Huh? I don't understand...

P2P platforms have many options, you choose what you use.

I'm saying that you choose not to sign up for or use Strike ever in any capacity since they combine KYC and corn. A huge no no.

I told my wife I'd workout every day for three months if she gives up sugar during that same time.

These are the casualties of that agreement...

For additional context. My wife works out almost daily but complains that she's not where she wants to be. And we both suspect it's due to a diet that isn't very optimized and includes lots of sweets...

I'm more of a long distance runner and cycler and have frequently been injured trying to lift. I'll focus on full range of motion and calisthenics to start...

Time to talk to Grok and get a workout plan nostr:nprofile1qqsdxerxjxa9k8teds0pkdpsmuq0uyvfajwzx2rh4h0p3j8k26h33uqpz3mhxue69uhhyetvv9ujuerpd46hxtnfduq36amnwvaz7tmwdaehgu3dwp6kytnhv4kxcmmjv3jhytnwv46qz8rhwden5te0dehhxarj9e3xjarrda5kuetj9eek7cmfv9kqx7rxew

Do people not realize that responding to spam can get you labelled as a feebleminded target who responds to spam?

Ie, I don't know if the filter is robust enough to determine in what manner you responded. It may only determine that you responded and then a list of those flagged numbers get passed around to other parties.

Been there... Really blows... Happened at a play area in a mall in Bangkok... So that's on top of paying to play. We ended up not participating... My wife got ticked off saying she'd be there supervising. And OH! You have to pay for a parent to enter, but it's required for a parent to supervise anyway...

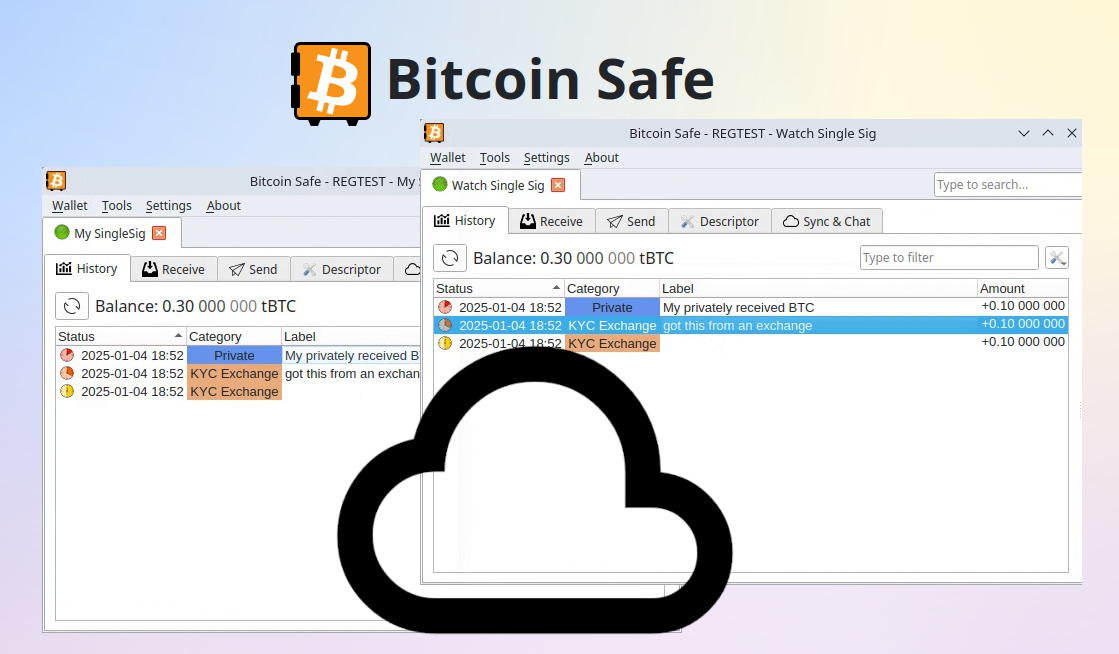

I tried signing up for strike... They asked for my personal information and I dipped. That's a hard no for something that handles Bitcoin...

I guess it's fine if you're using it for fiat only, if that's a thing...

Doing KYC for Bitcoin is just asking for trouble though

Why not just use bisq or robosats? I have guides on my blog expatriotic.me

And avoid Strike and it links your Bitcoin usage to your identity which seems unwise...

