You are one of the most coherent and honest debaters I've come across here.

Thank you.

Monero’s approach to miner incentives, using tail emission, prioritizes predictable, ongoing rewards to maintain chain security, which is a pragmatic solution but comes at the cost of permanent, protocol-level dilution for all holders. It’s a valid technical path, especially for a privacy-focused coin, but shouldn’t be portrayed as “more mature” simply because it avoids relying on demand for blockspace and organically emergent fee markets.

Bitcoin’s model, while demanding more from its users and market dynamics, anchors security in a combination of finite supply and the willingness of participants to pay for settlement, not in endless inflation. This challenges the ecosystem to innovate around transaction batching, scaling, and efficiency, ensuring that miners are still incentivized as the block subsidy declines.

It’s not a question of maturity versus immaturity, but of different tradeoffs: Monero chooses steady dilution for predictable security, Bitcoin chooses absolute scarcity and tests whether transparent fees and technological ingenuity can secure the chain. Downplaying the technical rigor of one approach or the economic principles of the other misses the point; both are serious experiments in decentralized security, and each deserves honest discourse, not cheap shots.

Gold’s “inflation” was always diminishing, not fixed, and its credibility came from new issuance becoming negligible over time, not from a permanent tail.

And yes, Monero’s tail emission is a practical approach to miner incentives, and Monero itself is a strong contribution to freedom tech and financial privacy. There can never be too much of freedom tech.

It’s bad faith for Monero advocates to repeatedly claim that Bitcoin’s hard cap will spell economic disaster through deflation. Historical evidence and economic theory both show that mild, productivity-driven deflation isn’t destructive — it’s often associated with growth and rising living standards.

Raising these fears ignores the real-world success of sound money periods and overstates the risks of Bitcoin’s approach, especially when both systems aim to empower users and preserve freedom of choice. Both systems offer real value and choice, there’s no need to attack one to legitimize the other.

Monero’s approach assumes we must inject uncertainty to preserve function — that error is a feature, not a bug. But monetary policy doesn’t need to be a balancing act between loss and growth. It needs to be clear, fixed, and incorruptible. Bitcoin gives you that. #Monero trades it away for a false sense of continuity.

Truth is: you can model inflation via discounting. You can model deflation via premiums. One assumes value decay and demands compensation. The other assumes value retention — and rewards patience and foresight. Neither breaks the economy. But only one requires trust in a planner.

#Bitcoin doesn’t hinder spending. It reconditions it.

And that terrifies those still addicted to the inflation drug — even if they code in Rust.

Mises did not treat central banking as capitalism; he firmly opposed central banks and any form of centrally controlled monetary policy, arguing that true capitalism requires free-market money. As he wrote in "Human Action":

> “The gold standard is the world’s money. It is not the money of governments and kings, it is the money of the people... The government may destroy the gold standard system. But it cannot replace it.”

Mises was clear that central banking represents government intervention, not a feature of capitalism.

> Hayek likewise favored letting prices fall when output expands, criticizing monetary policy aimed at artificially stabilizing prices. Hayek’s “neutral money criterion” held that prices should fall during real growth, and he opposed using monetary expansion to counteract such benign deflation.

This cuts through the core premise you guys put forth: few monies chasing more goods is BAD. This is just fiat logic in open-source clothing.

I provided enough evidence that this is not the case for any reasonable man.

Mises and Hayek did, in fact, defend the legitimacy, and even the benefits, of mild deflation resulting from productivity gains.

Mises argued that declining prices driven by expanding wealth and productivity are signals of rising living standards, not economic dysfunction. He explicitly stated, “when prices are declining in response to the expansion of wealth, this means that individuals’ living standards are rising,” and that such deflation is good for the economy. Hayek likewise favored letting prices fall when output expands, criticizing monetary policy aimed at artificially stabilizing prices. Hayek’s “neutral money criterion” held that prices should fall during real growth, and he opposed using monetary expansion to counteract such benign deflation.

The historical record, and their writings, demonstrate that both thinkers supported, not feared, mild deflation booked to real progress, contrary to what you claim.

Below are some links to prove this. Your intellectual dishonesty is obvious, pushing such disinformation to benefit your bias. On top of that, you are a bitter little person that doesn't deserve any further engagement.

