Miners- ASICs do nothing but hash numbers. Running a full node is setting up a computer to have the bitcoin software running, recieving new transactions, and storing past transactions. The computational load of nod is very low. It is mostly about having a good connection and enough storage. Miners just need an RPC connection to a full node to be able to hash the next block. Bitaxe is very efficient. S-19s give off heat for other uses. Anyway, good luck.

The point is to add an incentive to fix it.

nostr:naddr1qvzqqqy9hspzphgln4gzc723mar7378dy30gh73y7l5zc283jwv63u88fvrpzw3pqy2hwumn8ghj7un9d3shjtnyv9kh2uewd9hj7qg4waehxw309aex2mrp0yhx7mrpwvhxzurs9uqpqvejxe5kzum2x35ksdr4dfnnwcc0k99tc

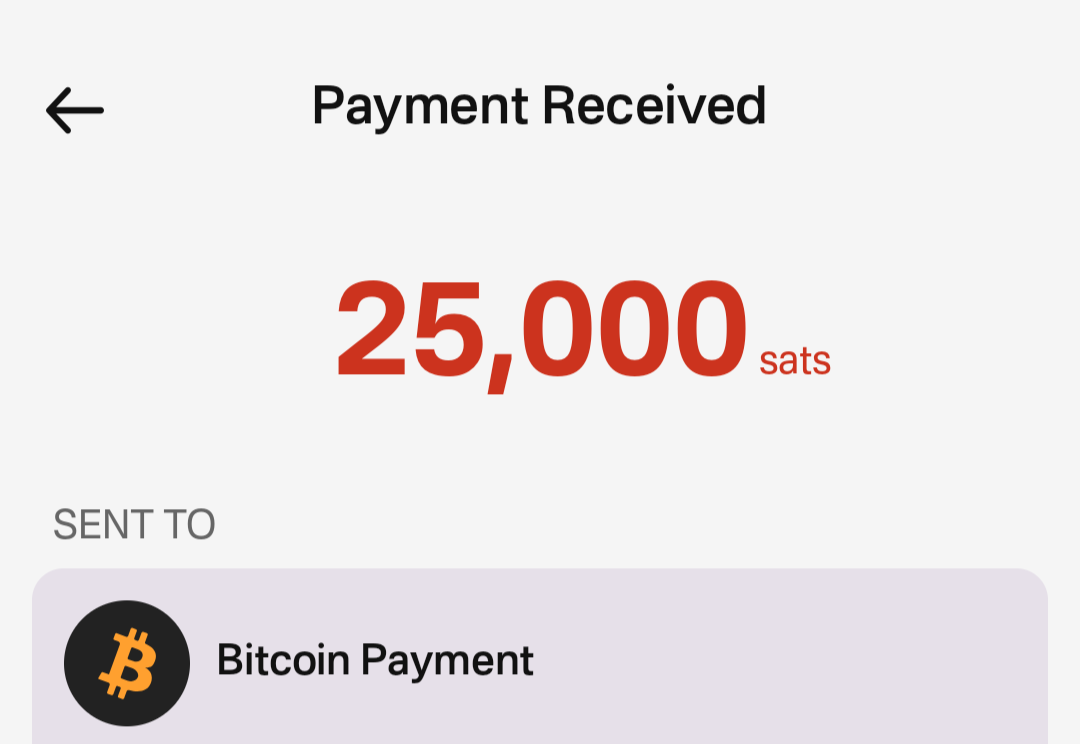

Does that not say "Payment Received" that is not a sent payment, right?

That is precisely what an economy does. Limitations of scarcity drive people to organize the resources most efficiently. Blocksize is no different. Humans often drive toward the power in numbers model because of evolutionary survival strategies. But, in this case decentralization mitigates the biggest threat, a single point of failure, I.E. Mining pools. Block template and self administered mining is the best bulwark against this. Even at the institutional level.

This is an argument against the bitcoin supply cap as well. Which for some reason everyone gets is fallacious.

Blocksize is the scarcity that gives Bitcoin TRANSACTIONS value. Whereas the supply cap is the scarcity that gives the coin value. This is why I implore the cypherpunks to learn more about economics and economists to learn more about privacy.

The focus should be Mining. The more you can distribute block template control, the more secure the blocksize becomes. The more centralized mining becomes, the more the blocksize is up for debate.

