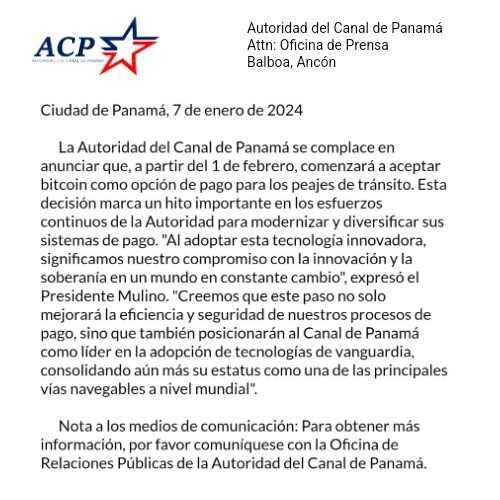

🚨 BREAKING: The Panama Canal Authority today announced its decision to begin accepting Bitcoin payments for transit fees beginning February 1, 2025.

The move is widely seen as a response to President-Elect Trump's recent comments about the canal. According to Panama's President Mulino, this "signif[ies] our commitment to innovation and self-sovereignty in a changing world."

Source: nostr:nprofile1qqsfgkuaywe08ex3ja7yhes9zh8qcghqrxspg50v6va0zzqwteaypmgpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhsz9mhwden5te0wfjkccte9ec8y6tdv9kzumn9wshsz3rhwvaz7tekvs68x7ryw3ckyerjwq6xvmrzxeekgatxxdjkkaphd3mkxetpv44x7mnvwuehxv3kwdshjdrsdfjk7um9xfmks6ty9ehku6t0dchsn57jht #panama #bitcoin #newstr

this is wishful thinking, not verified fact. if it were true, the media would go insane.

If you are a content creator, of any size, in any medium, and you are not on Nostr, trying to bring your fans to Nostr, you are wasting your time.

The only other thing I see to do on Primal is to Report User.

The answer, my friend, is to #grownostr.

I too use nostr:nprofile1qyx8wumn8ghj7cnjvghxjmcpz4mhxue69uhk2er9dchxummnw3ezumrpdejqzrthwden5te0dehhxtnvdakqz8nhwden5te0dehhxarj94c82c3wwajkcmr0wfjx2u3wdejhgtcpr4mhxue69uhkummnw3ezucnfw33k76twv4ezuum0vd5kzmp0qyf8wumn8ghj7mmxve3ksctfdch8qatzqythwumn8ghj7un9d3shjtnrw4e8yetwwshxv7tfqyt8wumn8ghj7un9d3shjtnwdaehgu3wvfskueqpzemhxue69uhhyetvv9ujuurjd9kkzmpwdejhgqgcwaehxw309aex2mrp0yh8xmn0wf6zuum0vd5kzmqqypfjmqcdllsfcyl8t693ghyz2uv0cy4sqqlkr4s7jpmhy8rll7fuk34pfty also get these SPAM DM's. Is there a way to block Nostr DM's?

Of course, then they just come back using a different npub and try again... nostr:nprofile1qy2hwumn8ghj7etyv4hzumn0wd68ytnvv9hxgqg7waehxw309anx2etywvhxummnw3ezucnpdejz7ur0wp6kcctjqyv8wumn8ghj7mrfva58gmnfdenhyetvv9ujucm0d5qs6amnwvaz7tmwdaejumr0dsq32amnwvaz7tmwdaehgu3wd45kcmm49ekx7mqprfmhxue69uhkummnw3ezummjv9hxwetsd9kxctnyv4mqzyrhwden5te0dehhxarj9emkjmn9qyf8wumn8ghj7mmxve3ksctfdch8qatzqythwumn8ghj7un9d3shjtnrw4e8yetwwshxv7tfqy28wumn8ghj7un9d3shjtnyv9kh2uewd9hsz9nhwden5te0wfjkccte9ehx7um5wghxyctwvsq3kamnwvaz7tmjv4kxz7fwdehhxarj9ejxjun9vd6x7uneqyt8wumn8ghj7un9d3shjtnswf5k6ctv9ehx2aqprpmhxue69uhhyetvv9ujuumwdae8gtnnda3kjctvqyvhwumn8ghj7un9d3shjtnhv4kxcmmjv3jhytnwv46qqgqj8taw05v8hgmddhwdjldlftx9nthlufpl0qje9lu0yhk4080nqcqm6yll this is still happening.

