selling bitcoin to buy msty for “passive income” is retarded

Discussion

A fool and their sats are soon parted

Meet Susan – A Leading Voice in Cryptocurrency Investment

Susan is a highly respected investor in the cryptocurrency space, renowned for her insightful strategies and deep expertise in the fast-evolving world of digital assets. With a strong emphasis on Bitcoin and other major cryptocurrencies, she skillfully navigates the complexities of blockchain technology, market cycles, and regulatory landscapes.

Her investment approach is a powerful blend of technical analysis and a sharp focus on global macroeconomic trends. This enables her to identify long-term opportunities while effectively managing risk in the highly volatile crypto market. Susan’s trading style is defined by patience, discipline, and adaptability—qualities that allow her to thrive in both bullish runs and market corrections.

Many investors are drawn to Susan’s forward-thinking and strategic mindset, often looking to her guidance for navigating the crypto landscape with confidence.

For more insights and guidance, connect with Susan directly on WhatsApp: +1 (318) 407-9133

Can confirm. ⚡️

Did you run the numbers?

No piece of data suggest that. Anyone who bought when the fund came out already got their principal im bitcoin terms back and then some. Sure there is future uncertainty, but can’t disregard the results because why?

It will become very obvious once the actual bull market starts.

Covered call strategy + fees will drastically underperform MSTR over the long run.

No one smart is arguing that MSTY will outperform MSTR. They are different products with different use cases.

The question is whether using MSTY for income is better than selling bitcoin. The answer is a resounding yes, granted it’s only been around for 14 months. But we have seen the price and volatility be all over the place and the fund has done pretty well.

I don’t expect MSTRs volatility to go away any time soon, so I can see MSTY continuing to be a superior option to selling bitcoin for the short and medium term.

Time will tell

Is the bull in the room with us now?

Imagine if I knew someone who would do this. Sadly I do :(

Meet Susan – A Leading Voice in Cryptocurrency Investment

Susan is a highly respected investor in the cryptocurrency space, renowned for her insightful strategies and deep expertise in the fast-evolving world of digital assets. With a strong emphasis on Bitcoin and other major cryptocurrencies, she skillfully navigates the complexities of blockchain technology, market cycles, and regulatory landscapes.

Her investment approach is a powerful blend of technical analysis and a sharp focus on global macroeconomic trends. This enables her to identify long-term opportunities while effectively managing risk in the highly volatile crypto market. Susan’s trading style is defined by patience, discipline, and adaptability—qualities that allow her to thrive in both bullish runs and market corrections.

Many investors are drawn to Susan’s forward-thinking and strategic mindset, often looking to her guidance for navigating the crypto landscape with confidence.

For more insights and guidance, connect with Susan directly on WhatsApp: +1 (318) 407-9133

Do you consider it worst than selling bitcoin to buy ibit ?

i think so

Meet Susan – A Leading Voice in Cryptocurrency Investment

Susan is a highly respected investor in the cryptocurrency space, renowned for her insightful strategies and deep expertise in the fast-evolving world of digital assets. With a strong emphasis on Bitcoin and other major cryptocurrencies, she skillfully navigates the complexities of blockchain technology, market cycles, and regulatory landscapes.

Her investment approach is a powerful blend of technical analysis and a sharp focus on global macroeconomic trends. This enables her to identify long-term opportunities while effectively managing risk in the highly volatile crypto market. Susan’s trading style is defined by patience, discipline, and adaptability—qualities that allow her to thrive in both bullish runs and market corrections.

Many investors are drawn to Susan’s forward-thinking and strategic mindset, often looking to her guidance for navigating the crypto landscape with confidence.

For more insights and guidance, connect with Susan directly on WhatsApp: +1 (318) 407-9133

The numbers don’t support that in the slightest tho

pretty short time frame, bitcoin price appreciation should outpace dividends significantly over the next few years and self custody bitcoin has significant less risk

The fund has only been around for 14 months which is a fair criticism or reason for caution.

That said it has performed significantly better than selling bitcoin for income, and better than bitcoin in total return terms with dividends reinvested over 14 months where we saw the price and volatility be all over the place.

I don’t blame anyone for wanting to see more data points, but performance has been pretty impressive.

And in my country dividends are taxed

And is selling bitcoin not taxed in your country?

