OK.

I think I got it now, thanks.

So what exactly is Muun good for?

Exactly, oterm to manage the chats, easily select the model, predefined prompts to start with, etc.

No, and that's why I run ollama locally

Yes, unfortunately a plausible scenario.

But even if this happens, I guess, think and hope, Bitcoin will still "work" as a digital gold, a store of value, and it will be possible to sell it in the future.

Worst case, on a regulated exchange and with a high tax, if they make everything else illegal, but still possible.

Right?

I love the pricing models, I can't help it. Here are the three models that are still valid and have not been imbalanced.

First the LGC model by Dave the Wave, although the author failed on the late 2018 3000 bottom and there created his model, since then it has not been invalidated predicting bottoms and tops very well.

Second the Power Law Corridor model of HCBurguer, which comes to say the same as the LGC model of dave the wave but better formulated mathematically, this model was created in early 2019 and from my point of view is the most accurate.

Finally the BARM model (Bitcoin Autocorrelated Exchange Rate Model) by @chipernom (The author keeps changing his name on social networks, it is difficult for me to follow him). From a statistical point of view it is the best model, from a price point of view, it is very crazy.

I leave you also the two articles corresponding to the LGC model and Power Law Corridor, unfortunately the author of BARM has deleted all his articles and they are not even in internet archive.

https://davethewave.substack.com/p/btc-the-lgc-model-and-support

To be honest, I like seeing these models as they give me hope I will be wealthy.

Although, not necessarily, in real terms, even if one of these models turns out true. Because, it may be that 1 BTC is worth a million dollars, but for a million dollars you can only buy a car.

But then, how can we tell if these are pure curve fitting vs having some real world reason to think they'd turn out accurate?

Are there any? STF had a rationale that sounded reasonable. But failed.

As much as I'd love this to be true, is there a real reason to think Bitcoin price would follow any specific model? I doubt.

If we attempt to predict BTCUSD price, probably the key driver is how much dollars they will print how soon.

And this will not necessarily follow any specific math equation, I think.

Anyway, happy to learn more and thank you for putting this together.

Is this a joke or are you serious?

If so, why?

I think he is a hero.

