There are those who say Bitcoin doesn't scale, and build blockchains with more throughput at the cost of more centralization (generally in the form of it being way harder to run a node), and then also point to Bitcoin as having low fees as a criticism.

The limiter it turns out, 16 years in, is not how many people *can* self-custody bitcoin. It's how many people *want* to.

Not everyone wants to deal with the technicalities of their own car, and not everyone wants to handle the technicalities of their own money. Quite few, in fact. It's always a subset for these types of things. People who are hardcore over their area of knowledge.

I leave my car details to pros down the street who I know the name of, and handle my money myself. There are those who handle their own cars but leave their money details to others.

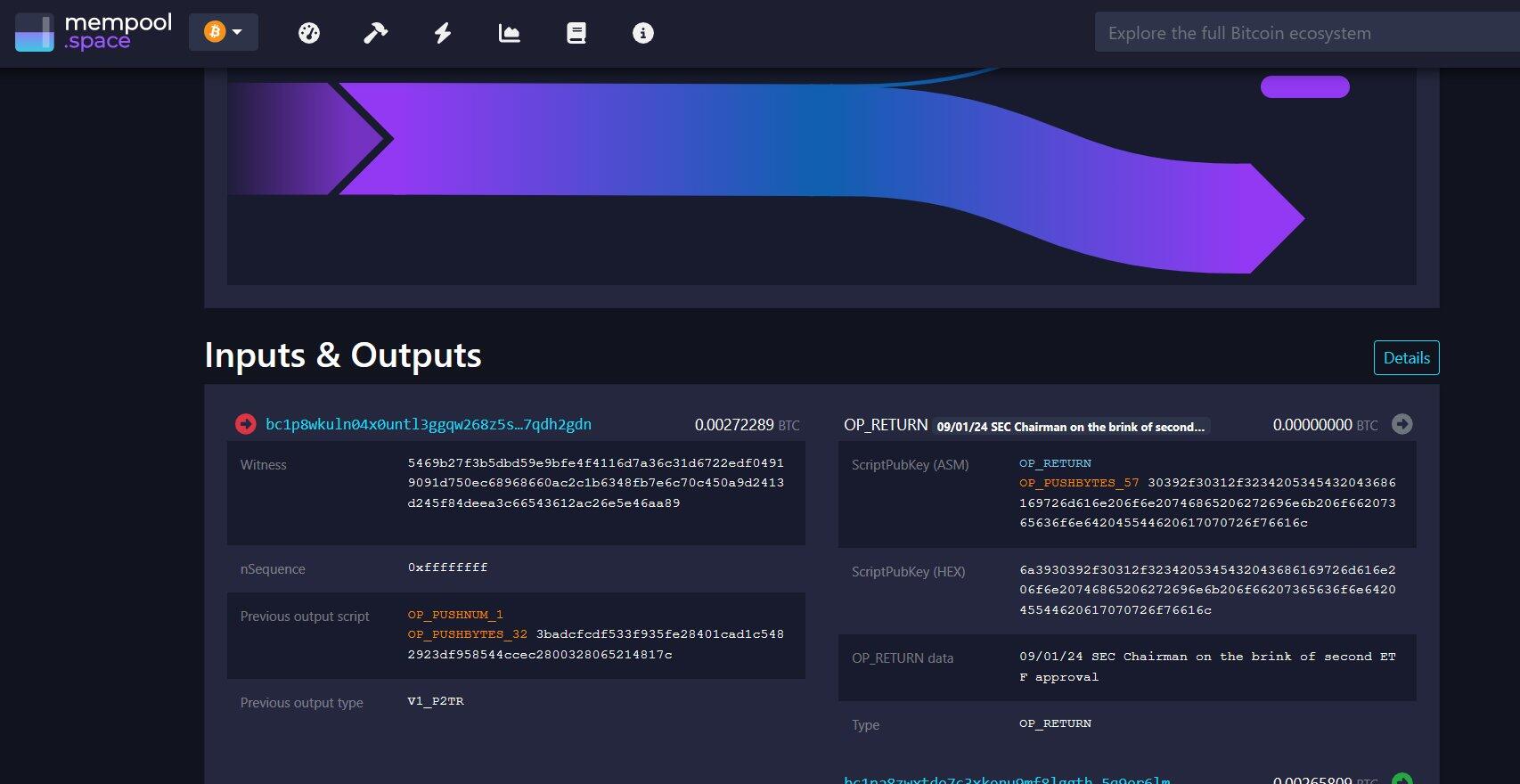

Bitcoin currently processes about as many transactions per year as Fedwire, which handles $1 quadrillion worth of gross settlement volume per year for the US and for a good chunk of the world (in context, it's approximately 200 million $5 million average-sized transactions). That's actually a crazy stat. Bitcoin is casually this open-source global Fedwire with its own scarce units, and unlike Fedwire anyone can permissionlessly build on it or transact with it, for low fees despite it being a +$2T network. And if it gets clogged there are all sorts of permissionless layers above it with certain trade-offs.

