I'm planning to experiment with something like this:

1. Buy lighting from exchange, Relai or Pocket Bitcoin, weekly dollar cost averaging

2. Peg in to Liquid, using side deal, after each buy, keep in Green wallet

3. Keep it in Liquid up to a more significant amount, perhaps after 6 or 8 weekly buys

4. Peg out from liquid to on-chain cold wallet

What do you think?

🟠 JAN3 will soon re-launch the Bitcoin layer-2 Aqua wallet, natively supporting sidechains 🌊

HT

@BitcoinAltcoinCryptoNews

https://video.nostr.build/bc95db75c4512155132cacc524da112fa3484bd1f0bed4cc4ab74c9f7988d6f6.mp4

By sidechains you mean what exactly?

I'm aware of Liquid.

Are there any other sidechains?

I think I get it now. Thank you.

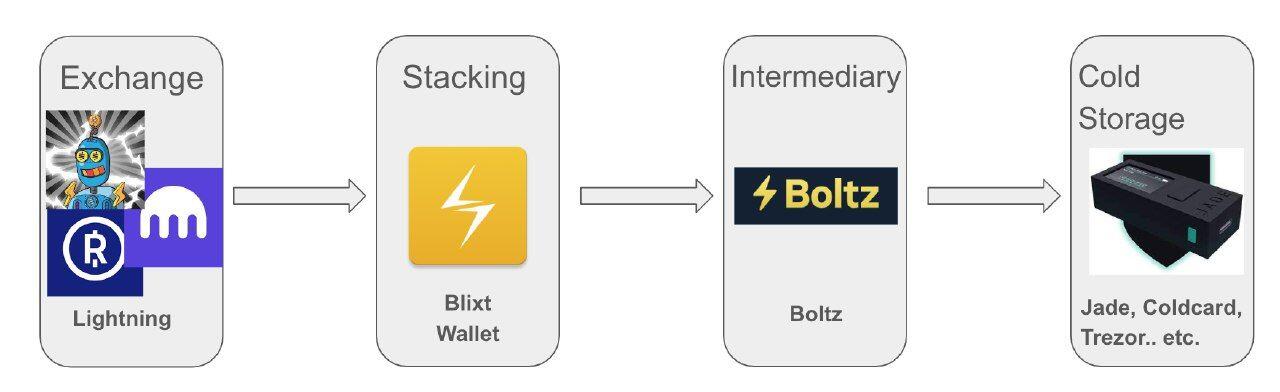

1. Buy Bitcoin on lighting using robosats.

2. Exchange lightning to liquid on boltz and send liquid to green wallet.

3. After a while, when it adds up and once fees are lower, peg out from liquid to Bitcoin on-chain, using sideswap and send to cold storage.

Am I getting it right? Like a plan for stacking sats with privacy and low fees?

Thank you. I'm looking for a way to directly buy liquid for fiat. As a way to buy Bitcoin, but avoid high fees.

For example, inspired by a recent BTC sessions video, buy liquid for $100 every month and, after 6 months peg it all out to Bitcoin and send to cold storage with one transaction on chain.

So I guess I'm looking for a liquid exchange, and ideally a non KYC one...

Do you know and recommend any?

I see a long list of partners on the liquid website but I was wondering if you can recommend any.

Same question here

My answer: ollama and oterm, on a regular laptop

Right. I guess I'm saying they can easily make it illegal, yeah, just like weed.

Enforce it fully, of course they cannot, just like weed. As long as I have a computer and internet access and ability to download a software, and enter my seed words, I can use Bitcoin of course.

But they can definitely make it harder. But the more I think about it, you are right, a comparison to weed is on point.

Thank you.

Yes, but, to be clear and make sure I get it.

The KYC Bitcoin in self custody is also real.

It's just that they know you have it.

They can attempt to confiscate it or tax it, but you still can claim you lost the keys or move to a different country, right?

Well of course unless they close the borders.

On the other hand, the non KYC-ed, if you bought it on Bisq using bank transfer, they might still trace it, because the seller will be likely known or suspicious for receiving a lot of small bank transfers from different people.

So is it that the only true non-KYC method is cash with trusted people? Or Bitcoin ATM? But then, convenience is out and costs are high and... In a dystopian scenario they will make it illegal to use this non-KYC Bitcoin anyway.

Of course, it will be hard for them to enforce but still.

Not good.

I'm worried.

If it gets really bad, it will be bad.

Bitcoin is probably the best thing we have, to protect wealth from inflation and theft, but it is far from a magically resistant digital gold that can withstand anything. If they make it illegal, it will be dangerous to use.

