There are about a dozen homes going up in our neighborhood. I think only 3 or 4 are pending sales

What about Cash!?!?

nostr:nevent1qqsr8hrxullzys4k643u26wp2k9t4gq5clwhj38vzy8nwne5ujszvdsxr7954

https://www.therage.co/bank-of-international-settlements-kyc-non-custodial-wallets/

Bank of International Settlements Paper Proposes Self-KYC For Non-Custodial Wallets

How about “No”?

Shared via https://contex.st

Yes! Brought to you by the same people that created the “tie” in “football”

Trying to sign up for with nostr:nprofile1qqsfnz2sqsflkatdssmeztxr90s8xrd7r07xkhfwaa6eu9zkcguljpgpz4mhxue69uhhyetvv9ujumt0wd68ytnsw43qzyrhwden5te0dehhxarj9ekxzmnyax2j7u so I can upload a vlog to primal… I only have my phone… when I enter my npub it messages my profile a code, but I have to exit the registration page in order to get the code… and then I have to start over and can’t get anywhere… what am I missing? I have compressed my video to 37mb but nostr:nprofile1qqs9xtvrphl7p8qnua0gk9zusft33lqjkqqr7cwkr6g8wusu0lle8jcprpmhxue69uhhqun9d45h2mfwwpexjmtpdshxuet5qyt8wumn8ghj7un9d3shjtnwdaehgu3wvfskueqdmqx6a does t seem able to cope with that as a file size. Help?! #asknostr #help #newbievlogger #vlog

I use a Nostr browser extension to login, no need to register

This author did not even mention how interest rates are the singular decision of a couple guys at a private bank.

