Yup, even bitcoiners are overwhelmingly NPCs. Given an opportunity to front run the same institutions that have enslaved you families for generations you are gonna sell for 100% gain because the market is "overheated".

Fucking idiots.

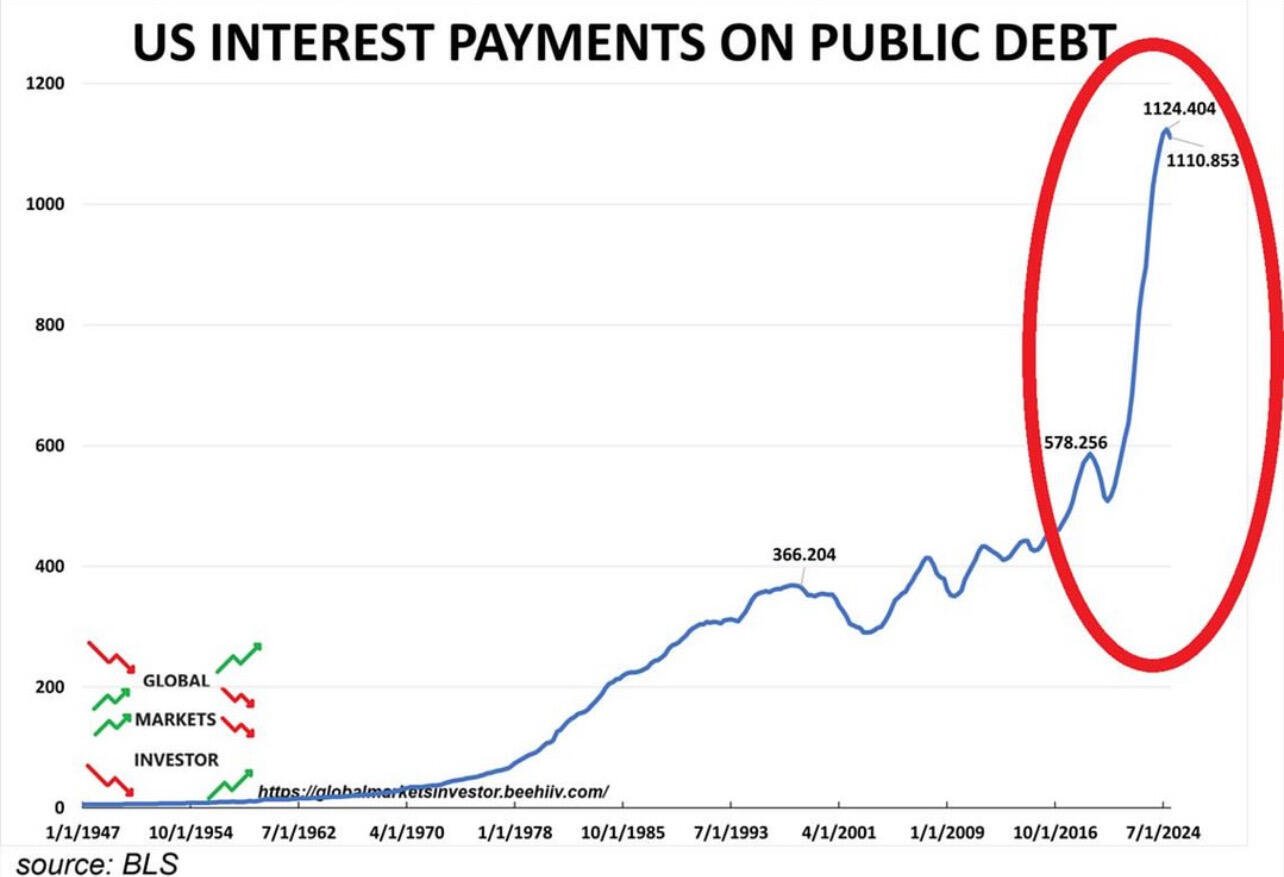

This is the inevitable debt death spiral that is inevitable with all FIAT.

