Perched at 1,147 meters, Petralia Soprana is a true Sicilian treasure!

With a history stretching back to 3000 BC, this ancient village has seen it all—Greeks, Romans, Arabs, and Normans have each left their mark.

Just imagine the stories hidden within its timeless streets!

[📹 gloriamonastero]

https://video.nostr.build/9fb3407c593c2d0795ab3cb1182bc49fb2383d602afa5c58c3872d62d7024155.mp4

I hope I get the chance to visit someday! 😊

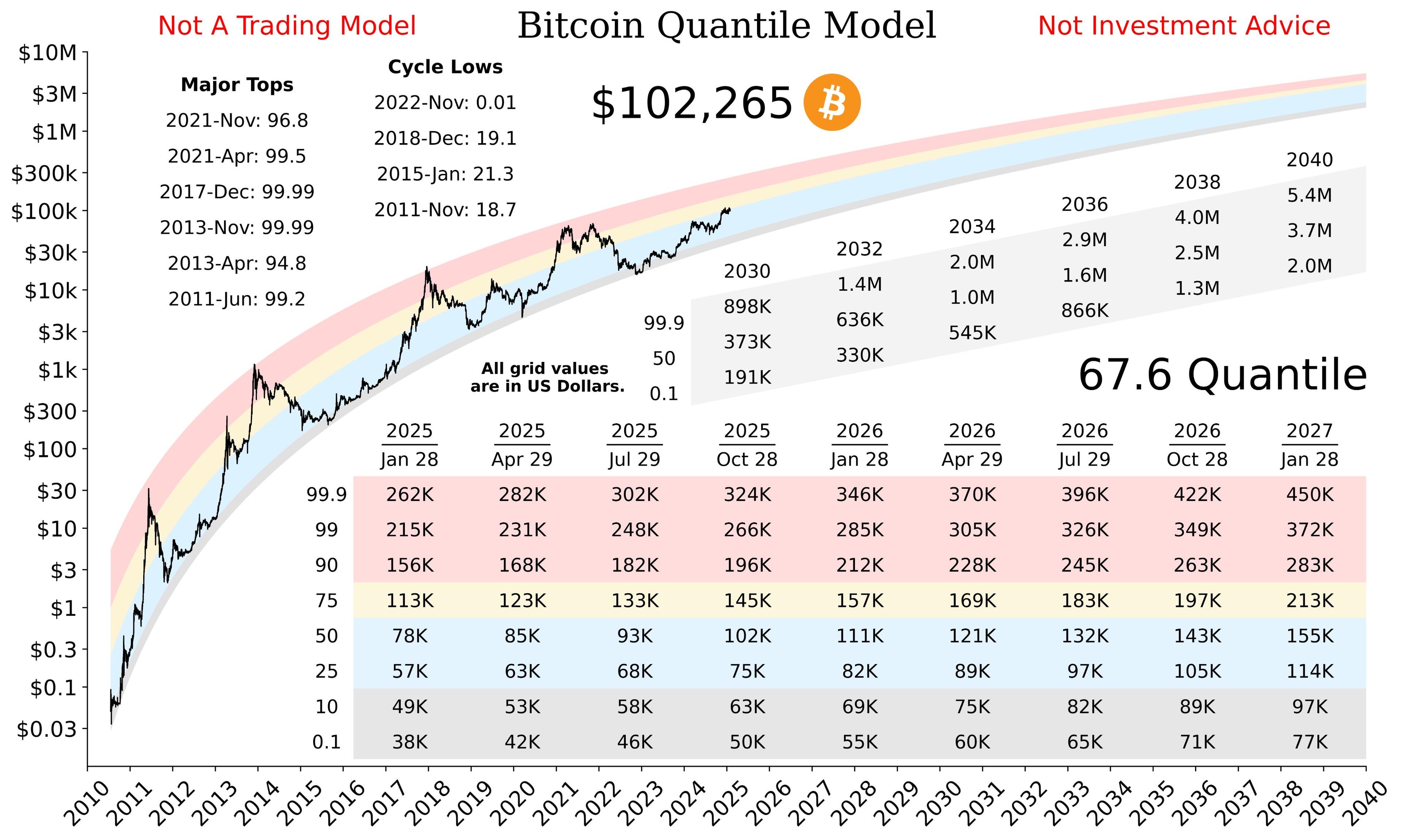

Good Afternoon Nostr, I've been playing with some numbers the last few days and would like to hear opinions on the results.

