At the end of the Economics of Bitcoin panel at Cheatcode with Preston Pysh, nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a and nostr:npub1sfhflz2msx45rfzjyf5tyj0x35pv4qtq3hh4v2jf8nhrtl79cavsl2ymqt, I offered a book recommendations list that will 100x your economic understanding and appreciation of Bitcoin.

After the talk, 20+ people asked me to write it down, so here it is, all books available for free in pdf, epub, and audiobook:

## Theory and History

### by Ludwig von Mises

This is about the theoretical foundations of Praxeology, Mises explains methodological dualism and defines the axiom of action, from which economic science can be deduced. At first glance it seems dry to read, but the ideas and concepts are very juicy.

https://mises.org/library/book/theory-and-history-interpretation-social-and-economic-evolution

## Economic Science and the Austrian Method

### by Hans Hermann Hoppe

Hoppe's foundational masterwork using a synthetic apriori proposition to define the axiom of argumentation, the bedrock for the deduction of a reasonable ethics. For centuries it was not possible to "derive an ought from an is", and Hoppe triumphantly proves that in fact a private property society ought to be.

https://mises.org/library/book/economic-science-and-austrian-method

## Man, Economy and State, with Power and Markets

### by Murray Rothbard

This is Rothnard's magnum opus treatise, the one book you must read to understand everything there is in economic science. It is full of beautiful logic, compelling history, and a very entertaining prose, Rothbard is a master wordsmith. Power and Markets is a deep dive into hard core anarchist thought, demolishing the illusion of government authority, so radical it got cut from the original print.

https://mises.org/library/book/man-economy-and-state-power-and-market

## The Ethics of Money Production

### by Jörg Guido Hülsmann

A solid exploration of the economic and moral consequences of inflation, a fascinating history of monetary interventionism, with insights from numerous religious scholars. This book shined a spotlight on this most devilish trick which turns humanity into a pack of looters and demolished the production stages of a civilization. It's published the year before the Bitcoin whitepaper, even mentioning the difficulty of creating digital base money, and I bet my stack that Satoshi read this book as he was designing bitcoin.

https://mises.org/library/book/ethics-money-production

## Cryptoeconomics, Fundamental Principles of Bitcoin

### by Eric Voskuil

This is not only the single best book about Bitcoin, it is also a monumental achievement in praxeological thought among those of Mises and Hoppe, because Voskuil introduces the axiom of resistance. This is the missing puzzle piece to articulate an applicable strategy of security and defense, without which freedom tech like Bitcoin cannot be understood. Voskuil has accurate definitions and solid arguments that lead to a proper understanding of each aspect of Bitcoin.

Thanks I just ordered Eric Voskuil’s book on Amazon $30.

Smash buy as soon as you have spare cash

Another government enslaving its people to fiat. It’s going to make a fascinating A v B study in the future of countries that allowed v banned bitcoin.

Congratulations Peter, that’s an important achievement. U hope you’re starting to feel the positive effects of the bitcoin cheat code.

The biggest problem in the world today is how our money works.

And I don’t mean this in some abstract, “we should be nicer” or “we should give money to…” way either. I mean it in a direct & practical way:

• Money is printed arbitrarily whenever it is convenient for the counterfeit class.

• We have a money where the rules differ drastically based on your political position

• The combination of the two mean free market forces are meaningless, and there is zero restraining force on infinite govt spending.

If we don’t fix the money, we are heading for disaster. This isn’t an esoteric warning, it’s an obvious lesson of history that we have been taught 100 times over.

We f*ckd around… bad.

So we either fix the money or find out.

#Bitcoin https://v.nostr.build/lLRl7.mp4

I’m guessing we find out, it’s so tiresome and predictable.

🧠Quote(s) of the week:

‘When you understand Bitcoin there is no way back. You will look at the system in a whole new way. Your friends and family will think you’re crazy. Choose wisely.’

― Bitcoin for Freedom

"3 rules that are a cheat code for life:

1. Create value for others

2. Spend less than you earn

3. Save in Bitcoin"

― BTC Sessions

🧡Bitcoin news🧡

9th of April:

➡️Japanese firm Metaplanet buys ¥1B ($6.5M) of Bitcoin, mirroring MicroStrategy's strategy. The company's shares jumped 90% following the announcement.