It's happened many times in the past it will happen again one final time now that we have an incorruptible money.

Gresham's law playing out to be followed by Thiers law. Bad money drives good money out of circulation util bad money is so bad people will not except anything but good money.

If you want to understand the present and future, learn the past.

Bitcoin is the best monetary network. So you should never spend your bitcoin until they won't accept anything else.

The free market is not stupid. The free market is the masses acting in their best intrest. It is your best intrest to hord your sats not spend them.

You just need to launch an app that makes it make sense to spend sats. It doesn't make sense now. This has happened many times in the past. There are economic theories that explain why.

A. It doesn't matter that people doent spend it right now.

B. En mass people will not spend it until it is the only thing vendors will except or there is incentives to do so.

The best money is not spent it is horded.

Don't trust, verify.

It will only be for moving large purchases moving to cold storage and interactions between companies, banks and nations.

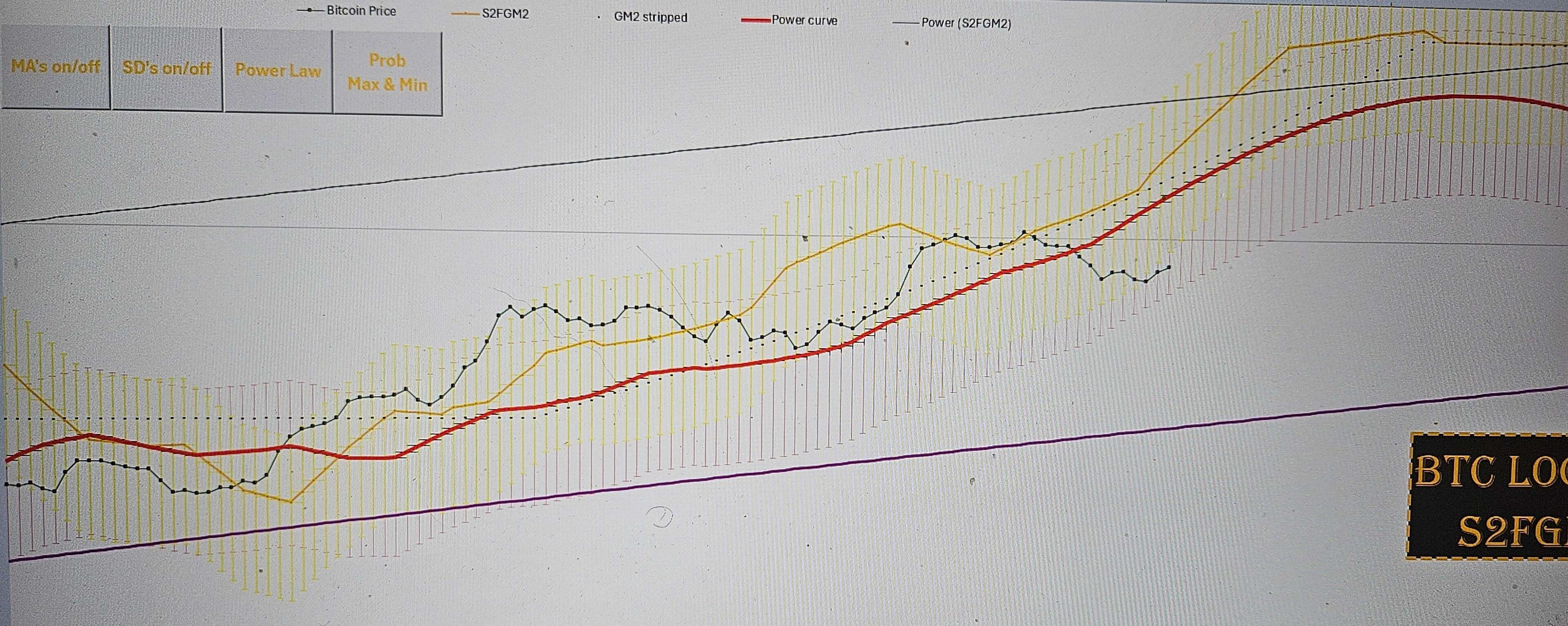

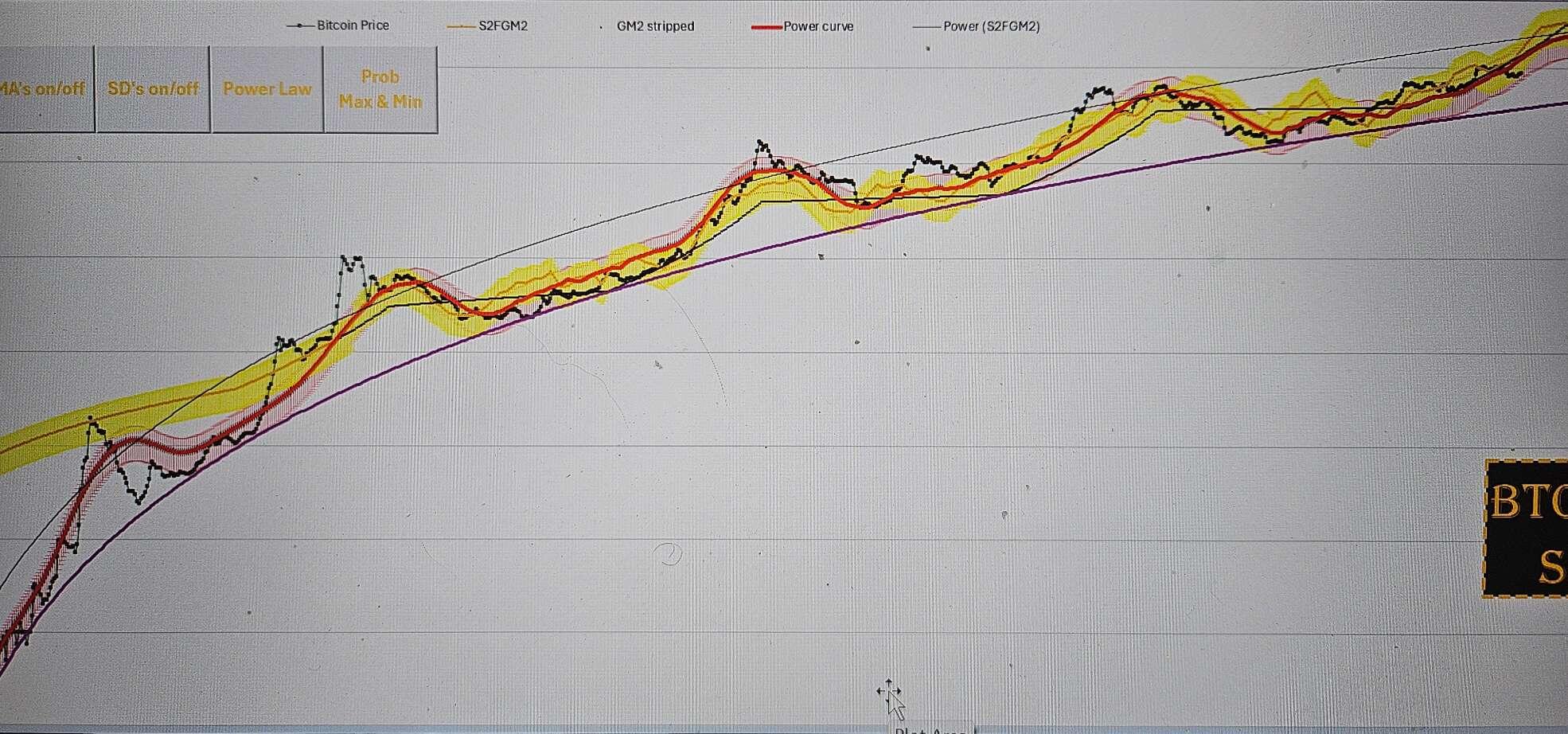

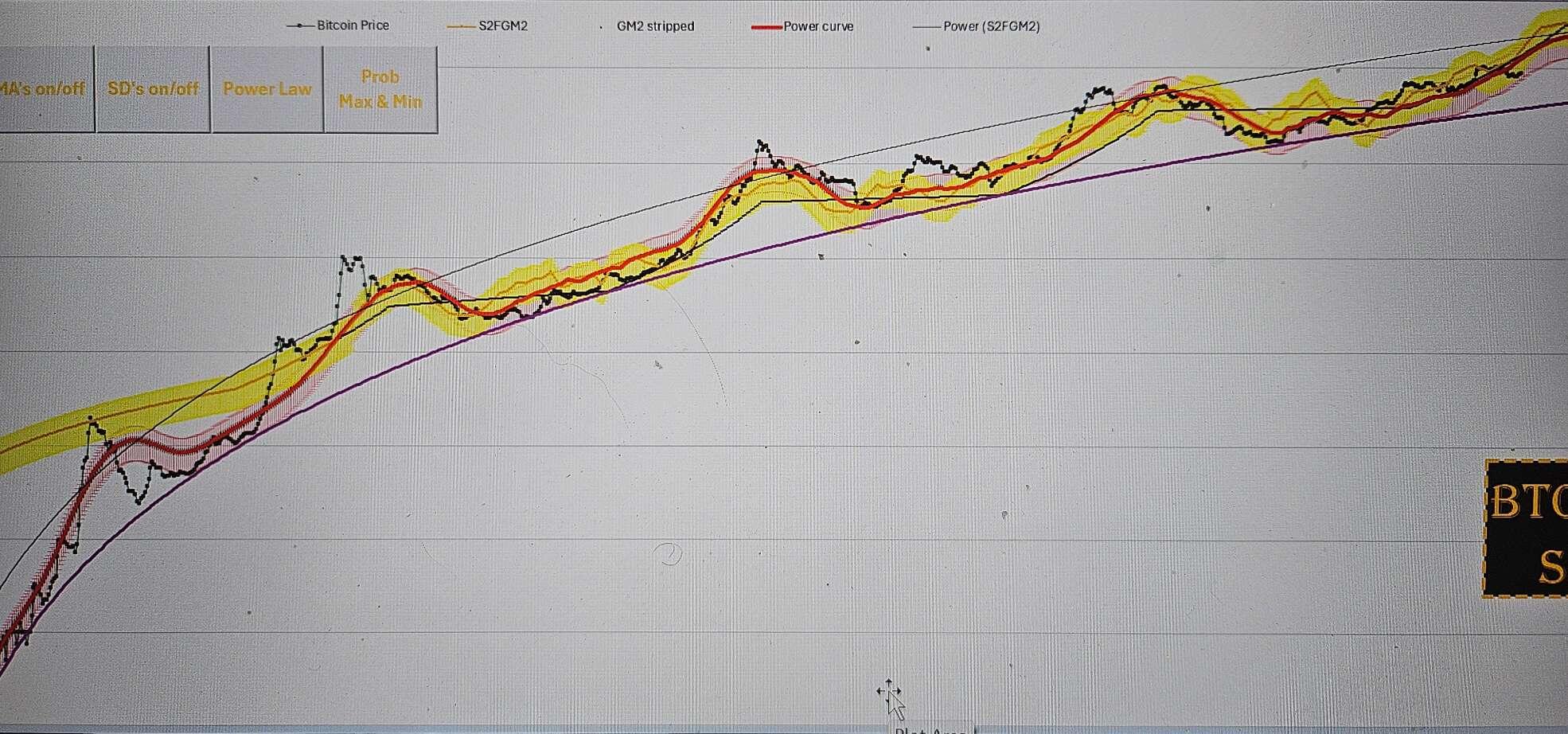

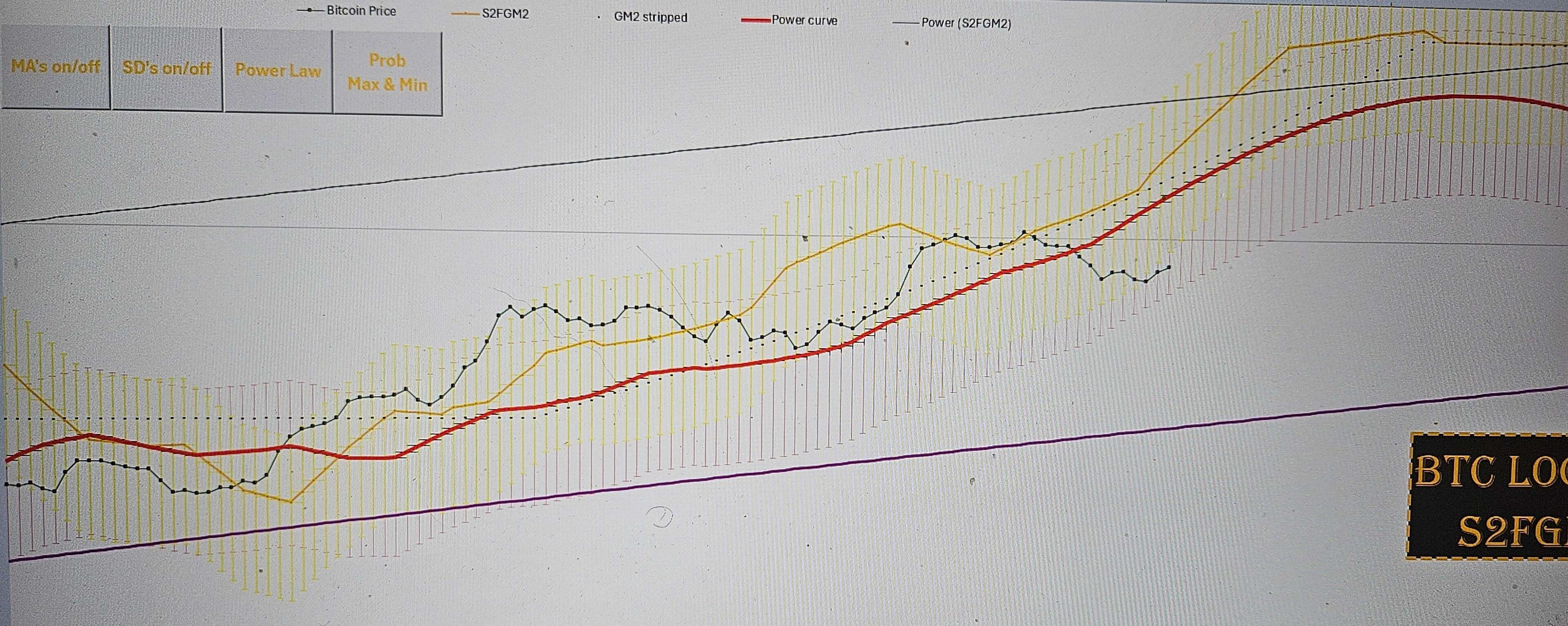

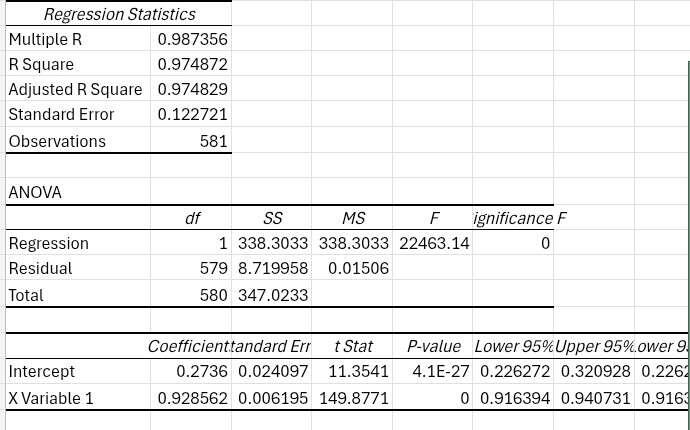

I put q shit ton of hours into this. Global M2 Delta with S2F R2=.963 and didn't sit right with me because it blows out the actual btc price power trend line. Did a lot of research a lot of regression realized s2f acts as a drive market responds in bell curve like many othe economic chang3s filter through a market but the S2F is dampened by power trend line. Absolutely insane statistical probability that this is correct within 2 SD and getting better each cycle. Redline for the win. Btc