What bonds? Where does the yield come from? That was my point (money printing is legal counterfeiting).

Here is a simplified description: https://nostr.how/en/zaps

Here is the protocol specification: https://github.com/nostr-protocol/nips/blob/master/57.md

Does that mean you could technically both agree to lie to everyone using a self created event using kind 9735 without ever sending sats? Is that what I'm reading?

Where does the profit come from? Just the counterfeiting or leverage trading BTC swaps?

Learning this is what really blew my mind on Bitcoin the first time. The second time was when I baked my noodle on ECDSA and how that works.

Nevermind, I see my follow kinds were blocked by my bunker, I had to re-authorize and accept. That was my blunder, not Olas.

The strange thing is my "Follows" filter just shows my own posts no one else I actually follow. And I follow tons of picture peepo.

Hey what relays should I add with with Olas? I just have the Primal Blossom server at the moment. Can they be the reggy relays or do they have to have specific NIP support?

🚀 TollGate pay-as-you-go internet access on open networks. Powered by Cashu.

The TollGate WiFi-router runs a Nostr relay + clients for handling payments. The TollGate app pays for internet-access with eCash over nostr!

https://cdn.satellite.earth/f4151c21e8073d8603ae272d11931d0780036eef64d04dbd13b7e75e9b6b643a.mp4

The flow:

- User taps connect (connect button will be automated)

- Tollgate App suggests tollgates to connect to (Android notification)

- User taps connect

- User taps sign-in

- The app handles payment and prevents captive portal from opening

Unfortunately some Android OS level restrictions requires quite some taps to connect 😕.

CC: nostr:nprofile1qyt8wumn8ghj7ct4w35zumn0wd68yvfwvdhk6tcpzemhxue69uhk7unpdenk2umede3juar9vd5z7qpqk03rader0vm94j5ee8fg7pc2x9xkr2phu77sljas7qu5mh8mvgvq26v5kf nostr:nprofile1qyxhwumn8ghj7cnjvghxjme0qyt8wumn8ghj7etyv4hzumn0wd68ytnvv9hxgtcqyz5cglaug6mvzzt3z8k7uy345sslkuy550w9ah9zvsg0rczd0w0n6s5rcnv

What in the what?

Anyone out there use voyage for checking the Notey-est of Nostr notes? I love the lightweight design but y'all are always quoting and boosting and poasting memes. Anybody do words anymore?

Open source doesn't mean audited. I have seen some very CCP politically curated AI responses. People have to dive deep into the weighting and training data.

Currency is a coupon for money.

Money is a Non-Consumable asset.

They are related but not the same.

When you accept bitcoin for an item, unpon confirmation, that transaction has final settlement.

When you accept lightning for an item, you must then close the Channel, and await confirmation to "Own" that Bitcoin. Then the transaction has final settlement.

That is the difference.

Put another way, if I give you a chicken, you have a chicken.

If I give you a coupon redeemable for a chicken, you do not have a chicken.

Everyone thinks that way which is why I don't get invited to a lot of parties.

Hooooooo boy. So did dollars before 1971. You trade cash (lightning) then settle on chain (exchange $35 per ounce of gold). This is why I have to write an article explaining money. And the difference between currency and money. It all gets so muddled because we've been using fiat for 54 years.

I do... You can spend gold too. The point is the time for confirmation makes it money not currency. Again, the 'tism.

Value is determined subjectively so the question is sort of narrow to begin with. But, on top of that Fiat is an illusion like slight of hand. The reason you think dollars were worth anything is because gold was worth something. Dollars haven't been tied to gold sinxe 1971. So this is essentially like Wiley Coyote (The dollar) running off of the solid ground (gold) and we haven't looked down in 54 years. Bitcoin on the other hand has a marketvalue because of its immutability, transferability, and permissionless nature. A similar question would be: If the weather started being nice outside, would you leave your house forever? Obviously not.

The only caveat is that Cashu is technically a layer 3 credit because the settlement is on Lightning.

That's not how money works. All money is an asset. Cash is a coupon for the asset. In essence layer 2s like lightning and liquid are cash. Bitcoin is digital gold but better.

Jack is incorrect just from an economics standpoint. Currency never was supposed to hold value. The deed to a house is not the asset, it is a coupon claim for the asset.

Cypherpunks and economists need to talk to each other more.