You can read more here:

In theory it's good for spam prevention. Publishing a normal amount of notes is not computationally expensive but spamming is. However, I don't see the point if you can set it yourself?

The gold seizure treason and plot. I know of no reason why the gold seizure treason should ever be forgot.

Happy 6102 day plebs! No-KYC #bitcoin in cold storage is the antidote to a 6102 rugpull by any government.

Use the tools. KYC is the illicit activity.

I think that not enough people care about the non-KYC principle to make offering it an attractive strategy for companies/jurisdictions. Sadly. I think the slow boil strategy of gradually tightening KYC is highly effective whether it's conscious or not.

Well, sure but the pressure to KYC has never been greater and will probably get considerably worse. The recent EU legislation is a case in point. Using the tools is only part of a solution. You also need to think long-term geopolitical arbitrage to not get fucked.

The constructed language Esperanto is an interesting example of this.

Hustling paper bitcoin gets you 25 years in prison. Now let's get those ETF addresses public.

Trustworthy but probably for too few people to matter in the end. And it couldn't be frozen completely to allow for emergency patches (fix critical vuln in libsecp256k1 for example).

🚀 Join us on the next step of our journey! Fedi Bravo is live!

Now you can…

💸 Use Fedi with real money.

📱Play with more mods

⚡Send and receive funds with your friends

We are almost there for the big launch! But to make the app even better, we need your help. You're invited to be a part of this, so remember to give feedback! Let’s build together!

Click the link below to get all the details on Fedi Bravo.

There's a confusing stack of green cash beside the words "real money".

Fair point but that's exactly what I'm saying. If we assume bitcoin will gobble up the global wealth, fiat debt will deflate because it has been folded so many times over itself like you said. If we tried to somehow pump global debt into bitcoin it would be a manifold double spend and couldn't be done, right?

I'm having a deja vu. I've read this conversation on stackoverflow way back. It didn't end well. We're talking about the same thing anyway essentially.

"Cashu is not a scaling solution for Bitcoin."

- nostr:npub12rv5lskctqxxs2c8rf2zlzc7xx3qpvzs3w4etgemauy9thegr43sf485vg

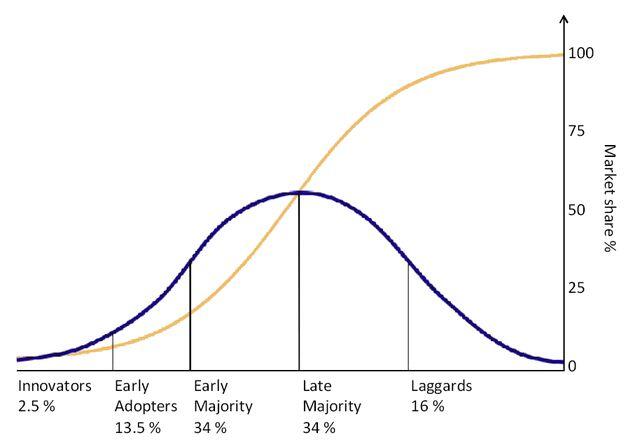

Assuming we are still in the innovator phase I would say this cycle takes us squarely into the next phase.

Does it make sense to compare the value of bitcoin to the global debt, though? Global wealth is probably much less than the global debt. Mixing wealth with debt seems like such a fiat concept. Does that make sense?

Never were much of a fan of the diminishing returns theory. I guess it kind of makes sense that the supply drop is smaller compared to the whole supply each halving, so it should have a lesser effect each time, right? But the new supply is always half of what it was before so it doesn't really matter in relation to the 21M. The only important thing is the supply / demand ratio.

And it makes sense that reaching every order of magnitude in terms of market cap is MUCH harder than reaching the previous order of magnitude, so logically the NGU gets slower over time, right? I'm with you thinking that we're not nearly there yet. As long as buying empty real estate makes more sense to the average wealthy person/business, we're not there yet.

But why exactly 14.1x from the halving? That would break the long-term power law.