Why are you trying to convince me? I’m not Jack!

Okay…

Head for the panic room Jack! Quick!

They are both designed to survive without him. I think both are better because of him but I fully expect Bitcoin to survive him. And I think there’s a damn good chance Nostr does as well. (But we’re in Nostr’s infancy. It could die in the cradle.)

nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z: if I send you 250,000 sats, can you tell your X followers you’ll zap something like 5,000 or 10,000 sats to any #Nostr newbies who download a client and connect a lighting wallet (and then do it)? nostr:npub12vkcxr0luzwp8e673v29eqjhrr7p9vqq8asav85swaepclllj09sylpugg being an obvious option. (My follower count on X is crud. So, it won’t amount to much if I do it myself.)

I tend to think it has an objective component too that’s just harder to determine when you manipulate money the very thing you use to measure value. Assuming we are talking about anything the world doesn’t consider priceless. (But then again, money helps there too by telling you “I can’t measure this.”)

I’ll be honest. I think the odds of success for #Nostr are a lot less than #Bitcoin at this current stage.

Maybe that’s just a function of how long both have been released.

But I see grand possibilities for both and hope to see them both succeed beyond our wildest dreams.

If you set up your lightning wallet in the primal app, we can zap you!

Not the account, the discount. The etf approval should mean more people buy it, & once it’s launched, people will redeem until the discount closes. I think MSTR is being priced not just for its operating company + the bitcoin but also as a Bitcoin etf. So when an etf with much lower fees and more reputable than grayscale launches, that should reduce the MSTR premium some (by premium I’m talking about the price of MSTR over the value of its Bitcoin holdings).

nostr:note1958gmv4jtr7luegn4qrha7fx7vjwaq40awpja70uyxtftr4y8utstk0svq

An easy to use non-custodial lightning wallet is the dream.

Is the nostr:npub12vkcxr0luzwp8e673v29eqjhrr7p9vqq8asav85swaepclllj09sylpugg Wallet custodial? Of course. But it’s primarily going to be used for zapping. So don’t keep large amounts of funds on it which will be the case for the vast majority of people using it.

I think this is an overreaction if you’re using it for zaps. You shouldn’t keep large amounts of bitcoin on it and I can’t believe that’s the intent.

Agree. I think this was a smart way to deal with Apple. I don’t think there’s a way for Primal or any iOS Nostr client to intercede and take 30% of zaps, convert it to fiat, and then send that converted fiat to Apple. But this gives Apple a piece of the pie so they don’t protest too much.

Primal. I don’t see an add button:

Anyone know how I add things to my feed? I want to add #bookstr.

nostr:note1zesefte42e2rqklfu44ktz9z8cjhnvs5r2u9pm0d4sg0dpzrzn3qujtr2f

Being able to buy sats via Apple Pay is brilliant. The markup isn’t worth it for normal purchases but it’s going to be extremely useful onboarding someone to Bitcoin who is primarily on Nostr for the open source media platform.

In addition, if MSTR/nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m hang onto the stack into the future, there’s a very high likelihood that other firms and/or their owners end up *needing* Bitcoin because they don’t yet own any.

If that happens, MSTR gets to buy whole companies or large amounts of equity of other companies at great valuations *in Bitcoin terms* because he’s the only guy on the block w/ enough bitcoin to make these purchases.

If this happens, this is the beginning of MSTR becoming the new Berkshire which would make Saylor the new Buffett and that’s a role he’d play really well.

My guess is that others such as nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z & nostr:npub1k7vkcxp7qdkly7qzj3dcpw7u3v9lt9cmvcs6s6ln26wrxggh7p7su3c04l also see this as a very plausible long term outcome for MSTR/Saylor. nostr:note1rnt8cttfplvqtghjx7mpmeffqatncdcscplm4g3lwrnw887sr2sq6gq9gq

