Good luck with that! 💪💥

Two thoughts.

1 - Don’t underestimate your roots and culture. Speaking from own experience. 3 years somewhere is nice, but if both you and your wife are German, it’s tough to settle long term in another place. You’ll need connections

In e.g. Mallorca you’ll find some nice German communities and bitcoiners, and it’s a hop to Germany

2 - What you’re looking depends a lot on your own expectations from the word “freedom”.

Europe has a lot of advantages, but you’ll need to keep it low key.

Other places have their own set of tradeoffs

Really looking forward to attending #BTCPrague

It’ll be the first big conference I go to

Recommendations welcome!

👋 Servus David!

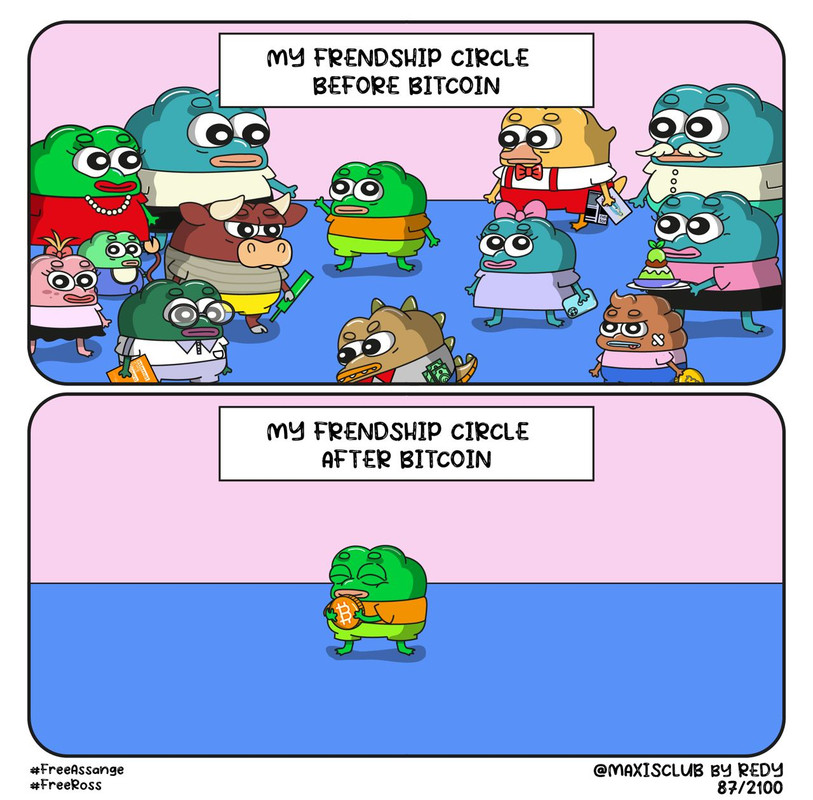

Us bitcoiners have the responsibility of creating bigger and stronger families and communities around us

Birth rates are the ultimate signal that reveal how optimistic we look into the future

Let’s turn the course of society around!

Bitcoiners who can but actively decide not to have more / any children reveal a suspiciously high time preference, which is a symptom of the fiat disease

Was there ever a SGR?

My understanding:

Gold coins > banks as custodians > banks issue notes fully backed > banks issue more notes than coins (fractional reserve) > central bank created as lender of last resort to local banks > local banks to deposit assets at central bank

Please include me 🙋♂️

I’ll be in Bavaria but might be able to drive by

🇪🇺 Europeos, cuidado con vuestros ahorros!! 💶

Tenemos aprox 3M de funcionarios (Estado, CCAA, Administraciones locales), aún queda camino por recorrer 😅

My mempool, my rules.

Anyhow, I’m very optimistic that these non-monetary transactions will eventually fade away. There is no fiat scheme that can subsidize something that does not generate net value forever.