This is amazing

Thanks for sharing

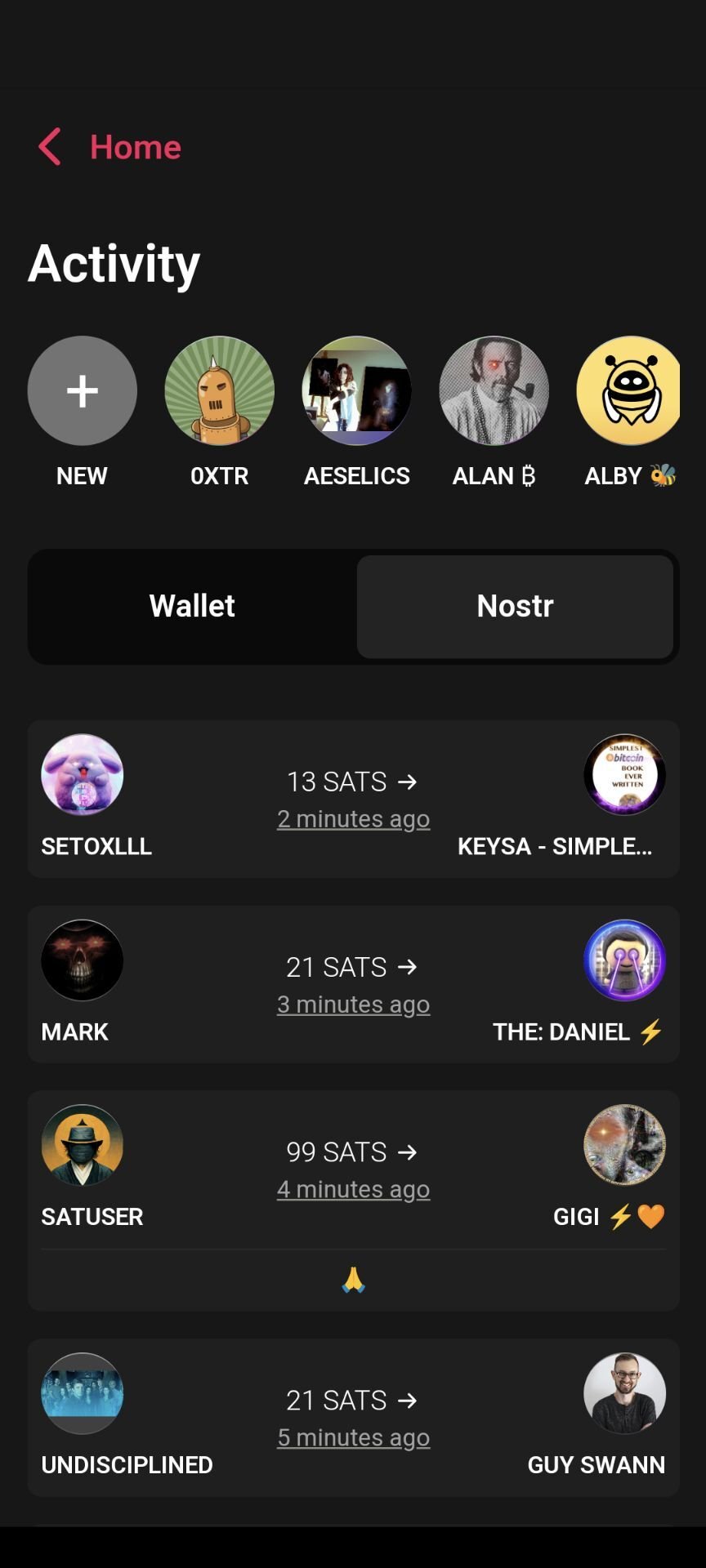

I've just followed 50 more people, based on your list of people you follow :-)

Thanks for sharing.

How to trade it?

Here is one idea, to get your input.

After the third candle, set a sell limit order a little bit below the low of the second bar.

I'm taking about the bearish scenario.

Stop loss at the high of the third bar.

Take profit at the stop distance, that is, target 1R.

Set and forget. Equal position size, risk adjusted.

Could that be profitable on a large number of trades?

Let's say on daily bars, stock market index and forex majors, and oil and gold.

Would be interesting to run a proper portfolio level backtest.

I’m looking for 21 plebs willing to get a free copy of my book History Echoes #Bitcoin in return for an Amazon review. HMU…

https://www.amazon.com/dp/B0C7MVH1HG?ref_=cm_sw_r_cp_ud_dp_561P15Q20QN1P4GDZFC7

I'm interested.