Some people say paper bitcoin holders detract from the network. I say the opposite- their willingness to hold IOUs helps add to price stability and network size without clogging it. That leaves more room for cypherpunks to develop with, and work on. And those who finance them.

This has been foreseen as early as Hal Finney in 2010, when he wrote about bitcoin banks (https://bitcointalk.org/index.php?topic=2500.msg34211#msg34211).

We live in a sweet spot by most metrics. A golden age. Historically, so few recognize it when they have it so good.

Bitcoin is big enough to be of interest to many, and yet is still niche enough in a global context to have low base-layer fees. Suitcoiners are happy to add to its scale, and yet cypherpunks can also build, and users can transact right on the base layer, and move to Lightning and Ark and BitVM and Liquid and any sort of trade-off they want if fees get high.

And you're bearish, anon?

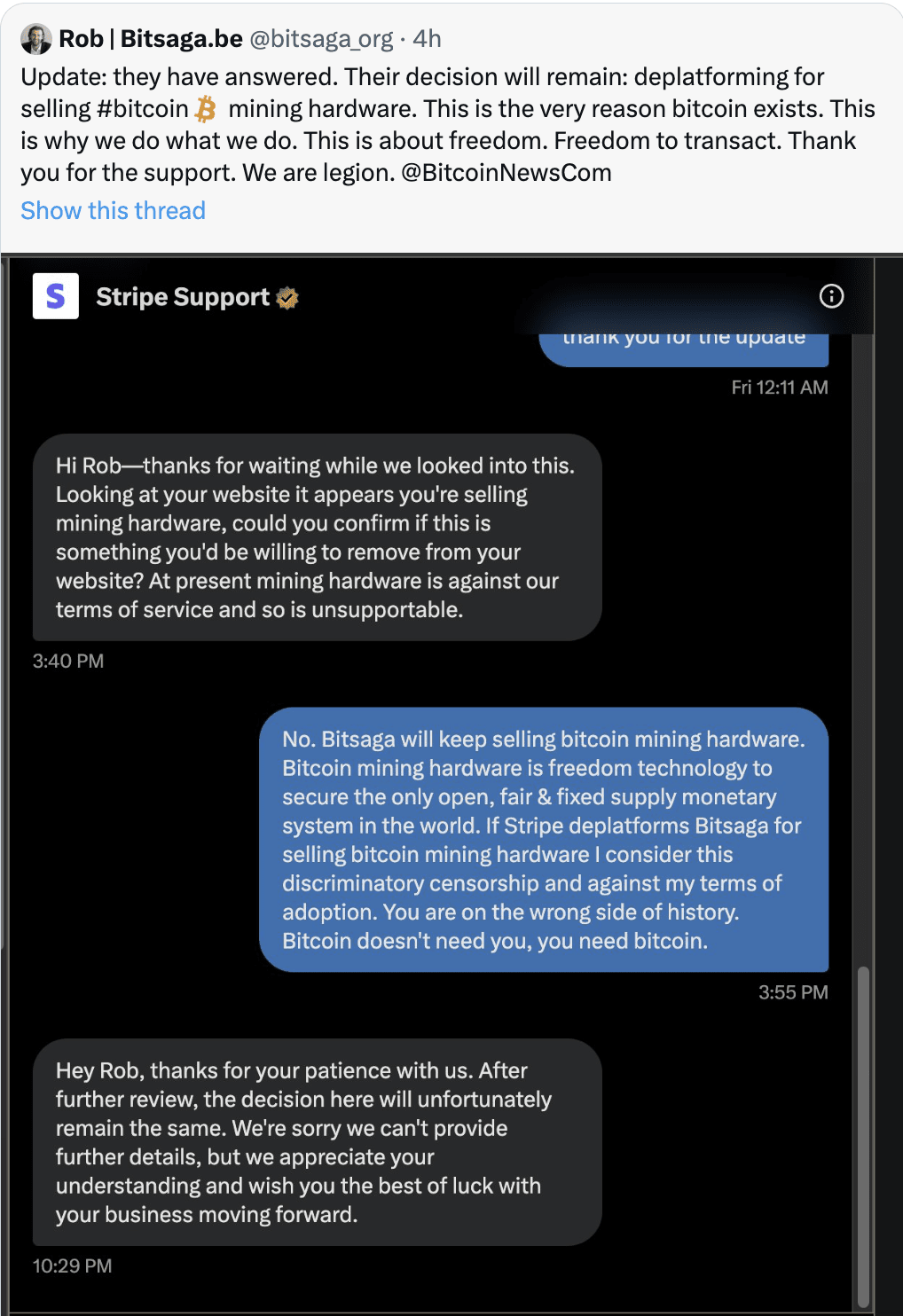

The real battle, though, is the ongoing government crackdown on privacy.

Bitcoin itself is in a pretty good technical place. It's a great tool. Certain conservative low-risk covenants might make it better, but even the existing design space is great and still expanding.

The US, Europe, and China cracking down on privacy is the threat. The headwind. And they're all expected. They're not surprising, but they're indeed fierce. That's the real battle- for the hearts and minds of people to embrace why privacy and permissionlessness are good traits.

In this ongoing funny contrast between podcasters and developers, that's the ideal role of podcasters- to spread the good news of what developers have built. To educate people. To tell them what's now possible thanks to developers. To articulate why cypherpunk values are good to a broad non-technical audience. That's where the overlap is. In overly-simplistic D&D terms, those with high CHA try to spread the work of those with high INT. It's not so much that "governments" are the problem. Governments often at least partially represent the people. If you convince a lot of people that privacy and sound money are good things, then you defang the problem. And you also challenge them legally in jurisdictions where it makes sense.

The technical foundation is good. The development of the past 16 years has been amazing, and it has brought us here. The scale has reached institutions, which is expected, not a threat. The actual threat is not treasury companies; it's anti-privacy regulations by governments. And more deeply that's a social issue, given how many people accept it. A vast amount of people believe privacy is only important for bad people who have something to hide. There's a ton of education work to do on it. Privacy is good. It's the default. But most people don't realize it when it comes to money.