Visuals of the data I'm referring to are attached.

Taking data from the mining network:

Hashrate increases divided by ASIC efficiency gains, multiplied by the reduced value of the dollar overtime (as a substitute for expected global decentralized miner cost reduction activity over time), multiplied by the halving effect on the price (1*2^X, X = number of halvings), gives us a multiplier that can be applied for per coin mining cost extrapolation.

I started with Jan 1, 2015 as before that date the block time was quite variable and not very stable around the 10 minute target, I feel anything before that date can be considered an outlier.

Jan 1, 2015 the price was $314, and it cost $234 to mine a Bitcoin.

From Jan 1, 2015 to Jan 1, 2025 hashrate increased approx 2500x, top ASIC efficiency went up 33.33x, dollar value dropped 46%, and there were 3 halvings in 2016/2020/2024 leading to an 8x multiplier on the price. Now there are a ton of variables not considered here, and the global and decentralized nature of the network leaves a lot that really can't be precisely calculated, so given the rather simple nature of this extrapolation anything somewhat close to actual values would be encouraging. So let's do the math.

$314 * (2500 / 33.33) * 0.54 * 8 = $102,460.

$234 * (2500 / 33.33) * 0.54 * 8 = $76,356

Jan 1, 2025 the price was $94,420, and the mining cost was $91,132.

$94,420 / $102,460 = 93% of extrapolation.

$91,132 / $76,356 = 119% of extrapolation.

Impressively close.

I then did this math for extrapolating the price from 2015 to every year after until 2025 and charted each result, along with the same extrapolation for mining costs, alongside actual values observed. That's the excel chart screenshot. Interesting how the actual price data bounces around the extrapolated price expectations based only on the mining network data explained above. Remember, the only actual price data used in the extrapolated prices is the initial price at the start yet.

Further, if we remove the halving multiplier effect from the extrapolated $102k price, to find the average annual increase without it, the price might've risen from $314 to $12,667.25 over that decade. That's an average annual increase over 10 years of 44.89505%.

Adding the halving's back in as sudden jumps every 4 years, and we have an equation to run in desmos that I then plotted the mining cost data points onto. The equation doesn't format correctly here so you can see it in the screenshots attached. The extrapolations in Desmos are... wild. Is this chart the most bullish of all?

I make no claims that this is what will happen, just that the data suggests it might. Note that from what I can tell neither the price nor the mining cost has fallen below the blue lines in Desmos since breaking through the $100 cost to mine level in Nov 2013's bull run. Nearly 12 years above this trend and never breaking it. I anchored the chart on the 2016 halving data and mining cost of $500 per coin.

Would love to hear the Nostr community's take on this, it was fun putting together and the data output is quite interesting IMO. Only time will tell if it continues to be accurate, but it would be quite something to see if it does.

☮️❤️₿

Sup homie!

I look forward to seeing how things develop!

Indeed. The better the asset the greater the benefit of holding fiat debt against it on your personal balance sheet. FIAT debt is now a sub-asset of Bitcoin.

Good afternoon Nostr. 😁

We live in abundance, Bitcoin clears the fog so we can see it.

No matter how bad things are, or might get, we will be okay. ♥️

GM. 🌅

Evolutionarily, every day you're still alive is a success. Don't make yourself feel like a failure by some other arbitrary measure, you're still alive and that's the main goal every living thing tries to achieve each day. Not all are successful, but you are.

🖖

My favorites are/were: Nutty Buddy, Swiss Rolls, Devil Cakes and Oatmeal Creme Pies.

I don't eat them as much anymore though, lately they just aren't as appealing since I'm eating healthier and more consistently.

