ok so its the block template. thanks for the clarification

i thought these were solo and similar to lotto ticket odds, although i love the decentralized hash rate component. do some folks point the has rate to a pool ?

the downdrafts dont bother me as much anymore and have learned over the years to just hodl and accumulate. stack would be bigger if id realized that early on but takes some of us longer to see the light

I’m now officially a “Node Runner”!

By running my own node, I help make the game:

More decentralized.

More secure.

More private (self-sufficient).

More efficient.

I don’t trust, I verify, hence more integrity.

More of the people, by the people.

Thx to everyone who helped me level up, including our conversation - nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe 🙏🏻 very grateful!

that's great Efrat - recently started running one myself and love how accessible it is to help network decentralization

it seems like many in the global West can sense problems with the money but dont know the source or the solution. the legacy biases are so entrenched. guess many people need to experience severe pain/problems to do the work

they're going to need a bigger printer

Lopp ( nostr:npub17u5dneh8qjp43ecfxr6u5e9sjamsmxyuekrg2nlxrrk6nj9rsyrqywt4tp) asked him the question i was wondering when i read that: shutting Bitcoin service providers or outright mining bans doesnt kill the network. Seems to be making a case around censorship resistance and PoW. Was surprised because i thought he had a solid history of Bitcoin-only advocacy

this has been a really tough one - what seemed like a well telegraphed recession from a major hiking cycle, inverted yield curve and bank failures hasnt played out yet due to printing, helicopter money and massive fiscal deficit spend.

obvious consequences are $ debasement and price inflation, unaffordable housing etc, but they've kept the music on for now. recessions seem to need a catalyst which i thought were the bank failures but they stepped in with BTFP

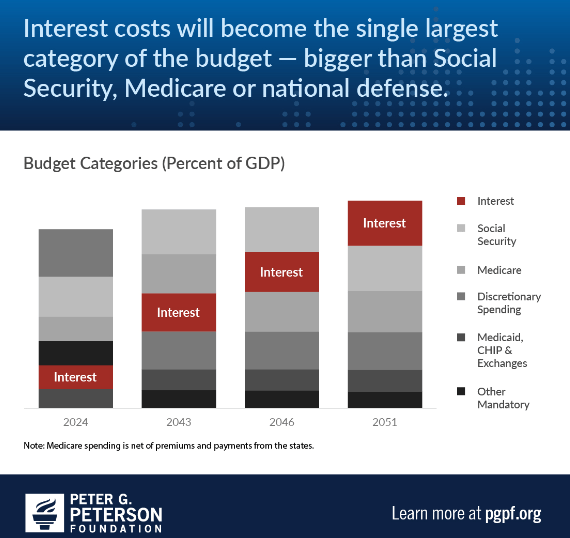

federal debt and interest expense % of budget are becoming a major problem as James has pointed out which means ever more debasement

seems like a disconnect between equity market and the magnitude of cuts priced into the forward curve in '24/25, which would suggest a weaker backdrop. do you take any signal from the de-inversion of the yield curve ?

that resonates Dr J and the rumors of this recession have been exaggerated since last year. the data and the 2-year yield move seem to guarantee a cutting cycle which should help normalize real estate. that said the employment / wage and savings rate / delinquency figures have deteriorated so curious how you're thinking about demand. are you basically thinking that recessions typically need a shock to catalyze and that the lower-end consumer doesn't really drive the bus on overall growth?

i think treasury and fed are deathly afraid of significant asset price declines and will step in with printing / liquidity

patience is harder than kindness for me but fatherhood, bitcoin and mediation are helping

that is really impressive in a ridiculously competitive category - congrats!

savings rate is down and may even be negative excluding govt transfer payments from income. also seeing credit card balances increase meaningfully. auto and cc delinquencies on the rise

i love how accessible it is to run a full node for a non-technical slightly over the hill dude. thankful that decentralization won out over the big blockers. tick tock

kalamata olives. roasted, unsalted almonds and cashews