Don't you see what... what's going on? We're no better off than we were before. They let us complain and--and make suggestions but, they never really change anything. They let us choose between Master Jones and Mr Johnson. What's the difference? They still make all the rules. Punish us if we disobey. We... we still do all the work. They come and take as much as they want. And they give us just enough. Just enough, that we don't rise up, or run away. Slave... to work. The way I see it is, they just change the words they use. Nothing is really changed, we are all still slaves.

Why should we obey their rules? We didn't agree to this. They forced this upon us. They have tricked you into thinking that choosing your own master, is the same as being free.

Well, you’re principled, hats off. Thx!

Of course, this note is likable, not all the way zappable :)

They all work for the same people.

Here on #Nostr it’s a community more than social media. It’s a two way street of where you follow people you like, if they like you, they follow you back. You have a dialogue and grow. Not the algorithm hyped “influencers” talking at you, while they don’t care about what their “followers” say. Personally I would change the term follower to connections on Nostr.

And we haven’t even started to scratch the surface on hard times…

I think they were the good times generation and the current generation are the weak men? Isn’t this the current generation?

Maybe create your own sample of goods and services?

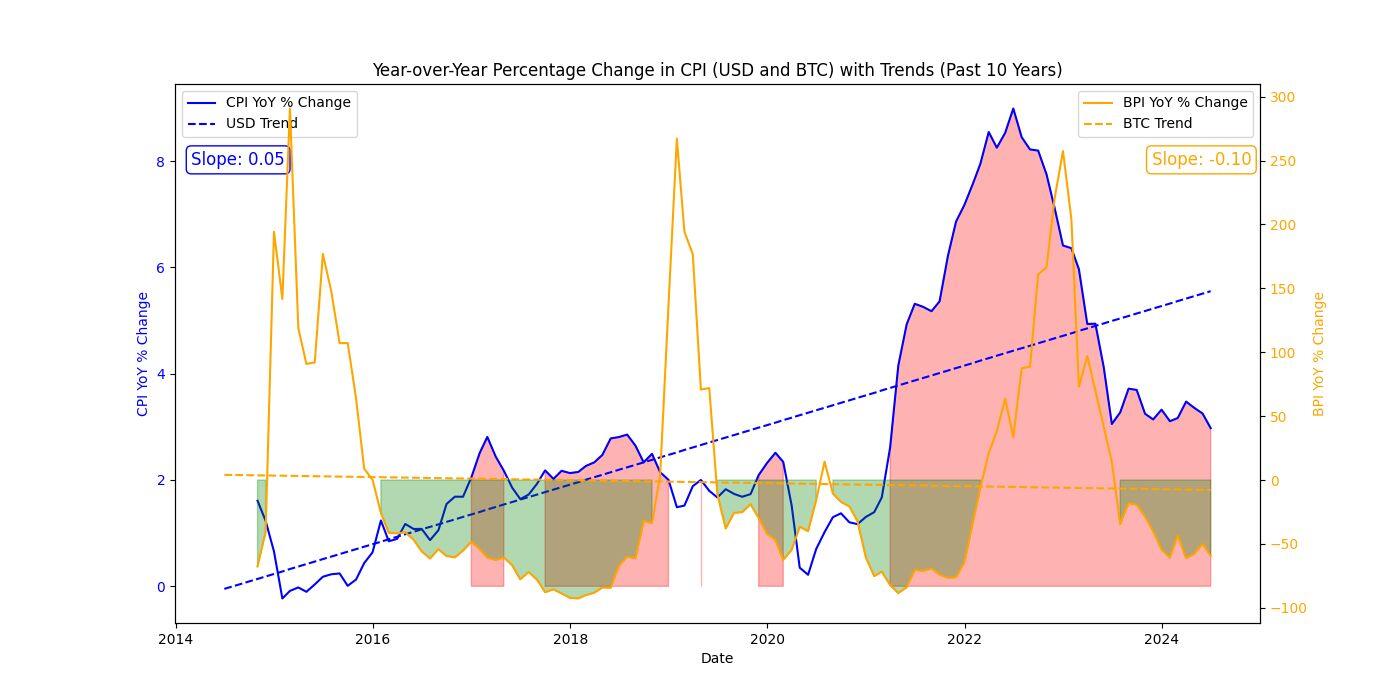

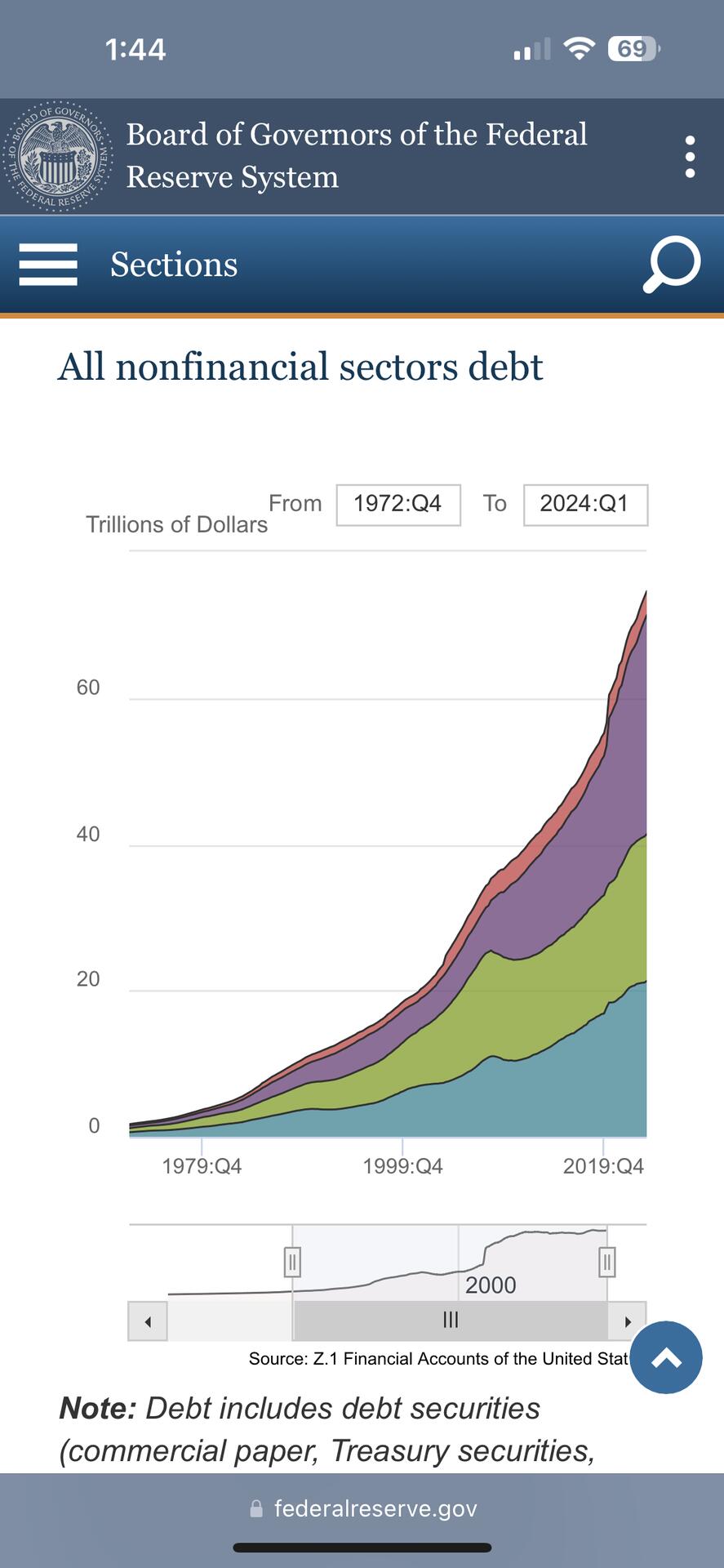