11th of April:

➡️SEC to file lawsuit against defi crypto platform Uniswap - Reuters

This is why Satoshi disappeared and made Bitcoin impervious to government attacks.

12th of April:

➡️IMF demands El Salvador change its Bitcoin law in return for a $1.4 billion loan. (please read the part on the IMF below -> segment Macro/geopolitics.) How I read this statement, the IMF is annoyed at the mere existence of Bitcoin. Basically, they are saying: Sell your 'hard' money and get indebted to us.

➡️"The more energy Bitcoin mining uses, the more emissions it can reduce

35 midsized venting landfills running Bitcoin mining is all it takes for Bitcoin mining to be the

world's first emission-negative industry

Achieved organically, without subsidy, without purchasing offsets." - Daniel Batten

Could it be possible for Bitcoin to save the environment with its Proof-of-Work design and be the main player in the 'green' energy revolution?

13th of April:

➡️Paraguay Senate approves resolution to sell energy surplus to bitcoin miners, criticizes sale of energy to Brazil for 25% of what bitcoin mining generates, directs this energy to 20 new bitcoin mining companies instead. Remember Paraguay is a large hydroelectricity producer and Bitcoin could be the answer.

I am pretty sure that Bitcoin will be the primary engine of prosperity in the 21st century. Countries like El Salvador, and Paraguay but also several countries in Africa will lead the way.

14th of April:

➡️UFC lightweight Renato Moicano: "If you care about your country, read Ludwig Von Mises' 6 lessons of the Austrian Economic School motherf*ckers".

He also demanded his fight bonus in Bitcoin.

He is referring to, it’s a series of six lectures Mises gave in Argentina in 1958, later combined into a book: “Economic Policy: Thoughts for Today and Tomorrow”:

1. Capitalism

2. Socialism

3. Interventionism

4. Inflation

5. Foreign Investment

6. Policies and Ideas

Full read: https://cdn.mises.org/Economic%20Policy%20Thoughts%20for%20Today%20and%20Tomorrow_3.pdf

➡️The number of addresses holding more than 1 Bitcoin peaked in January 2024 at 1,024,484 and has fallen by 13,000 since.

15th of April:

➡️Norway became the first country in Europe to introduce regulations for data centers aimed at controlling which projects are permitted.

Cites emissions, and energy consumption control. They state Bitcoin mining “is an example of a type of business we do not want in Norway”

They are not going to ban mining. They want to force data centers to report to the government what kind of processes they are doing. Still bad though! Why, because it is misguided, ineffective, and futile. If electric cars = zero-emission... electric miners too. Are they going to ban or regulate EV cars too?

Clown policy that will backfire badly for a country already going through a currency crisis and for a failing continent, Europe.

Read the following thread by Daniel Batten.

https://twitter.com/DSBatten/status/1779859225809990116

Ergo: Politicians have no clue or are being paid to not understand things that benefit society/their people.

➡️Germany's biggest Federal bank LBBW to launch Bitcoin custody services to institutional customers.

Bitcoin ETF news:

"Weekly Bitcoin ETF Flows:

IBIT +7,000 BTC

FBTC + 1,300 BTC

GBTC -11,000 BTC

Net Flows - 1,100 BTC

In a week of GBTC Sales, CPI freak outs and War fears, Bitcoin holds 67K and has slight outflows."- Thomas Fahrer

On the 9th of April:

➡️The value of BlackRock’s Bitcoin holdings jumps to $18.9 Billion.

➡️Fidelity now holds 150K Bitcoin worth over $10 Billion.

On the 11th of April:

➡️Asia ETF's

- Hong Kong approving Bitcoin ETFs

- South Korea will approve Bitcoin ETFs

- Chinese fund managers launching Bitcoin ETFs

US Bitcoin ETFs pushed the price from $38K to $73K.

South Korea's pro-Bitcoin Democratic Party has won the national election to form a government. More than 6 million South Koreans — over 10% of the population own Bitcoin or crypto.

DP: "We're going to allow the ETFs, domestic or overseas."

➡️GBTC sees the smallest outflow since the launch of the Bitcoin ETFs with just $17.5 million leaving the fund on the 11th of April.

