https://www.youtube.com/watch?v=0ANECpNdt-4 AI integration in OSs. Presentation from Signal Meredith Whittaker

The $60 Billion Question: Is Venezuela Secretly a Bitcoin Superpower?

Alex Saab may control $60 billion in Bitcoin for the Maduro regime. As Trump's naval blockade tightens, the real battle is being fought on the blockchain.

Welcome to Whale Hunting, where we follow the money behind some of the world's most brazen financial crimes and expose the networks of people who enable them.

Nicolás Maduro is in U.S. custody. In the early hours of Saturday morning, Delta Force operators dragged the Venezuelan president and his wife from their bedroom in Caracas and flew them to the USS Iwo Jima, now steaming toward New York where Maduro will face drug trafficking and weapons charges in federal court.

But as Washington celebrates the most dramatic U.S. military operation in Latin America since the 1989 Panama invasion, a more urgent question is emerging in intelligence circles: Where is the money?

For years, Maduro and his inner circle systematically looted Venezuela—billions in oil revenue, gold reserves, and state assets—and, according to sources with direct knowledge of the operation, converted much of it into cryptocurrency. The man who allegedly orchestrated that conversion, who built the shadow financial architecture that kept the regime alive under crushing sanctions, is not on that ship.

His name is Alex Saab. And he may be the only person on Earth who knows how to access what sources estimate could be as much as $60 billion in Bitcoin—a figure that, if verified, would make the Maduro regime's hidden fortune one of the largest cryptocurrency holdings on the planet, rivaling MicroStrategy and potentially exceeding El Salvador's entire national reserve.

The claim comes from HUMINT sources and has not been confirmed through blockchain analysis, but the underlying math is provocative. Venezuela exported 73.2 tons of gold in 2018 alone — roughly $2.7 billion at the time. If even a fraction of that was converted to Bitcoin when prices hovered between $3,000 and $10,000, and held through the 2021 peak of $69,000, the returns would be staggering.

Sources familiar with the operation describe a systematic effort to convert gold proceeds into cryptocurrency through Turkish and Emirati intermediaries, then move the assets through mixers and cold wallets beyond the reach of Western enforcement. The keys to those wallets, sources say, are held by a small circle of trusted operatives—with Saab at the center.

What Washington didn't know—and what court documents would later reveal—was that Saab had been a DEA informant since 2016, even as he built Maduro's shadow financial empire. Now, with Maduro captured, the question becomes: Will Saab cooperate again? Or will he disappear with the keys to Venezuela's stolen fortune?

The Courier

On September 17, 2019, the U.S. Treasury's Office of Foreign Assets Control added David Nicolas Rubio Gonzalez to its sanctions list. The designation identified him as controlling at least three companies: Corporacion ACS Trading S.A.S. in Colombia, Dimaco Technology, S.A. in Panama, and Global de Textiles Andino S.A.S. in Colombia.

His father, Álvaro Pulido, had been indicted by the U.S. Department of Justice two months earlier, charged alongside Alex Saab with laundering more than $350 million from fraudulent Venezuelan state contracts. But David was not charged. He was sanctioned—his assets frozen, his ability to do business with Americans severed—but he faced no criminal prosecution.

Why?

According to sources with direct knowledge of the operation, David Rubio Gonzalez was not just a businessman. He was a courier. These sources describe a network that physically moved gold along a route from the Dominican Republic through Venezuela to Turkey and Dubai. Each trip, they say, netted the courier $1 million for his services.

The gold originated in the Arco Minero del Orinoco, a vast mining zone in eastern Venezuela. It was purchased by the state-owned mining company Minerven, processed by CVG Minerven—whose president maintained close ties to Saab—and transported abroad by private aircraft or Turkish Airlines commercial flights. But moving gold at scale requires trusted hands. Someone has to physically carry it, clear customs, deliver it to the refineries and brokers who convert it to cash.

David, sources say, was one of those hands.

The question that haunts investigators is simple: If David was important enough to sanction, why wasn't he important enough to indict? His father faced eight counts of money laundering. David faced none.