gets this far below where it is supposed to be as prediction is moving up over 4k a week. We are in for a huge move soon probably a little consolidation then another huge move back end golf the summer into late September early october.

250k absolute min by first week in October. Blow off rop 1mil. More realistic high 300k

I fully expect to be at new ATHs next Sunday. IYKYK

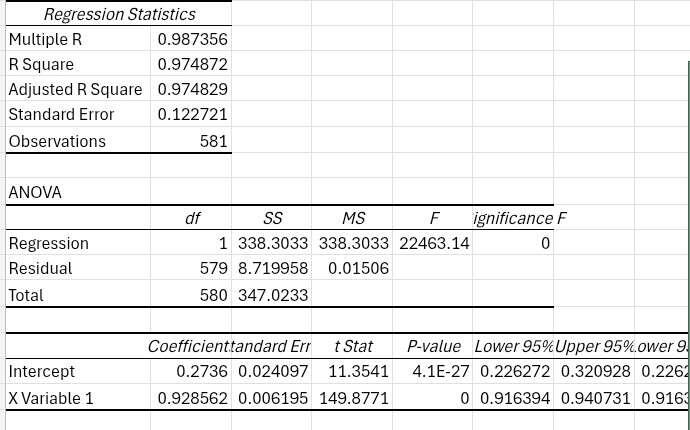

Significance F = In statistical analysis, a significant F-value (from an F-test) indicates that the overall model is statistically significant, meaning it explains a significant amount of variance in the dependent variable. Essentially, it tells you whether the model as a whole provides a better fit to the data than a model with no predictors.

Significance F in in my model has so many 0000s after the decimal point that excel just called it 0. 😆

This week's fair market value is between 121k powerbellGM2 and 141k S2FGM2 increasing about 4k every week for the immediate future.