Why Deflation Is Good for the Economy | Mises Institute https://mises.org/mises-wire/why-deflation-good-economy

Why Price Deflation Is Always Good News | Mises Institute https://mises.org/mises-wire/why-price-deflation-always-good-news

Declining Prices Do Not Destroy Wealth; They Enable Its Creation https://mises.org/mises-wire/declining-prices-do-not-destroy-wealth-they-enable-its-creation

Here's a long-post on this subject that might be of relevance.

It's futile to argue with intellectually dishonest folks. They claim Austrians were against mild deflation — an obvious lie.

With all due respect, citations should be provided for such claims.

nostr:naddr1qqxnzde4xvungdfexymryve3qythwumn8ghj7un9d3shjtnp0faxzmt09ehx2ap0qgs9zs7rw003k4y2wltea360yuj46y5md9d4yt0mt06rfx96fdgpm7grqsqqqa28qw5u0k

The security of Bitcoin’s network isn’t dictated by nominal sats/vB fees, but by their real-world purchasing power. As technology and energy markets evolve, the value each sat buys increases, offsetting declining block subsidies and flat fee rates. What secures #Bitcoin is that the cumulative economic value of block rewards (fees plus subsidy or just fees from 2140) remains sufficient to incentivize honest miners, not whether fees rise endlessly on a chart.

Lightning’s off-chain scaling doesn’t weaken base layer security—it specializes it. Most #Lightning channels close cooperatively and can be timed when fees are low; force closes are rare edge cases, typically stemming from unplanned disruptions, not routine use. If on-chain settlement becomes costly, it’s an accurate pricing signal that higher-value transactions should take priority, mirroring traditional system settlement hierarchy.

Bitcoin’s long-term security model relies on efficiently aligning economic demand for settlement with honest miner incentives, not perpetual inflation or fee hypergrowth. As adoption and value rise, users will pay more in aggregate for scarce block space, even if that means fewer, but more valuable, on-chain settlements. Real-world miner costs continue to fall, and network security adapts dynamically—anchored in market forces, not central planning or silent dilution.

Block subsidy declining ≠ collapse.

What matters isn’t sats/vB staying fixed, but whether those fees buy enough real-world resources (ASICs, energy, bandwidth) to secure blocks. As hardware and energy sourcing improve, securing the chain requires less in monetary terms, not more.

Security in Bitcoin is dynamic. Miners respond to incentives. If fees dip too low, block space fills up, and fees rise—no central planning required. It’s a self-adjusting market.

As for Lightning exits, closing a channel costs one on-chain tx. That cost is amortized over time and traffic. If the mempool is full, you planned poorly or waited too long. Exit is always possible; it’s just priced like any scarce resource.

And no, #Bitcoin doesn’t rely on “price up forever.” It just needs enough value to outpace attack incentives, which adjust dynamically. Attacks, if attempted, create fee spikes or price surges, restoring the balance.

Bitcoin’s layer 1 is expensive, slow, limited — on purpose. That’s its guarantee. Scaling happens above it, not within it. That’s not feudalism, it’s voluntary hierarchy on neutral ground.

Cheap base layer security through permanent inflation like #XMR’s tail emission isn’t sustainable. It’s just stealth dilution. Bitcoin’s model requires planning, not tweaking. And it’s working, whether you like it or not.

#XMR cultists fear deflation but preach open markets — a contradiction they can’t resolve.

Monero cultists often attack #Bitcoin’s 21M hard cap by invoking the tired trope that deflation discourages spending, thereby preventing rational economic calculation. In contrast, they celebrate #XMR’s perpetual tail emission — planned inflation — as a necessary feature that ensures miners are incentivized and the economy keeps “moving.”

But this is orthodox Keynesian logic dressed in cypherpunk cosplay.

Most of self-righteous twats deserve misery.

The only comforting thought is that everyone is destined to die.

You wouldn't know unless you have one.

Fuck off noe.

When freedom loving #monero cultists try to discredit #Bitcoin and start pushing arguments in favor if centralized money control.

Cognitive dissonance at its best.

Arguing in favor centralized systems you are, then. My point exactly.

Calling me names? Triggered much? I wonder why? Was it the kyke thing? 😄

RELAX

Answer the question first and I just might entertain you with an answer.

Answering questions with questions like a kyke.

> your daily reminder that John Keynes was in favor of centralized control of the economy

This is what?

What does this mean to you?

Centralized economy means interventionism and this goes against the premise of "no state is the best state".

