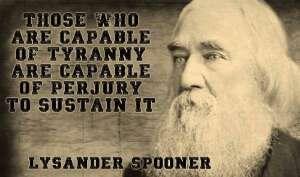

There are so many problems with this thinking I'm only going to address the most fundamental one: the central planning fallacy.

You see it as an absolute necessity to prevent all failures. This is wrong and bad.

It's the same dynamic we see in forest management. For decades the US forest service has had a zero tolerance policy toward wild fires. The results? Disastrous. Forest fires cannot be entirely prevented. They are a force of nature. If you suppress natural fires you enable unnaturally large fires. In 2018 California suffered its deadliest and most destructive wildfire in recorded history. The entire city of Paradise California burned to the ground.

I see parents all the time who coddle their kids too much. They never let them fail. They never utter a harsh word for fear of upsetting their kids feelings. Kids need to fall down and scrape their knees so they learn not to do that. They need to get yelled at when they misbehave so they learn how to behave. What's the result of all this coddling? The world is filling up with risk averse adult-sized children who never learned how to fail. But they learned how to vote. Now we have cops dragging parents to jail for not preventing their 10 year old kids from walking two miles to town. We're trending in the wrong direction.

Same story for banks. The US financial-congressional complex has prevented all bank failures for a generation with ever larger bailouts. As a result, all banking is centralized and the systemic risk has never been higher. Our whole financial system is Paradise, California before the fire. Everyone except the bitcoiners are blissfully ignorant. They don't have an escape plan, or even fire insurance.

In a sane world, banks fail. To think otherwise is to be ignorant of how the world really works.