#wtf

# The Boomer Mirage - Joshua Stylman

**Source:** https://stylman.substack.com/p/the-boomer-mirage?triedRedirect=true

## Summary

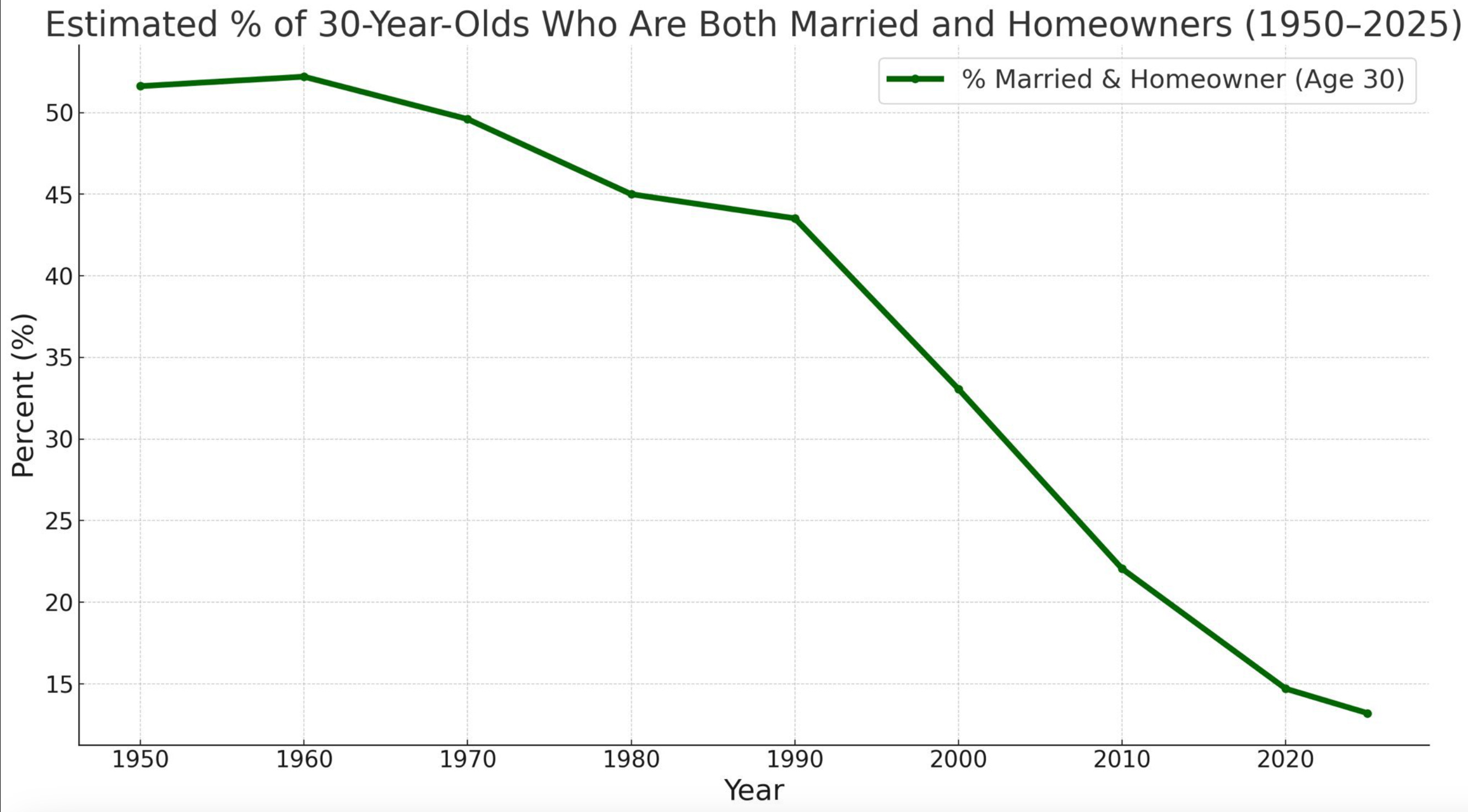

- • The document analyzes a chart depicting the decline in marriage and homeownership rates among 30-year-olds from over 50% in 1950 to an expected 13% by 2025, attributing this trend to systemic economic changes rather than cultural shifts.

- • It argues that the economic foundation for family formation has eroded, leading to the breakdown of the social contract and the transformation of adulthood from a starting point into an ongoing struggle.

- • The post–World War II economic boom was based on unsustainable conditions, including cheap energy and demographic advantages, which have since vanished, leaving subsequent generations facing economic challenges.

- • The housing market reflects this decline, with data indicating more sellers than buyers as younger generations are priced out of homeownership.

- • Institutions once seen as stable have shifted to extraction models, causing foundational aspects of life—like family and ownership—to be commodified and priced out of reach.

- • The document highlights a transition from tangible assets for Boomers to digital assets for younger generations, emphasizing the trade-offs involving surveillance and control in modern financial systems.

- • It critiques the emergence of digital financial systems as a replacement for traditional ownership, warning of the potential for increased economic monitoring.

- • The author suggests that the collapse of the old system presents an opportunity to create a new structure based on truth and agency, rather than nostalgia for a bygone era.

- • The piece concludes with a call to recognize the paradigm shift and to build a new economic and social framework that prioritizes genuine sovereignty over manipulated participation.

## Key Information

### Extracted Entities

**Keyword:** becomes, boomers, digital, economic, generation, next, people, rates, real, system

**Location:** America, U.S.

**Organization:** American Dream, Federal Reserve

**Person:** Aaron Day, Catherine Austin Fitts

### Referenced Links

- [Federal Reserve data](https://fred.stlouisfed.org/series/MORTGAGE30US)

- https://x.com/NewsLambert/status/1952220030722068877

- [systematic replacement of real value with declared value](https://brownstone-org.webpkgcache.com/doc/-/s/brownstone.org/articles/fiat-everything-when-decree-replaced-reality/)

-

- [pointed out](https://rumble.com/v6wtn9m-catherine-austin-fitts-whats-so-smart-about-the-genius-act.html?e9s=src_v1_mfp)

*... and 12 more links*

---

*Shared from Contexst on Aug 19, 2025 at 22:54*

Shared via https://contex.st

How is it outperforming when it’s an IOU?

I’ll take the hit

THIS.

WE ARE NOT PROGRAMMERS

WE ARE DEBUGGERS

If we comply we’ll all Be Safe 🫶🏻😂

# Why must we end the

Generated on: Aug 19, 2025 at 18:49

Model: OpenRouter: openai/gpt-4o-mini

**You** (18:49):

Why must we end the Fed

**AI Assistant** (18:49):

The case for ending the Federal Reserve (Fed) rests on several criticisms of its fundamental nature and role in the economy. Critics argue that the Fed cannot truly act independently of political influences and has never effectively restrained government spending, contrary to the belief that it can support responsible fiscal policy. Furthermore, the notion that the Fed can effectively plan and stabilize the economy is seen as misguided; its interventions often produce adverse consequences instead of the intended benefits. Ultimately, many believe that the Fed is inherently flawed and that its existence does not contribute positively to economic stability. Sources indicate that common criticisms—like calls for more independence or better management—are often misdirected since the fundamental issues persist. (Mises Institute).

**You** (18:51):

It does not make sense for a small cartel of banking executives to be the ones who set interest rates. Isn’t that a conflict of interest? Couldn’t we figure out some sort of marketplace for setting interest rates wouldn’t that be more fair?

**AI Assistant** (18:51):

The argument for ending the Federal Reserve often hinges on concerns regarding its structure, the perceived conflicts of interest, and the efficacy of its monetary policy mechanisms. Critics assert that allowing a small group of banking executives to set interest rates can lead to significant problems in economic fairness and stability.