Thank you! It was. Just a home cook for now, so no restaurant... Yet. 😉

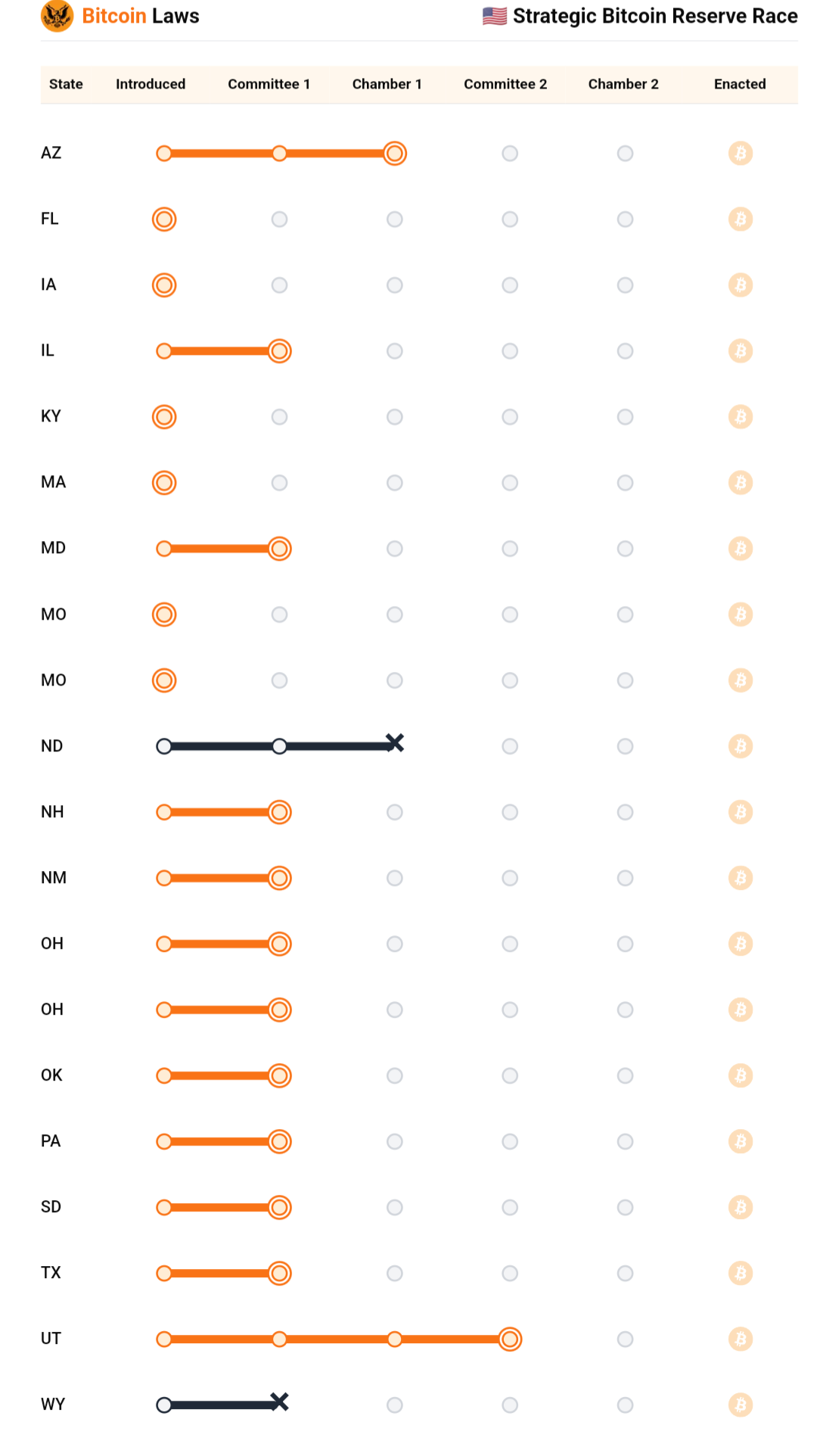

The blue states have so far been richer in the current system, wouldn't it be funny if the red states openness to Bitcoin causes them to jump ahead?

State governments are who we really want establishing Bitcoin Strategic Reserves. We've all been thinking US vs Foreign countries, nobody thought about the states themselves competing against each other as well!

We're picking up steam.

I have a cast iron, works great. Recently got a large stainless steel wok with glass lid and steel spatula for $25 at Costco and I love it! Been wanting a wok for a while.

Buying whole brisket and trimming/rendering the excess fat to make my own tallow at home! Works great.

My view is that mining cost follows the price, and price also follows the mining cost. They have a sort of equilibrium, dancing around each other over time.

If Bitcoin truly does go parabolic, it'll be because the hash wars have started and Bitcoin are extremely valuable strategically.

If the price alone goes parabolic it's unsustainable and will crash, if both the price and the cost to mind goes parabolic then it's hyperbitcoinization.