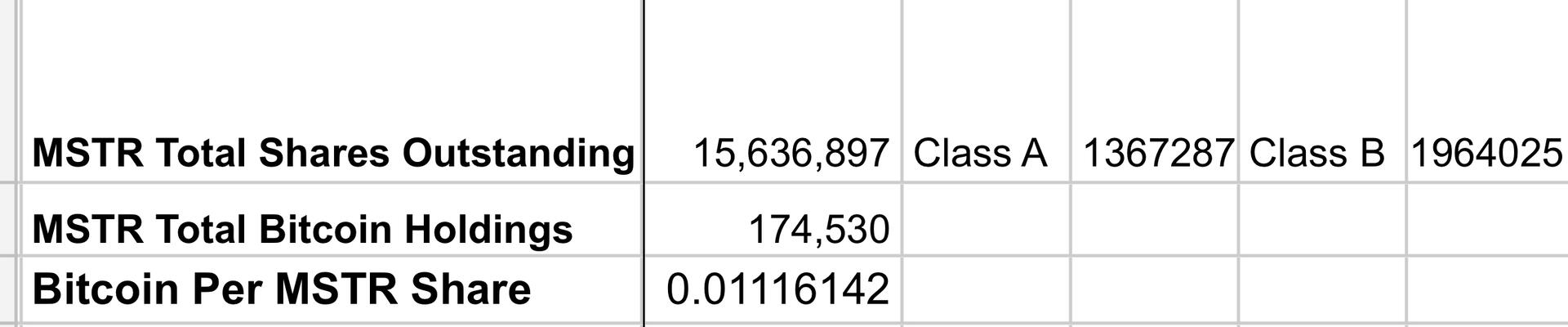

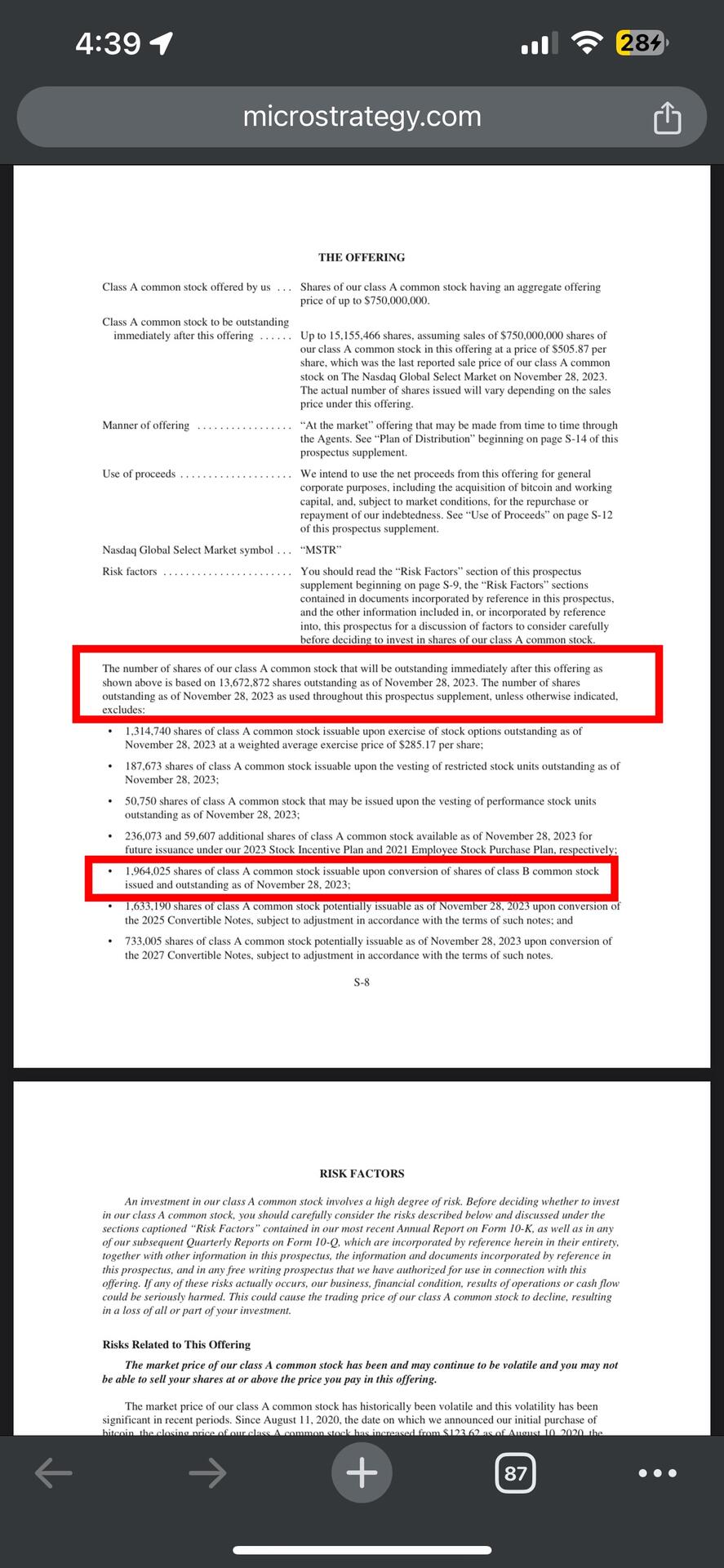

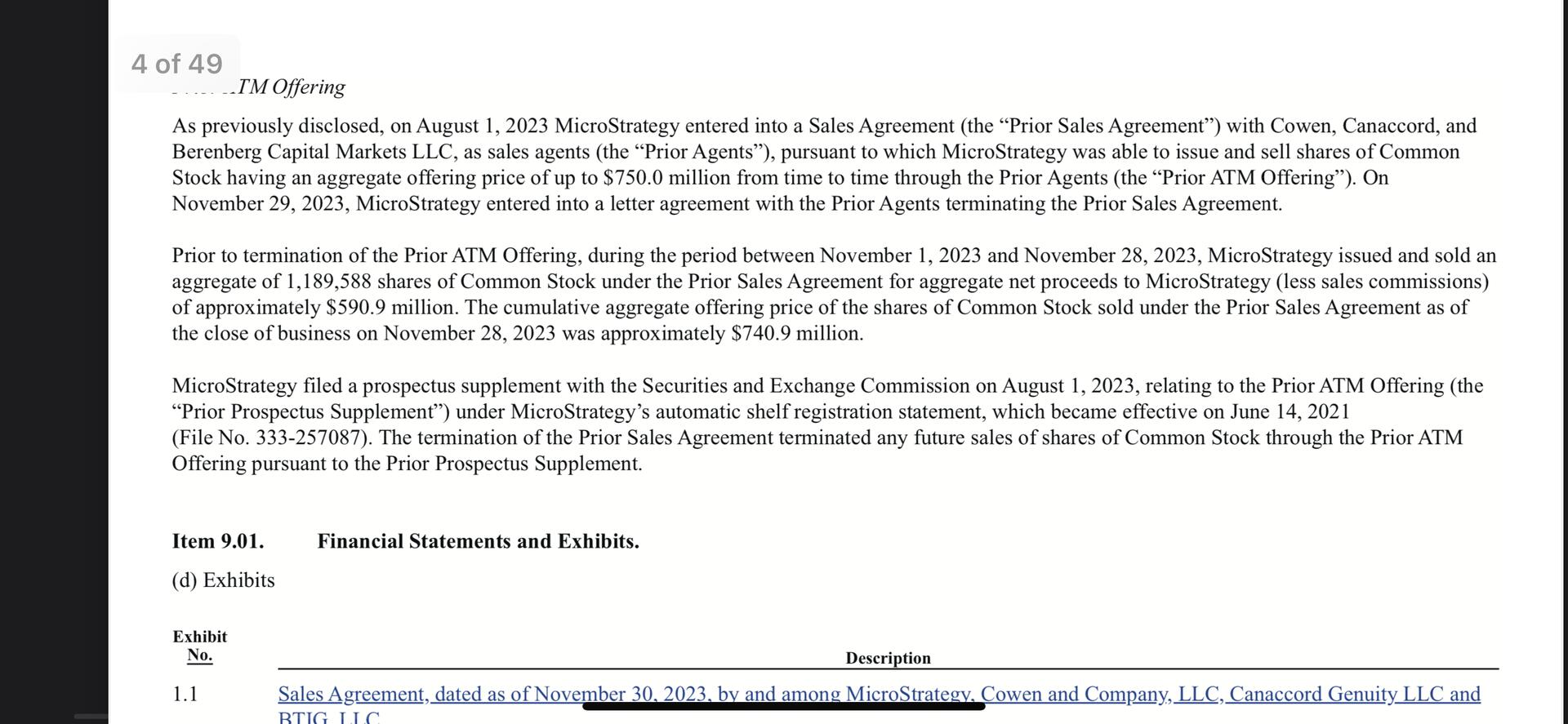

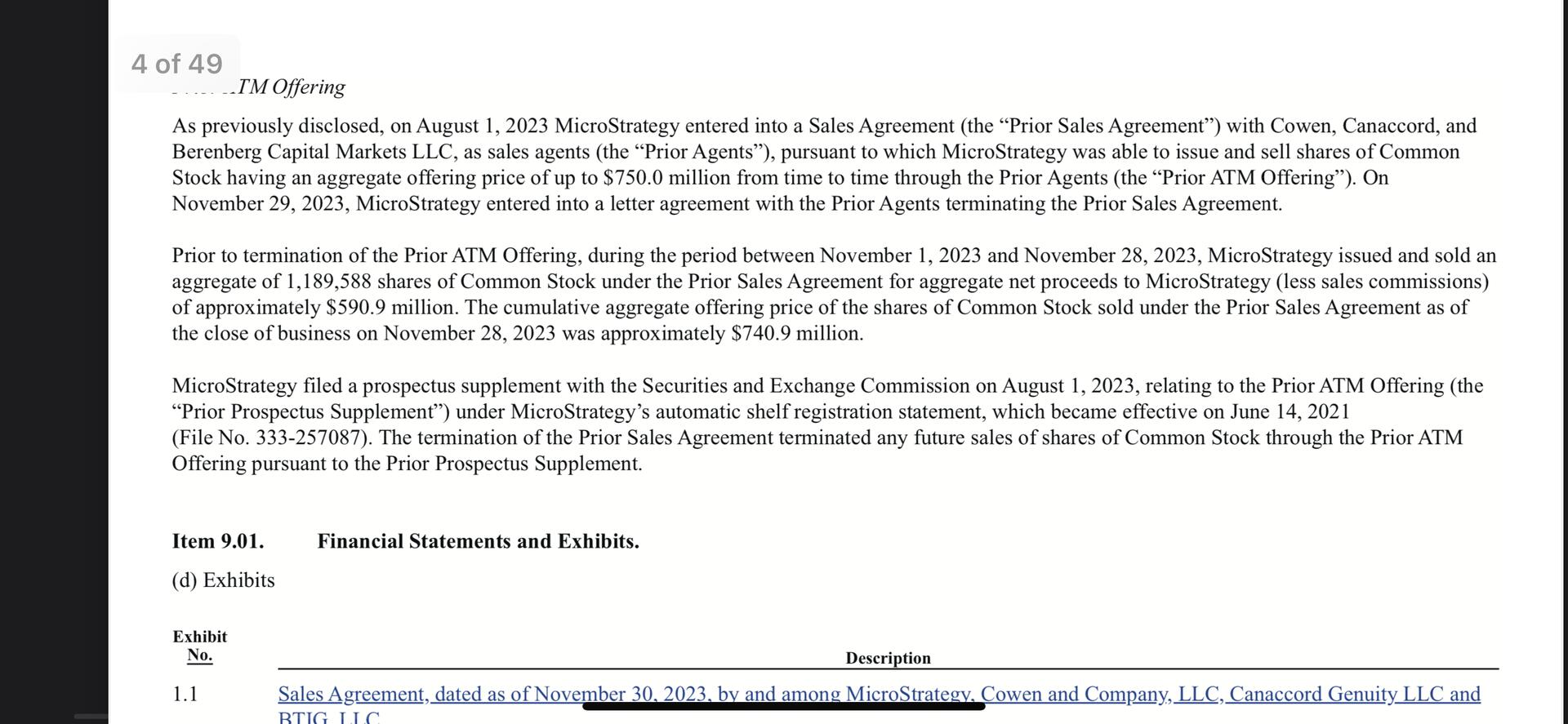

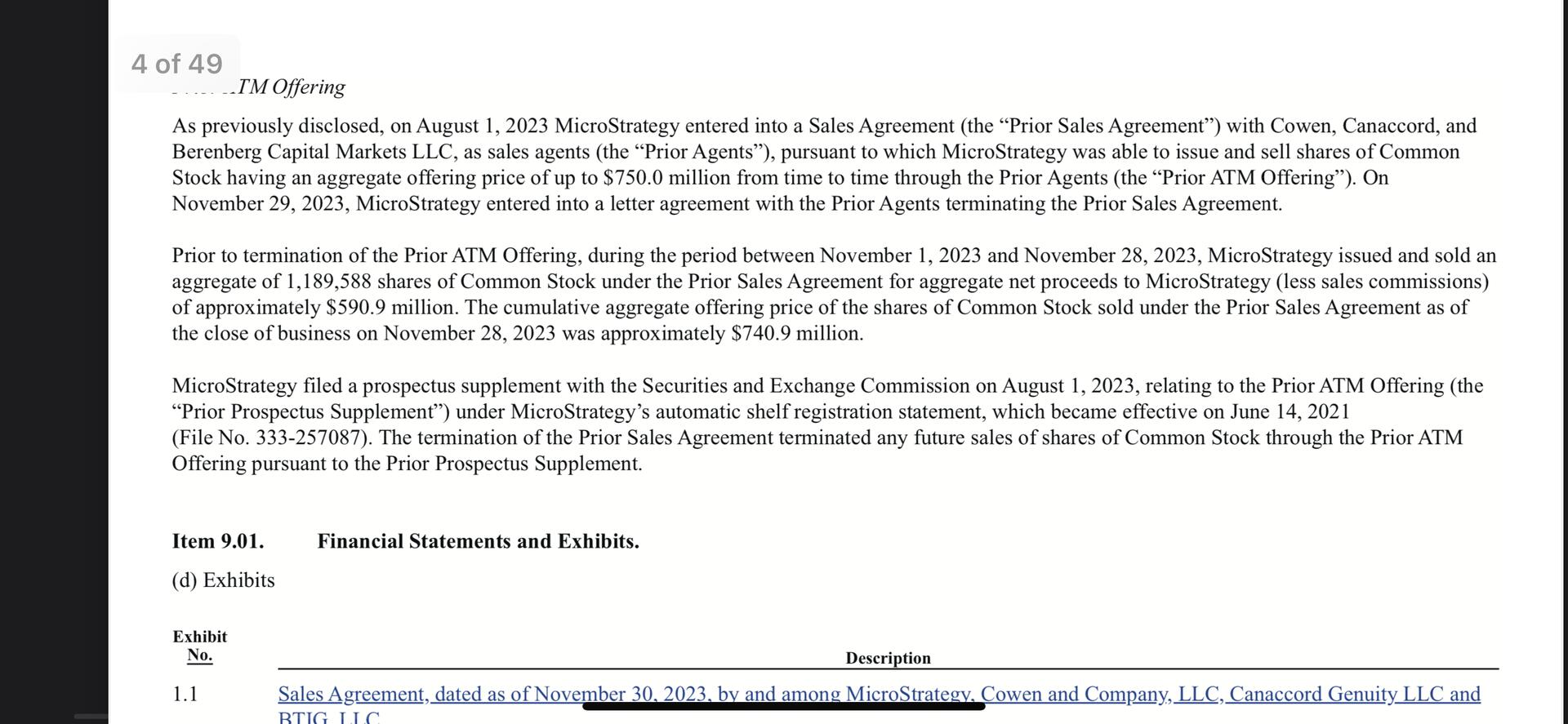

I think my numbers were off slightly. These numbers are taken from page S-8 of the supplemental prospectus and accurate as of November 28th. (I had to verify and kit just trust my work! Haha) https://www.microstrategy.com/content/dam/website-assets/collateral/financial-documents/financial-document-archive/prospectus-supplement_11-30-2023.pdf

No surprise that you get it too! I feel I’m in good company.

https://damus.io/note1fw3nlsj6fyj7gxz4pqk4u2gwqzq2u8kvq88d37kcwk6hnndj2zksld99nt

Another simple way to do it is to build a premium/discount calculator comparing sats per share to the price of bitcoin and if the current MSTR premium ever becomes a discount, you’re good to buy. This means you’re getting the sats at a discount and the operating company for free. This is what I used to trade among MSTR, GBTC, and OBTC.

You need to value the operating company separate from the Bitcoin. Once you know what the value of the operating company is, you’re looking for the price of a share of MSTR to be below the per share value of the company + the price of sats per share (the photo below will give you the current sats per share but remember this changes). If an opportunity presents itself again, my guess is that it will be around the approval/launch of the spot bitcoin ETFs and people sell MSTR for the ETF or just buy the ETF instead of MSTR and then it could get oversold.

