modern world wide web, only been around since 1991, do you think it will fail, and we go back to the reliable old telegraph?

Bitcoin is information, which can move light speed, since it has no mass.

Bitcoin does not require trust. Anyone can review the code, and run whichever version they desire, as long as it obeys the rules that everyone else agrees to. Who cares who designed it... How about the number 0? Can you trust that 0 is a valid concept and not a trick, if you don't know who came up with the idea?

51% attack, Bitcoin breaking, quantum computing, government attack, you are not the 1st to ask these questions ...if you are truly curious, keep learning! Do you like books or podcasts? I will post some useful research.

Yeah it tends to happen again, once she stops nursing…

Awesome idea!

I was trying to think of a good medium for this…I’m thinking Acrylic print for the wall??

Bitcoin isn’t a hedge against anything, it’s a replacement for the current monetary system.

Trading some vegetables is one thing…how do you make a pencil, without money?

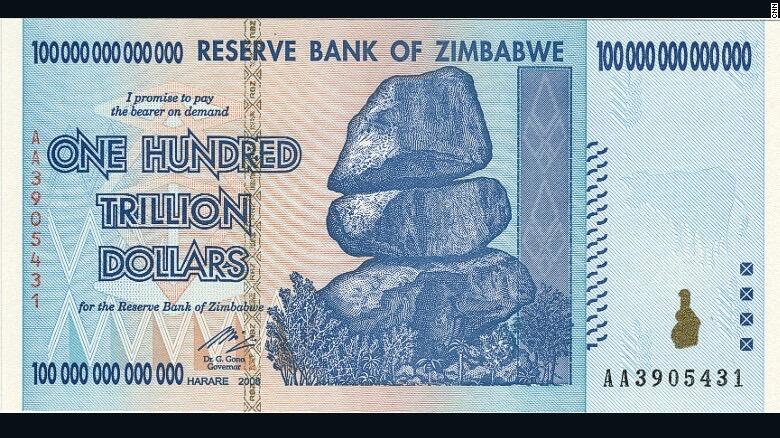

Yes, gold destroyed every other softer money: glass beads in Africa, silver in India and China, and countless other examples throughout history: hard money destroys the wealth of those holding soft money.

The problem with gold is it was too slow for the 20th century. It had low salability across space. That’s where banking, gold receipts, and later currencies took over. They had greater salability across space than gold. The tradeoff was that gold had to be centralized into banks. This required trust, that there was actual gold to back the receipts for gold. Eventually humans being humans, that trust is violated. Bitcoin requires no trust. It’s like moving a gold coin at the speed of light - no receipt, or currency backed by it, is required - it is a bearer asset. It can remain decentralized, like physical gold coins, yet move at light speed anywhere. It solves the salability across space better than currency, and is even more salable across time than gold.

Why does Bitcoin go down. It is monetizing. Some people have knowledge, and some don’t. Information asymmetry. If Bitcoin never went down - it would never distribute to more people. If someone had never sold 2 pizzas for 10,000 bitcoin, how could it distribute to millions of people world wide?

You talk about civilization ending events like an EMP…do you think your physical assets remain in your possession in that scenario? I hope you are well armed, well trained, and have a large network of such people handy, but even then…good luck with holding on to your physical property.

Bartering value for value. A myth, made up by people who have never bartered. Ever been to a gun show? I’ve been to a lot - some sellers advertise “buy sell trade”, but in all my years I have NEVER done or seen a trade. The person that has the gun for trade invariably does not want to trade for the gun you have — EVEN THOUGH THESE ARE ALL SIMILAR DEVICES, and everyone there is looking for a gun!…now imagine trading different types of things — what are the chances that you and the other person have something that the other wants…0.0000% Without money, civilization cannot exist.

In order to understand bitcoin, you cannot approach it from a technology standpoint. You must first understand what money is — how it came to be, the history of it, and how, as a technology it is as important as mathematics and language, perhaps even more so. The Bitcoin Standard, by Saifdean Ammous, it’s more a primer on Austrian Econ than about Bitcoin, and will give you the essential foundation of understanding first what money is, then explaining why bitcoin will destroy all other money, just as gold destroyed all other ancient money.

All finished!💙 nostr:npub1cp6wlyvy3swhf2rrnjp2rn0hxu3tdzz89lqjppp6yw255lytwhgqs222sp

Let me know what you think! This piece really inspired me to add colour and bring a more realistic appearance to it. I loved it! Thank you for sharing that lovely photo with me 🙏🏼💙

Absolutely beautiful work Dorothy!!!

I hope so ..this close to voting acceleration instead of slow decline...

Kamala win: $669k by Dec 2025

Trump win: $169k

8,000 yrs < 300,000 yrs

I've been debanked by Paypal. (can't connect a bank account or credit card for onramping due to account restrictions)

And no, Canada isn't safe for banking by dissidents.

I've learned a long time ago never to put faith in technology - it will ALWAYS disappoint.

https://media.freespeech.social/ipfs/QmfMGUKBpQ6Pzq4kMQE9dHgjjpi5hbc5DxHvemU3Xn9yxv

Money is technology - fiat currency is highly centralized, fragile technology. Bitcoin is decentralized, anti-fragile technology.

There is no single point of failure - no clownstrike update…it is more robust than physical currency (governments can de-monetize banknotes at any time…India with the 500 rupee note for example)