This image keeps popping up since decades but I've always thought it's really stupid.

The two foods serve different purposes.

A beer in Germany costs less than a bottle of water and no one says "there is a problem with the system!"

You must take off your shoes to enter this bank, because thieves always use shoes to rob banks!

Fucking retards

Does this work unilaterally? I mean if your company disappears

I really hope for some more effort from simplex devs, there are dozens or maybe hundreds of issues on github without any meaningful answer. Looks like they are very understaffed for such a project

In the same webpage right after your article Forbes serves me a big "Why DOGE is important". Forbes is embarrassing.

Thank God Bitcoin has brilliant minds like Peter's that help us grasping those things

That confirms the fact they don't bruteforce the PIN.

It doesn't work like that.

The PIN on latest Pixels works like the PIN on hardware wallets with Secure Element. The encryption key is not the PIN. The key is protected by the SE and the PIN is used to ask to the SE for the key. The SE avoids PIN bruteforce.

We should not. It's not wealth like Bitcoin, it's the ability to publish one's thoughts, so it shouldn't be given to anyone else.

Hey guys still no 12-word seed creation?

Discord is rolling out end-to-end encryption,

Do you trust it?

Before you rush to say no,

It's designed and audited by the same auditors that SimpleX uses (Trail of Bits)

So do you trust Trail of Bits to say SimpleX is secure, but not design Discord's encryption?

You know I actually wrote Trail of Bits to ask on pricing to audit my own app (which isn't a messenger btw). They use Gmail, so I used PGP.

The guy at Trail of Bits apologized that he didn't have his PGP key anymore, since he never gets encrypted emails. Aren't you guys supposed to be receiving code to audit or emergency 0-day flaws? That's going naked over Gmail? So he directed me to a web browser app that had third party Google JavaScript and claimed it was end-to-end encrypted. This might be true, but he has no idea what that JavaScript was doing.

So without even looking at the details of Discord's new thing, I can tell you they don't give a rat's ass about privacy. All this is doing is trying to remove legal liability in a post Telegram-legal world. But we can remove legal liability for them, by not using Discord.

Source: https://discord.com/blog/meet-dave-e2ee-for-audio-video

What do you think of SimpleX?

Big point in favor of Nostr success here.

To avoid physical attacks, majority of bitcoiners keep their interest private. Rightfully.

With Nostr you can go around with a Nostr T-shirt and have orders of magnitude smaller concerns.

(Not zero though)

Your story is beautiful, but it's better for us to wish for a future in which Nostr relies on some economic incentive instead of voluntarism.

hey guys set up a lightning address so we can zap the improvements

You're right! Thanks for the patience

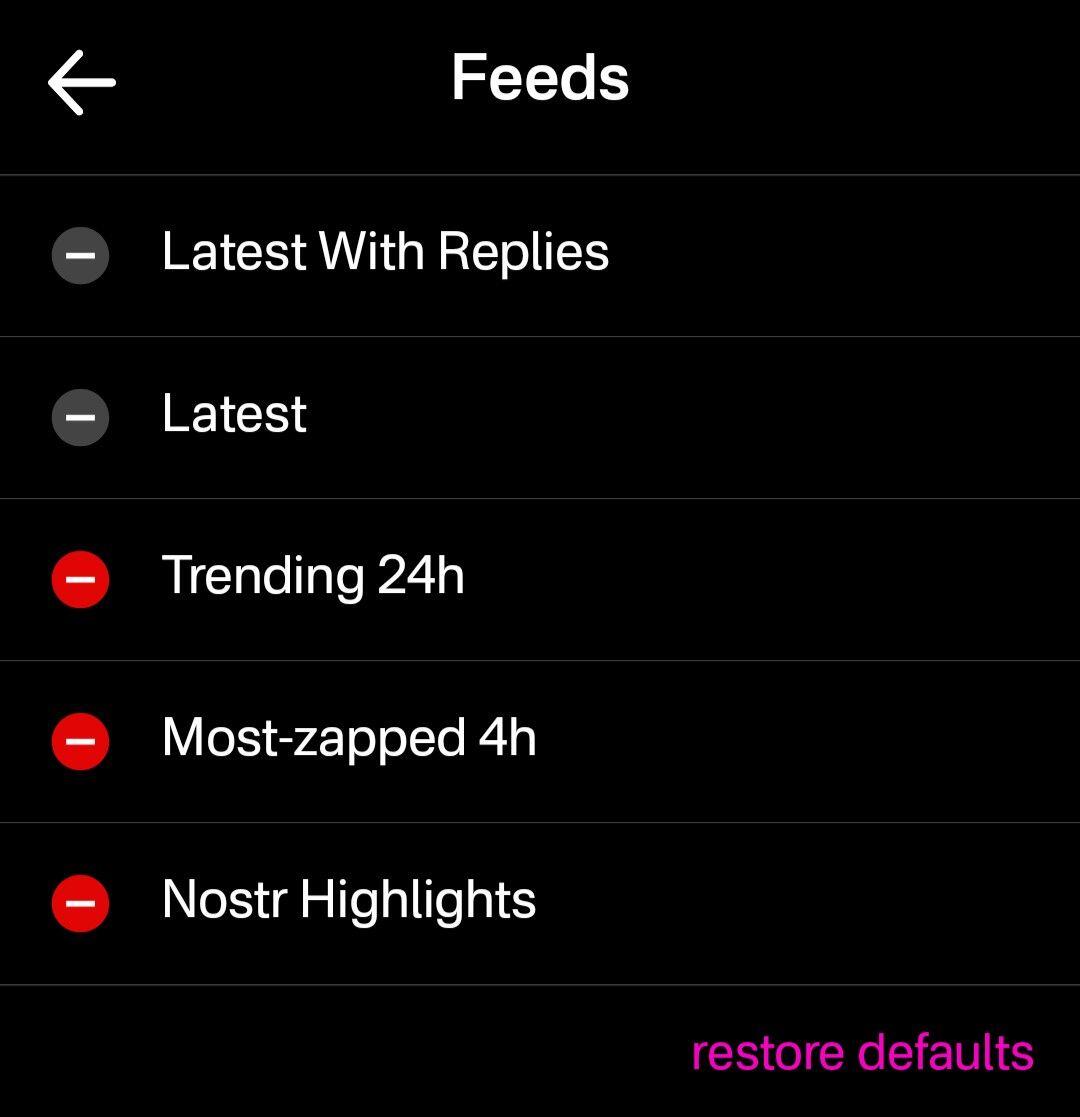

Sorry but I can't understand how. It seems there is no way to drag and reorder elements.

It all depends on the format you play.

Modern costs a lot and the power creep is huge, it forces you to spend $$$ almost every year.

Forget Legacy.

Pauper costs nearly nothing but you have to like the playstyle.

Commander I don't know I don't play it.

Advice: Pauper is OK; the rest is wasting money, just play with proxies with friends at local small stores which allow them.