This is brutal to watch. Holy shit

https://video.twimg.com/ext_tw_video/1846678546648907776/pu/vid/avc1/1280x720/v7gS3rX68zkFSu_e.mp4

I'm guessing "You know what I'm talking about." will become her meaningless version of "C'mon, man!" when she gets stuck. I don't think I could handle 4 years of that.

so, date/time stamps are just inherently unreliable... that hadn't occurred to me, but it makes sense... good tip!

I think it all boils down to the well-intended but naive socialist impulse that it would be an inherently good thing for a society to enforce material 'equality'... they just don't seem to see the word 'force' is hidden right there in plain sight.

Furthermore, if you can't inspect the code, even being able to change the server would be no assurance of privacy, either.

Amen! I particularly like that you didn't demonize the word 'censorship'. It is simply a reality that some content will get censored by some relays; and, frankly, this is a good thing.

There seems to be a lot of energy wasted trying to claim that this isn't 'censorship'. I think this is a mistake. It provides a false point of contention. I believe it would be more productive to simply embrace the fact that individual relays will conduct 'censorship' within their own individual jurisdictions as it were - but as you correctly point out, this does not present a censorship problem for the network as a whole.

Movie ranker? perhaps designed in such a way with the forethought of eventually being expanded to be a general user ratings system (for movies, businesses, other users, etc).

Strategies ranged anywhere from staring at the ground to actually making eye contact with another human being.

... and then there's the version when you're married:

I couldn't remember what I didn't like about coracle, so I just tried it again. I think your aesthetic comparison is on point. What turned me off, though, is that it constantly asks for approval to sign events that are a mystery to me what the events are. I know I could just blindly trust and set to automatically approve everything (and I usually just blindly approve anyway); but I'm not convinced that's a viable long-term expectation for a client to make. noSturdel only asks for approval to sign events when there's an obvious reason for it (like when I post a note).

This is a really good explainer by nostr:npub1ath4je07y7py74nvu044fum3f8hz3exc3dtcv782qg94w5gaddusl74k6d on the U.S. social security trust fund.

The trust fund only exists as an accounting fiction. That is, there are no assets backing it up. Put another way, it could have been designed to be backed by treasury bonds, for example, but the issuance of those additional treasuries (i.e. government liabilities) would consequently just push the national debt higher by the same amount (currently about $2.8T). Regardless, everyone - even the government - expects it to be in the negative in about 10 years, so there won't even be any fictional assets anyway.

CORRECTION: Upon some deeper diving, it seems the trust fund is in fact designed to be 'backed' by treasuries (this was my mistake; not nostr:npub1ath4je07y7py74nvu044fum3f8hz3exc3dtcv782qg94w5gaddusl74k6d'); so, if I understand it correctly now, the ~$2.8T is already reflected in the total debt.

This is a really good explainer by nostr:npub1ath4je07y7py74nvu044fum3f8hz3exc3dtcv782qg94w5gaddusl74k6d on the U.S. social security trust fund.

The trust fund only exists as an accounting fiction. That is, there are no assets backing it up. Put another way, it could have been designed to be backed by treasury bonds, for example, but the issuance of those additional treasuries (i.e. government liabilities) would consequently just push the national debt higher by the same amount (currently about $2.8T). Regardless, everyone - even the government - expects it to be in the negative in about 10 years, so there won't even be any fictional assets anyway.

I doubt my search has been exhaustive, but nostr:npub1wyuh3scfgzqmxn709a2fzuemps389rxnk7nfgege6s847zze3tuqfl87ez has been my main driver lately.

Possible third assassination attempt on Trump stopped at coachella. https://v.nostr.build/npK8t0DrChpBMcs1.mp4

Wow! I feel more informed from a 3-minute public address by local LE then what the Feds have provided after 3 months.