No surprise, $MSTR issued more stock to do it. (See below.)

This was the right move as the stock has been trading at a high premium above its #bitcoin holdings, higher than the operating company is worth. ($MSTR should trade at a premium above its bitcoin holdings as hr operating company also has value, the question is how much.)

I believe nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m is laser eye focused on one metric: *sats per share.* He’ll do anything that doesn’t threaten the stack to increase it.

IMO, he’s a brilliant capital allocator.

This is why I had my mom buy some MSTR shares back when the stock was trading at the price of the bitcoin plus $8 for the operating company. It’s was a steal. Since then both Bitcoin and the MSTR premium have soared.

Now, if only Saylor can enter into a tiny loan he uses to buy bitcoin. Then when Bitcoin goes down & every lazy person who can’t be bothered to understand the loan agreement thinks MSTR is going to default pushes the stock to a large discount, he *buys back* shares and demonstrate to Wall Street what real capital allocation looks like.

When Bitcoin tanked, and as a result MSTR tanked because lazy people thought MSTR was at risk of defaulting on the Silvergate Loan, I moved my GBTC into MSTR & netted a bunch of sats. I’ve since moved back into GBTC, then OBTC, and then back into GBTC again netting me a bunch more sats.

I’m waiting for the MSTR premium to come back down to move out of GBTC into MSTR which is, all things being equal, the better play. (No fee, an operating company that will keep generating free cash flow to stack more sats, and one of the best capital allocators in the business.)

My guess is the divergence between the GBTC discount and the MSTR premium closes when a Bitcoin spot etf gets approved/launched. So that’s what I’m keeping my laser eyed focus on.  nostr:note1pk7c7gqws528u8kgrnfefx0yljnhh7m49v3nnu6xca8l5f03wevslfrpd5

nostr:note1pk7c7gqws528u8kgrnfefx0yljnhh7m49v3nnu6xca8l5f03wevslfrpd5

nostr:npub1k7vkcxp7qdkly7qzj3dcpw7u3v9lt9cmvcs6s6ln26wrxggh7p7su3c04l: as a MSTR owner, any added thoughts about the above?

No surprise, $MSTR issued more stock to do it. (See below.)

This was the right move as the stock has been trading at a high premium above its #bitcoin holdings, higher than the operating company is worth. ($MSTR should trade at a premium above its bitcoin holdings as hr operating company also has value, the question is how much.)

I believe nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m is laser eye focused on one metric: *sats per share.* He’ll do anything that doesn’t threaten the stack to increase it.

IMO, he’s a brilliant capital allocator.

This is why I had my mom buy some MSTR shares back when the stock was trading at the price of the bitcoin plus $8 for the operating company. It’s was a steal. Since then both Bitcoin and the MSTR premium have soared.

Now, if only Saylor can enter into a tiny loan he uses to buy bitcoin. Then when Bitcoin goes down & every lazy person who can’t be bothered to understand the loan agreement thinks MSTR is going to default pushes the stock to a large discount, he *buys back* shares and demonstrate to Wall Street what real capital allocation looks like.

When Bitcoin tanked, and as a result MSTR tanked because lazy people thought MSTR was at risk of defaulting on the Silvergate Loan, I moved my GBTC into MSTR & netted a bunch of sats. I’ve since moved back into GBTC, then OBTC, and then back into GBTC again netting me a bunch more sats.

I’m waiting for the MSTR premium to come back down to move out of GBTC into MSTR which is, all things being equal, the better play. (No fee, an operating company that will keep generating free cash flow to stack more sats, and one of the best capital allocators in the business.)

My guess is the divergence between the GBTC discount and the MSTR premium closes when a Bitcoin spot etf gets approved/launched. So that’s what I’m keeping my laser eyed focus on.  nostr:note1pk7c7gqws528u8kgrnfefx0yljnhh7m49v3nnu6xca8l5f03wevslfrpd5

nostr:note1pk7c7gqws528u8kgrnfefx0yljnhh7m49v3nnu6xca8l5f03wevslfrpd5

Also, at some point, post the etf approval and launch which should close the GBTC discount, I’ll probably buy spot Bitcoin. This is all in my Roth, so I’ve got to roll it over to some place that will let me do that like unchained. And for various other reasons, I wasn’t able to do so.