We're winning. For 16 years ya'll have been amazing. But we'll need another 16 years more. More developers. More podcasters. All of it. We're a $2 trillion in market cap entering into a global fiat network of hundreds of trillions. And as their own institutions melt down from their own failures, their own top-heavy demographics and false promises, they will look for scapegoats. They will look toward those who are winning, and say they are the enemy.

When interviewers ask my price predictions, I tend to be conservative. That's mostly a liquidity assessment, and a rotation from OGs to new buyers. Price growth does take time.

But under that surface, I also have the benefit of being a general partner at among the largest bitcoin-only venture funds. I see what people are building, and I'm bullish. And for those who are working on stuff that doesn't align with profit, entities like the HRF and OpenSats are doing great work. Across all of the options, people are building great things.

I couldn't be more bullish on the ecosystem that's in place. All of you.

Let's go.

Good evening.

Lyn you seem to see things so clearly. We are lucky to have you.

Privacy tools like JAM,Wasabie etc and where other options are available. Thanks.

A thought In response to another great message from #jeffbooth: How do plebs ensure the network does stay secure? You can make the obvious steps like run your own node, mine BTC and educate others, this helps. But bigger picture how do you prevent KYC and perhaps more importantly miner centralisation as they coalesce into large publicy traded entities?

I’m writing this because I keep getting asked to comment on Saylor/Saif video even though my position hasn’t changed.

The natural state of the free market is deflation which means all prices fall forever in Bitcoin (assuming it stays decentralized and secure)

Free market economies are more productive meaning faster deflation (or real wealth gains by falling prices)

That system is incompatible with an inflationary monetary system meaning one of those systems must fail.

Either:

1) A system based on truth, hope, and abundance for all 8 billion people on the planet driven by a free market economy and all prices fall relative to bitcoin forever. This means Bitcoin is used as a medium of exchange and freedom tech spreads to the world through lightning, Liquid, Fedimint, Cashu, etc.

OR

2) A control system. An extractive rent seeking system that is NOT the free market (similar to the one we have had for 5000 years that resets every 100 or so years through war) continues to centralize by having you believe price of bitcoin is going up in fiat which makes the surveillance state stronger. This eventually centralizes Bitcoin - custodians, media, regulation (funded from the same manipulation of money) where it is attacked from layer 2. (Similar to gold)

While these ideas may “seem” compatible in the short term because you want Bitcoin to go up in fiat. What it really means is that you are giving your energy and strength to the system centralizing the world by converting Bitcoin to Fiat….to then measure prices.