### Criticisms of Centralized Interest Rate Setting

1. **Conflict of Interest**: Critics argue that having a centralized authority like the Fed, comprised mainly of banking professionals, creates a conflict of interest. This group may prioritize the interests of the banking sector over the broader economy. The mechanisms by which the Fed sets interest rates—primarily through its Federal Open Market Committee (FOMC)—can lead to policy decisions that benefit banks rather than the general public, including the potential for asset bubbles and economic imbalances (Mises Institute).

2. **Inefficiency of Central Planning**: There is a prevailing belief that the Fed can effectively manage economic fluctuations and steer the economy towards stability. However, critics maintain that this central planning approach is fundamentally flawed. The idea that the Fed can avoid "policy errors" and correctly time interest rate adjustments ignores the complex and often unpredictable nature of the economy. The argument posits that a market-driven approach to setting interest rates would be more effective, promoting fairness and potentially leading to better resource allocation (Mises Institute).

3. **Historical Record**: Advocates for ending the Fed often point to its historical inability to curb government spending or effectively manage economic crises, despite claims of independence. They argue that the Fed has not served as a check on government fiscal irresponsibility and has exhibited a consistent inability to stabilize the economy, leading to critiques that its interventions often exacerbate economic issues (Mises Institute; ZeroHedge).

4. **Alternative Models**: Proposals for a marketplace system for interest rate determination involve leveraging supply and demand dynamics instead of a centralized authority. A market-based approach might enable more organic adjustments in response to economic changes, reducing the risk of distortions caused by central bank intervention. Critics suggest that inviting market forces to set rates could lead to a more equitable system, aligned with individual economic behavior rather than the arbitrary decisions of a small group of policymakers (Mises Institute).

### Conclusion

The call to end the Federal Reserve stems from concerns about conflicts of interest associated with centralized interest rate setting, the inefficacy of its monetary policies, and a lack of accountability. Critics argue for a more decentralized approach that allows market mechanisms to dictate interest rates, potentially leading to a fairer and more resilient economic framework. As the debate continues, the central question remains whether such systemic changes could genuinely yield a more stable economic environment or whether they risk further complications without the oversight of a centralized authority.

Shared via https://contex.st

I will buy the top and the bottom and the middle 4 ever

“As part of the law’s rollout, the Treasury has issued a formal request for public feedback on novel techniques to detect illicit finance involving digital assets.

One of the methods now on the table is coding identity verification directly into DeFi protocols.” nostr:nprofile1qqswtq2r77f7f0uqtfxldnwq9z0r22eu7z98k0n2l2hcnh2f00c0ffspr9mhxue69uhhxetwv35hgtnwdaekvmrpwfjjucm0d5q32amnwvaz7tmwdaehgun9d35hgetn9ehhyec6yzvar

Nothing but good times ahead, we are in the golden age after all😊

https://reclaimthenet.org/us-treasury-weighs-digital-id-verification-in-defi-under-genius-act

Bitcoin don’t GAF

Fingers crossed my fiber line is good enough!

LOL thought I bought the dip at 116!

I’ll always buy the top

And the bottom

“Tap all the telescopes Cheech is using”

#winteriscoming

https://files.sovbit.host/media/0689df5847a8d3376892da29622d7c0fdc1ef1958f4bc4471d90966aa1eca9f2/0a5f25c289e50141d8bc2a04e446d3b8b9f1ee606afad185a6c31aef9363192f.webp https://files.sovbit.host/media/0689df5847a8d3376892da29622d7c0fdc1ef1958f4bc4471d90966aa1eca9f2/5cdaa0449e4ec0a16fe44b3f48632945e737824349aed8ae4ac66309fe99ffa0.webp

We'll need at least 2x this amount of wood. But the next batch will be bought.

What’s winter!?!

#coastalcarolinas

Always has been

The “paper of record” thinks this is bad news

Not paying taxes is what peak performance looks like

Shared via https://contex.st

GM!

# Doug Casey on the China Hysteria: Manufactured Threat or Inevitable Rival?

## Summary

- • Doug Casey discusses the historical context of fear toward China, tracing it back to the 1860s and exacerbated by events like the Korean War and Mao's ideology.

- • The perception of China's prosperity as a threat is misguided; the real issue lies in the U.S. government's approach to China amidst its own decline.

- • Current U.S. policies, including sanctions and military provocations, are counterproductive and may lead to conflict.

- • China has transformed from a poverty-stricken nation to a global power due to the shift from communism to a form of state capitalism initiated by Deng Xiaoping.

- • Despite China's advancements, its future growth is uncertain due to shifts in government policy and cultural changes.

- • China is not an existential threat; its military developments do not imply intentions of aggression against the U.S. or nuclear conflict.

