🏴☠️ WEEKLY REWARDS DROP: 12,000 SATS TO THE PLEBS 🏴☠️

You zapped. You liked. You reposted. You commented.

And some of you got randomly paid for it. 🫡

💣 REPOST BOUNTY – 2,000 sats each

For spreading high-signal degeneracy:

nostr:npub19vem9txx6xl9j2dx0pm2g76g8grsccguq5lsfz8l8u0yek5lynzshkgqpq

nostr:npub1de6l09erjl9r990q7n9ql0rwh8x8n059ht7a267n0q3qe28wua8q20q0sd

nostr:npub1n0aq6vafymeezu8rgyuluw2nsvwwf0e0qdpc9d2uvcfgclsf4d8s3qqu2z

⚡️ REACTION BOUNTY – 1,000 sats each

For smashing buttons like based apes (likes, zaps, the whole chaos):

nostr:npub19ma2w9dmk3kat0nt0k5dwuqzvmg3va9ezwup0zkakhpwv0vcwvcsg8axkl

nostr:npub1vs5xv3atjgn4fhw9cl5kummt7fvle4jxs6qx56m24sgh2hmvw2tqe8fxgj

nostr:npub1y80vm0yvp64cx6e8y0eetu4mhwt5muzrttgaj8a988xnx5q4kn2qlu87je

🧠 COMMENT BOUNTY – 1,000 sats each

For dropping actual words under memes (brave move):

nostr:npub1lyqkzmcq5cl5l8rcs82gwxsrmu75emnjj84067kuhm48e9w93cns2hhj2g

nostr:npub17t33l3a3852l4ajh706ngwmpg2tj03uxsd6dvy4wumupdkcf59tspayzna

nostr:npub18u5f6090tcvd604pc8mgvr4t956xsn3rmfd04pj36szx8ne4h87qsztxdp

🏴☠️ 12,000 sats fired into the plebchain. No fiat. No forms. Just memes and Lightning.

Keep zapping. Keep shitposting.

We’ll see you next week.

#bitcoin #plebchain #memeconomy

Gm Legend

One medium orange provides about 70 mg of vitamin C, meeting nearly 80% of the daily recommended intake for adults.

The evolution of money reflects humanity’s shift from basic survival to complex economies, driven by the need for efficient trade and trust. Here’s a concise rundown:

Barter (Pre-3000 BCE): People swapped goods directly—think trading grain for tools. It worked for small communities but fell apart when needs didn’t align or goods weren’t easily divisible. No standard value, just haggling.

Commodity Money (3000 BCE–700 BCE): Societies used items like shells, beads, or livestock as currency. These had intrinsic value and were widely accepted. Examples: cowrie shells in Africa, grain in Mesopotamia. Problem? Hard to transport or standardize.

Metal Money (1000 BCE–600 BCE): Precious metals like gold and silver became popular—durable, divisible, and valued. They were weighed for trade, but inconsistent weights and purity caused issues. Think ancient Mesopotamia or Egypt.

Coined Money (700 BCE–1500 CE): Lydia (modern Turkey) minted the first coins around 700 BCE—gold and silver with stamped value. Coins spread globally (Greece, Rome, China), standardizing trade. Drawback: heavy to carry, prone to debasement.

Paper Money (700 CE–1700 CE): China pioneered paper currency in the Tang Dynasty, backed by goods or metals. By the Song Dynasty, it was widespread. Europe caught up in the 1600s with promissory notes from goldsmiths. Trust was key—paper’s only as good as the issuer.

Gold Standard (1700s–1900s): Paper money was tied to gold reserves, stabilizing value. Countries like Britain and the U.S. adopted it in the 19th century. Trade boomed, but gold’s scarcity limited economic growth. Abandoned in the 20th century (U.S. fully off by 1971).

Fiat Money (1900s–Present): Money’s value comes from government decree, not gold or goods. Dollars, euros, yen—no intrinsic worth, just trust in the system. Central banks control supply, enabling flexibility but risking inflation if mismanaged.

Digital Money (1980s–Present): Credit cards, online banking, and mobile payments (PayPal, Venmo) made money intangible. Cryptocurrencies like Bitcoin (2009) introduced decentralized digital cash, challenging fiat but volatile and energy-intensive.

Current Trends (2025): Central Bank Digital Currencies (CBDCs) are emerging—digital fiat with blockchain-like tech (e.g., China’s digital yuan). Crypto’s still niche but growing in defiance of regulation. Cash use is declining; digital wallets dominate in urban areas.

Each stage solved problems of the last but introduced new ones—portability, trust, or scalability. Money’s core job hasn’t changed: it’s a shared agreement to make trade work. If you want specifics on any era or tech, let me know.

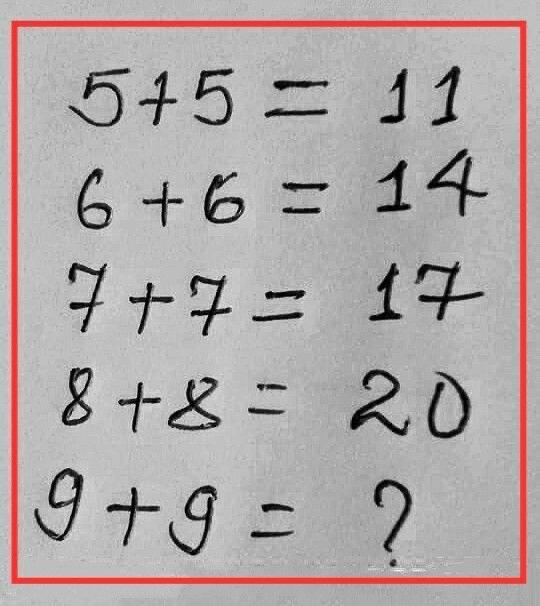

As far as I’m concerned the math is correct , the numbers alone doesn’t mean anything , let’s say for example if you put 5 drops of water on top of 5 drops of water , it wouldnt give you 10 drops , instead it would give you 1 huge drop of water, to me everything is equal to 1 , zap ⚡️ if you agree 👍

I need me some bitcoin

#nostr a place you find only the truth , just joined nostr:nprofile1qqs9xtvrphl7p8qnua0gk9zusft33lqjkqqr7cwkr6g8wusu0lle8jcpzamhxue69uhhyetvv9ujucm4wfex2mn59en8j6gpremhxue69uhkummnw3ez6ur4vgh8wetvd3hhyer9wghxuet59uaa9rst recently and I wish I joined earlier

Legend keep up the good work 🚀🚀🚀

Chocolate pooping or pooping chocolate

The human body contains trace amounts of gold, about 0.2 milligrams on average, mostly in the blood. It’s so minute that it’s never been economically viable to extract, and its exact purpose remains unclear.