I know man. Truth is being inside a walled garden is necessary sometimes.

How do you get around? Some places literally don't have cabs anymore unless you have Uber. Prague one example...

To be fair I have been using it since 2020 or so

Uber can never find location - and tbh using Uber at all feels like a massive self-own anyway.

I use GrapheneOS.

Can't be making life too easy now can we.

Need a couple apps to just not quite work right for that extra spice.

So so true.

Be anything you want. Being "nice" is a failure to do anything.

He means we would need 90%. It wouldn't need to be that much, I estimate about 70% for actually seriously disrupting spam.

As funny as it is, BSV would deserve to be dead even if it was priced way higher. The market is likely just coincidentally signalling towards the truth here.

I don't trust people not to be idiots lol.

Thank you to everyone who has switched to Bitcoin Knots.

Happy father's day!

Everyone failed.

To be fair, it was a trick question.

Name something more delicious than steak tartare.

It's just cowardice, defeatism, ideological subversion etc. None of it has any coherence.

To this day, there are still people claiming that we think spam filters can stop 100% of spam.

I have made mistakes in this discussion because I'm so often technically out of my depth.

But I don't want to be doing this thankless, miserable fight if I have to lie to myself to maintain my stance.

So you can argue that I'm doing it for clout or followers or that it's somehow related to my paycheck from OCEAN all you want (it isn't) - but far more simple an explanation is that spam-apologists will just go along with those they perceive to be experts and never bother thinking things through.

Otherwise how could anyone possibly be making that argument?

Like I'm not aware that > 80 byte returns are of course consensus valid and thus can and do end up in blocks?

I see it from giants in the space, people with write access to Core. They have genuinely never considered the role that spam filters have played and created this absurd standard where filters must be as effective as consensus or be discarded one-by-one no matter how much the community pushes back against them for doing it.

Trying to point out how crazy this is gets you relentlessly mocked (yes obviously a lot of pro-filters are relentlessly mocking Core and their apologists right back) or more revealingly called "bots" or "LLMs". This happens in "official" statements even and formal write-ups about the decision making process behind merging 32406. People disagreeing with Core are spam/bots/Nazis and LLMs.

Honestly, many accusations have been thrown at Core devs for being - while comp sci experts - lacking in necessarily related fields like economics in particular.

But it isn't that - what's lacking is genuinely the ability to look at your own motivations and ask yourself if you're truly being honest with yourself or lazy in your assessment in an effort to cherry pick whatever is necessary to end up back in alignment with those with the most influence and control.

Everyone is aware of the psychology at play here, and it's why - in any conflict where you don't have a vested interest - people naturally side with the underdog.

This is why when people completely outside the loop of Bitcoin hear some story like "Hijacking Bitcoin" and they so readily believe it because underdogs are logically almost always fighting for something out of principle while the people they oppose have power that they wish to maintain.

No this doesn't make the underdogs correct in every circumstance. Stubbornness and narcissism play a role there too unfortunately.

Regardless, it's a sensible heuristic.

Why is a pool with < 1% of the hashrate trying to change the way mining works almost entirely fighting some un-winnable war against a smug, entrenched elite with 98% market share?

Yes it can be nefarious, yes I can be a fed or I can just be wrong.

But I'm not. And it's hard for me to see people who want to antagonize anti-spammers as anything more than cowards supporting that complacent status quo that clearly is leading us down the path of eroding what makes Bitcoin unique vs your average crypto.

Filters work for reducing spam, they don't work for preventing double spends obviously.

Uploading arbitrary data into Bitcoin’s blockchain is just storing data on other people's computers without their permission and taking advantage of the fact that they're trying to be sovereign Bitcoiners.

umbrel setup is extremely easy. ping nostr:nprofile1qqsz8ffq6k7qcnkvm05826s4x42ejjpvnu6725qn8d6jmwapexzwzkcprfmhxue69uhhyetvv9ujummjv9hxwetsd9kxctn0we5qzrthwden5te0dehhxtnvdakqzxrhwden5te0wfjkccte9eekummjwsh8xmmrd9skcslelcc if struggling

reconsidering what? your hallucinated policy of not broadcasting blocks we dont like in a totally effective way to prevent them getting in the chain?