There are only a few explanations. He could be cooperating with U.S. authorities—providing information in exchange for immunity or a reduced role in any future prosecution. He could be under sealed indictment, his charges hidden from public view until the moment of arrest. Or he could have simply slipped through the cracks, a secondary player deemed less important than the principals.

But if our sources are correct about his role as a courier—a man who physically handled the gold that became the regime's crypto fortune—then David Rubio Gonzalez may know exactly where the money went. And with Maduro captured, that knowledge has never been more valuable.

The Gold-to-Crypto Pipeline

The $60 billion didn't materialize from thin air. It was built through one of the most audacious financial operations in modern history: the systematic conversion of Venezuela's gold reserves into untraceable cryptocurrency.

In 2018, as Venezuela's economic crisis deepened and access to hard currency narrowed, the Maduro regime turned to gold. The country had been exporting gold for years, but now the operation scaled dramatically. Venezuela exported 73.2 tons of gold in 2018 alone—roughly $2.7 billion at the time.

Maduro placed the operation under the supervision of his close ally Tareck El Aissami, whom he appointed Minister of Industries and National Production. Alex Saab emerged as a central facilitator. The gold flowed to Turkey, where it was refined and sold. It flowed to the UAE, where it entered the global market. And in April 2020, tons of Venezuelan gold were flown to Iran on Mahan Air as part of a gold-for-gasoline swap.

Iran International reported that a Lloyd's Insurance leak revealed the scheme was coordinated by the IRGC Quds Force and Hezbollah. Gold sold in Turkey and the Middle East generated proceeds that funded Hezbollah operations. Some nine tons of Venezuelan gold were exported in a single month, according to Bloomberg. In return, five Iranian oil tankers delivered an estimated 1.5 million barrels of gasoline to Venezuelan ports.

But gold is heavy. It's traceable. It can be seized. The next step was converting it into something that couldn't be touched.

Sources describe a systematic effort to convert gold proceeds into Bitcoin through OTC brokers in Turkey and the UAE—brokers who asked few questions and operated outside the traditional banking system. The Bitcoin was then moved through mixers, software that obscures the origin of cryptocurrency transactions, and into cold wallets: offline storage devices that exist beyond the reach of any government or exchange.

The timing was fortuitous. Venezuela began moving gold in earnest in 2018, when Bitcoin traded between $3,000 and $10,000. By the time the price peaked at $69,000 in November 2021, any holdings accumulated in those early years had multiplied by a factor of seven to twenty. If the regime converted even $3 billion in gold proceeds to Bitcoin at an average price of $5,000, those holdings would be worth $40 billion today.

The crypto infrastructure didn't stop with gold. Venezuela's own PDVSA-Cripto corruption scandal revealed that Saab's partner Álvaro Pulido—David's father—used Tether-based settlement systems to divert billions in oil-sale proceeds. Between 2020 and 2022, PDVSA increasingly required intermediaries to settle oil cargos in Tether, routing payments through OTC brokers and private digital wallets.

The scandal revealed ships loaded with more than $20 billion worth of oil departing Venezuelan ports without payment ever reaching PDVSA. By December 2025, Venezuela was collecting 80% of its oil revenue in USDT. Tether has frozen 41 wallets containing $119 million linked to Venezuela—but that represents only what authorities have been able to trace.

The Architect

To understand how this system was built, you have to understand the man who built it.

Alex Saab was born in Barranquilla, Colombia, in 1971. He spent the 1990s running modest textile businesses. His career changed when he partnered with Álvaro Pulido, who was involved in drug trafficking and invited Saab to do business in Venezuela. Colombian left-wing senator Piedad Córdoba—who died in January 2024—introduced Saab to Maduro.

The contracts that followed were staggering in their brazenness. In 2011, Saab agreed to supply parts for 25,000 prefabricated houses under "Gran Mision Vivienda Venezuela." The contract paid up to four times the actual cost. His company received $159 million to import housing kits but delivered only $3 million worth of products.