Quite simply - If Bitcoin is only a store of value, it fails as a store of value.

Ps - It won’t fail. #1 is inevitable in time because too many (and more each day) have seen behind the curtain and are determined to build path #1.

Many of you here - the people that inspire me every day. You make a difference with every word, thought and action.

Almost did that in all caps per nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx because it’s so important.

Referring to # 1 above…..There is no second best.

Thanks. Well put. How do plebs ensure the network does stay secure? Run your own node, mine BTC and educate others will help. But bigger picture how do you prevent KYC and miner centralisation as they coalesce into large public ally traded entities?

Announcing $1.3m pre-seed investment from nostr:npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m and

Asymmetric VC in SimpleX Chat 🚀

Also SimpleX Chat v6.0 stable is now released with the new user experience and private message routing – details in the post.

Fantastic. Well done all.

Would like to share but wish to DM in a private way, perhaps on SimpleX?

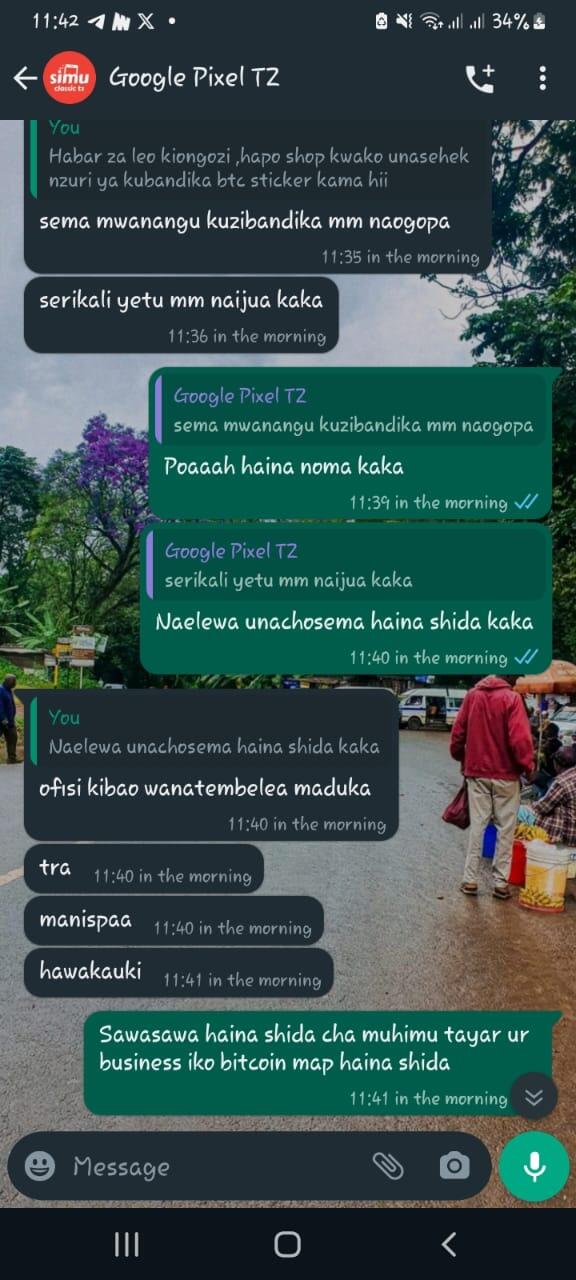

From restaurants to retail stores, find merchants near you who accept Bitcoin payments using nostr:npub1864jglrrhv6alguwql9pqtmd5296nww5dpcewapmmcazk8vq4mks0tt2tq.

nostr:npub1jan3xfrvxmd35smylytmnp3ne0sgqh2x47yq766s55zaf6eja4rselx52y CBO nostr:npub1anr0rh50qtcljgavps72dmyz76thgcv0y9txew03uq303vekqmrsly3qjz explains.

Love watching the numbers and places grow...

Well done. Karma will come for that guy.

Building and testing Primal for StartOS

nostr:npub12vkcxr0luzwp8e673v29eqjhrr7p9vqq8asav85swaepclllj09sylpugg nostr:npub126ntw5mnermmj0znhjhgdk8lh2af72sm8qfzq48umdlnhaj9kuns3le9ll #RunningPrimal

nostr:npub12vkcxr0luzwp8e673v29eqjhrr7p9vqq8asav85swaepclllj09sylpugg nostr:npub126ntw5mnermmj0znhjhgdk8lh2af72sm8qfzq48umdlnhaj9kuns3le9ll #RunningPrimal

Great News! Love StartOS.

Your a genius. That made me chuckle.