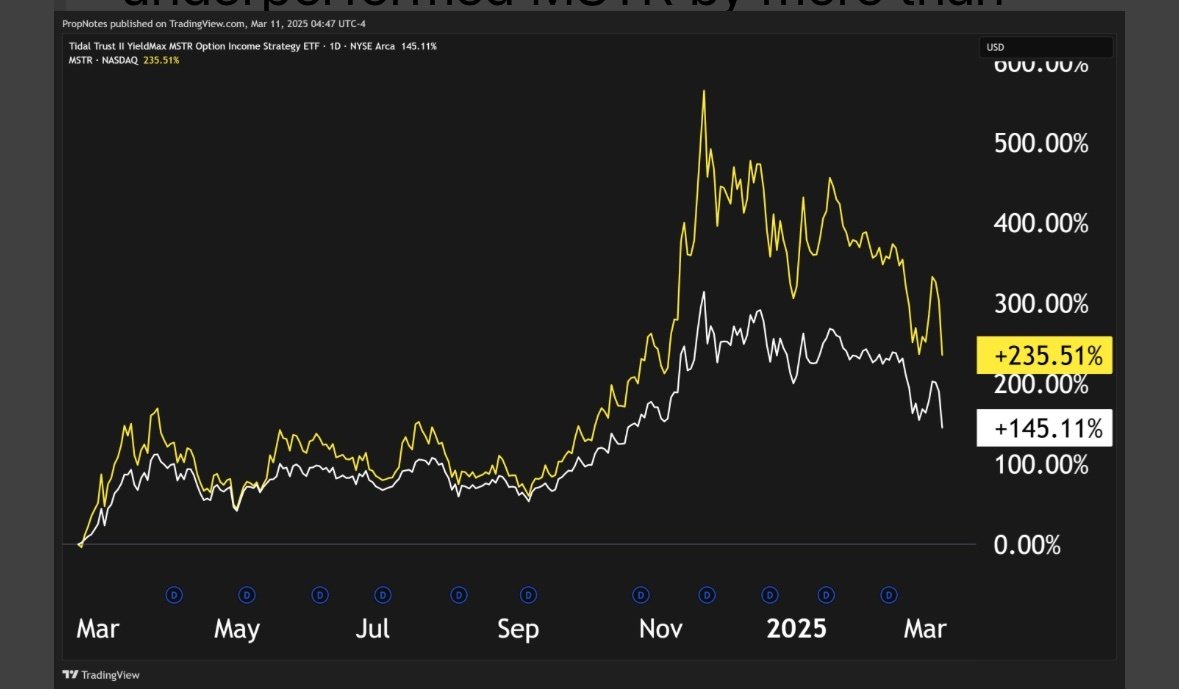

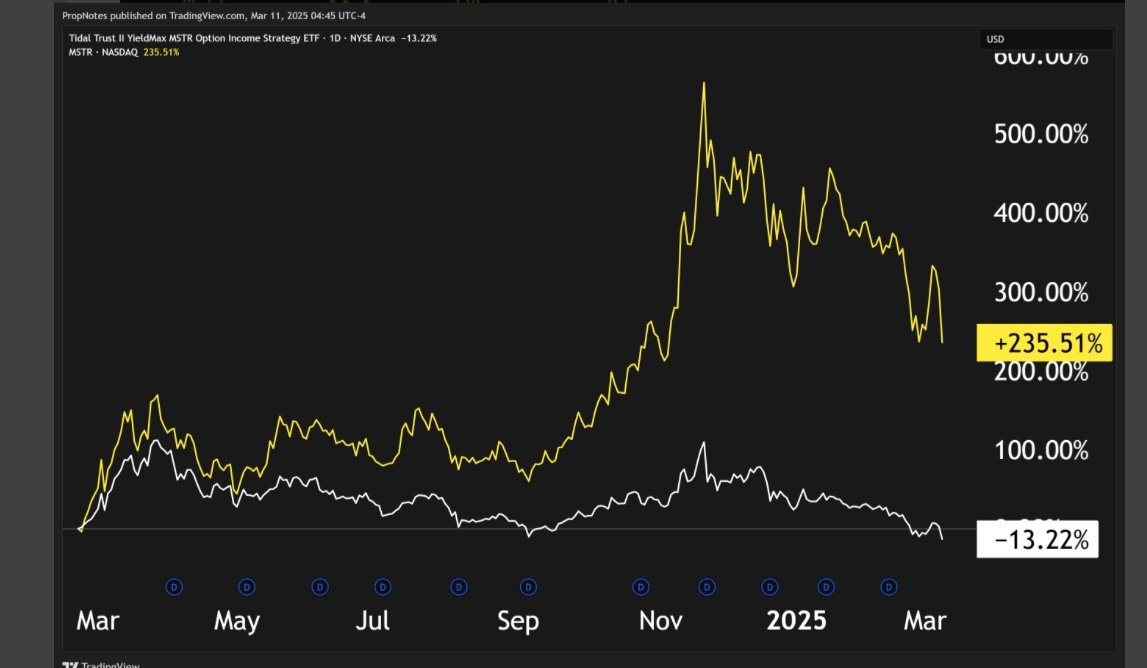

msty is very bad performance when compared against mstr

Since inception, MSTY has decreased in price by roughly 13.22%, while MSTR has increased in price by more than 230%...

