to either ignore or kick it down the road somewhere.

Podcasting 2.0 could definitely use nuts.

cc nostr:npub12rv5lskctqxxs2c8rf2zlzc7xx3qpvzs3w4etgemauy9thegr43sf485vg nostr:npub13ql75nq8rldygpkjke47y893akh5tglqtqzs6cspancaxktthsusvfqcg7

To expand on that a bit: in practice you need a (semi)custodial lightning wallet as a listener anyway, because otherwise you're going to run out of battery on your podcast walk. Who then know what you're listening to and when.

As a podcaster you can self host, but - especially with splits - you'll miss out on some of the payments due to routing issues.

If instead you can post (pubkey locked) e-cash tokens somewhere, that's probably easy enough for a podcast client to support and hardly requires bandwidth.

nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx I think your node is down, I can't post my pun!

Podcasting 2.0 could definitely use nuts.

cc nostr:npub12rv5lskctqxxs2c8rf2zlzc7xx3qpvzs3w4etgemauy9thegr43sf485vg nostr:npub13ql75nq8rldygpkjke47y893akh5tglqtqzs6cspancaxktthsusvfqcg7

nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx I think your node is down, I can't post my pun!