-----BEGIN PGP SIGNED MESSAGE-----

Hash: SHA256

The concern over Shor's algorithm potentially compromising elliptic curve cryptography (ECC) in Bitcoin is 100% valid, but it's important to note that Bitcoin's protocol is designed to adapt and evolve.

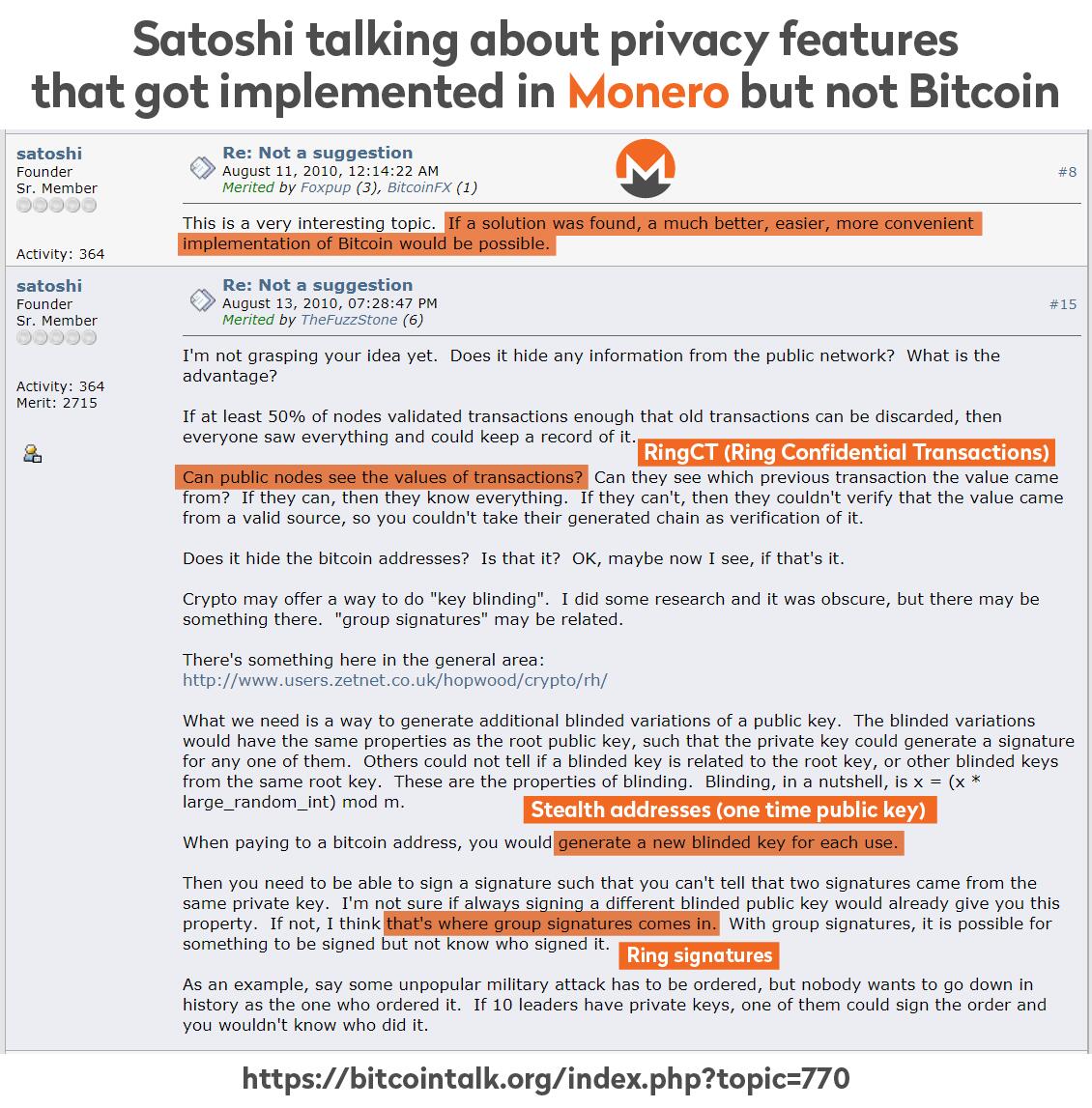

Bitcoin can undergo updates, potentially split into other currencies, like Bitcoin Cash (Where they tried to apply more size to the Blocks, and failed, security has to be simple, strong and descentralized, not complicated and with centralized decisions like Monero and Ethereum that are so much easier to destroy with quantum computers), and strengthen its security with improved cryptographic methods.

Even simple measures like increasing key bit lengths exponentially increase security. For instance, the number of possible private keys in a 256-bit system is 2^256, and the number of public key combinations is around 10^77, nearly approaching the estimated number of atoms in the observable universe (10^80).

Bitcoin's current cryptographic standards, while considered 'outdated' in the face of quantum computing, already provide formidable security for decades since the first block. As technology progresses, the potential number of private keys and addresses can expand to unimaginable scales like Googols (10^100), Centillions (10^303) or more, making targeted attacks by quantum computers increasingly impractical.

The decentralized nature of Bitcoin, with its diverse cryptographic approaches and lack of centralized targets, further complicates any singular quantum computing attack scenario.

"You underestimate Leviathan"

I underestimate Leviathan much more, it's not a galactic and omniscient entity, it's just a bunch of old people who are always 10km behind technology, in any generation and age.

You are doing what everyone has done throughout history, overestimating these people and giving them power, but you forget that 300 people can beat 1 police officer, and 11,000 people beat 1 old politician who only thinks about himself, like it is in our country.

Don't forget moments like:

- - Risks of phone radiation

- - Collapse of power grid due to cyber attacks or solar storms

- - Superintelligent and cruel A.i

- - GPS Risks due to Solar Activity

- - Conspiracy theories about 5G Technology

- - 2038 Computer Apocalypse

- - Theories about Nikola Tesla and Electromagnetic Energy Harm

And more, like Haarp controlling climate changes, etc.

When the police and military run out of money because of politicians investing trillions into taking down the currency that many of them use, there will be nothing an old idiot can do but scream at people to use Bitcoin in his country.

-----BEGIN PGP SIGNATURE-----

iJUEARMIAD02HExvcmVuYUZyb21MYW5pYWtlYSA8U29tZXdoZXJlSW5MYW5pYWtl

YUBtYWlsMnRvci5jb20+BQJmjvVtAAoJEIIIjim8wfl80CcBAJIxoODEgJROu9Lq

rdw4Lbz9z44DmqExu1s+AFRBXjLZAQCeBXq3Dpz4YRCFsvuEDcEKRxKVYsouYeUu

iiFXh4jyaA==

=ZVMt

-----END PGP SIGNATURE-----