Kind of a morning person, can't sleep longer than 10 am no matter how late I go to sleep. Could adjust to earlier but gf is an evening person so I'm adjusted to her rhythm.

But trying to wake up early just for the sake of it is useless imho, unless you can leverage it (quiet hours with no family distractions for example). It's the same amount of waking hours you have regardless of when you get your 8 hours of sleep. And cutting sleep to wake up early is just dumb, it's not sustainable and leads to worse performance during the day.

Yeah, I LOVE well matured gouda, 3 years or more. Can't tolerate milk in regular quantities but luckily I can tolerate a bit of gouda at least without autoimmune symptoms. It's a special treat for me.

I'm biased, you liked number 3 the most? :D

Never had significant cravings for veggies, just a minor one for cauliflower fried in butter on a pan. Would eat it actually if I didn't get autoimmune symptoms from it.

If you need more volatility you should move to Microstrategy 😂

Currently reading Sovereign Individual – what an excellent book! The logic of violence and its game theory on different scales especially is a theme I've been pondering lately, and to which I'm getting some answers from this book.

Like why do large nation states with a lot of unconsensual transactions exist when praxeologically speaking prosperity is created with consensual trade.

The book suggests that it is because of the gun powder revolution which increased the returns on effectiveness of violence – the bigger you are, the easier you can overpower others. And these governments can survive and get away with unconsensual transactions because the other option would be to be completely oppressed by an even worse group and worse taxes. They can't tax it all, however, you have to allow some consensual transactions within a jurisdiction, otherwise they risk the parasite draining its host completely. This is why governments still have to allow some sort of market economy so that there's gonna be something to tax at all. But when capital was tied to physical places, they could abuse it because there couldn't be competition for governments. "Tyranny of the place", as it's called in the book.

However, the game theory of violence is going to shift dramatically with capital moving to cyberspace. Cryptography and private/public key technologies (bitcoin, NOSTR, etc.) create defenses that cannot be broken by increasing effectiveness and which cannot be monopolized by governments – now governments will start to have to actually provide value and a service to keep citizens, otherwise they'll leave with their capital.

"Just vote harder."

People looked so good a century ago.

I wonder what happened to our food.

https://video.nostr.build/3082b90814cdd085ca83ccc83b114c3a9f2332c02259a9c15d82e5f7edb23248.mp4

We started using machine lubricant as food.

When I still could eat pizza, pineapple + ham was a great combo. Don't care what others think, I liked it.

