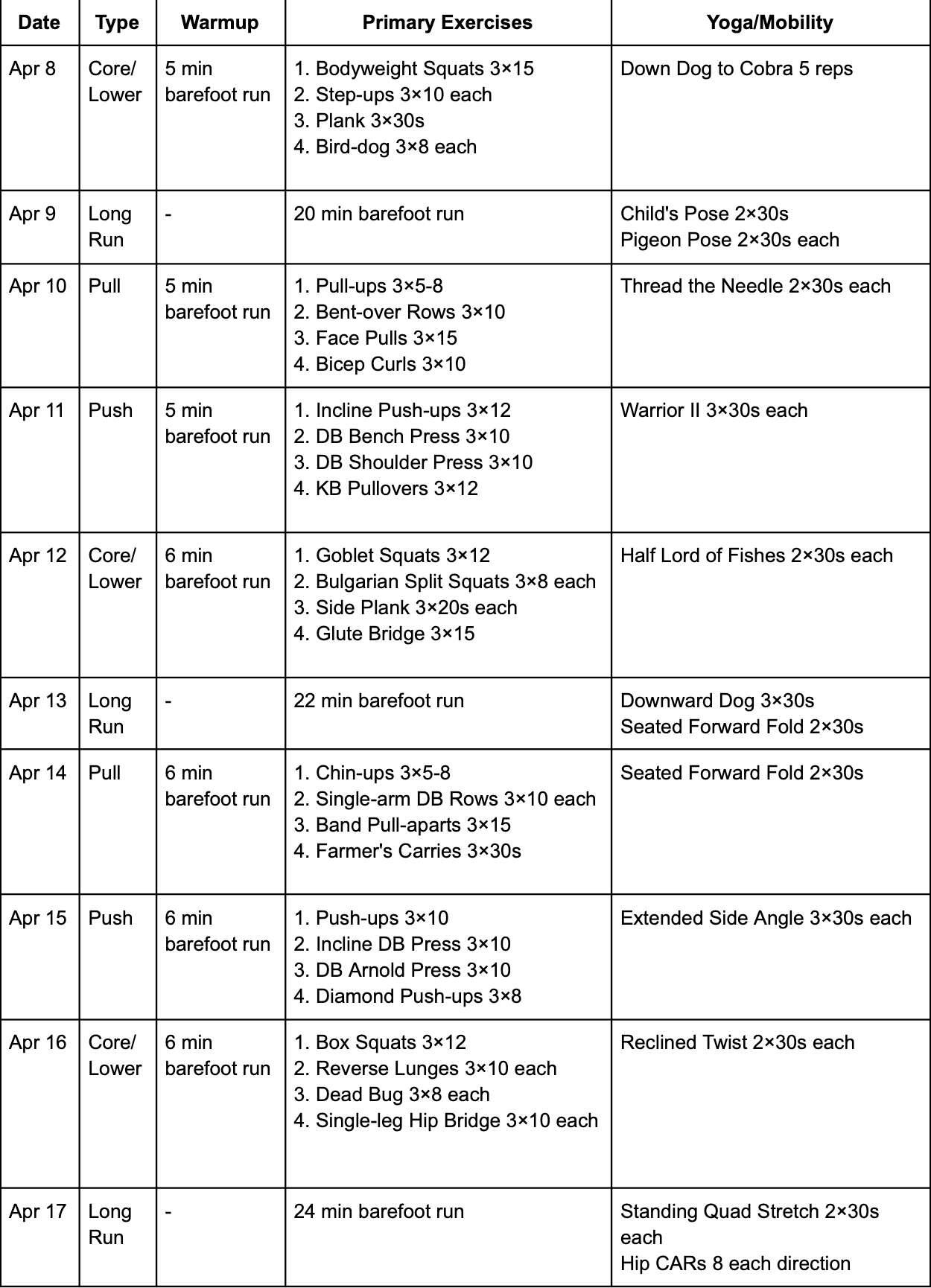

I told my wife I'd workout every day for three months if she gives up sugar during that same time.

