Isn’t the obvious leak here that the exchanges are cooperating with authorities and telling them time, amount and user details of every monero deposit/ withdrawal?

If the sender or receiver of a transaction shared details of the transaction with others, is not a failure of the protocol.

Savings aren’t idle though.

If you deposit 1000 euros to a savings account paying 1% interest, the bank doesn’t just put your money out the way and generously give you 1% extra a year.

No, they take your money and invest it in something else, with the goal of making 10+%, pocket the majority of it and throw you a small kickback for letting them use your money to make themselves richer.

The money is hard at work. It’s just the saver that isn’t seeing much benefit from this.

She already was, for 90 minutes, while Biden had an op.

https://www.cnn.com/2021/11/19/politics/kamala-harris-presidential-power/index.html

Small airlock doors, obviously.

Personal responsibility

So he’s going to compensate you for your losses.

Right….

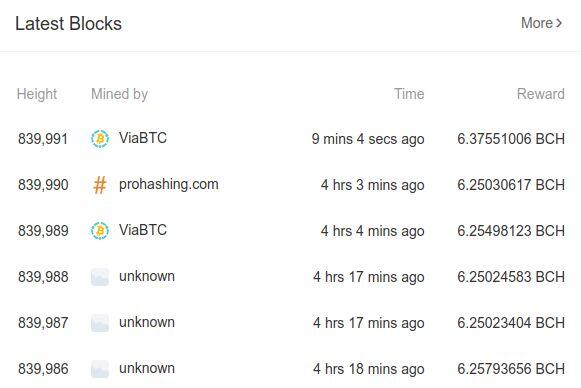

Bitcoin Cash is 8 blocks away from their halving and the network is behaving erratically.

They just went 4 hours without a block mined.

Their version of mempool dot space is down: https://bchmempool.cash

Perhaps miners are moving away from bcash, given it’s about to be worth a lot less to mine, leaving it with a far lower hash rate than its current difficulty would suggest.

Welcome to law

Anti-drone defence might be more practical. The energy required for an effective EMP is huge and fairly inexpensive to defend against.

For drone defence, try this:

Today is a good day to create a secure off-site data backup.

https://blog.lopp.net/how-to-securely-back-up-data-to-cloud-storage/

How do you protect against your yubi key breaking or getting lost. It is a single point of failure and has always worried me about using gpg in this way.

Just a more opaque and hidden way for the Fed to give the banks money to bail them out

It signals to the listener that “the point” is about to be reached, so they should start paying attention now.

SARS happened long before covid and trained affected regions.

Post them here so we can see the nsfw app store images.

nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a you might be pleased to know Broken Money is #1 in its category on Amazon UK

Could it be that the engagement on other platforms is an illusion, created by fake users and the service provider.

Seems that’s how Reddit was bootstrapped, for example.

I think it is naïve to think that the people of the world will control their bitcoin.

Currently it requires a high degree of technical competence to store and protect your funds. The problem with being your own bank is that you have to be a bank. The $5 wrench attack is very real, and robbery becomes much simpler if everyone self custodies.

It is logical to conclude that the majority will let other store and protect their bitcoin. And we are back with banks and governments that can take what they like from you.

So what’s bad about a bitcoin future? It might look exactly like the present.