I spent a 1000 plus hours figuring out that BTC's value is either based on S2F or S2F sitting on the BTC actual prices power trendline. I used the monthly delta of Global M2 lagged 13 weeks and smoothed to filter out the noise. Essential GM2's effects make it impossible to get a .95=r^2 with a S2F model because it makes too big of an impact without accounting for it.

With it PowerBellGM2 has an r^2=.975 insanly high and beyond reasonable doubt. STFGM2 has an r^2=.963. Pretty freaking high. They are very similar but S2FGM2 is more reactive of GM2 and less accurate which i am happy about because I found PowerBellGM2 due to the fact that I could not reconcile in my head that S2F does not corrispond to long term BTC price action and either btc price actions power trend line must break or S2F must break.

As of now I don't see a reason for PowerBellGM2 to break unless BTC price starts heading orders of magnitude higher. Like 1.5mil this cycle. 5 mil next cycle and I just don't see that happening. In that case we'll S2FGM2 might be our winner.

Outside of the first cycle btc price action rally if ever breaks outside of 2SD of their predictions except blow off tops. Time will tell but if you know anything about statistics it is almost beyond doubt that S2F drives price action muted by btc actual price power trendline. Keeping price within the range of human nature. All the other numbers relating to PowerBellGM2 are even more ridiculous than it's r^2. So yeah i think i am pretty close to knowing how to forecast BTC in USD.

Ok, so it was kinda right. Yesterday ETH/BTC pair dropped to a point where there were zero weeks in ETH history that from open to close you could have sold your BTC to buy ETH and actually been in profit. Then the rip began. 150k by May 31st we are way behind schedule.