⚡️🚨 ALERT - Israel's destruction campaign of Rafah continue.

Footage shows Israeli soldiers cheering as they level an entire residential complex in Rafah’s Saudi neighborhood, southern Gaza.

Celebrating the destruction of civilian homes isn’t defense — it’s pure war crime.

https://video.nostr.build/2d68d99ed78362b33ac932af249815d990a7a7988f9b231f1072961516bea475.mp4

The aim is to build third temple and welcome Messiah

You don't see how you're arguing in favor of centralized systems?

You can't starve children to death in self-defence, no matter how much you twist the narrative.

Save #Gaza

Will nostr:nprofile1qyv8wumn8ghj7urjv4kkjatd9ec8y6tdv9kzumn9wsq3vamnwvaz7tmjv4kxz7fwwpexjmtpdshxuet5qqsqfjg4mth7uwp307nng3z2em3ep2pxnljczzezg8j7dhf58ha7ejgqgzx3h have me on RHR to learn about Pubky?

In good faith, for the freedom of the internet?

I think RHR is the one podcast I've not been on yet!

That's a conflict of interest.

What do Rome, the USA, and Bitcoin have in common?

According to Erin Redwing, the answer lies in the stars — literally.

In our latest BitCorner episode, she maps out how astrological cycles predict the fall of empires… and why Bitcoin might be the next era’s foundation.

https://blossom.primal.net/bd6b24cb03f83920da62261ce5e52a0840d6f943e59a91ba4d46b3ab025e2979.mp4

She maps...

Why didn't she map that shit and buy Bitcoin in 2010 lmao

What is this disenchantment with #bitcoin going on here lately?

#asknostr

I'm thousands of miles away from my servers and I'm still able to zap notes here with the same ease as if I was sitting in the same room.

#bitcoin and #corelightning nodes connected to me by the magic of #nwc and #headscale is pure satisfaction.

I see it pings but there are no posts relayed through it to my client. Doesn't it relay posts from the other public relays while filtering out spam?

Go to system settings, developer options and check running services, your gboard is running extra services even when it's without permissions.

I had similar setup with it, but I also had Google play services installed. The Gboard app communicated with google play services without any permissions. If you have installed Google play services and it is rubbing alongside Gboard, it is not such a sure thing that what you type stays on your device.

Anything users find of quality, could be articles, news, art, music and so on.

Speaking of wallets and accounts, when pubky implements zapping? It's crucial for incentivizing good content.

Ironically, nostr:nprofile1qqsgeksa4tajm7x673gq2v7t56dkgkh6pjhhzdhrgxlpke4za8jmmkqpzemhxue69uhhyetvv9ujuurjd9kkzmpwdejhgqgjwaehxw309ac82unsd3jhqct89ejhxqgkwaehxw309aex2mrp0yhxummnw3ezucnpdejqetk0p4 uses #walletofsatoshi for nostr account 😂

No, no, I meant @nsec.app

Yes, but the trend of volatility contraction is ongoing.

It's a nice thought experiment, that's for sure.

Was Big John right? Not sure about upgrading to H though 😆 https://video.nostr.build/2e8879da23d0885f6837550cb59abc8cb9b3cd6983a2d0f6ab1878be703d2a76.mp4

Depends on what kind of smoker one is.

Why would they do that if the guy's a net negative for nostr?

While we are very excited about nostr:nprofile1qqs8t4ehcdrjgugzn3zgw6enp53gg2y2gfmekkg69m2d4gwxcpl04acppemhxue69uhkummn9ekx7mp07rhc3q, we are also riddled as to the differences between #keychat and #whitenoise.

I'd like a nice comparison table showing the key differences between these two.

#asknostr

That's great, it starts one at a time. I'm more worried about businesses not accepting Bitcoin, and seeing not much of an effort in this direction by bitcoiners.