In 2016, when the regime launched the CLAP program to distribute subsidized food to families in need, Saab and Pulido built a network to exploit it. They sourced low-quality food from foreign suppliers, assembled the boxes abroad, and shipped them to Venezuela at inflated prices. To move funds and conceal the scheme, they used shell companies in Hong Kong, the UAE, and Turkey. The U.S. Treasury designated these networks in July 2019, calling them a "corruption network stealing from Venezuela's food program."

Zair Mundaray, a former Venezuelan prosecutor who investigated Saab, told Whale Hunting that Saab slipped into Maduro's inner circle precisely because he had no loyalties outside it. Unlike other power brokers in Caracas, Saab was not tied to any traditional political families or factions.

"Saab fits the profile of someone with no links to Venezuela's traditional castes or power groups, whose only real connection is to the presidential family," Mundaray said. "In Venezuela, power operates much more like a criminal cartel than an institutional structure. That creates a climate of mutual distrust and internal power struggles."

Saab's goal was simple: to make money, "and he found the perfect platform in a president who is himself a criminal."

But Saab became more than a contractor. He became the guarantor of Maduro's fortune.

"As the public and private spheres ultimately merge, there's no distinction," Mundaray said. "Saab is the guarantor of Maduro's fortune — money dispersed across multiple countries and stored in different convertible assets that ensure him a life of luxury for generations, without ever lifting a finger."

In April 2018, Maduro made it official, appointing Saab as Special Envoy with "broad powers to carry out actions on behalf of the Bolivarian Republic of Venezuela." He was no longer a contractor. He was a diplomat.

On June 12, 2020, Saab's plane touched down on the volcanic island of Sal in Cabo Verde for what should have been a routine refueling stop. He was en route to Iran. Instead, local authorities arrested him at the request of the United States.

The U.S. Department of Justice had unsealed an eight-count indictment charging Saab and Pulido with laundering more than $350 million through U.S. bank accounts. But then came the twist that no one expected.

Court documents reviewed by Whale Hunting revealed that Saab had also cooperated with U.S. law enforcement—providing information on bribe payments made to high-level Venezuelan officials.

Saab entered into a cooperative source agreement with the Drug Enforcement Administration on June 27, 2018—the same year Maduro appointed him Special Envoy. He met with U.S. law enforcement officials in August and September 2016, November 2017, June and July 2018, and April 2019. He also made four payments totaling over $12.5 million to DEA-controlled accounts to disgorge profits from his bribery schemes.

He was building Maduro's shadow financial empire while simultaneously informing on it.

In December 2023, President Biden negotiated his release in exchange for ten American prisoners held in Venezuela, including one close to our hearts: Leonard “Fat Leonard” Francis (subject of our Fat Leonard podcast, listen here). Saab received a presidential pardon and was required to leave the United States permanently. He landed in Caracas to a hero's welcome. Maduro embraced him publicly. Within weeks, Saab was appointed Minister of Industry and National Production.

He was once again at the center of Venezuela's survival architecture. Until this morning.

Who Has the Keys?

With Maduro in custody and facing drug trafficking charges in Manhattan, the question is no longer whether the regime can survive. It's whether its stolen fortune can be recovered—or whether it will vanish into the blockchain, accessible only to those who hold the keys.

The old sanctions-evasion toolkit—ships, banks, front companies—still exists. But the new one runs on stablecoins, OTC brokers, private digital wallets, and bilateral deals with governments that have no incentive to cooperate with U.S. enforcement.

Sources describe a Swiss lawyer who allegedly controls access to the wallets. The keys may be distributed across multiple people, multiple jurisdictions, multiple layers of security designed to survive exactly this scenario: the capture of the regime's leader.

David Nicolas Rubio Gonzalez was sanctioned in 2019 but never publicly charged. His father was indicted. He was not. If sources are correct that he served as a courier—physically moving the gold that became the crypto fortune—then he may know exactly where the money went. Is he secretly cooperating with U.S. authorities? Under sealed indictment? Or has he disappeared with knowledge that could unlock billions?

And then there is Saab himself. A man who has already cooperated with the DEA once. A man who was pardoned by one American president and may now be the most valuable intelligence asset for another. A man who, according to a former Venezuelan prosecutor, is "the guarantor of Maduro's fortune."

Where is Alex Saab?