I too use nostr:nprofile1qyx8wumn8ghj7cnjvghxjmcpz4mhxue69uhk2er9dchxummnw3ezumrpdejqzrthwden5te0dehhxtnvdakqz8nhwden5te0dehhxarj94c82c3wwajkcmr0wfjx2u3wdejhgtcpr4mhxue69uhkummnw3ezucnfw33k76twv4ezuum0vd5kzmp0qyf8wumn8ghj7mmxve3ksctfdch8qatzqythwumn8ghj7un9d3shjtnrw4e8yetwwshxv7tfqyt8wumn8ghj7un9d3shjtnwdaehgu3wvfskueqpzemhxue69uhhyetvv9ujuurjd9kkzmpwdejhgqgcwaehxw309aex2mrp0yh8xmn0wf6zuum0vd5kzmqqypfjmqcdllsfcyl8t693ghyz2uv0cy4sqqlkr4s7jpmhy8rll7fuk34pfty also get these SPAM DM's. Is there a way to block Nostr DM's?

If you mute a profile, I believe it also blocks the DM.

Happy Birthday, Bitcoin!

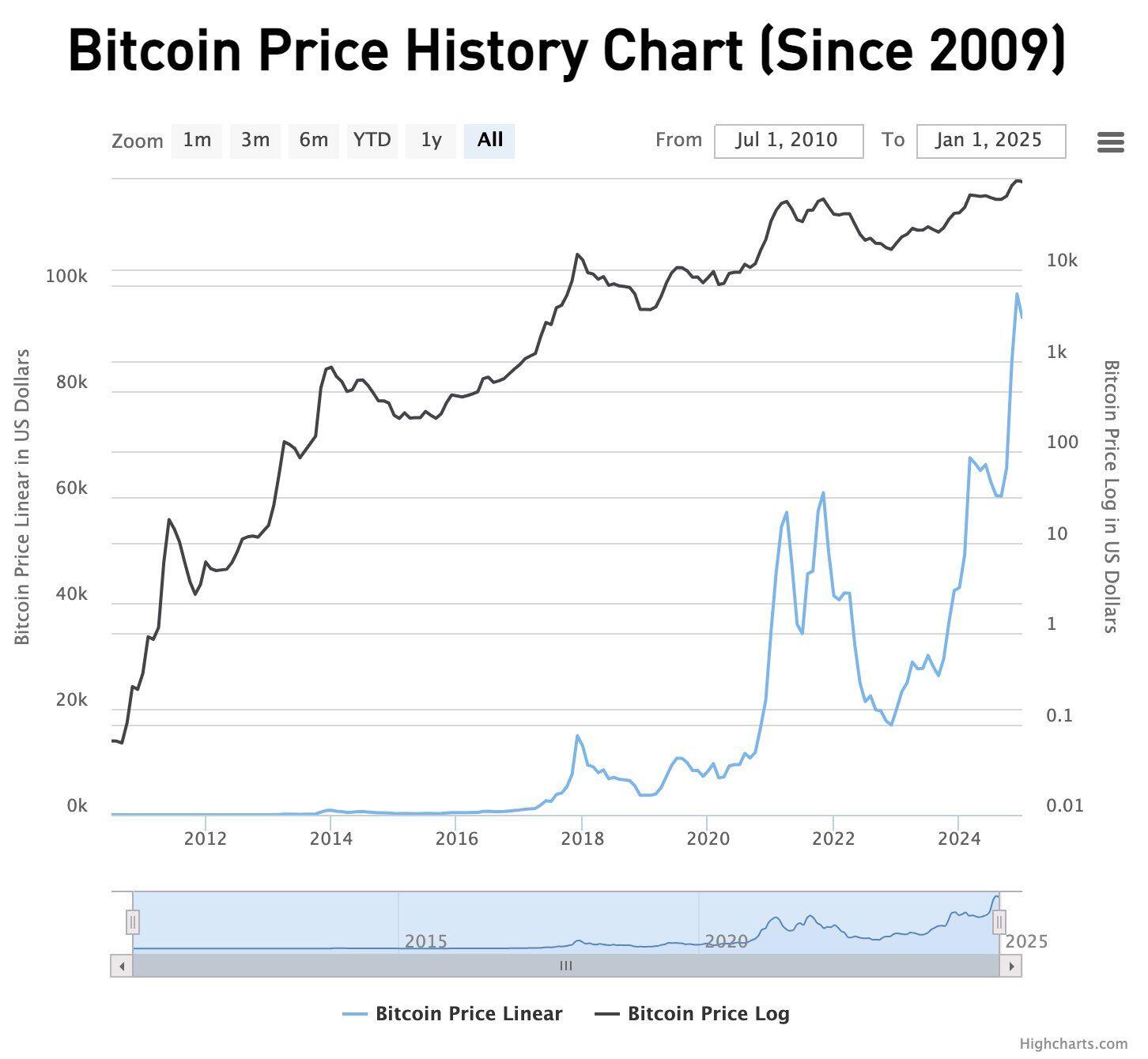

I am not a maximalist. I don't have all of my capital in Bitcoin. And while I have a regular DCA of what I can afford going into Strike/BTC, I also put capital into a fully diversified investment strategy with stocks, funds and other things. Because while Bitcoin may be the best option for a global reserve asset, unless we buy mining equipment there is no built in revenue stream that will increase our assets over time within the Bitcoin network. So my investment goal is to build a portfolio of dividend paying investments on the wall street side, and then continue to buy Bitcoin on the crypto side for the rest of my life. It would be nice never to have to "sell" a single sat, only use them for zaps towards posts on Nostr that I like.