15th of April:

➡️Hong Kong just approved the first batch of Bitcoin ETFs

➡️"Since launching on Jan 10, U.S. ETFs, even including all GBTC sales, have amassed 222,000 Bitcoin in just 65 trading days—that's 3,415 BTC daily!

Now Hong Kong ETFs join the game, just as the weak hands have folded and miners have half as much to sell." - Thomas Fahrer

💸Traditional Finance / Macro:

👉🏽 'BlackRock is eating the world: Hits record $10.5tn in assets under management in Q1 2024, +15% YoY, boosted by $57bn of total net inflows to its investment products.'

👉🏽Here's a crazy stat that no one will believe.

The universal investment benchmark is the 60/40 portfolio of stocks and bonds.

What if you replaced the bonds entirely with gold....crazy right?

Turns out it makes no real difference.

(picture 2)

Now wait till they do Bitcoin.

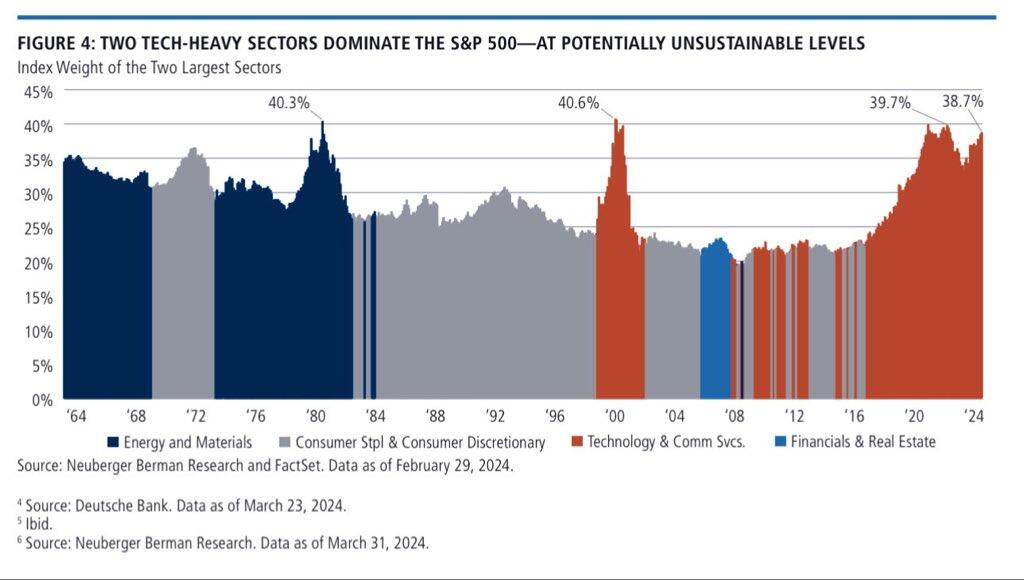

👉🏽This time is different:

(picture 3)

🏦Banks:

👉🏽no news

🌎Macro/Geopolitics:

On the 9th of April:

👉🏽"The EU must find ‘enormous amount’ of money to face global challenges, says former ECB chief Mario Draghi."

Money Printer go brrrr to infinity…because 'Whatever it takes' - Draghi

How?

Confiscate

Tax(visible)

Tax (hidden)

Government “Innovation”.

