Meet the Streisand effect

IMO for easy to use distros Ubuntu has been surpassed by some of it's derivatives (Pop!, Mint). I daily drive Mint myself and it's extremely low maintenance.

Another tip, if you're going "hard mode" with Arch you can use EndeavourOS - It has a live CD with a GUI install, so it's way easier to set up, But then post-install it's essentially the same as another Arch installation.

Just browsing NOSTR and zapping interesting posts is enough…I don’t necessarily need to post all that much myself, but getting to vote with my zaps as to what I like is pretty damn rewarding.

I seem to zap nostr:npub1rtlqca8r6auyaw5n5h3l5422dm4sry5dzfee4696fqe8s6qgudks7djtfs , nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z , and nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a most consistently, but I’m an equal opportunity zapper so I get a wide range of folks covered.

What a time to be alive…

⚡️⚡️⚡️

Even sending zaps is so much fun. 🤙

I've lived in Switzerland for 3 years, I really recommend it!

Nature around here is beautiful - It's in the middle of the alps, so you have a lot of big and small mountains nearby. There's also many lakes between the mountains you can go boating or swimming in. In winter there's great access to skiing. Here's some photos from Lucerne / Lake Lucerne and Mt. Pilatus for flavor. 🤩

Local life is extremely safe and crime free - Even the largest cities like Zürich feel safe at night, which is important to me at least.

Switzerland as a country is very Bitcoin friendly: Lugano has made Bitcoin legal tender. Zug is nicknamed "crypto valley" - Sadly that's mostly due to a lot of shitcoins incorporating there, but they do that because the legislation is very friendly and tax rates are low. Which is also something I appreciate.

Income potential in Switzerland is high by international standards - It's roughly comparable with secondary US cities, but the quality of life here is much better! I make a low six figure income working as a programmer here. For types of jobs it's mainly big corporate healthcare / finance / mechanical engineering. Although you can also find some cool Bitcoin and freedom tech companies such as Relai or Proton that are based here.

Switzerland has low taxes by OECD standards, although not quite the absolute lowest globally. I pay around 20% income tax and social security combined. There is no capital gains tax, but there is a (very small) wealth tax. You can sell your Bitcoin without incurring any taxes. But you do need to declare how much Bitcoin or other assets you have, as you're taxed on total wealth.

The only real downside I can cite is high cost of living - The largest cities are like San Francisco levels of gentrification. You spend the equivalent of $28 eating lunch out, and $3k/mo renting. It's not so bad if you have a local salary, I still feel like my income goes pretty far. But you're absolutely not remote working or something from here, that's for sure.

However you get what you pay for in Quality of Life. 🤙

I also tried restoring my current Cashu.me wallet in https://v2alpha.nutstash.app/ and AFAICT it doesn't work? At least I put in the words and the same Mint (https://mint.minibits.cash/Bitcoin), and it didn't find any balance.

I’ve just dropped my weekly update on the MLS messaging progress. It’s a short one this week but don’t let that fool you, I’m feeling very bullish about the progress. 🤙

Huge thanks to nostr:npub1klkk3vrzme455yh9rl2jshq7rc8dpegj3ndf82c3ks2sk40dxt7qulx3vt and nostr:npub1l2vyh47mk2p0qlsku7hg0vn29faehy9hy34ygaclpn66ukqp3afqutajft who spent multiple hours each with me on calls talking through ideas. 🙏

nostr:naddr1qvzqqqr4gupzq9eemymaerqvwdc25f6ctyuvzx0zt3qld3zp5hf5cmfc2qlrzdh0qqxnzdejxqmnwwpc8qcr2vectx9xjf

This is really important work, thank you for doing it. 💜🤙

nostr:npub1zuuajd7u3sx8xu92yav9jwxpr839cs0kc3q6t56vd5u9q033xmhsk6c2uc is currently writing a NIP with MLS, which is kind of a upgraded double ratchet that can be used with larger groups. No clients have it yet AFAIK.

GM ☀️ PV 🤙

Ten years on and the Gox just keeps on Goxing. Congrats to everyone who made it out alive.

