So true. We have a body for a reason, and yet it’s probably the most neglected part of our reality. The state of most bodies is tragic. nostr:note17qyv7a4vkyye447nwwhhddf6z73nlxk5w2y0z0nqzlc4m0qxmq6qzrjuz0

I’ve seen Jeff Smith’s Bone in comic shops for as long as I can remember. I never read it but it was like that one album cover you always noticed every time at the record store - something just caught your eye. RASL is amazing. I only realised it was Jeff Smith from Bone after picking it up. Such a great story combining sleuth, private investigations, love and science (Nicholai Tesla fans, anyone?). Give it a go.

Bitcoin’s worst performance over any 4 yr period from 2011, is 23% annualized. This presents a very credible argument for inclusion in any portfolio; state, business or individual. It’s volatile to the upside, sorry to say. It’s not going to be very stable.

https://x.com/michliq_/status/1884531521475805444?s=46&t=1h13yD0xG3H5pbAzUkoTEg

We are still far from main stream adoption.

I recently wanted to test / check my seed phrase for my #blockstream #jade wallet. Just to make sure I didn’t have a typo somewhere. Turns out you can’t do that. I had to move all the funds, wipe the device, setup from scratch and generate a new seed phrase. I wrote that down like four or five times to make sure.

Then, when I tested the seed phrase on Sparrow wallet I could only see one account balance. I have three accounts on the device.

There zero documentation that I could find explaining I needed to change the derivation path to access the funds from each account. Zero.

I stumbled upon the solution quite by accident. I now have added the paths to the seed phrase for future use, that I hope I will never need.

Don’t get me wrong, I love the Jade and it’s a great device. But, while I’m no dev, I do run a full BTC node, and LN node, #alby hub, using #btcpayserver to invoice clients in bitcoin, etc.

But, if I had lost my #jade and needed to restore the wallet I would have needed help to access all the accounts. This is not how it should be.

Today, I have learnt something nostr:note1343x79madjchyha4dfzneu4nsrq977nchmrar4wjrvmy9gzlugqsc8mfa0

The least they could do is give you the car for free. nostr:note1sf56gjr8srwa793uch0ykew8m5zam98axynp3gzpcz0l9carypfqvm9suh

I would like to add to the old saying, ‘If women ruled the world there would be no more wars’, by adding ‘If women ruled the world the wars would never end.’

Men will punch each other in the mouth and then go have a beer together afterwards.

Women can hold grudges a long time.

So what’s all the hoopla about DeepSeek and why is it breaking everybody’s brain right now in Ai?

I’ve been doing a dive for a couple of days and these are the main deets I’ve pulled together, will have a Guy’s Take on it soon, so stay tuned to the nostr:npub1hw4zdmnygyvyypgztfxn8aqqmenxtwdf3tuwrd44stjjeckpc37q6zlg0q feed

DeepSeek ELI5:

• US has been hailed as the leader in Ai, while pushing fears that we need to be closed and not share with China cuz evil CCP and they can’t figure it out without us

• ChatGPT and “Open”Ai is poster child, eating up retarded amounts of capital for training and inference (using) LLMs. Estimates say around $100 million or more for ChatGPT o1 model.

• In just a couple of weeks China drops numerous open source models with incredible results, Hunyuan for video, Minimax, and now DeepSeek. All open source, all insanely competitive with the premiere closed source in the US.

• DeepSeek actually surpassed ChatGPT o1 on most benchmarks, particularly math, logic, and coding.

• DeepSeek is also totally open with how its thought process works, it explains and shows its work as it runs, while ChatGPT makes that proprietary. This makes building with, troubleshooting, and understanding with DeepSeek much better.

• DeepSeek is also multimodal, so you can give it PDFs, images, connect it to the internet, etc. it’s a literal full personal assistant with just a few tools to plug into it.

• The API costs 95% LESS than ChatGPT API per call. They claim that is a profitable price as well, while OpenAi is bleeding money.

• They state that DeepSeek cost only $5.6 million to train and operate.

• Capital controls on GPUs and chips went into effect in the past year or two trying to prevent China from “catching up,” and it seems to have failed miserably. As it seems China was able to do 20x the results per dollar with inferior hardware.

• The US model of Ai, its costs, its capes structure, and the massive demand for chips has been the model for assessing the valuation, pricing, and future demand of the entire Ai industry. DeepSeek just took a giant dump on all of it by out performing and spending a tiny fraction to achieve it while also dealing with lack of access to the newest chips.

All of this together is why people are freaking out about a plummet to Nvidia price, reevaluation of OpenAi, and the failure of US to stay dominant or even the legitimacy of staying proprietary as it may just cause us to fall behind rather than lead. All after a $700 billion investment was just announced that now just kinda looks like incompetent corporations wasting horrendous amounts of money for something they won’t even share with people, that you can’t run locally, and is surpassed by a few lean Chinese startups with barely a few million.

I’ll catch that podcast for sure. Curious if any of their claims about what they spent can be verified? Also, any way to check that the search inputs and out outs aren’t stored somewhere. I guess if it’s fully open source that can be verified.

What is a Bitcoin Strategic Reserve and how to get started.

What is a Bitcoin Strategic Reserve? I'm so glad you asked. This is just a fancy way of saying you have some savings in Bitcoin. In the case of an individual person this would be the same as a savings account, except in bitcoin. In the case of a company this sort of savings would be called a treasury. Company treasuries don't come up in conversation too often simply because most companies can’t leave cash just lying around in case of an emergency. Inflation eats away dormant cash like a melting ice cube. Reference previous article for more details. The profit predicament.