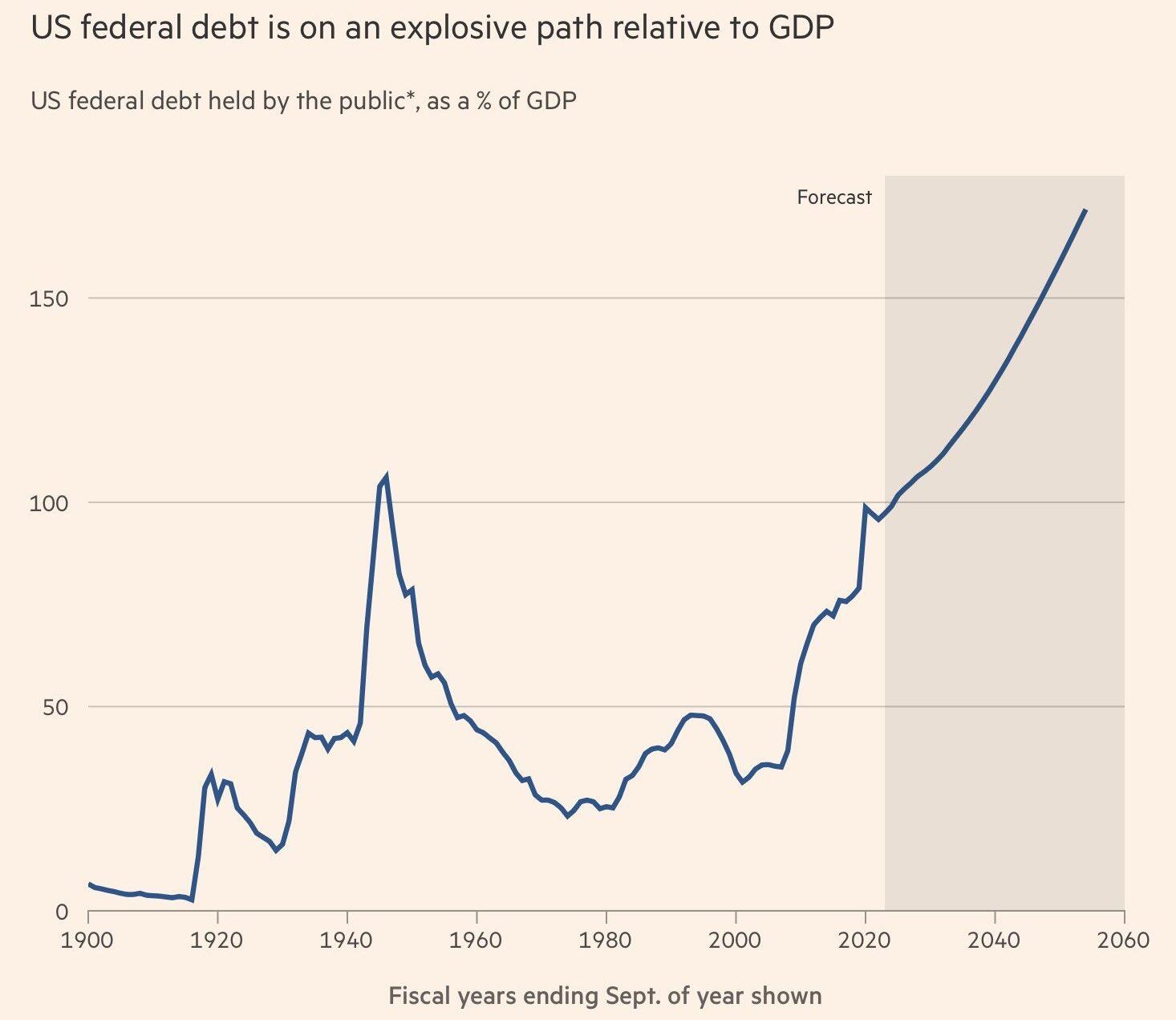

👉🏽Constant QE or default are the only ways out. And financial repression is the default, just in slow motion.

(See picture 4)

'This assumes no recessions or geopolitical events for the next few decades.

Japanese-style financial repression is the only way out of this mess. Or what other viable options are there?'

