9:90 is beautiful

Thank you

I understand

Please put underneath my Christmas tree this year 12,562 Whatsminers M53S+'s

and also 2 metric tonnes of Uranium-235

Please and thank you 💜

Classic drunk post. Good times then

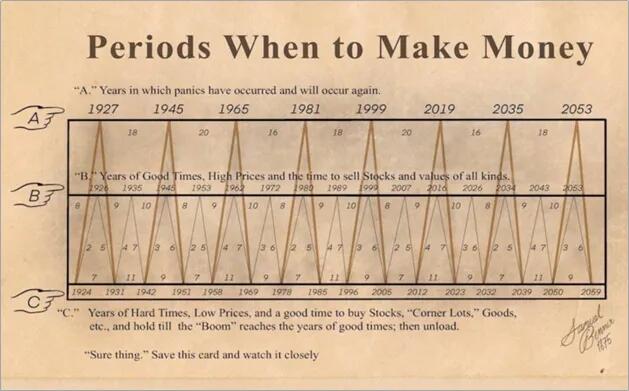

Classic chart; seen it for years

Nots not perfect but its a close enough gauge to be in the ballpark

USA govt. forking Bitcoin, saying its new version of Bitcoin is for store of value, not P2P electronic cash

I've been thinking about writing a paper on this

Think I did too. Had to search for them and see if they even exist still.

Sent in a ticket over a week ago and no response.

That’s what I was thinking if people are into it

Hoping I can use something like nostr:npub1l2vyh47mk2p0qlsku7hg0vn29faehy9hy34ygaclpn66ukqp3afqutajft ‘s honeypot wallet as a plugin to my app so I can generate cashu tokens and then embed the token into memes as a service on Gifbuddy 🤞

I’m pretty sure we can even lock the token to an npub so you can post memes with tokens to be redeemed by specific people; almost like tipping on their profile, but more fun because it’s a meme and can be shared anywhere

Could reference everyone's LUD-16 too. If no lightning@address then can lock to their npub

Truly shocked how many people are scared to buy/sell sats in person.

What are you so afraid of? You're around friends and you're "scared" to P2P? Guess you don't see them as friends.

NGMI

Thanks for your dedicstion & the time & effort 💪

Now that nostr:npub1getal6ykt05fsz5nqu4uld09nfj3y3qxmv8crys4aeut53unfvlqr80nfm NWC no longer works, what is a comparable wallet that can be used to zap people so that zaps are visible to others?

I've tried sending sats to ln invoice nostr:npub1sn0rtcjcf543gj4wsg7fa59s700d5ztys5ctj0g69g2x6802npjqhjjtws generates as well as nostr:npub1yzvxlwp7wawed5vgefwfmugvumtp8c8t0etk3g8sky4n0ndvyxesnxrf8q wallet (great app btw), but these zaps don't show on other clients ;(

For more technical folks

nostr:nprofile1qqszrqlfgavys8g0zf8mmy79dn92ghn723wwawx49py0nqjn7jtmjagpz4mhxue69uhkummnw3ezummcw3ezuer9wchszyrhwden5te0dehhxarj9ekk7mf0qy88wumn8ghj7mn0wvhxcmmv9uynmh4h's Brick wallet, running as the frontend to his Bankify backend

👉Brick wallet -web UI for NWC https://github.com/supertestnet/brick-wallet

👉Bankify - turn any Cashu mint into Lightning wallet with NWC support

No, been here since the first epoch

In all seriousness;

I'm being extreme on the bullishness. My real vision is we don't go through ~$300k this cycle, and we see ~$70k again (its how the three year waves go from fresh ATH, to new "depressing low" [like your example above])

We'll see ~$70k in '26, maybe even #58KGang (one can only hope)

Will be happy if wrong

I for sure hope I am so so dead wrong

But a bulltard is always right, eventually

No, but that is def guaranteed tech too.