And OCEAN being one extra node broadcasting a solved block somehow fixes that does it?

so make sure your node is well connected obviously?

the concern troll you and econo are attempting is embarrassing.

the idea that a pool can exert censorship by leveraging its supposedly superior connectivity is a joke. come back when you're ready to be serious.

weird how that gets forgotten? people still conflate solo with lotto

Saifedean

Telegram is so bad for scammers.

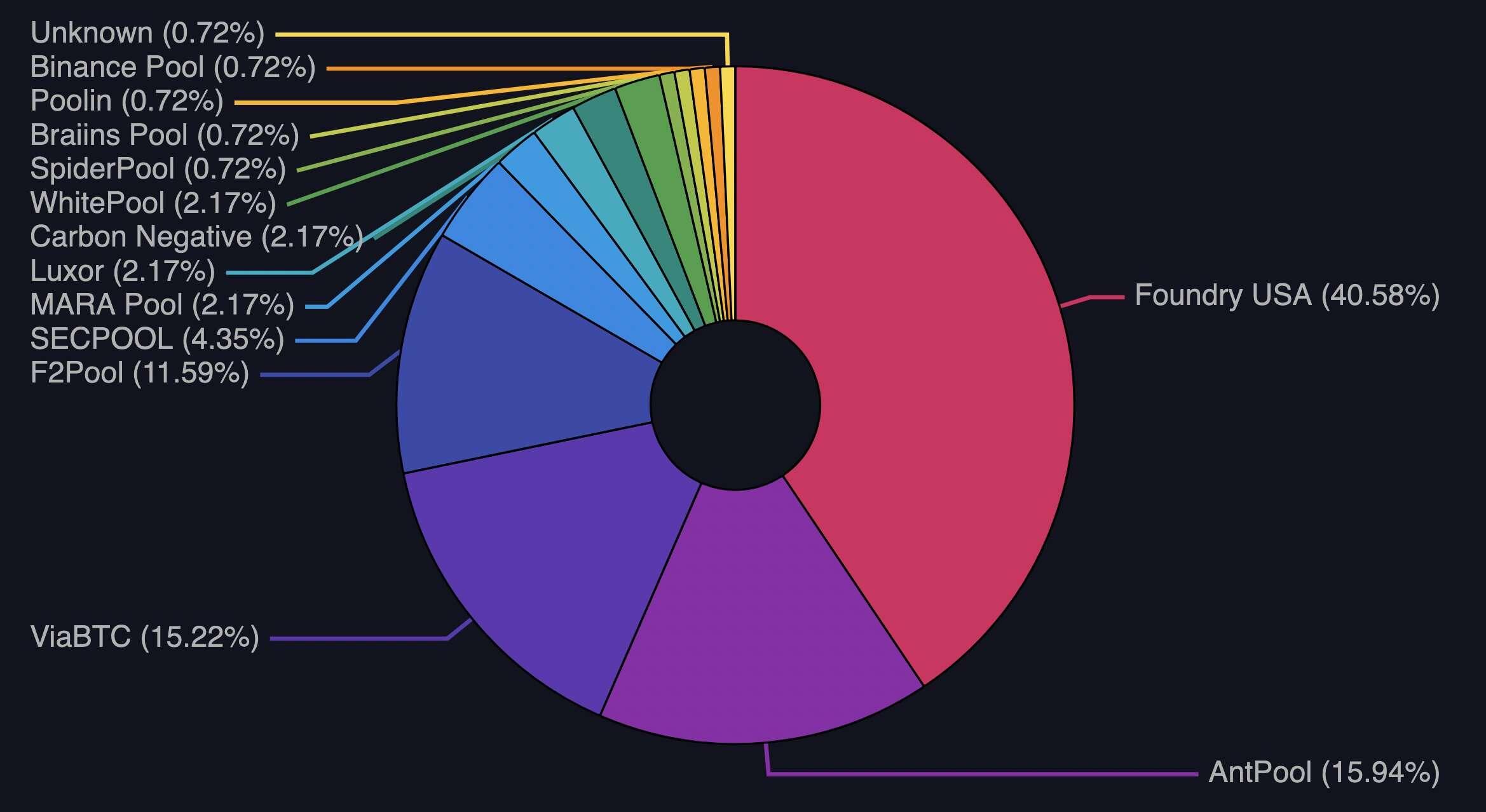

So we're regularly noticing how unacceptably large Foundry has gotten and it would be good if Bitcoiners in general understand why we are where we are.

First, let's talk about what it is pools actually do, starting from the theoretical going all the way the practical.

In theory they make no difference to anything - they simply reduce variance.

Instead of earning $.X per year, you earn $.X/365 per day.

This is far more consistent and makes day to day operations easier and it's clear why someone would want to do this - assuming they're a smaller miner who is not capable of finding block frequently enough without pooling and splitting rewards with others.

This might be desirable to the point where you'd even pay a split to the coordinator (pool) because it's that valuable of a service.

To take it further, the absolute hands-down most common payout model for a pool to use is FPPS - this doubles down on the supposed benefit that is so compelling here. It stands for Full Pay Pay Share which -in theory - means that miners get paid on a share to share basis (something they're submitting multiple times a minute) a highly predictable amount.

This means you not only have you abandoned dealing with lotto-variance (waiting until you find a block) or even standard pool variance (waiting until someone on the pool finds a block) but instead you're mining with a pool that grants you earnings multiple times per minute regardless of if the pool is finding any blocks or not.

This is variance reduction to such an extreme that the product becomes unbelievably expensive because pools have now put themselves in a position where they must pay miners for blocks that might - and very often don't - happen.

This was demonstrated beyond doubt when OCEAN (non-FPPS) released its numbers and they outperformed FPPS by over 30% in some cases during its first year of operation.

*Note: This is NOT a "You should mine on OCEAN" post. I am simply trying to explain why miners are making the decisions they are because it seems to be eluding almost everyone.