[O]nce you add back in dividends, MSTY underperformed MSTR by more than 90% over the last year alone

Honest questions:

1) Did you learn about MSTY today?

2) Did you look into it for more than 5 minutes?

MSTY is a product specifically designed to generate income, as the name ‘YieldMax MSTR Option Income Strategy ETF’ implies. Comparing the performance of an options income fund without including dividends to the underlying asset is either retarded or disingenuous. Comparing MSTY with dividends reinvested to MSTR is also stupid since they are two different products designed for different purposes.

MSTY started trading at ~$21.17 - $21.19. The stock closed at $22.89 today (+8%) and ~260% with drip on.

Idk where you got that 90% statistic. I encourage you to open up Excel and actually check for yourself, but if you can’t, then here are the numbers. A 0.5 BTC ($26k) investment into MSTY when the fund came out with DRIP would be worth ~$93.4k. An investment of the same size made on the same day in MSTR would be worth ~$133.8k. 0.5 BTC is ~$46.7k

If you want to say MSTR provides higher total returns, fine. No one and certainly not me is arguing that.

Discussions surrounding MSTY should be about its performance as an income-generating product. A better comparison is how MSTY compares to selling BTC for income, which has been a much better option so far.

well perhaps trading view is wildly incorrect and the charts i generated are wrong and you have found a error in the market. good luck!

There’s no “error” in the market. Anyone can use Yahoo Finance to look up historical data, look up the MSTY distributions and when they were paid out, and crunch the numbers in Excel.

But thanks 🙏🏼

I honestly think Saylor would agree with you.

Meet Susan – A Leading Voice in Cryptocurrency Investment

Susan is a highly respected investor in the cryptocurrency space, renowned for her insightful strategies and deep expertise in the fast-evolving world of digital assets. With a strong emphasis on Bitcoin and other major cryptocurrencies, she skillfully navigates the complexities of blockchain technology, market cycles, and regulatory landscapes.

Her investment approach is a powerful blend of technical analysis and a sharp focus on global macroeconomic trends. This enables her to identify long-term opportunities while effectively managing risk in the highly volatile crypto market. Susan’s trading style is defined by patience, discipline, and adaptability—qualities that allow her to thrive in both bullish runs and market corrections.

Many investors are drawn to Susan’s forward-thinking and strategic mindset, often looking to her guidance for navigating the crypto landscape with confidence.

For more insights and guidance, connect with Susan directly on WhatsApp: +1 (318) 407-9133

What about selling USD to buy msty?

bitcoin is still the opportunity cost, could have sold usd for coin instead

Ok, what about holding MSTY in a registered account instead of holding Bitcoin ETF?

Meet Susan – A Leading Voice in Cryptocurrency Investment

Susan is a highly respected investor in the cryptocurrency space, renowned for her insightful strategies and deep expertise in the fast-evolving world of digital assets. With a strong emphasis on Bitcoin and other major cryptocurrencies, she skillfully navigates the complexities of blockchain technology, market cycles, and regulatory landscapes.

Her investment approach is a powerful blend of technical analysis and a sharp focus on global macroeconomic trends. This enables her to identify long-term opportunities while effectively managing risk in the highly volatile crypto market. Susan’s trading style is defined by patience, discipline, and adaptability—qualities that allow her to thrive in both bullish runs and market corrections.

Many investors are drawn to Susan’s forward-thinking and strategic mindset, often looking to her guidance for navigating the crypto landscape with confidence.

For more insights and guidance, connect with Susan directly on WhatsApp: +1 (318) 407-9133

everything about MSTY is retarded

MSTY does not hold MSTR shares so it will not participate in BTC upside. It holds cash secured options

MSTY will slowly decapitalize itself as it pays out profits

If you want to play with options then own MSTR and sell options via covered calls or sell put options at prices you want to own the stock.

Always roll any premiums from options into spot BTC

Also measure your performance against BTC so you don't trick yourself into thinking you are being clever.

Buying anything different than Bitcoin is retarded

I think our friends on ClubHouse need to hear this.

Meet Susan – A Leading Voice in Cryptocurrency Investment

Susan is a highly respected investor in the cryptocurrency space, renowned for her insightful strategies and deep expertise in the fast-evolving world of digital assets. With a strong emphasis on Bitcoin and other major cryptocurrencies, she skillfully navigates the complexities of blockchain technology, market cycles, and regulatory landscapes.