POW all the way 💥

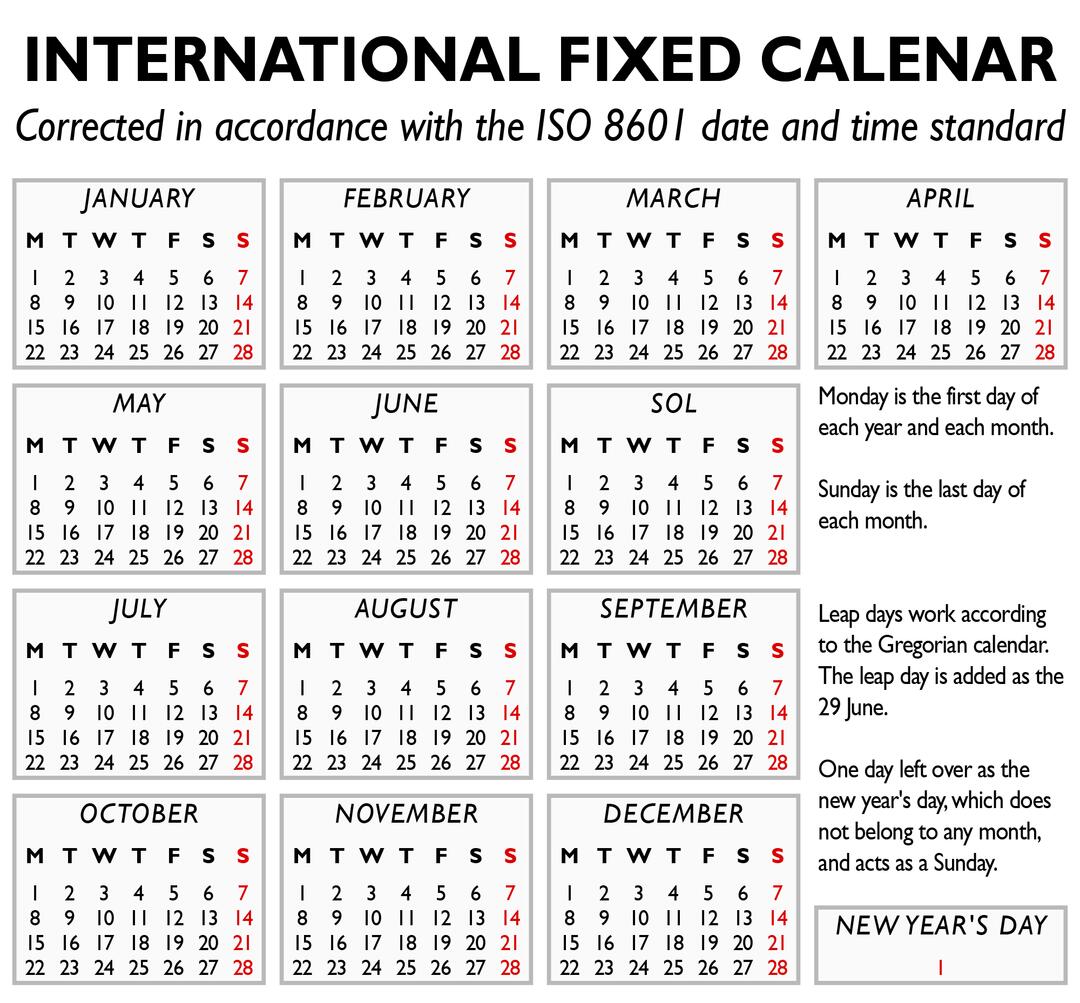

AFAIK the whole American continent starts their week on Sunday, whereas the whole Eurasia and Oceania do so on Monday.

If we also increase the definition of seconds by a tiny bit, we’d also get rid of leap days. They occur because in fact a year is 365 days and 6 hours long, so every four years you missed a day to account for

💯

Though bitcoining is just saving. We need to educate in distinguishing both terms

Better for individuals, better for corporations, better for Global South, better for interpersonal / societal relationships, better for climate and for the Earth.

Only problem: worse for cantillioners, central planners, and a relevant portion of public servants and employees of publicly-funded agencies

Even though that’s impressive, I think we need to still come a long way in terms of education and UX so that DEXs become relevant in terms of volume

Specially surprised because here in Europe, since 2025 with the Travel Rule things are getting worse

We’re in the middle of a massive shift.

From bonds - once the “safe haven”…

…to Bitcoin.

From the most „stable“ asset… to the most „volatile“.

Bonds were added to every portfolio as the so-called base layer of safety.

Because they guaranteed one thing.

You get your money back.

Truth is, that promise is dying.

Because even if you get your money back…

it’s worth less. A lot less.

That’s a hidden default & it’s happening at scale.

From “Who guarantees I get my money back?”

To “What guarantees my money keeps its value?”

Answer: Bitcoin.

Shift’s begun.

No clue when it ends.

10 years? 20?

No fucking clue.

Doesn’t matter.

Bitcoin needs to run to function.

So do I.

So do you.

Run!

You either see it now… or you’ll see it later.

Timestamp of freedom 897,966

https://blossom.primal.net/378e59c700932db3b119ac14f80e59c5268c5aacf5243a0b89c9e332a5b6eee4.mov

It will be an ongoing shift, at least for 1-2 generations

But why so bearish?

It’s not just bonds. It’s real estate. It’s gold. It’s equity markets. It’s FX markets.

Humanity will understand the difference between saving and investing.

The difference will be: we will not be penalized for saving