Love this question! Yes, if I had to guess. The reason it's appreciating so fast now is because money is moving into Bitcoin from other assets with a much larger capital base. After hyperbitcoinization Bitcoin will be the largest pool of capital so this'll no longer be the case. Then it'll go up like 3-5% a year or something in line with real GDP growth.

Although at that point the account denominator would probably have flipped, so you wouldn't say that "Bitcoin has gone up by x%" you would say "prices have decreased by x%".

I mostly care because I still talk to my family in the EU over Signal, and they're normies so getting them to switch to something non backdoor will be hard. 😔

There are, but they have their own problems. They're a black box, by design. (How did this particular fuzzy hash end up here? You're not allowed to know.) Also companies that host these lobby governments to mandate everyone use their services, so they are constantly trying to rent seek. One of them, Thorn, is a sponsor of chat control for instance.

Two reasons: First of all in the current law developers/users are not obliged to do anything, only commercial actors. Second of all, even if they where, it's unenforceable. There's no way to make i.e. SimpleX add backdoors without gatekeeping what software you can write or run, which is clearly unconstitutional in many EU countries, not to mention impractical. The current legislation may also violate fundamental rights for that matter, but we'll only see it challenged in court if it passes. So at least my understanding is that nostr would be mostly unaffected.

Please don't misunderstand me as not caring about Chat Control though - I think it's a really bad law and should be repealed so that i.e. Signal and Proton can keep serving the EU. It's good that there are E2EE companies, it makes it way more normie accessible.

Mostly not at all, it only targets commercial actors. Primal might need to do something like geoblock EU. FOSS is a great way to bypass this bad legislation if it does come to pass. SimpleX will also be unaffected.

Also worth noting the vote June 19 is just the council of ministers vote - It won't be law until negotiated with parliament, which is broadly against chat control.

Mutiny is good, I use it myself. If you use a Fedimint it's very easy to setup.

Nah, that's misinformation. There never was a formal agreement and nothing that needed to be renewed. RHR discussed this a bit last week.