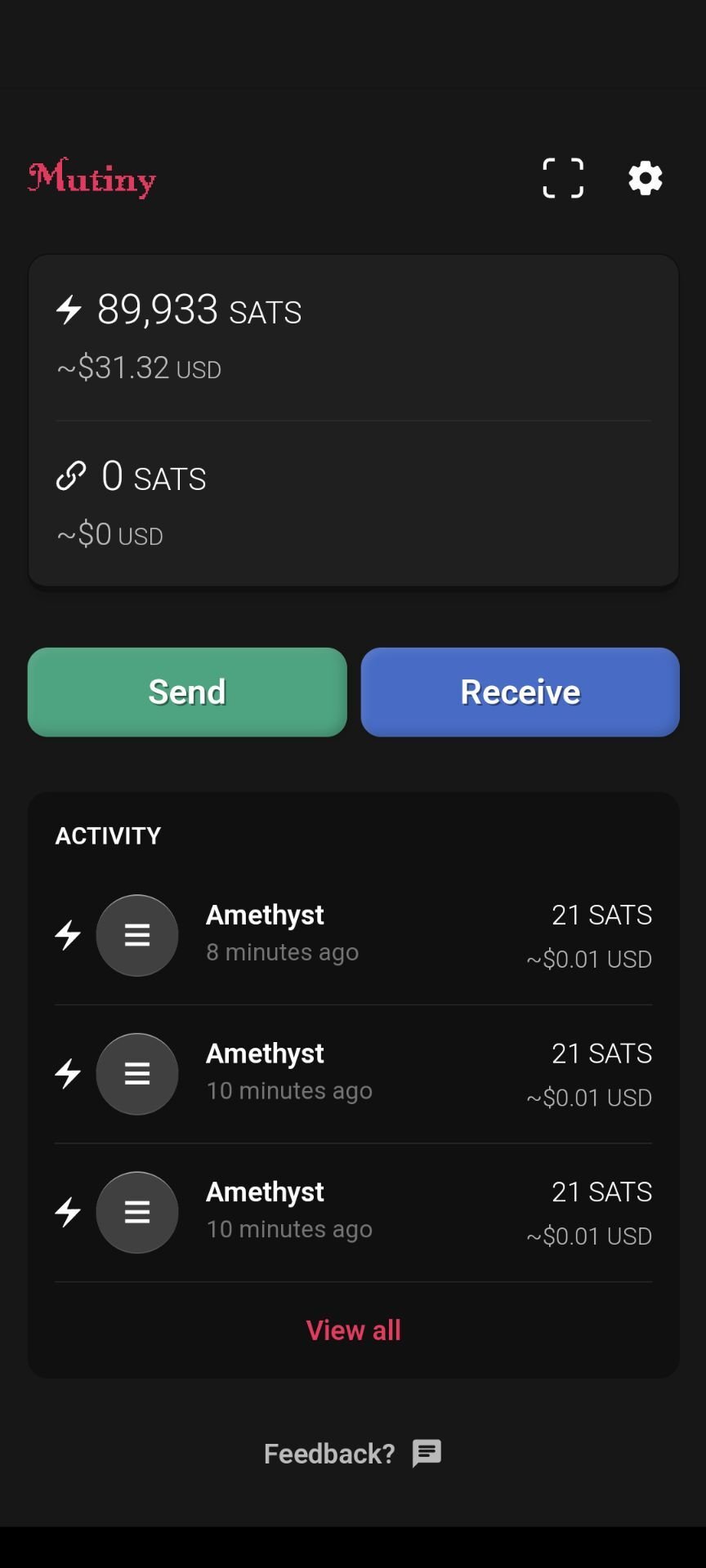

Yes, among lightning wallets, I think it is a good choice. Check out mutiny wallet as well.

Phoenix is an online, hot wallet.

You said large amount.

For large amount, please consider using cold wallet, offline.

It can be done by using a hardware wallet such as cold card, bit box, jade, etc.

Thank you for sharing

This is inspiring

I may try it, too

I wanted to say I did not know it existed.

This BIP 85 thing is amazing.

I did know it existed.

Thank you.

So I can create many online wallets from my master seed?

And it's safe?

And the only thing I need to recover is the index number?

Amazing.

If there any downside or risk?

Is it really safe to recover an online a wallet from 12 words bip39 created as a child index 0 from my precious cold offline secret seed?

I find it scary.

They are cooking a similar regulation in Europe, as well.

They don't want us to self custody Bitcoin.

Because then we can send it, without permission, to anyone we want.

And if we keep Bitcoin on an exchange, or buy their ETF, they can censor or confiscate it with one click. And tax it.

What if they make it impossible to legally send Bitcoin from an exchange to your wallet?

I guess exchanges in the US, Canada and EU will stop supporting withdrawals.

Then we will be left with an option to keep Bitcoin on a regulated exchange, or buy it peer to peer, Bisq or Robosats or alike, or buy from a centralized exchange from some other jurisdiction, e.g. from El Salvador.

But then, freedom-loving governments of Europe and North America, for our protection of course, can block bank transfers to exchanges outside of the EU or NA.

But OK, even then, we will be left with the custodial or P2P options.

I guess that's manageable. They will not be able to enforce a ban on running a wallet software on your computer or a phone, and a ban on buying P2P.

I mean, they can make anything they want illegal, but it's impossible to enforce, I think.

But for sure they can hinder adoption.

And also, what if, in the future, someone wants to sell a sizeable stack, and even dutifully pay capital gains tax... What if they say you must show some proof of the source of funds?

I think we all need to keep good records of all the purchases we are doing now.

To have a future option of selling it to a regulated exchange.

P2P will likely always be an option, but if it is deemed illegal in a dystopian future, then the sale price will be largely discounted.

Does my thinking make sense?

Anything else we can do, to protect our ability to save for the future, using the asset they cannot print?

I guess it is good to have both non-KYC and KYC stack, separately.

If they go after you, to seize your KYC stack, which they know you have, you give it to them, at least the part you have not lost in the boating accident.

If you want to sell on a regulated exchange, you easily can because it is tagged.

And the non KYC-ed stack, you can sell P2P on the future.

I'm afraid that we will have two parallel bitcoins in the future. Official, on regulated exchanges and ETF, and non KYC-ed.

With different prices and transacting methods. I hope I'm wrong.

Anyway, my thoughts. Happy to hear what people think. Thanks for reading.