Where is David Rubio Gonzalez?

And who has the keys to as much as $60 billion in Bitcoin?

https://www.youtube.com/watch?v=yibAIntR02E Who is willing to give up all that data? have you seen this? nostr:nprofile1qyxhwumn8ghj7mn0wvhxcmmvqyv8wumn8ghj7urjv4kkjatd9ec8y6tdv9kzumn9wsqzqpxfzhdwlm3cx9l6wdzyft8w8y9gy607tqgtyfq7tekaxs7lhmxf5dcd8v nostr:nprofile1qqs9wsu887m90qrxeug5p2wnrcmglddtsjlc4dys0uh62rgw442u0sqnadkaf

“Hurricane season “ by Fernanda Melchor is a book that has almost no punctuation and in the beginning is super weird to read. I am native Spanish reader and enjoyed it like very few books I have read. Just looked up the English translation and it appears it is very good and faithful to the style and slang. Don’t bother with the Netflix adaptation. The book is one of the most important books written in Spanish in several years

https://blossom.primal.net/095b9de4e2a66e28ef735eaa2ff87621df36100c20cdc425984ae6b5ee481cf0.mp4 We had a Bitcoin Bazar event at casa de Satoshi in CDMX.. Merchants and even a kid teaching people how to create their seeds with coins and nostr:nprofile1qyx8wumn8ghj7cnjvghxjmcpz4mhxue69uhk2er9dchxummnw3ezumrpdejqqg8je9kf0ajpnffclpx087njugv5vp0psjqfdeh9zuxvukmk0xw5qqpfw6hy for 12th word. Thanks to nostr:nprofile1qyt8wumn8ghj7ct5d3shxtnwdaehgu3wd3skueqpp3mhxue69uhkyunz9e5k7qpqk3rychegd7vs20prks4g8g9xfyk2djw4pxxeukkj0mjhg68evz8qavczcc and others for attending..

What I thought!!! Already got 2 messages. Metamask flags it as scam

https://x.com/wikileaks/status/2001277266240921711 Assange Note on Nobel Prize to C Machado.. Stirring the pot... what do you think?

is there a part of the test where the dog reacts differently with different people, and he picks u? as in it connects to someone.. Which would translate maybe to "Pick the fights worth it"

i drank a lot at school in the fountains and also at home in the gardens directly from the faucet. Still have that copper taste..

for all those that are interested in launching a bitcoin treasury company https://1clickbtctreasury.com/

and this one too https://www.wired.com/story/bitcoin-scam-mining-as-service/

Is wired coming back from its ashes and doing good relevant reporting again ? https://www.wired.com/story/a-simple-whatsapp-security-flaw-exposed-billions-phone-numbers/?_sp=d7ada12c-1e9e-48c4-ae52-d6a5aa4b0bdf.1763499628323

UK citizens are blocked from viewing a Ledger blog post explaining multi-sig, “due to new rules.”

Shared via https://pullthatupjamie.ai

at least maybe they will be protected from all the phishing attacks due to ledger mishandling of data.. 🤣

ibraries are the blockchain, books are blocks, vile content is SPAM,... Bitcoin popes want to abolish it..

ibraries are the blockchain, books are blocks, vile content is SPAM,... Bitcoin popes want to abolish it..