These are the casualties of that agreement...

For additional context. My wife works out almost daily but complains that she's not where she wants to be. And we both suspect it's due to a diet that isn't very optimized and includes lots of sweets...

I'm more of a long distance runner and cycler and have frequently been injured trying to lift. I'll focus on full range of motion and calisthenics to start...

Time to talk to Grok and get a workout plan nostr:nprofile1qqsdxerxjxa9k8teds0pkdpsmuq0uyvfajwzx2rh4h0p3j8k26h33uqpz3mhxue69uhhyetvv9ujuerpd46hxtnfduq36amnwvaz7tmwdaehgu3dwp6kytnhv4kxcmmjv3jhytnwv46qz8rhwden5te0dehhxarj9e3xjarrda5kuetj9eek7cmfv9kqx7rxew

Right as I was in the middle of arbitraging from Peach to Bisq. Muther fucker

Why on earth would I waste my time rewriting what nostr:nprofile1qqs2vrneurk665gq6a2rke572y7mc8ppwr5wnd60mw8fwxharc8xsycpz4mhxue69uhkummnw3ezummcw3ezuer9wchsz9mhwden5te0wfjkccte9ehx7um5wghxyctwvshsz9thwden5te0wfjkccte9ejxzmt4wvhxjme0vl44wp took days to write? I have a life and family.

There are no short cuts. Do your homework. I don't respect you because you have misrepresented my position and wasted my time.