As more and more businesses start to look at a Bitcoin Strategic Reserve (BSR) it’s worth discussing some ideas around this. There are a few ways for this to be done:

Firstly, the SBR is a reserve. It’s not working capital, and it’s not short term investing. It’s capital that can be stored for at least 5 years without disrupting company liquidity.

Now how do you actually go about creating one? Let’s look at two options.

1. Buy Bitcoin with retained earnings and store it, or

2. Get paid in Bitcoin and store that as your strategic reserve.

Option One:

This option involves the company opening an account with a registered Bitcoin exchange. Be prepared for some serious admin jumping through all the KYC hoops – exchanges are financial service providers after all. Deposits funds to the exchange account, and then buy Bitcoin. The exchange typically charges between 1% and 2% per transaction, but make sure to check the ‘fees’ page on your chosen exchange. Fees are different for each type of transaction. An eft payment from your company bank account to your exchange account is the cheapest but you do have to wait the usual 2-3 days for the fund to clear. You can use quicker payment options but fees tend to be higher for the convenience.

Option Two:

A much more interesting option is getting your clients to pay you in bitcoin. This way you can get bitcoin without having to open an exchange account and go through the troublesome KYC process with multiple verifications and emails forwards and backwards. You also avoid the exchange transaction fees but, more importantly, you also avoid the merchant fees for credit card transactions.

Merchant accounts for businesses charge between 2.2% and 3.5% per transaction this means for every R100 your client pays by credit card you pay R2.20 – R3.50 to the bank for the favour. Of course, there is also an initiation fee the bank charges for the hardware and setting this up and there can be a monthly admin fee that you are required to pay to continue the service. There is an increasing number of third-party companies providing the similar solutions but the fees are pretty much similar to traditional banks.

https://www.news24.com/news24/bi-archive/card-online-payments-south-africa-2021-6

Something else to think about with credit card payments is that you don't actually receive the money immediately. Yes, the transaction shows as approved when the credit card is swiped and your customer takes his product or service, but the funds only arrive in your account days later. This means that not only do you pay a transaction fee but you're also going to spend up to a week waiting for your money.

For the sake of simple math let's use 5% as the cost of taking money you have earned from your business to purchase Bitcoin (3% merchant fees and 2% exchange fees). Now imagine if your client paid you in Bitcoin. This means you now get the Bitcoin at a 5% discount and the Bitcoin is stored directly to your account.

Business owners sometimes say that they cannot afford to lose out on rands and that they need every penny to meet their expenses. The reality is you are not going to be converting all your sales from rands to bitcoin overnight. You will only have a very low percentage of people using Bitcoin to buy your products and services, at least for the moment. Pick ‘n Pay stores have been early bitcoin payment adopters and even with their national footprint of groceries (cheap daily necessities) they only received 0.34% of their annual turnover in bitcoin.

The fees that you are paying on credit card transactions are going to amount to far more than what you would miss by being paid in bitcoin with a near zero transaction fee. This is also a convenient savings tool as the bitcoin that comes in gets stored and left there. It's a small percentage you probably won't even really notice it and yet it's just going to add up week by week, month by month until you have a really significant portion. Think of this as a forced savings account.

You can even afford to incentivise clients to pay in bitcoin by offering a discount.

Another benefit is that by offering or by accepting bitcoin payments can sell to customers outside of South Africa, that would normally have difficulties sending you cross border payments via traditional means.

Speak to us for more information.

https://bitcoinforbusiness.io/what-is-a-bitcoin-strategic-reserve/

Sweet, thanks. I’d zap you but…..

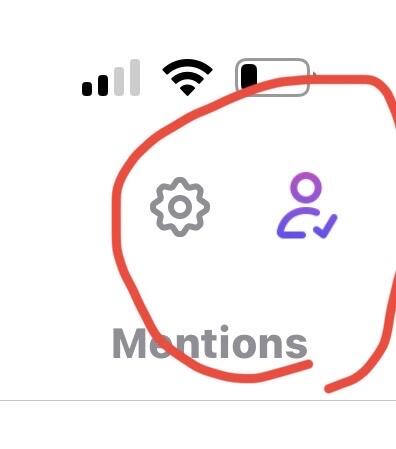

What is this purple icon on the top right of the screen on Damus? You can tap it on and off (purple or grey)

Devices like these may be the ultimate solution to mining centralization. Someone on a podcast last year said they imagined a future where every single electronic appliance/ device would have a mining chip embedded. That’s a future I was to see.  nostr:note17f0gqk93mevr6qz4kcu9wdl9pvnkeehdxpf4224fxs9dzt42vfzq9xt0f2

nostr:note17f0gqk93mevr6qz4kcu9wdl9pvnkeehdxpf4224fxs9dzt42vfzq9xt0f2

When people working in bitcoin aren’t Bitcoiners, this s what you get. nostr:note17f0gqk93mevr6qz4kcu9wdl9pvnkeehdxpf4224fxs9dzt42vfzq9xt0f2

Pretty incredible to have a major national retailer accept bitcoin. nostr:note1q78m5709hmcrun6x0u8klfru8k95ukllt9yq90gkpuv6xcqee8uskrlw3l

Spread the word nostr:note16pmry0h6w6w3wygugxed6g5zatm4r86q45urt4g20vfsu4mqf78sgpq4hy