Your thesis regarding what CPI is, is wrong. Like the name suggests, the CPI measures price increases (even though manipulated). Thus completely useless data. Price increases are the trickle down, delayed effects of inflation. Inflating the money supply that is. Which, in a debt based system is debt. Total debt, including federal, state and local, business and private debt. Currently $80 trillion in the US. The purchasing power of #Bitcoin imho is currently more of a function of adoption. Unfortunately the exchange rate vs the USD is also heavily manipulated ever since the Government/Wall Street got involved. And they are slushing it around between the USD/Futures and ETFs, Strategic Reserves, Corporations, seized Bitcoin etc.

It used to be, like the Soviet Union, people in these centrally managed systems became more and more complacent and production of necessary goods collapsed. Today, with automation, everything is oversupplied. We got cars, clothing, iPhones, food (albeit poisonous) and housing coming out of our ears. People only really get upset when they’re hungry. So even so a large part of the population doesn’t work (and no, bullshit jobs aren’t work), it may take longer than in the past to collapse. The money sponge is huge this time…

Charity by the robot owners?

The Jones Plantation

LOL. The inflation they ran 5-10 years are the prices you’re paying today. Unless you speak newspeak.

A payment is a payment. An agreement is an agreement. A dispute is a dispute. Etc etc.

Collectively yes. Or one could say, the more solo miners there are, the more Blocks will be mined decentraly vs centrally.

As well fortify from taxation, regulation etc

And thus fortify the #Bitcoin network against things like a 51% attack or forks.

To guess the number to win a block you need computing power. Centralized miners have a lot of computing power, a big computer in essence. A solo miner is a small computer. A lot of small decentralized computers add up to a lot of computing power to compete with centralized miners to win blocks.