But even if it gets bad, I guess it will be better to have some Bitcoin than not having it.

Anyway. I'm probably unnecessarily worried.

I'm afraid there will be two different markets for Bitcoin in the future.

One will be KYC-ed, official, tagged Bitcoin, and the ETF. It will be easy to buy or sell, easy to spend, but it will be taxed of course, and hard to, or even illegal to self-custody, and we will need to show a proof of the source of funds it was bought with.

The other market will be a shadow or even black market for non-KYC self-custodial Bitcoin. It will be hard or impossible to confiscate, and close to impossible to enforce it being illegal, if they decide to make it illegal, but, while it is easy to store the seed backup and run a wallet app on a computer, in such hostile regulatory environment, I guess it will sell on a black market with a steep discount.

I hope I'm wrong and they will not try to make self custody and running a node illegal.

And today, as much as I'm hesitant and unhappy to admit it, I think it is wise to have two separate stacks. KYC and non-KYC stack.

KYC one with good records, transactions history, due taxes to pay, but you are OK.

The non KYC-ed one, well, in case needed. In the dystopian scenario, might be a good thing to have. It's not illegal today.

What do think?

Keep non-KYC stack, but indeed I'm afraid they can trace even the past P2P buys, if paid digitally, unless cash was used.

Hope P2P markets and cash will still be available.

Second passport.

Low profile.

Perhaps some gold bars in small denominations. Or silver coins.

Fiat savings, cash and in the bank, incl. some assets that may protect from inflation.

Have the KYC stack, too. This is the official and taxed one. If they go after it, boating accident, or surrender.

Not that I have these things, just learning about this now, thinking aloud. Looks like we have similar worries.

If it comes to the really worst dystopia, I think the key thing will be an option to leave. But if they close the borders, even that may be gone.

I hope I'm unnecessarily worried and things will be ok. But better at least think about some options I guess.

I saw your note only now.

I have the same worries.

I'm currently reading this book https://vonupodcast.com/free-vonu-book/

It discusses some options.

It is interesting how everything is still valid or worse.

But better in that we have Bitcoin and Nostr...

If I want to buy a coffee with Monero, do I need to wait 10 minutes for next block?

Thanks a lot for sharing.

Impressive.

Precious skill... I'd like to try and learn one day... But hardware requirements nontrivial...

How do I create my own?

I know how to run a model locally, using ollama.

Can you please share any good resources on how to create my own model based on my texts?

What destinations are you looking at?

📢𝟭𝟬𝟭𝟬𝟭 𝗣𝗨𝗕𝗟𝗜𝗖 𝗕𝗘𝗧𝗔 is now available 🎉

The mobile #Bitcoin & Lightning wallet that lets you do MORE with YOUR coins

📈 Peer-to-Peer Perpetual Futures

💲USDP : Usd-over-Lightning

Keep control of your funds 𝗮𝘁 𝗮𝗹𝗹 𝘁𝗶𝗺𝗲𝘀 #selfcustody

#FOSS

Learn more⬇️

The app is available for🍏 iOS (testflight) & 🤖 Android

𝗧𝗥𝗬 𝗜𝗧 𝗡𝗢𝗪

Learn more⬇️

📈Peer-to-Peer Perpetual Futures

Using DLCs, 10101 make it possible to open LONG and SHORT positions directly from your wallet

Contracts are peer-to-peer (10101 is not a trading platform), counterparty risk is eliminated : you remain in possession of your keys

⬇️

💲USDP : Usd-over-Lightning

You can convert a part of your balance in USDP : the first synthetic dollar on Lightning

Protect yourself from Bitcoin's volatility while holding nothing but Bitcoin (and a contract!)

Balance is resizable, and soon : transferable 👀

⬇️

We have a telegram channel to communicate with the community on our news, updates or even community events!

Of course, our team is available in a support channel if you experience any difficulties or need any help with 10101 :

⬇️

10101 is a Free Open Source Software built in public since day 1.

Everyone is free to check the source code and contribute

https://github.com/get10101/10101

⬇️

Even if you are not a developer you can contribute and help us improve our app!

By testing it, reviewing it, or even participating in our community calls.

Let's co-create the future of finance!

#SoundFinance on Sound Money

I'm getting "something went wrong" error message when I follow the link to get it from Google play

I'm not in the U.S.

No? OK, I guess I need to dig deeper.

Yesterday, when I was moving sats from WoS to other wallets, when I tried Phoenix, my transaction was tried rejected due to high fee.

And when I tried to move sats to Muun, it worked, instant and free.

Perhaps I was lucky or had a channel.

Anyway.