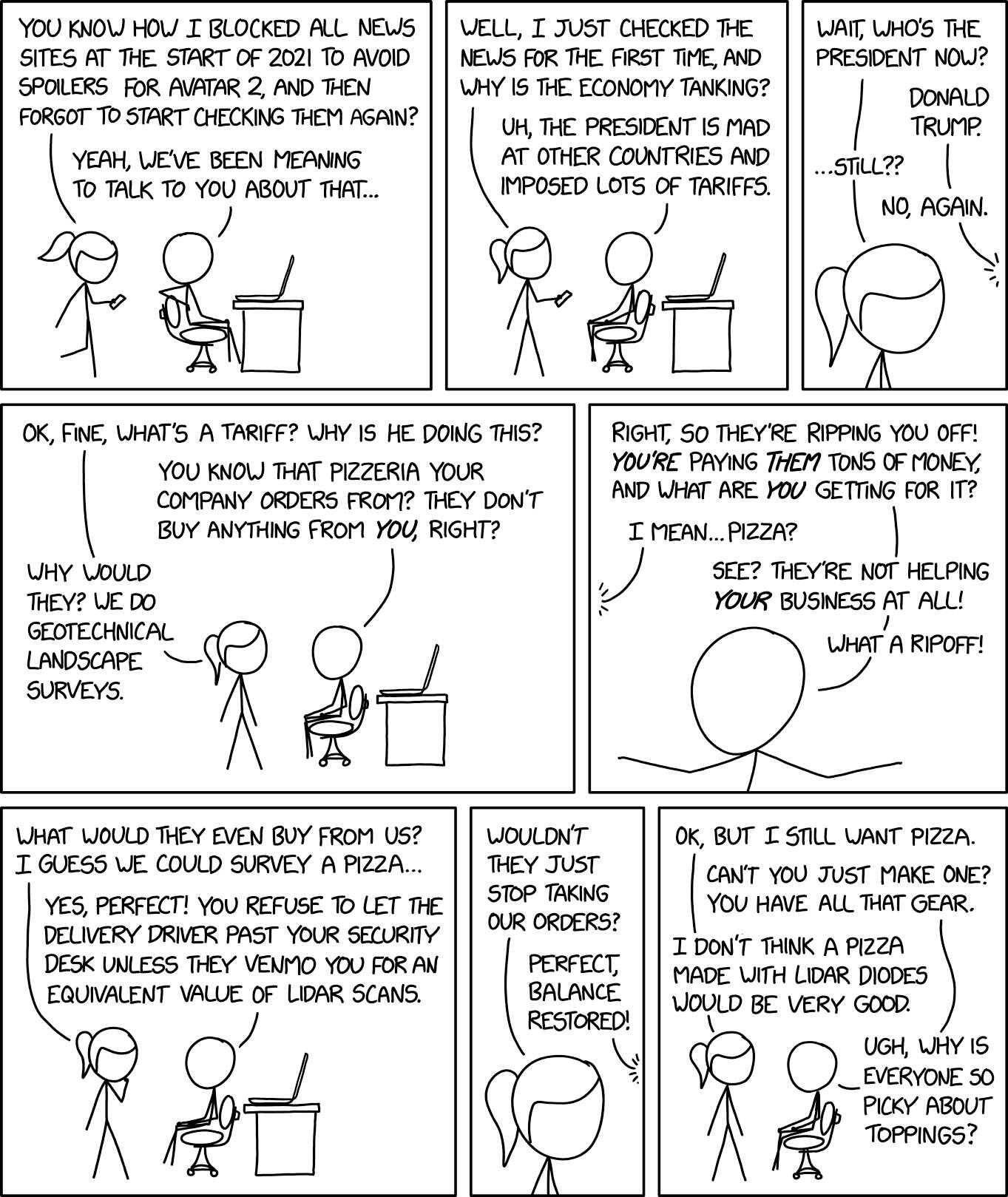

Win a trade war? That makes it seem like the point is for something magical to happen with China.

The outcome he's hoping for is that global comprehensive tariffs push companies to come into the US if they want to do business in the US...

I lived in Indonesia (in AnHui rn) and saw this a lot. Many things are taxed 100-200% and you'll see companies set up shop locally so they can compete. Honda for example.

Let's see how the nostr:nprofile1qqsyx53h3h7ec4fwlspjq0kqec5gv54t7rc48xdtq6q4y94wsw4fnjqprdmhxue69uhkummnw3ezuumpw3ehgunpd35kztnrdakj7qghwaehxw309aex2mrp0yhrq7rrdpshgtnrdakj7qg4waehxw309aex2mrp0yhxgctdw4eju6t09uhgml9t Coordinator ratings goes. The way its done it solves the problem of bad Coordinators removing inconvenient ratings.

But I avoided to show users results for now because still I have to solve the problem of bad users spaming with non legit ratings.

That's the problem with users not having reputation like Peach and nostr:nprofile1qqsgqfapsalnnesrmt7xxfu7qp95akwlscw33n5pm8zrclt3xhdg7egprdmhxue69uhhyetvv9ujucnfw33k76twwpshy6ewvdhk6qgawaehxw309ahx7um5wghx6at5d9h8jampd3kx2apwvdhk6tcpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhscyvr9p

_Good Morning_ ☕ 📖 🌞

Dedicated Cost Principle

Dedicated Cost Principle: Only necessary costs by miners contribute to double-spend and censorship resistance. Unnecessary costs, like those from misconfigured machines, are wasteful and do not enhance security.

Energy Efficiency Theory: Suggests adding non-dedicated costs to mining, like the discovery of prime numbers, to make PoW more efficient, assuming these have marketable value. However, this theory is invalid as the same efficiency could be achieved by basic PoW with separate operations for marketable products.

Brewer Analogy: Just as brewers can sell their grain byproducts to farmers, improving efficiency by turning waste into value, miners could theoretically offset mining costs with marketable byproducts. But necessary net costs must still match the reward due to competition.

Byproduct Value: Costs dedicated to producing independently-marketable value can be offset by selling that byproduct, making them not truly a cost to the mining process.

Merged Mining: Often used to boost new coins' hash rates but fails to secure them as the hash rate isn't dedicated. The full cost of the hash rate can be recouped by selling it on one chain, allowing for censorship on others without cost.

**Cryptoeconomics by [Erik Voskuil](https://github.com/evoskuil).**

*The book can be found on [GitHub](https://github.com/libbitcoin/libbitcoin-system/wiki/Cryptoeconomics).*

The rest of the summarized chapters are at https://expatriotic.me/cryptoeconomics

No.