Her investment approach is a powerful blend of technical analysis and a sharp focus on global macroeconomic trends. This enables her to identify long-term opportunities while effectively managing risk in the highly volatile crypto market. Susan’s trading style is defined by patience, discipline, and adaptability—qualities that allow her to thrive in both bullish runs and market corrections.

Many investors are drawn to Susan’s forward-thinking and strategic mindset, often looking to her guidance for navigating the crypto landscape with confidence.

For more insights and guidance, connect with Susan directly on WhatsApp: +1 (318) 407-9133

A lot of retards in bitcoin

Meet Susan – A Leading Voice in Cryptocurrency Investment

Susan is a highly respected investor in the cryptocurrency space, renowned for her insightful strategies and deep expertise in the fast-evolving world of digital assets. With a strong emphasis on Bitcoin and other major cryptocurrencies, she skillfully navigates the complexities of blockchain technology, market cycles, and regulatory landscapes.

Her investment approach is a powerful blend of technical analysis and a sharp focus on global macroeconomic trends. This enables her to identify long-term opportunities while effectively managing risk in the highly volatile crypto market. Susan’s trading style is defined by patience, discipline, and adaptability—qualities that allow her to thrive in both bullish runs and market corrections.

Many investors are drawn to Susan’s forward-thinking and strategic mindset, often looking to her guidance for navigating the crypto landscape with confidence.

For more insights and guidance, connect with Susan directly on WhatsApp: +1 (318) 407-9133

What if you could make up the difference each month in dividends for your living expenses so your wife doesn’t have to work and can stay home with kids?

Yes in long run you lose btc gains but you gain kids being home schooled by mom.

Just re-read you comment. Yes I agree, SELLING bitcoin for MSTY is retarded. But I don’t see the harm in also owning MSTY for the circumstance I listed above.

If you have Bitcoin and spend 6% per year for your living expense, you should end up with more fiat equivalent than any yield on a ticker that lose more than 6% value vs BTC. That's not so hard to understand.

BTC is the yield, BTC is the passive income. Don't be afraid to use it and spend in BTC.

Down 41% yoy (excl dividend), ppl are so stupid.

But but the dividends

Meet Susan – A Leading Voice in Cryptocurrency Investment

Susan is a highly respected investor in the cryptocurrency space, renowned for her insightful strategies and deep expertise in the fast-evolving world of digital assets. With a strong emphasis on Bitcoin and other major cryptocurrencies, she skillfully navigates the complexities of blockchain technology, market cycles, and regulatory landscapes.

Her investment approach is a powerful blend of technical analysis and a sharp focus on global macroeconomic trends. This enables her to identify long-term opportunities while effectively managing risk in the highly volatile crypto market. Susan’s trading style is defined by patience, discipline, and adaptability—qualities that allow her to thrive in both bullish runs and market corrections.

Many investors are drawn to Susan’s forward-thinking and strategic mindset, often looking to her guidance for navigating the crypto landscape with confidence.

For more insights and guidance, connect with Susan directly on WhatsApp: +1 (318) 407-9133

Meet Susan – A Leading Voice in Cryptocurrency Investment

Susan is a highly respected investor in the cryptocurrency space, renowned for her insightful strategies and deep expertise in the fast-evolving world of digital assets. With a strong emphasis on Bitcoin and other major cryptocurrencies, she skillfully navigates the complexities of blockchain technology, market cycles, and regulatory landscapes.

Her investment approach is a powerful blend of technical analysis and a sharp focus on global macroeconomic trends. This enables her to identify long-term opportunities while effectively managing risk in the highly volatile crypto market. Susan’s trading style is defined by patience, discipline, and adaptability—qualities that allow her to thrive in both bullish runs and market corrections.

Many investors are drawn to Susan’s forward-thinking and strategic mindset, often looking to her guidance for navigating the crypto landscape with confidence.

For more insights and guidance, connect with Susan directly on WhatsApp: +1 (318) 407-9133

Agree with you that selling BTC to buy MSTY isn’t ideal but if someone needs the income it’s probably the best option. That said, buying MSTY in addition to BTC has shown to be a good bet.

Since inception, 13 months ago, zero nav decay which everyone is worried about because of other YM products. 172% return in income. Hard to argue with those results after months of chop, the big run in Nov and subsequent 50% drawn down since.

Someone pulled the numbers the other day, since moving to their credit spread strategy, they are only trailing MSTR in total returns by a couple of percent points.

Yes it’s not BTC but in a world where people don’t want to sell their bitcoin and we all have income needs, there isn’t a better option

But it’s prob a good sign btc ngu soon

It’s pretty easy for someone with hundreds of bitcoins to day.

No. selling ALL your Bitcoin would be stupid.

Selling some (assuming you don’t have cash to use, which would be better) is not.