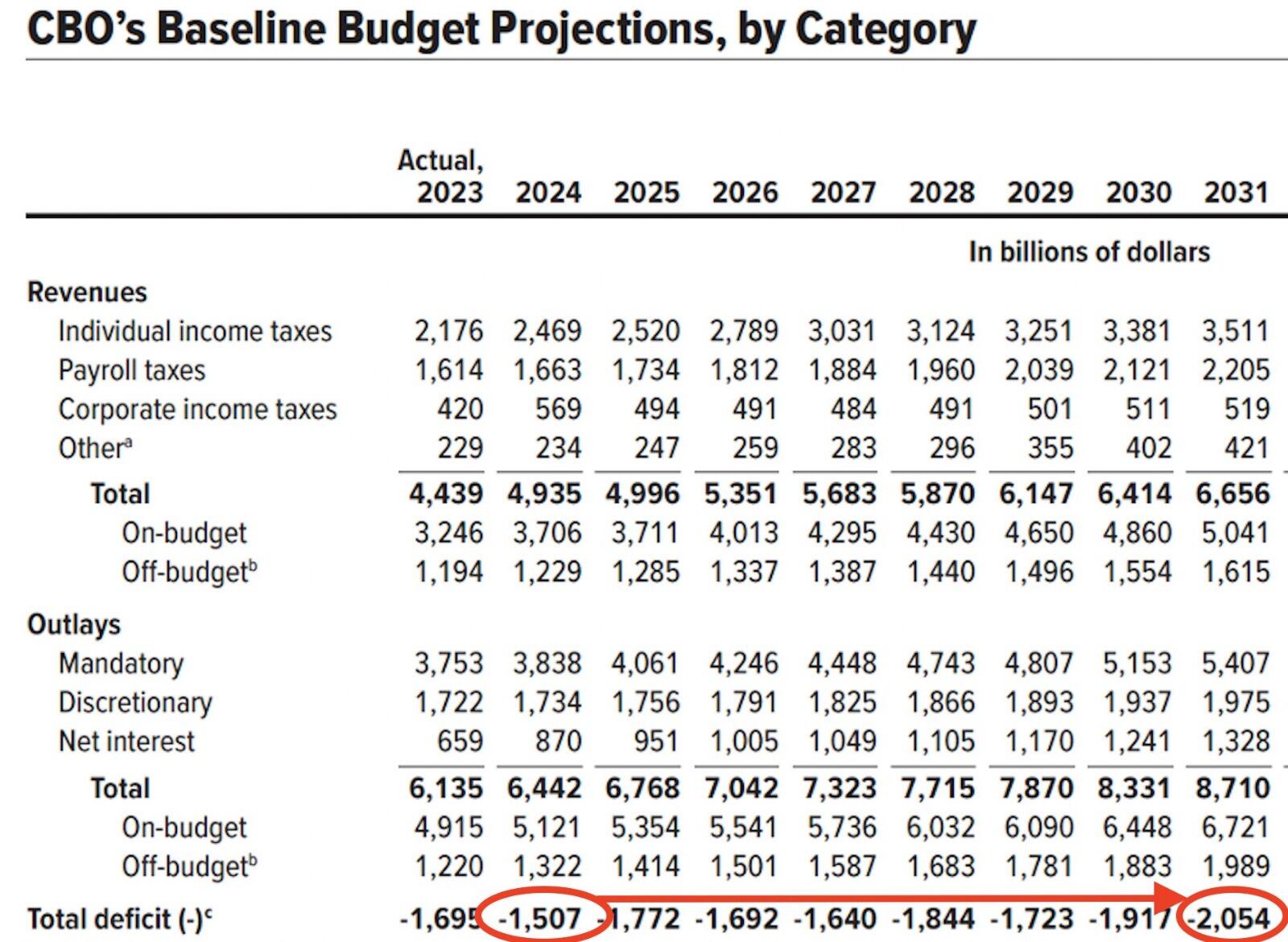

👉🏽"The federal budget deficit totaled $1.1 trillion in the first half of fiscal year 2024, CBO estimates"

'And yet, just over a month ago, the same CBO released their report projecting a $1.5T deficit for the entire year. At this rate, the deficit will be $2.2T, a 47% overshoot and even higher than the projected deficit in 2031.' - James Lavish

The US spending is out of control and it's getting worse at an exponential rate. Within one month, they (CBO) posted a 47% overshoot on the largest budget in world history.

The whole US budget, but also here in Europe, implodes around 2030 - 2035 at the latest. A new system will rise...the only question you need to ask yourself will it be Bitcoin or CBCD's? (Picture 5)

On the 10th of April:

👉🏽March CPI inflation rate UP to 3.5%

- Above expectations of 3.4%.

- Cor inflation is 3.8%, also higher than expected rate of 3.7%.

3 straight years with inflation over 3%

They said "Inflation is transitory"

'Inflation has not fallen in a single month since Biden's term began (the closest was July 2022 when it was unchanged), which leaves overall prices up over 19% since Bodenomics was unleashed. And prices have never been higher.'- Zerohedge

This means that overall prices are up a whopping 19% in less than 4 years.

We have not had a year-over-year inflation print below 3% in 36 consecutive months.

Furthermore, inflation has been above the Fed's 2% target for 37 straight months.