I still don't see a lightning bolt, but I do have notification that you sent a zap at 12:25pm PST.

best New Year's in a very long time.

search algorithms to help us find content, not filters to control content.

My opinion is that the current system of an inflationary currency is tyranny. It's a harsh word, used in order to get strong reactions. Let me be even more clear and more harsh. The US Dollar and the systems that create it and support it is destroying civilization, and it's time we said that out loud.

If I put $100 into a bank, it should be able to buy $100 worth of goods and services in 1 year, 10 years, 100 years. Period. The reason it can't do that today is because we have an inflationary currency that loses purchasing power over time, and that's a failure of design and implementation. There are reasons why such a system might be desirable for certain groups of people or institutions, but the cost of such a system is too high for everyone else.

It is possible to design a system that would be able to maintain purchasing power over years or decades. But it would take the full cooperation of everyone on the planet to make it work properly. And no matter how much we yell "why can't we all just get along", it's just not going to happen. So the ONLY alternative is a fixed supply monetary foundation, and the changes that come with it.

The next few years or decades is going to see the implementation of that system, no matter what we think. Because it is the only path in front of us. We can delay getting on that path, but that's not going to work forever. As of today, everyone who is invested in the stock market in any capacity is invested in Bitcoin. There is no way to escape, resistance is futile.

So learn about it, ask questions, yell and scream at the brick walls, whatever. The future is coming whether we are ready for it or not.

Just saw a video from Katharina Pistor about her book "The Code of Capital". This was shared with me on Facebook after I asked my wall "What is Money", and it's an interesting set of concepts.

https://www.youtube.com/watch?v=m81pkJs5fcY

My comments in response:

First aspect, Priority, is enforced within the Bitcoin network in several ways. First, on the non-custodial blockchain itself, if you don't have the keys to a wallet, none of the assets in that wallet are available to you. Zero. It doesn't matter what the law says, it doesn't matter how much force is used, without those keys the assets can't be touched or manipulated. Second, in custodial wallets, you can have institutions working in the same way that banks work in the fiat world, giving you access to your assets but keeping the keys safe so that if the law identifies those assets as being needed to pay a debt, they can be accessed without undo force. If a court requires a bank to open an account and pay someone from the assets, they can and will do that. Perhaps that is why so much effort is being made to bring as much Bitcoin as possible under the control of financial institutions, governments and other potential third parties. They will never get all of it, there will always be some on-chain that are excluded from legal control, but if they can build financial tools and infrastructure using custodial wallets it can work exactly like the current fiat custodial system with the added advantage of the limited supply. Which I'm sure some people are trying to get around, but we'll deal with that eventually.

Second aspect, Durability, is absolute within the Bitcoin network. Much like Capital itself is a conceptual framework, the blockchain makes it visible exactly how much of the 21 million BTC that are available are in each and every wallet address at any given time. Once released by a miner, BTC can neither be created nor destroyed, only transferred between wallets.

Third aspect, Universality, is also part of the reason Bitcoin is superior because the asset is pure mathematical and computer code, making it completely safe against destruction. And if contracts in custodial systems like I described above are put into place, guarantees can be made that a certain amount of capital is available to replenish "lost" BTC from a reserve if someone is stupid with their keys or one of those third party custodial systems is hacked.

Convertibility is a potential weakness in that there is only one form of BTC, and that's the numbers on the blockchain. In order to convert those numbers to other types of assets, it requires an exchange of value. And "cash" or physical representations of BTC do not exist, except as perhaps printed materials related to wallets on custodial third party controlled accounts. Again, goes back to whether third party custodial systems are needed, and in order for the current players in the financial games to keep control over our lives and our nations, they probably feel the need to take control over as much BTC as possible as quickly as possible so that they can continue to keep that control.

The enforcement mechanism in the pure non-custodial blockchain system is simply the keys, nothing else exists. And third party actors, meaning any institution or legal entity, are unable to overcome that in the context of BTC. I agree with her premise that these various sources of law have all of the power in the fiat systems. But they have NO power in the on-chain system. It's pure peer-to-peer.

I usually joke that I'm looking forward to moving to an orbital station in the Sol-Earth L5 area. But that will take at least a few hundred years to construct.

Once we end the tyranny of currency that loses purchasing power over time, we can dispense with the primitive idea that the goal of business is to accumulate wealth, and instead focus on the real reason we have competition and cooperation, which is to lower costs.

And it seems to be working this morning? maybe something related to the clock...

Happy New Year!