Honeypot just means your information is centralized. So it attracts hackers.

It can also work in the way you mentioned.

Read the article I gave if you have questions.

Personally I don't want a hacker having access to my passport, photos, tax ID etc. Everything one is required to submit to be KYCed...

Not to mention the risk of people put on a list of people owning cryptocurrency. Both from hackers or the government. Ever heard of executive order 6102? Sooo many problems. And your questions indicate you probably didn't bother reading the article I linked

For those that are interested...

Ashigaru is a "fork" of Samourai wallet. It has been up and running quite a while and is even better than Samourai. You can download it here, https://ashigaru.rs/ but you will need TOR to do so.

You will also need a dojo. You can run your own, which is preferable, on a server like #Start9 or even #Umbrel. If you don't have your own you can use someone else's. A friend you trust is next or you can look here https://dojobay.pw/

The reason I'm writing this is... If you have an old phone that you don't use, download Ashigaru on that. Then download Sentinel watch only wallet on your daily driver phone, here https://github.com/wanderingking072/sentinel-android/releases.

Sentinal is a fantastic watch only wallet from the same arena as Ashigaru. You can then create your TXs on your Ashigaru wallet and sign it, whilst your phone is in airplane mode. It can't be sent as you are not online, safe from predictors. It can create a QR code which your Sentinel Watch Only wallet can scan and send.

Why? Well apart from being probably the most privacy minded wallet out there, you have just used your old phone as a seed signer. Airgapped. Free.

Thank me later

#FreeSamourai

Secret and private aren't the same thing. If you've KYCed you've put your information in a honeypot...

My new setup is full intensity "Night Light" mode + greyscale "Color correction" using nostr:nprofile1qqs9g69ua6m5ec6ukstnmnyewj7a4j0gjjn5hu75f7w23d64gczunmgpz4mhxue69uhhyetvv9ujumt0wd68ytnsw43q4gnztg

I'll never go back. So easy on the eyes.

Put my work monitor on greyscale mode also + 50% intensity Night Light on the computer. 100% made it too dark and low contrast (muddy)

I told my wife I'd workout every day for three months if she gives up sugar during that same time.

These are the casualties of that agreement...

For additional context. My wife works out almost daily but complains that she's not where she wants to be. And we both suspect it's due to a diet that isn't very optimized and includes lots of sweets...

I'm more of a long distance runner and cycler and have frequently been injured trying to lift. I'll focus on full range of motion and calisthenics to start...

Time to talk to Grok and get a workout plan nostr:nprofile1qqsdxerxjxa9k8teds0pkdpsmuq0uyvfajwzx2rh4h0p3j8k26h33uqpz3mhxue69uhhyetvv9ujuerpd46hxtnfduq36amnwvaz7tmwdaehgu3dwp6kytnhv4kxcmmjv3jhytnwv46qz8rhwden5te0dehhxarj9e3xjarrda5kuetj9eek7cmfv9kqx7rxew

Day 4 of working out. Used Claude 3.7 to make a training regime. 90 days no days off if my wife consumes no sugar in the same amount of time. Also upped my calories and taking creatine.

You can just sell sats at 9% markup on Peach and then buy back at -1% discount on nostr:nprofile1qqsgqfapsalnnesrmt7xxfu7qp95akwlscw33n5pm8zrclt3xhdg7egprdmhxue69uhhyetvv9ujucnfw33k76twwpshy6ewvdhk6qgawaehxw309ahx7um5wghx6at5d9h8jampd3kx2apwvdhk6tcpz4mhxue69uhhyetvv9ujuerpd46hxtnfduhscyvr9p.

Best part is that until your order is taken on Peach you're only exposed to Bitcoin...

GBP buyers seem most willing to sell sats at -1% premium IMO

No worries, this was just my rant after watching the space get filled with so many opinions and hot takes. Everyone has become an expert it seems... I chose the word ignorant on purpose. Rather than dumb... People seem to want to comment on something they've never really seen. The US has never had a robust system of tariffs...