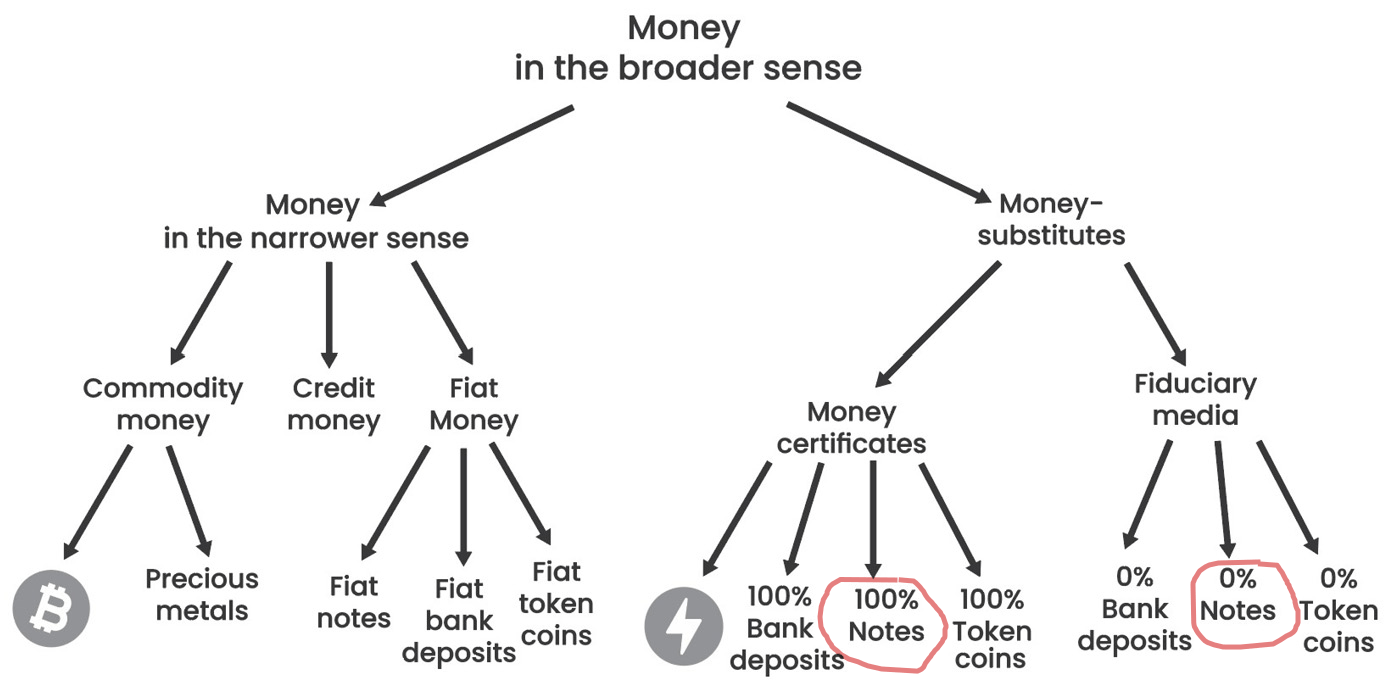

This diagram is from nostr:npub1gdu7w6l6w65qhrdeaf6eyywepwe7v7ezqtugsrxy7hl7ypjsvxksd76nak book Principles of Economics. And the Original definitions are from Mises' Theory of Money and Credit. (My highlights.)

Based on this model ecash would be a bank note - If the Mint is honest and redeems all notes for Bitcoin we'd say it's a 100% Note. If they're dishonest and have less than full backing it's a 0% note.

Circulation credit is when the person issuing a loan pays it out as fiduciary media (i.e. unbacked money substitutes). So they paid you out with money they don't actually have on hand. If the loan is paid out in commodity money, or 100% commodity backed certificates then it's commodity credit.

So in the case of a loan paid out as ecash it depends on it the ecash is fully backed or not - If it is backed then it's commodity credit and if not it's circulation credit.

I looked into this myself. This is not possible AFAIK, as the VPN apps want to proxy all your traffic, so they fight each other.

But I found a quite nice workaround, which is to do this:

1. Run just Tailscale on my phone.

2. Run Tailscale on my home server.

3. Set my router to use Mullvad as Wireguard proxy.

4. Set the phone to use the home server as exit node.

That way you can VPN back to your home server, but you also get IP privacy to the phone at the same time.

Aren't Optimism that shitcoin that was posting spam on nostr a while back advertising their airdrops? 😂

I checked mempool several times today and almost all of the time, I found mempool filled with garbage data (to scam the people).

If these blocks have been filled with garbage most of the time then why do we need 4MB blocks?

Why are Bitcoiners talking about further upgrades? Instead it would be WISE to talk about reducing the blocksize limit since the free market has been trying to tell us that we don't need 4MB blocks. It's being misused by attackers and spammers.

Reducing the blocksize will probably do following things: -

1) Keep the cost of running nodes very low (hence it helps with decentralization)

2) It promotes scalability in layers (i.e. L2, L3 etc) instead of on chain scaling.

What are the real risks by reducing block size? Except some scammers can't scam the people easily (but I believe that's a good thing)

I think #bitcoin thrives more with conservatism than progressivism.

cc nostr:npub1lh273a4wpkup00stw8dzqjvvrqrfdrv2v3v4t8pynuezlfe5vjnsnaa9nk nostr:npub1wnlu28xrq9gv77dkevck6ws4euej4v568rlvn66gf2c428tdrptqq3n3wr nostr:npub1au23c73cpaq2whtazjf6cdrmvam6nkd4lg928nwmgl78374kn29sq9t53j

Are you conservative about changes, or do you want to eff with the block size limit? I have a lot of sympathy for ossification, but if you believe that you should keep the current block size. Because we know Bitcoin works today, and you shouldn't fix what isn't broken. All updates to consensus code are risky, and should be avoided as long as possible.

I'm not a core dev, so take it for what it's worth, but altering the block size feels 10x more reckless than even the most risky soft forks being talked about now (I.E drivechains, OP_CAT et cetera). That alters the entire economics around using L1 for miners, hodlers and everyone else. Nobody could possibly predict all the consequences of doing that ahead of time. Which IMO means you shouldn't do it.