So miners are apparently opting for variance reduction to the point where they want to get paid no matter what for blocks that may or may not even exist with resolution all the way down to the share level.

But here's the part where the disconnect between theory and reality comes in.

Nearly all the miners on Foundry have absolutely zero need for this kind of variance reduction - or indeed any at all.

The publicly traded miners that make use of Foundry all have the ability to find multiple blocks a day without any third party whatsoever which is way more than enough.

As mentioned already, FPPS is an extremely expensive product that logically would only be required by a miner faced with 24 hourly energy bills who only has 100 Petahash or so. Again, the typical Foundry miner is 100 times the size of this coming in at almost 10 Exahash at the smaller end.

So if Foundry solves a particular issue - variance - and charges a fortune to do it, and its main customer is miners that could lotto-mine and find multiple blocks a day without incurring the costs of FPPS then what on Earth are they doing?

The naive answer is that they haven't done the maths. In some cases I actually know this to be true. You're an enormous miner and you do a deal with Foundry - they charge you 0.1% fee and you think that's equivalent to if you cut out the middle man entirely pretty much so it becomes worth it.

But with FPPS the fee is never the fee. That is the airport currency exchange sign that says "0% COMMISSION" and gives you something about 14% worse than market rate. Where is the money going?

I don't think most miners are actually making that mistake, at least not all of them.

It's time to explain the real reason here.

Compliance by proxy.

And this is what's key to understand.

History: Once upon a time a pool called GHash(.)io got above 40% of the hashrate (which Foundry is doing repeatedly at this point) and the miners all fled out of instinct to protect the network. You simply cannot have any single entity making 50% of the blocks that get added to the chain or anything approaching that.

So why aren't miners doing it today? Are they that addicted to variance reduction when the calibre of miner that uses Foundry is perfectly capable of reducing their own variance anyway even though it's costing them a fortune?

Again the entire space needs to understand why history will not be repeating itself here and this where I find the greatest amount of self-delusion and dishonesty in this space.