But then you're KYCed... So that's a non starter

So ignorant...

Ideologically speaking, in a vacuum, assuming tariffs are a perfect sphere and that there is no friction, I think tariffs are bad.

But... ⤵️

The US is capable of making so many things in-house.

The inability to do so is a security risk. Especially for chips for military weapons...

Also competing countries like Japan in the 80s and 90s tech and car boom and China today give their public companies a leg up. Taking advantage of the "global" free trade policy of the US... All so people can buy cheap shit from Wal-Mart...

So while you're celebrating all the cheap non-tariffed goods you got, you also ain't got one of those, what's it called,,? Jobs...

People here ain't never left America and suddenly became tariff experts in 1 month.

I moved to Indonesia 10 years ago and guess what, most cars that people buy are domestically produced. Even if the brand is foreign.

Why?

Because there's a 100% luxury tax on imported cars.

Why?

CUZ THEY ARE A MANUFACTURING POWERHOUSE THAT CAN MAKE THE DAMN FORD OR HONDA OR TOYOTA locally, and so guess what, they do!

I've been to an import grocery store and saw a $0.35 coke next to a $3 Dr pepper.

Why?

Cuz Coke done moved a damn factory to Indonesia and made soda in-house.

Come on people this ain't rocket science... People aren't gonna die if they can't buy imported shit anymore...

Market's adjust.

_Good Morning_ ☕ 📖 🌞

`Debt Loop Fallacy`

- **Debt Loop Fallacy**: Theory suggesting modern state currency isn't actual money but a money substitute, a claim for borrowed money, leading to a conceptual loop.

- **Fiat as Money Substitute**: Claims are for a definite amount, but this leads to circular reasoning as the value is defined by what the state will accept in trade.

- **Nature of Money**: Money represents what it can be traded for, not an intrinsic value. Fiat differs from commodity money only by presumed lack of use value, which is subjective.

- **Invalid Theory**: A claim cannot be for itself; holding the claim satisfies the claim, making it money, not a debt. Thus, the theory is invalid.

- **Transition to Fiat**: Occurs when representative money loses redeemability, as with the U.S. Dollar in 1934.

- **Money Substitutes and Debt Regression**:

- **No Regression**: Direct money (e.g., Gold, Bitcoin, modern U.S. Dollar).

- **Single Regression**: Representative money (e.g., redeemable U.S. Dollar).

- **Finite Regression**: Indirect claims with a finite chain of settlements.

- **Infinite Regression**: Theoretically impossible; a claim must end.

- **Conclusion**: The "debt loop" is essentially a description of money itself, not a fallacy, as money substitutes eventually become money when claims settle or are circular.

**Cryptoeconomics by [Erik Voskuil](https://github.com/evoskuil).**

*The book can be found on [GitHub](https://github.com/libbitcoin/libbitcoin-system/wiki/Cryptoeconomics).*

The rest of the summarized chapters are at https://expatriotic.me

Before or after they went self custodial?

The point is that nostr:nprofile1qqsrf5h4ya83jk8u6t9jgc76h6kalz3plp9vusjpm2ygqgalqhxgp9gpzfmhxue69uhk7enxvd5xz6tw9ec82cspp4mhxue69uhkummn9ekx7mqpzpmhxue69uhkummnw3ezumrpdejqd2970s was the premier self custodial wallet.

So they're uniquely situated to recognize the pain points of onboarding...

Now it's gone the way of Mutiny Wallet and added ecash.

Most vendors and businesses that accept payment with LN are using WoS anyway because the UX is better... I don't have stats for that, but my gut says custodial solutions like nostr:nprofile1qqst4qyeqenw7zm0fwjsty68h6cnys5jre2xd8ngqpjv5a2j26s78fspzemhxue69uhhyetvv9ujucm0d9hx7uewd9hj75a0pev or WoS are getting used more than local LN nodes... Since then you don't need to worry about node maintenance