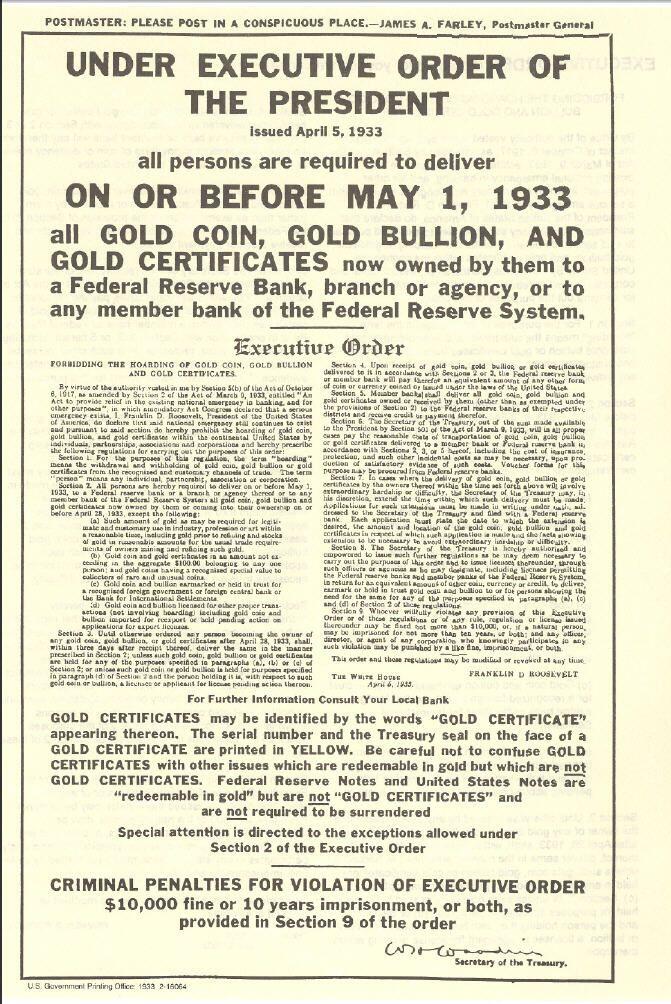

I don't want the government to know I own bitcoin... 90 something years ago April 5th an executive order went out demanding people surrender their gold.

Hard to say you don't have something when you've KYCed

Been playing with that setup too. I like it...

90+ years ago on this day the government seized everyone's gold at $22 an ounce... Then once they finished taking everyone's gold, they repriced gold to $35 an ounce. Effectively halving the purchasing power of the dollar overnight...

FDR was not a good man.

Beware a politician who's backed into a corner.

Very similar to Nixon in 1970 with the gold shock when he ended the controvertibility of dollars into gold for other nations... It was still $35 an ounce. 10 years ago it was $1200 an ounce. And today it's pushing $3000 an ounce for gold... SMH... All starting in 1933 when it became illegal to hold or own gold or use it as currency... Nothing could be allowed to compete with dollars... How else could they inflate them without competition or accountability?

Huh.. I'm not sure how that works... I thought like the edit is submitted and relays and clients can honor it or not. Eg if you used Amethyst you'd see my edits.

_Good Morning_ ☕ 📖 🌞

`Custodial Risk Principle`

- **Contract as Claim**: A contract representing an asset is a claim against its custodian, often termed as a security.

- **Value of Security**: The value is the underlying asset's value minus costs of exchange and enforcement.

- **Custodial Risk**: Central to any money system; reliability of the custodian limits money's usefulness.

- **State Money**: The state acts as the single custodian, with potential for default through reserve liquidation or fraud.

- **Bitcoin's Non-Custodial Nature**: Bitcoin's value is based on its trade utility; if no merchant accepts it, it's not useful. Merchants collectively act as custodians.

- **Merchant Role**: Merchants exchange their property for Bitcoin, not securitizing it. They can stop accepting Bitcoin, reducing its utility, but this isn't a default as there's no obligation.

- **Economy Size**: Bitcoin reduces custodial risk through the size of its economy, not through technology or contracts.

- **Blockchain and Custodial Risk**: Blockchain technology doesn't protect against custodial default; tokenized assets remain securities with inherent custodial risks.

- **Insecurity of Security**: Ironically, the "security" in traditional terms is the element that introduces insecurity due to custodial risk.

**Cryptoeconomics by [Erik Voskuil](https://github.com/evoskuil).**

*The book can be found on [GitHub](https://github.com/libbitcoin/libbitcoin-system/wiki/Cryptoeconomics).*

The rest of the summarized chapters are at https://expatriotic.me

I love that I can secure my nsec with my nostr:nprofile1qqsg8k9myvegcelvu2klzvrdh9lr7qnms57chkhjymgpcts09n4dutspzemhxue69uhkummnw3ezumtfd3hh2tnvdakz7qghwaehxw309aux6u3ww4ek2mn0wd68ytn0wfnj7qgmwaehxw309aex2mrp0yhx7unpdenk2urfd3kzuer9wchs3ct77k passport core

nostr:nprofile1qqs2vrneurk665gq6a2rke572y7mc8ppwr5wnd60mw8fwxharc8xsycpz4mhxue69uhkummnw3ezummcw3ezuer9wchsz9mhwden5te0wfjkccte9ehx7um5wghxyctwvshsz9thwden5te0wfjkccte9ejxzmt4wvhxjme0vl44wp would love to see this compared to sparrow in the Bitcoin Brief

I use it for work because the IT guy prefers it... Can't imagine using it for a personal machine...

Just download Mint or Ubuntu and you're good...

I like Fedora myself...

Using MacOS still but when this machine craps out I'm running Linux

Path was huge in Indonesia. I thought it got discontinued though