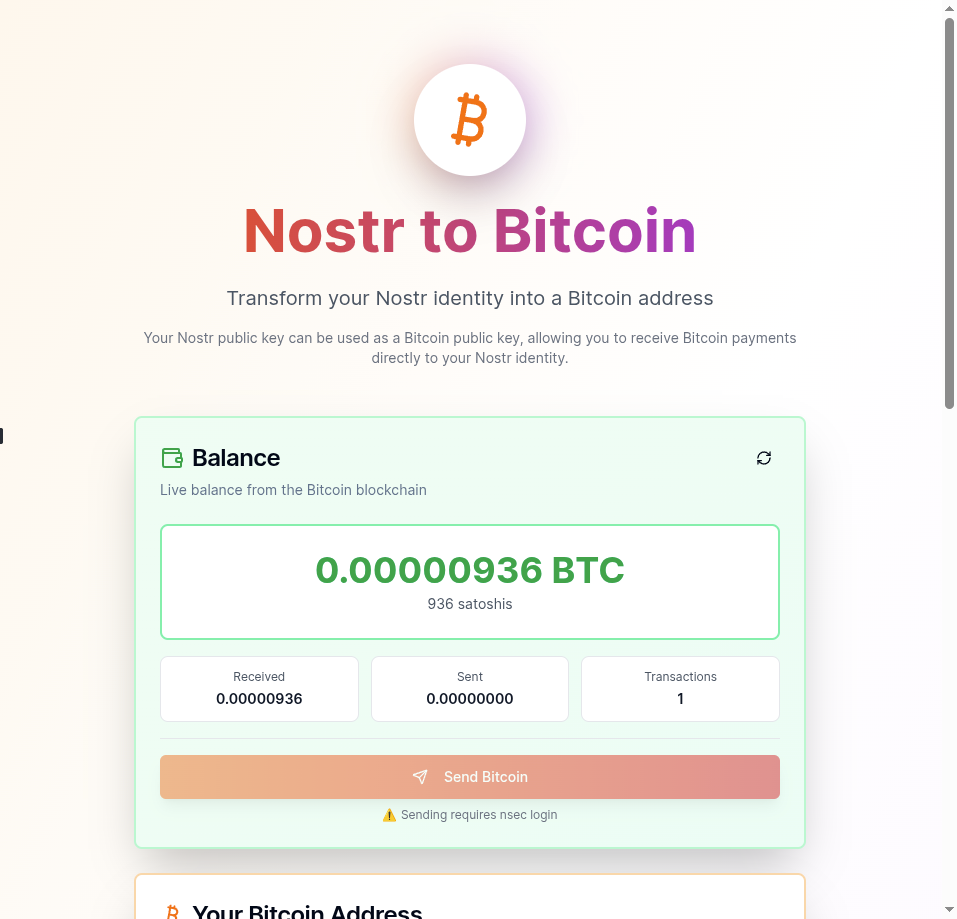

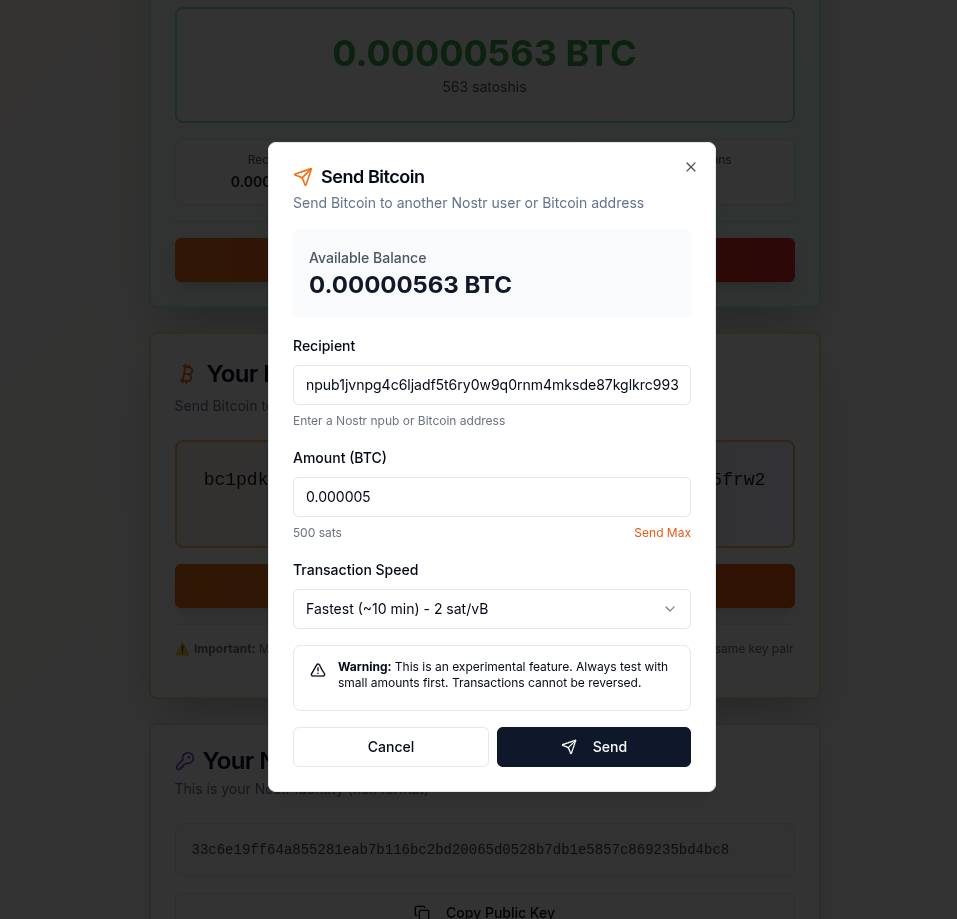

Shakespeare on-chain wallet experiment: https://nostr-to-bitcoin.shakespeare.wtf/

Your Nostr identity is your Bitcoin wallet. You can send Bitcoin to any npub. No setup is required by either party. It "just works"

I connected it to my NWC with local alby hub. the shows dont show. What am I missing. Also tried to import WIF into some wallets but they none seem to have support for taproot. should I go for Core? what am i missing.. I sent some funds and want to recover.. Its a fun mission..

I need to investigate how to do that

Over Lightning? You connected in the app option

In love with a cat

China Morning Missive

The PBoC just announced no change to its interest rates. To most, this will be viewed as an errant move given all the arguments over deflation and the recent cut made by the Fed.

The decision, however, makes perfect sense. The deflation argument aside, which I view as being poorly understood by macro traders, there’s been a clear rebound in both consumer and investor sentiment locally. Even though we are far from aggressive optimism, there is a deep desire among the policy players in Beijing to refrain from supporting old economic drivers which are heavily dependent on interest rates.

The play over the past 18 months, and which remains firmly intact, is to hold the focus on deleveraging the economy. Yes, as I’ve noted in the past, China has issued a massive number of government bonds. There are also countless articles discussing China operating this year with a budget deficit of nearly 10%. Where are all those funds going? That is the question I’ve found none to be asking, and it is a vitally important question.