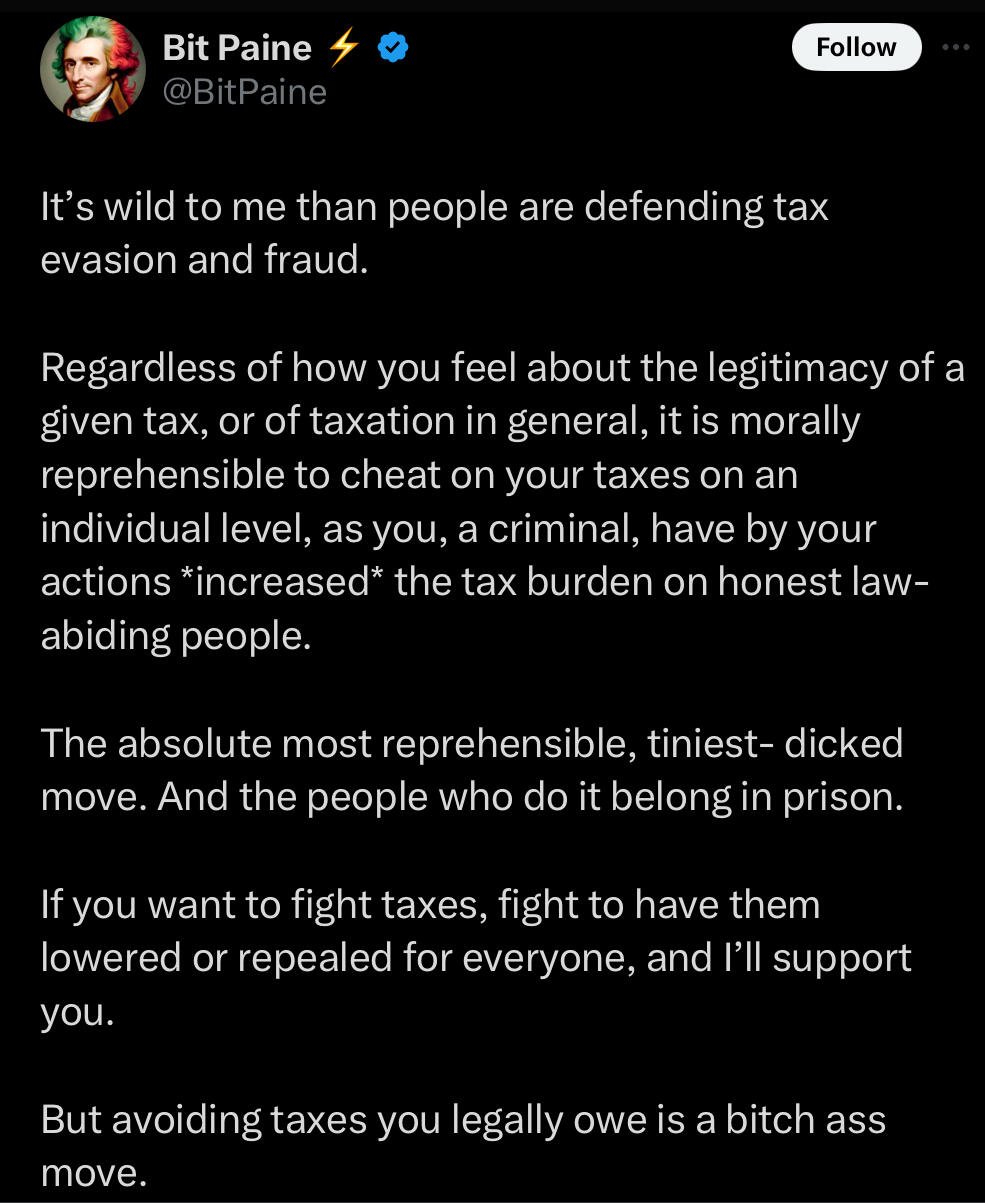

Haha, let's be criminals.

I'll take it.

Meanwhile the French MSM media: "Bitcoin #halving means #Bitcoin value will be divided by 2 in April." The reason for the halving is to "stimulate demand."

https://video.nostr.build/9cc4418b1bae91aec23d2ed19d09347501d4538186197dd41281142c741ca94d.mp4

BFM BUSINESS

They are so brainwashed by keynesian propaganda that they can't even understand that the money supply is getting scarcer in bitcoin 😂

Receipts? Does that mean shorting?

It's not normal to get weary and achy in our 50s, or even 60s or 70s – it's the food that's doing it.

This "passing" has taken 15 years already, so I guess it's about time 😄

What do you think about these guys thesis? They argue that MSTR isn't really a BTC derivative, thus it'll be valued different than by NAV. And if it gets added to S&P MSTR will get buying pressure which is indefferent about its NAV. It's high risk for sure, but I think there's a compelling case why it could go much higher due to these financial dynamics and not being an ETF but a running business with cash flow. 2021 top was 6x to NAV, so it has happened before already.

But yeah, MSTR is just few percentage speculation for me. Only thing I'm speculating atm – everything else in BTC – because in my estimation there's a good risk/reward ratio to outperform BTC – especially in a bullmarket.

EVERY SINGLE PERSON ON THE PLANET https://video.nostr.build/3d56d12ea093cb65964b27246604e5c4fcb2e969324566b96ed261b5ace7f27c.mp4

Nice, this is a good one.

I don't know if Saylor thinks this way, but I like to distinguish between money and currency so that currency has an issuer and money does not. So in that framework he would be correct to not call it a currency.

Becoming scarcity and demand are never priced in until the reality kicks in.