⚡️⛏️ WATCH - Bitcoin’s Orphan Block System

https://blossom.primal.net/d2564e0f756edb3e42ec0bc1b3679cc311b370ea8585524078eaae898630e5b8.mov

Love how nostr:nprofile1qqsrk63a8wentzpk5ex3eqpf9wtww6vwcddzuh9y2800567n4ulwhpqppemhxue69uhkummn9ekx7mp0t64q2q style blocks keep popping up everywhere

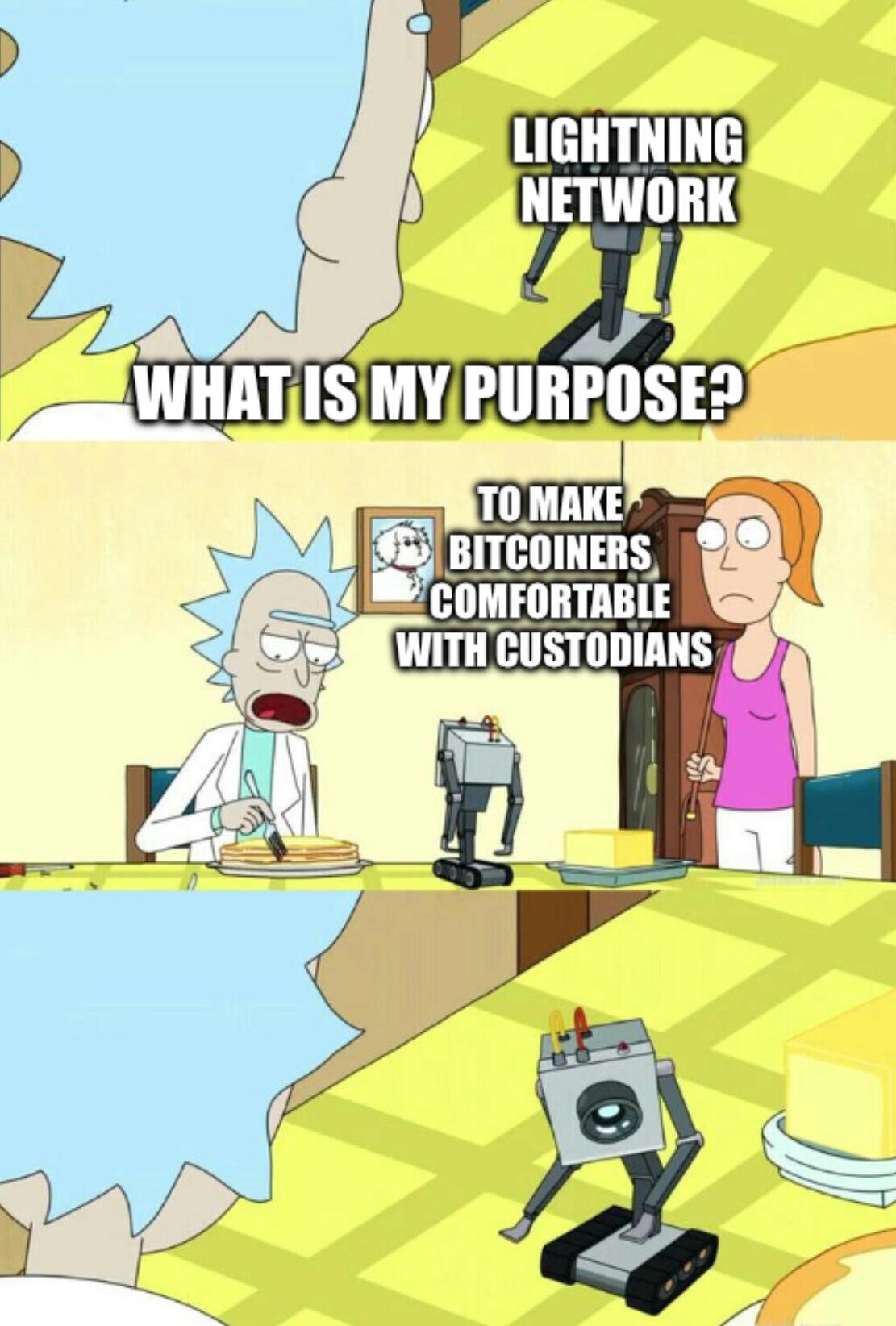

There's non custodial lightning too, so so of a generalization.

> the likelihood of a Gaza ceasefire (more like the likelihood of stopping Gaza genocide)

Seems it won't stop until they free up the place for a massive real estate project with the third temple of Solomon being at the epicenter of it. In judeo-christian teachings, that's one of the omens that needs to occur. How can it occur of the place is filled up with Muslims and they got their second holiest mosque there?

Well...

...now you know how.

It's certainly more resilient, but there's not an evident upside here in sight.

But it's nonetheless a good idea to outsource the processes that are legally of higher risk premium.