GM.

I'm bullish on bitcoin, and I think a lot of people overthink it.

One of my favorite metrics is the market value vs realized value ratio. The realized value is basically just the on-chain cost basis. The value of UTXOs at the dollar price during which they last moved between wallets, which often means the time people pulled them from exchanges or deposited them to exchanges.

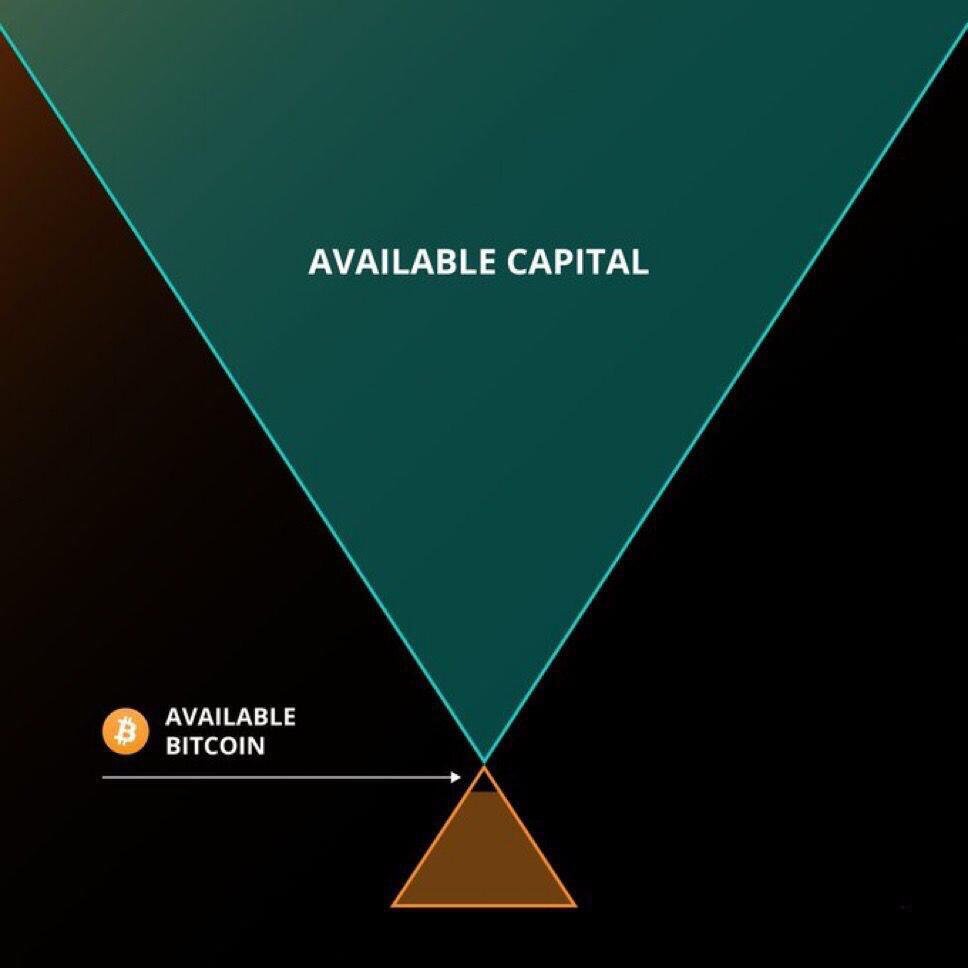

A relatively small amount of marginal buying can push up the market value by a lot. Like how if you buy one house on a street, it can boost the estimated price of all houses on that street even though only one of them traded hands. But when market value becomes stretched relative to cost basis, it means that part of the market value is kind of illusory. We don't *really* know what houses on that street are worth if only one of them traded hands recently and thus liquidity was low. Over time, as more houses on that street trade hands and we have more price points, the estimated value of the street becomes more real. The same thing for bitcoin; as more bitcoin trades hands at certain levels, it starts to make that level "real" compared to how real we should consider it when it just touches a certain level for a little while with limited volume.

Right now, bitcoin is at an all-time high in its realized price, i.e. cost basis.

Back when bitcoin was poking over $60k in April 2021, the cost basis for the network was only about $350 billion. Now, at the same market price, the cost basis approaches $650 billion, or more than twice as high. The marginal bitcoin has traded hands and moved between wallets at much higher prices than years ago, even though the market price is about the same. In other words, these levels have been truly liquid and been consummated by the market more than they were back in 2021, and thus the price is more robust at this level than back then.

The launch of the spot ETFs pulled forward some excitement this year, and so we've been in this big consolidation since March. But even in that time period from March to the present, the on-chain cost basis increased from like $520 billion to $640 billion, and so price discovery and progress is being made despite the ongoing price chop.

As the network builds a bigger and more solid base like it has been doing, it can set the stage for the next major breakout. The network looks healthy to me.