Inflation is now building on previous years of inflation; we effectively have compounding inflation. Everyone should be asking for a 20% raise.

👉🏽For the less informed.

Price inflation at every fast food restaurant in the US has far exceeded CPI inflation since 2014.

Prices at McDonald's have DOUBLED since 2014 while official inflation data shows just 31% inflation.

Prices at Popeyes, Taco Bell, and Chipotle have risen by 86%, 81%, and 75%, respectively.

Traditionally, fast food was considered to be a "cheap" food option.

The CPI is a lie it’s manipulated to be lower than real inflation.

👉🏽On the same day, the US 10-year Treasuries had their worst day since May 2023, with yields surging after the one-two punch of a hot CPI and a bad auction. Peter Boockvar: "10-year auction was bad...Dealers were left with 24% of the auction, which is the most since Nov. 2022."

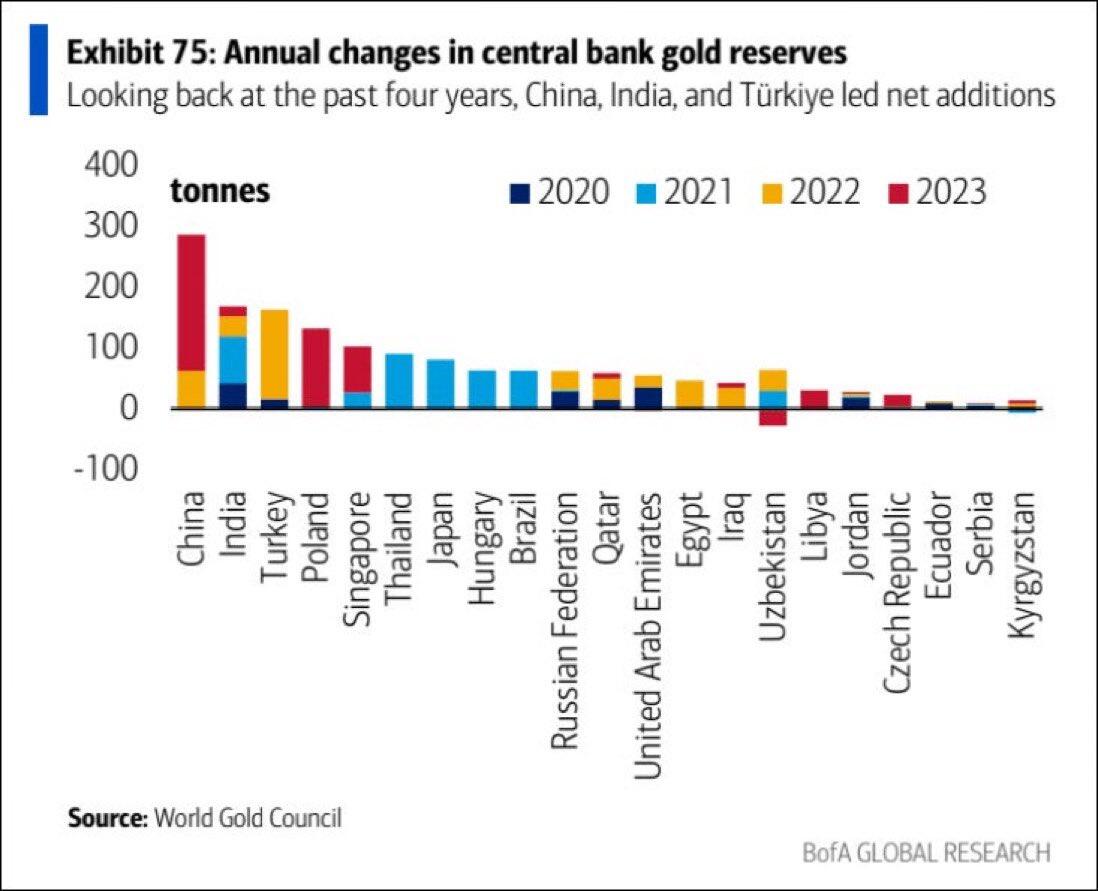

👉🏽China has been buying more gold than any other nation since 2020, with India in second place.

Can we call this DeDollarization?

(picture 6)

More on China...