Compliance by proxy was not a thing in 2016. At least not for miners.

Since then, someone has come along and turned what is completely unacceptable to the powers that be - Bitcoin mining - and turned it into a completely sanitized, censorship prone shell of its former self - and *that* is the true motivation for "miners" paying these exorbitant fees.

Compliance is new. And it isn't a factor people are taking into consideration.

Whenever we point out how precarious the situation has become, there is the typical response - "If Foundry ever do

It's time to put this cope-strategy to bed.

If a miner is perfectly capable of reducing their own variance to the tune of reliably finding multiple blocks per day themselves - why are they using a pool at all? Especially if that pool costs a fortune?

Or more crudely - If losing a tonne of money for no apparent reason isn't compelling enough to leave Foundry, then jeopardizing Bitcoin isn't going to be either.

The true motivation is all that matters, and its overwhelmingly just compliance. "Miners" of substantial size increasingly do not want anything to do with Bitcoin and want all their hashrate transformed from raw Bitcoins coming fresh out of the blockchain into a nice clean product that their accountants and lawyers can tolerate regardless of the cost.

To take the counter position to my argument here, there are of course costs to rough-housing it and grappling with Bitcoin directly as MARA does and I don't want to pretend otherwise but I don't think they come anything like close to justifying the enormity of the revenue lost due to the extreme over-kill that is FPPS.

This is the only area in which I will take pushback from someone in one of the relevant companies as it's possible I am just wrong.

The following companies - BitFarms, Hut8, RIOT, WULF, HIVE, Cleanspark and a couple of handfuls of others are all - to the best of my knowledge - paying a fortune for the combined benefit of variance reduction (which they absolutely have no need of) and compliance by proxy.

If anyone from any of those companies can explain to me why I am wrong and that if/when Foundry's size results in them engaging in censorship or any other abuse of the network (heck, already requiring KYC and regular inspections of mining facilities is unacceptable and that's already been the case for Foundry miners for years) then why should anyone believe you would move to another pool or go the Mara route?

At present I believe that Foundry could continue its inexorable ascent to the 51% magic number we're all afraid of and the new cope will be "Well they haven't done

At the moment "It's just KYC", "It's just mandatory inspections" and "It's just lost revenue."

All of that is unacceptable. "It's just transactions associated with Russia/Iran" comes next and the shareholders of publicly traded Bitcoin miners are unlikely to view censorship based on that criteria as being anything to worry about. "Why do you hate America??"

The old cope of "another miner will just include them and their business will survive while the censoring miners die" is complete and utter delusion.

Almost 100% of revenue from the chain is subsidy. Transaction fees are neither here nor there. And if we think the US Pubcos are all going to voluntarily go admit bankruptcy because they lost a few hundred bucks a week from mining blocks that censored blacklisted UTXOs then we are deluding ourselves.

I reiterate - miners are with Foundry because compliance is increasingly all that matters. This has resulted in enormous centralization of template construction that becomes a genuine attack vector at ~30% and has been consistently way above that for a long time now. 51% is a meme, and imo not a powerful enough one to inspire change if it actually comes to that. The frogs are already boiling and no one cares.

Let's be honest. None of the miners on Foundry are leaving any time soon but the variance reducing product they offer that can be so trivially replicated elsewhere is not why any of them are doing what they are doing.

Foundry is the sole occupant within the regulatory moat that is Bitcoin mining in America and I don't see that as trivial to replicate at all.

And the reason I wish to sound the alarm 10,000 louder than I have been before this point is that the current US administration has run a campaign that specifically talks about centralizing Bitcoin in the US.

The phrase "We will make all the Bitcoins in America" is exactly the worst possible thing you could want to hear given everything I've talked about in this post and not only is it not being rejected by Bitcoiners, it is being celebrated as a good thing.

Dude. 41% and rising?

Bitcoiners from 2015 would have resolved this by now.

Here's what you need to do https://x.com/GrassFedBitcoin/status/1847970083122839721?t=qeHR402NFqMm4CEH6mvWxw&s=19