Also, I’m not too worried about counterparty risk or seizure of bitcoin by the government in the immediate future. So, I wanted to trade my way into more bitcoin than I would otherwise have. But I do think both are real risks in the medium to long term.

No surprise, $MSTR issued more stock to do it. (See below.)

This was the right move as the stock has been trading at a high premium above its #bitcoin holdings, higher than the operating company is worth. ($MSTR should trade at a premium above its bitcoin holdings as hr operating company also has value, the question is how much.)

I believe nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m is laser eye focused on one metric: *sats per share.* He’ll do anything that doesn’t threaten the stack to increase it.

IMO, he’s a brilliant capital allocator.

This is why I had my mom buy some MSTR shares back when the stock was trading at the price of the bitcoin plus $8 for the operating company. It’s was a steal. Since then both Bitcoin and the MSTR premium have soared.

Now, if only Saylor can enter into a tiny loan he uses to buy bitcoin. Then when Bitcoin goes down & every lazy person who can’t be bothered to understand the loan agreement thinks MSTR is going to default pushes the stock to a large discount, he *buys back* shares and demonstrate to Wall Street what real capital allocation looks like.

When Bitcoin tanked, and as a result MSTR tanked because lazy people thought MSTR was at risk of defaulting on the Silvergate Loan, I moved my GBTC into MSTR & netted a bunch of sats. I’ve since moved back into GBTC, then OBTC, and then back into GBTC again netting me a bunch more sats.

I’m waiting for the MSTR premium to come back down to move out of GBTC into MSTR which is, all things being equal, the better play. (No fee, an operating company that will keep generating free cash flow to stack more sats, and one of the best capital allocators in the business.)

My guess is the divergence between the GBTC discount and the MSTR premium closes when a Bitcoin spot etf gets approved/launched. So that’s what I’m keeping my laser eyed focus on.  nostr:note1pk7c7gqws528u8kgrnfefx0yljnhh7m49v3nnu6xca8l5f03wevslfrpd5

nostr:note1pk7c7gqws528u8kgrnfefx0yljnhh7m49v3nnu6xca8l5f03wevslfrpd5

No surprise, $MSTR issued more stock to do it. (See below.)

This was the right move as the stock has been trading at a high premium above its #bitcoin holdings, higher than the operating company is worth. ($MSTR should trade at a premium above its bitcoin holdings as hr operating company also has value, the question is how much.)

I believe nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m is laser eye focused on one metric: *sats per share.* He’ll do anything that doesn’t threaten the stack to increase it.

IMO, he’s a brilliant capital allocator.

This is why I had my mom buy some MSTR shares back when the stock was trading at the price of the bitcoin plus $8 for the operating company. It’s was a steal. Since then both Bitcoin and the MSTR premium have soared.

Now, if only Saylor can enter into a tiny loan he uses to buy bitcoin. Then when Bitcoin goes down & every lazy person who can’t be bothered to understand the loan agreement thinks MSTR is going to default pushes the stock to a large discount, he *buys back* shares and demonstrate to Wall Street what real capital allocation looks like.

When Bitcoin tanked, and as a result MSTR tanked because lazy people thought MSTR was at risk of defaulting on the Silvergate Loan, I moved my GBTC into MSTR & netted a bunch of sats. I’ve since moved back into GBTC, then OBTC, and then back into GBTC again netting me a bunch more sats.

I’m waiting for the MSTR premium to come back down to move out of GBTC into MSTR which is, all things being equal, the better play. (No fee, an operating company that will keep generating free cash flow to stack more sats, and one of the best capital allocators in the business.)

My guess is the divergence between the GBTC discount and the MSTR premium closes when a Bitcoin spot etf gets approved/launched. So that’s what I’m keeping my laser eyed focus on.  nostr:note1pk7c7gqws528u8kgrnfefx0yljnhh7m49v3nnu6xca8l5f03wevslfrpd5

nostr:note1pk7c7gqws528u8kgrnfefx0yljnhh7m49v3nnu6xca8l5f03wevslfrpd5

I guess it’s “the free market” when you like it and “blackmail” when you don’t.