I'm thinking moreso semiconductor manufacturing will be cheaper than ammo manufacturing, therefore using semiconductor components as the ammo itself

You can easily overvolt a capacitor and have it "shoot" out a barrel with a lot of force

I agree with this. As long as you dump whatever you just received into sats, idc how you get paid

Extreme examplr; I'm not a fan but I respect the shitcoin traders whose sole goal is to short the shitcoin and pump the Bitcoin

I honestly thought many folks are self-employed entrepreneurs demanding Bitcoin exclusively for their work. I was sadly mistaken. That list is extremely small I'm now realizing

GN💜

To my knowledge still, yes. Would need to confirm. Don't see why he would leave being such a pivotal member of the team💜

Interesting thanks for sharing

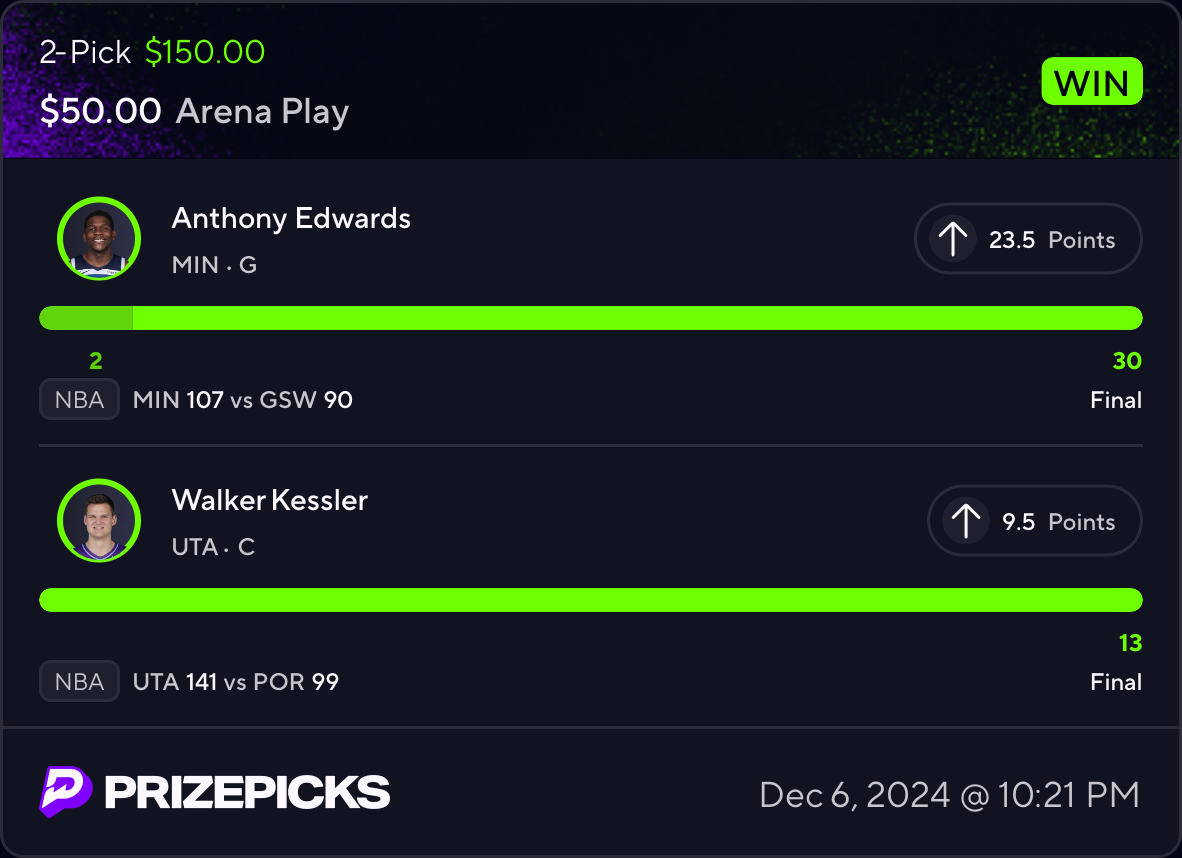

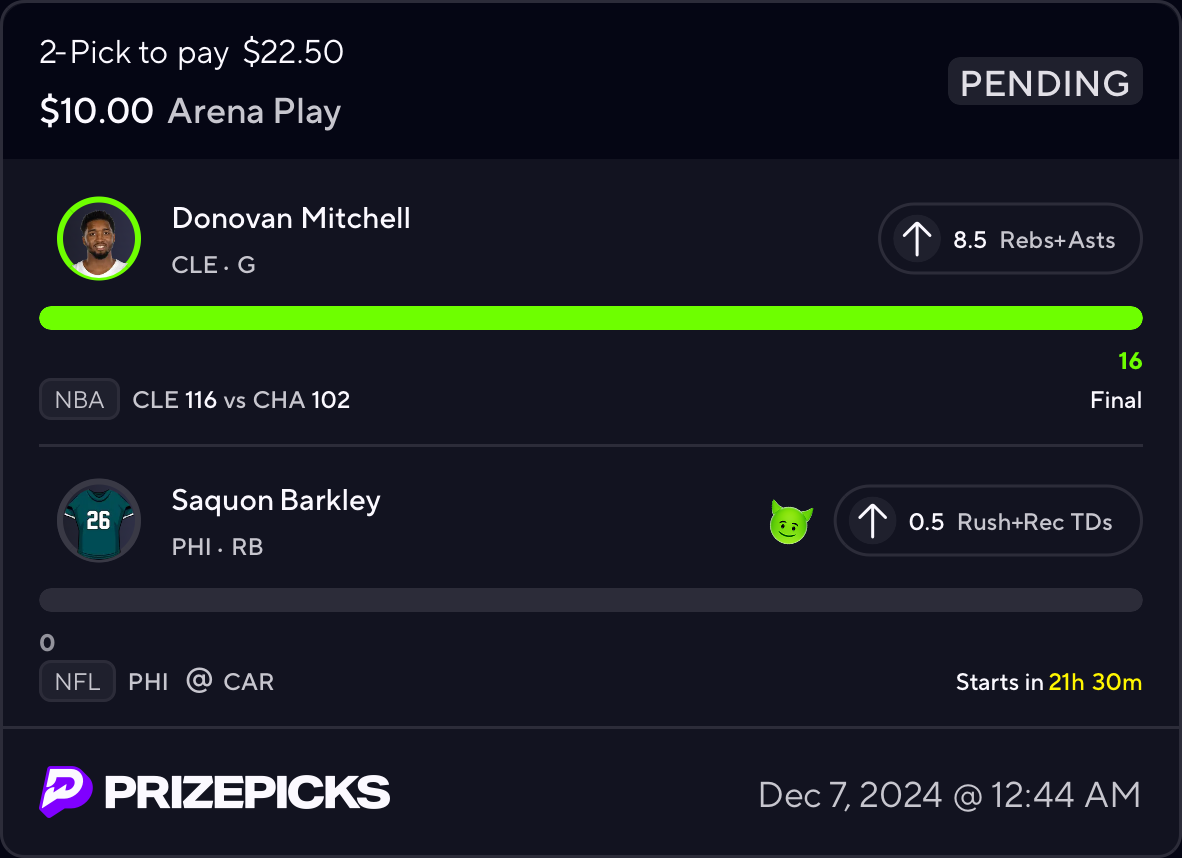

I don't place bets (I'm tempted to though)

I do watch quite a lot of basketball, but not enough to tell you what (for example) Ant's BPM are over the past 5 games

I've made more purchasing power by sitting on my hands than actually trying to generate returns

Please disappear when you have the means to

Your Ego cannot stand the gains that you generated.