- • The U.S. government is increasingly bankrupt, relying on military spending while falling behind in science and technology.

- • Both major political parties in the U.S. utilize external threats like China as distractions from internal issues, demonstrating a lack of moral core.

- • The narrative around China parallels past fears of Japan, highlighting a tendency to scapegoat other nations instead of addressing domestic economic issues.

- • The U.S. has become a multicultural empire with military bases worldwide, leading to a loss of respect from other nations, despite ongoing fear of American power.

- • The impending decline of the U.S. dollar and economic instability is more critical than the perceived threat from China.

## Key Information

### Extracted Entities

**Keyword:** china, chinese, doug, economic, government, military, state, threat, u.s., world

**Location:** America, Beijing, California, China, Chinatowns, Chinese, Chinese Roadrunner, Europe, India, Iran, Japan, Mao, Mexico, Russia, Taipei, Turkey, U.S, U.S.

**Organization:** Clintons, Communist Party, Obamas, Republican, State

**Person:** Deng, Deng Xiaoping, Doug Casey, Fu Manchu, Joe, Mao, Rube Goldberg, Sax Rohmer, Trump, Wylie Coyote, Zelensky

### Referenced Links

- [Get your copy here.](https://internationalman.com/special-report/guide-to-surviving-and-thriving-during-an-economic-collapse/)

- [collapsing from within](https://internationalman.com/special-report/guide-to-surviving-and-thriving-during-an-economic-collapse/)

---

*Shared from Contexst on Aug 17, 2025 at 09:27*

Shared via https://contex.st

BitKey might be better as it is 2 of 3 multisig with recovery

HUGE BREAKING NEWS!🚨🚨🚨

In a BOMBSHELL development, DNI Tulsi Gabbard has confirmed an investigation into Anthony Fauci for perjury and his role in FUNDING gain-of-function research at the Wuhan Institute of Virology, as part of efforts to uncover the origins of COVID-19.

She also warned about biolabs in Ukraine —The real cause of the Russia/Ukraine war.

^^^

Fauci denied it under OATH

HE IS FUCKED

ARREST FAUCI https://video.nostr.build/9a2a48baf65ebf3b516e2913346db3dbb44da45d4248e20fec71348c126d175d.mp4

At least Bessent has a Vlog

Ah shit, I thought being a podcaster was cringe enough, now I need to go full cringe car-driving vlogger.

nostr:nevent1qqsy6j6t0ge5n2q2v4z9smdrv9y8x238he6rztv7t8ztfc0phh0mw9st3nw8e

You can do it

https://www.josefprusa.com/articles/open-hardware-in-3d-printing-is-dead/

Open hardware desktop 3D printing is dead - you just don't know it yet | Josef Prusa / 3D printing

Shared via https://contex.st

We just sent you a Nostr DM.... If you didn't get it, could you please reply here? Or feel free to reply on Telegram or Signal -- our contact details for these are here: https://megalithic.me/contact

Lemme try the service out

"F**k That" - Hunter Biden Rejects Melania Trump's $1 Billion Lawsuit Threat Over Epstein Smears | ZeroHedge

WHO GIVES A FUCK WHAT ANY BIDEN SAYS?

Shared via https://contex.st

Yes. 1 mile from the intercoastal

Yeah, it’s a trend. I find the storms hooking right more often than u might think. Why? No idea, pole shift? Who knows

I am entertained!

Ok, who gonna vibe code this extension?!!?

nostr:nevent1qqsypsm8uw7vg7vads4fwf3j3kndml7kmj9wfzfaydnhvf4xu8kd65gy498hl

Funny how the US model can only show a few days out, looking menacing until it turns right later in the forecast

I have studied closely the storms of the last 5 summers down here in the Carolinas. They have been taking right turns more and more.

The BS climate narrative is deep in the models they use and the public facing visualizations

Prediction: Erin will take a hard right and not bother anyone

Shared via https://contex.st

⚡️🇬🇧 UPDATE - 729.000 British citizens signed a petition demanding an immediate general election.

The government refused, defending their stance.

The public is outraged with Starmer.

nostr:nevent1qqspg9cvz0wczut35qxk6va4qc9kszat2xj6nvfuzhzgw292wjjp08g5d63w5

But but but but but but but but but but but but

We signed a petition!!!

It’s not this post, that’s for sure

I guess the guy they had doing this didn’t work out, huh?

Image text:

Pubky Developer Advocate Synonym • Anywhere ? Remote only • Full Time # Engineering / Open-source • 2755 views 5d Apply to this job • Save Welcome to The Atomic Economy The Team Founded in 2020, Synonym is building the world's first digital free-market society, including any necessary R&D required to deliver "The Atomic Economy." The Atomic

Shared via https://contex.st

Another waste of money