Left pocket, right pocket. The majority of funds raised by the central government are being redirected to local governments for the expressed purpose of debt restructuring. Net-net, this supposed “fiscal bazooka” provides zero, or at least minimal, stimulus. China is working to put its fiscal house in order.

So whenever you see those clickbait titles which includes “China’s money printer”, go into the content with a great degree of skepticism.

China leaves benchmark lending rates unchanged as expected, despite Fed rate cut https://www.cnbc.com/2025/09/22/china-leaves-benchmark-lending-rates-lpr-loan-interest-unchanged-despite-fed-rate-cut.html?__source=iosappshare%7Ccom.apple.UIKit.activity.CopyToPasteboard

Have you tried putting these in the READS section in primal? IDK what you have to do but it may have more visibility

You need to change your efax to the eknotsfax version

nostr:npub1fndee72v9t5cc7szu3mdgkghs2musu9xmr608jzr5hwt0dfhvf2qp4z6h2 was doing some AI Nostr meetup lately

Where ?

Mi hijo de doce hizo un cypher. Que es y que dice

It’s like x86 platform coming to mining

I don’t know. The city is quite big. You can point them to me

im here.. we met at some nostr event in nashville

💯 . Its super important to vet your partner in difficult situations. Fights, how they treat service, kids, people that upset them, animals…. It’s not a cliche. my marriage was before btc, but when she got it and hears that btc is down in fiat terms she always says “buy more “ if I use it for something “why didn’t you use that fiat shitcoin?”

Excelente conversación!!! Hay manera de contactar a Elias. Es posible que tenga yo en latam algo que le interese!! Gracias

https://fountain.fm/episode/cCynM5v7WpZxedb0c863

nostr:nevent1qvzqqqpxquqzqzl9uhujkdpck2m4wpv9wqw3cmkvvu5dch4y4f78qcs9064ykd4r3r2chd