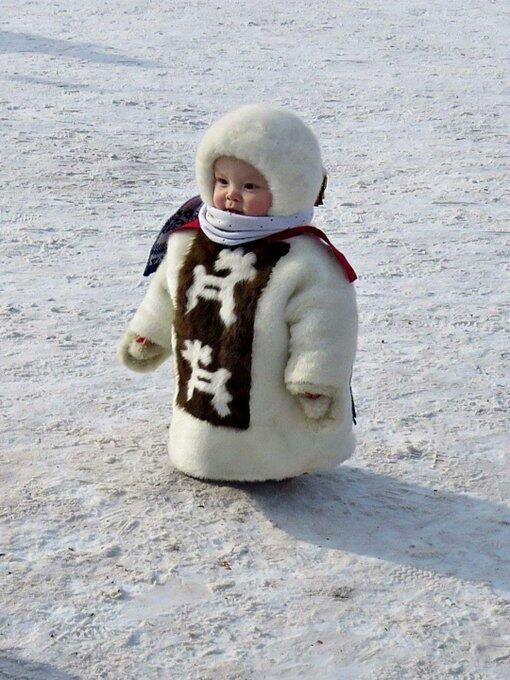

Is that the final stage of a really big nesting doll?

You can rehypothecate a synthetic?

Let’s break it down and explain why you might want to care.

A synthetic asset, also known as a "synth", is a financial instrument that mimics the characteristics of another asset or asset class without requiring the owner to own the original asset.

Rehypothecation is a financial practice where a broker or financial institution uses a client's collateral for their own purposes.

Rehypothecation can be risky, as over-leveraging assets can lead to complex chains of obligations. This can increase systemic risk if the market declines.

My understanding of the 2007/8 financial crises is these are the methods used. With the property market as asset base and with the banks playing the role of bad actors.

This is now what Saylor is doing with $MSTR he is buying Bitcoin, packaging that Bitcoin up as $MSTR shares, these shares have no direct relationship to the underlying asset.

Then investment firms are creating funds tracking the performance of $MSTR shares either betting for or against them and selling synthetics at multiple times the underlying asset of $MSTR shares, which has multiple times the underlying asset of $BTC.

This model is actively being replicated by many other firms copying this model, believing it to be sound.

Why should you care about this?

We know that the 2007/8 crises was a tremor and we are yet to experience the actual earthquake.

Bitcoin was created by Satoshi to counteract what happened in 2007/8 by creating hard money.

Saylor through $MSTR and others through ETFs, which while currently backed by real Bitcoin (as far as we can tell), are creating synthetics and being rehypothecated.

Meaning that Bitcoin is becoming part of the problem rather than the solution. Not only that, it is dramatically increasing the size of the problem.

It has never been more important for us to self custody Bitcoin and not allow its use as a Synthetic or to allow it to be rehypothecated.

Saylor discusses this here, it sounds clever, and to be frank I don’t understand most of it, but it is actually using Bitcoin as a leverage device:

https://v.nostr.build/C0z85M8H3Gbyc6Y2.mp4

nostr:note19stecwggn4c5u6qntdc42vxnv09q9dy6vvh3sfyzwx9296xtgess8cwmdp

Personally, I'm not concerned - because the only Bitcoin I care about are the keys that I control. It's true that a bunch of Bitcoin rehypothecation could result in a Mortgage-Backed-Security-style crash similar to 2007/8; which could in turn crash the $ price of Bitcoin just like the $ price of real estate crashed in 2007/8. But, ultimately, the BTC someone owns with no strings attached will still be the same BTC - just like the house someone owned with no strings attached is still the same house.

Nearly 50 years ago, the hype was well deserved compared to the state of the art movie making at the time. It continues to amaze me how many CGI movies are still being created that look way more fake than a bunch of stop-action models from a half-century ago. But, I can agree, the story-telling was merely good at best.

I tend to think more people thinking before speaking is probably a good thing.

Hanlon's razor isn't about accuracy; it's more like giving the benefit of a doubt. That is, the default presumption should be unintentional incompetence until there is no reasonable doubt of malice. Purposeful incompetence, on the other hand, is itself a form of malice; so it's still consistent with Hanlon's razor to call it malice when you see it.

Order is correct, too.