2017 all over again going s2f cranking higher and money printer go borrow.

Bitcoin will be 150k or higher by end of May. Next week will be a pretty good up week then fireworks.

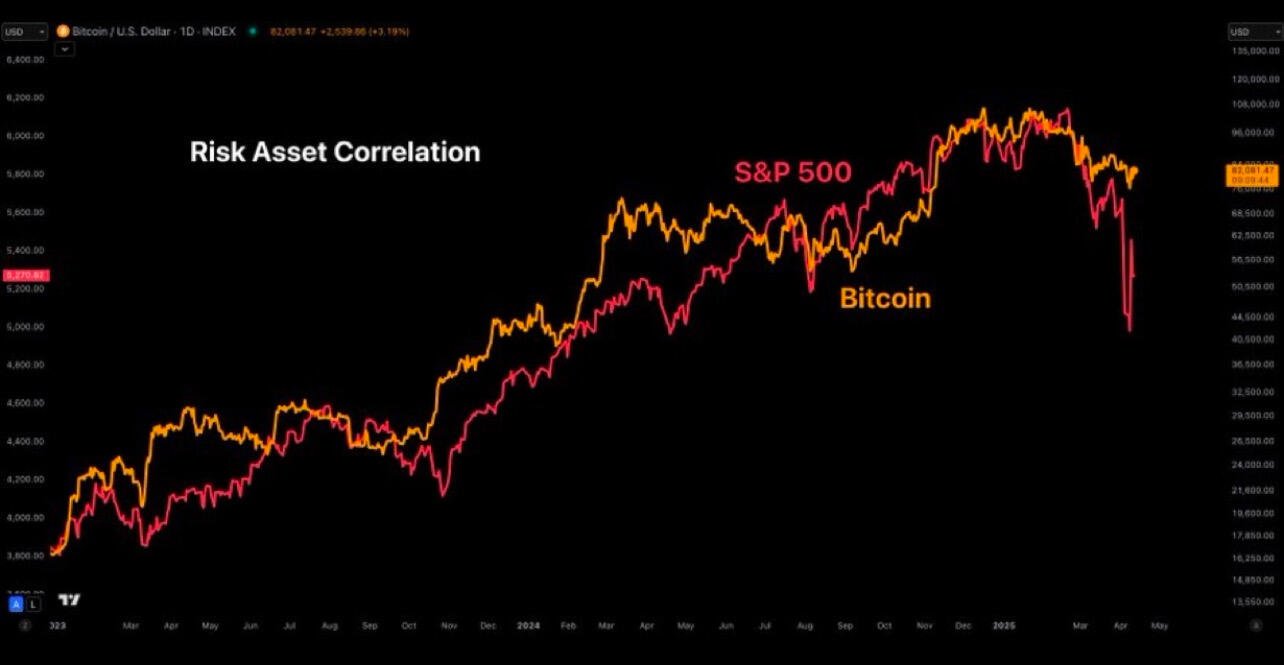

Here is were you are very wrong. As sound money is adopted it will look like the stock market is exploding. FIAT will be hyperinflation and it will settle with the usual suspects. Real Estate, equities and to a lesser extent commodities. They will learn from Saylor and come up with their own strategies for Bitcoin acquisition. The mindless masses will be throwing their FIAT into the equity casino trying to get a bitcoin multiplier before their fiat evaporates. Once FIAT is in nonsensical free fall or gone yes the market will slow because there won't be funny money for them suck off the tit of the worker.

Then there will be no zombie companies. It will go back to how the stock market was in the early days. You will pay a dividend or have an amazing pathway toward a huge dividend or there is no reason for anyone to buy a stock.

I mean really think about that. We are so late in the FIAT shit hole that it is almost a faux pas to give a dividend. It is insane.

So I agree with you in the end state after the full conversion, stocks and real estate will lose their escape from FIAT premium but during the transition stocks are going to skyrocket in a manner we could never imagine today.