👉🏽"Following Moody's in December, Fitch Ratings revised the China debt outlook to negative from stable.

China's pace of debt accumulation is very problematic. Public debt has more than doubled since the Great Financial Crisis and is heading to above 100% of GDP.

More importantly, total debt has ballooned from 133% in 2008 to 272%(!) in 2022. It will have risen again in 2023.

The current 10-year Chinese bond yield is at 2.29%, which is extremely low for a country that expects to grow by 5% annually. Coincidence? Of course not! China has the same debt sustainability issues as every other major economy, and rating agencies must act." - Jeroen Blokland

On the 11th of April:

👉🏽IMF Prepares Financial Revolution – Say Goodbye To The Dollar

https://www.zerohedge.com/markets/imf-prepares-financial-revolution-say-goodbye-dollar

The only thing I can say on this is:

- I am not surprised

- Please reject CBDCs with everything you have. The centralization of digital currencies will never work!

- The IMF is not elected!

Anyway, no need to panic whatsoever. The IMF probably goes before the dollar. The dollar is and will be the number one (fiat) currency of the world.

On the 12th of April:

👉🏽"Another strange sign that someone knows something:

Gold is up ~20% over the last 5 months and has doubled the S&P 500's return.

Meanwhile, bonds are down nearly 9% as interest rate cuts are priced out.

Historically speaking, gold and bonds have almost always traded together.

There is now a ~30% GAP between the performance of gold and bonds, one of the 5-month divergences largest on record.

Gold is completely ignoring the fact that higher interest rates are here to stay while bonds are getting crushed." - TKL

Central banks /countries are selling their debt portfolios and buying gold. That would be my take. The financialization of everything era is over.

On the 15th of April:

👉🏽'The US credit card delinquency rates are now at their highest on record, according to the Philadelphia Fed.

In Q4 2023, more credit card balances were 30+ and 60+ days past due compared to any other period in history.

The percentage of credit card balances at least 30 days past due is now ~3.5%.

Meanwhile, total credit card debt has skyrocketed in recent months and is now at a record $1.3 trillion.

The average credit card interest rate is also at a record 28%, according to Forbes.' - TKL

🎁If you have made it this far I would like to give you a little gift:

Warmaking has become increasingly unlimited in the fiat age, as financing has moved away from war taxes and war bonds and towards quiet borrowing

This is a very well-documented essay and thread with data and statistic by nostr:npub1trr5r2nrpsk6xkjk5a7p6pfcryyt6yzsflwjmz6r7uj7lfkjxxtq78hdpu :

https://bitcoinmagazine.com/culture/how-the-fed-hides-costs-of-war

Book tip: Read The Creature from Jekyll Island.

Extra gift!🎁

Your wealth is melting—the first report by Joe Burnett is 37 pages exploring how humanity's relationship with wealth has changed after the discovery of Bitcoin.

https://8198895.fs1.hubspotusercontent-na1.net/hubfs/8198895/PDFs/Your%20wealth%20is%20melting-1.pdf

nostr:npub1z5ds93lv6uky7n4676txw7aqp9qdcyhs00qdsmy96s4k6qd8rvaqnzmqhw

Only invest in Bitcoin what you can’t afford to have gradually stolen from you by the government.

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats.

#zap 🧡 #weeklyrecap #nostr

#plebchain

#BTC

#Bitcoin

#zap🧡

#plebchain

#grownostr

#stacksats

#bitcoineducation

#adoption

Oh man I was feeling a bit down today but all of that made me realize how lucky I am to be amongst Bitcoiners. Thanks so much.

Sweet glad to see Norway banning themselves from Bitcoin, I’ve always wanted a cheap Fiord

Beautiful to see and to know I’m part of it with a stack of like minded plebs

At least the pressure is blown off quick

Imagine wanting to sell or being forced to sell, less than a week out

Stacked Sats, took them from the weak and over leveraged and sent to storage where they won’t see the light of day for a long time

Saddening it has to be a disaster for so many innocents.

Thanks for cheap Sats just 6 days before the halving.

I’d rather have a car from the 70s

Bitcoin is up 1230% over the last 5 years, has any 401k done that?

Why in bitcoin code is “if halving>=64 return 0” when there is only 32 halvings?