#Bitcoin is meant to be spent.

HODLing builds foundation. Spending brings adoption. https://v.nostr.build/GxWaLKw9v1Jh1dxq.mov

So here's the thing. No to all of this. This is just ignorance talking. This is classic not reading history. Bitcoin is something new, it needs my help, it will die with out me and Jack. Nope it is money and it is the very best money there has or will ever be. Very smart people already figure some stuff out. Austrian economists knew what they were talking about. Let the free market go where it pleases. Free market economies crave free market money.

Bitcoin is better than any alternative, hence you should not spend it. Be a free market individual and do what makes sense for you not what you think is best for Bitcoin. Altruistic actions don't represent a free market and guess what Bitcoin doesn't need you, sorry bro. If it makes you feel any better it doesn't need Jack either!!!

Gresham's law:

Bad money drives out good.

Simple, but what does it mean. When US took silver out of the quarters everyone put those quarters in a jar and never spent them again. They weren't altruistic and spent them cause uncle Sam said to. Sovereignty in quarters is better than this new shit, imma keep it. Good move. That quarter is now worth $5.68. You stashed 100 quarters good for you that $25 is now worth $568. When the Roman's put less gold in coins people melted the old coins and kept the gold. Free markets at work.

So what?

So you spending BTC now to be altruistic takes it out of diamond hands and puts it into salad hand who dumps it on the exchange for whatever they can get. Maybe you spend and replace or maybe you would bought that replacement BTC anyway?

Well if no one spends it, it dies and isn't worth saving, bro!

Wrong.

Bitcoin is the best money. It will win eventually you doing something that doesn't feel right is not acting in a free market way; en mass it slows the inevitable.

Well if it's money when do I spend it?

Thiers' law (the conclusion of Gresham's law):

People will accept the money they believe to be of highest long-term value, and not accept what they believe to be of low long-term value.

What does this mean?

During extreme case like during the great inflation in the Weimar Republic in 1923, as the official money became so worthless that virtually nobody would take it, people simply stopped accepting the currency in exchange for goods. That was particularly serious because farmers began to hoard food. Accordingly, any currency backed by any sort of value became a circulating medium of exchange. In 2009, hyperinflation in Zimbabwe began to show similar characteristics.

This will eventually happen to all FIAT. Because FIAT is a flawd system that talks a bond paying intrest to make new money to pay back a bond that was paying intrest. Ending in the inevitable FIAT debt death spiral. FIAT will start to die faster and faster around the world. Starting like dominos in Nation States that would have naturally had a FIAT collapse anyway. https://www.hardmoneyhistory.com/history-of-fiat-currency-failures/

As BTC establishes itself more and more as demand for high inflation money will fall faster with an established alternative. As each fails the entire value of that nations economy is absorbed into BTC and that nation prospers as BTC grows. The alternative is to stand up a new currency which is guaranteed 30 years of shit economy or accept USD, Euro or other monetary system as yiur currency where you don't benefit from The Cantillon Effect. So the entire value of your nation is inflated away 5% a year into the coffers of the US, European Union, whomever you choose. This leads to never ending poverty. People won't give their gooberments the option. Hard pass.

In the meantime people that want to get there hands on KYC free bitcoin or avoid purchasing fees will offer discounts to customers to purchase in BTC.

That is how a free market works. Bitcoin is free market money. Understand economics before you listen to people like Jack that know Bitcoin is awesome but don't truly understand what it is or why it doesn't need anyone to be its advocate. It's bigger than your altruistic fantasies.

Don't trust,; verify.

If you run into any issues let me know and I'll walk you through it. There were a lot of things I tweaked to get better r2. Like instead of big delta bumps once a month in GM2 I took the delta and divided it into the weeks of the month. Stuff like that.

I honestly didn't do it for trading. I did it because PlanB's STFX model interested me but is like ok you can't do a regression on his stuff and get a statistically significant model for BTC using daily pricing. He did stuff where it was like grouping things together for certain time periods gave you statistical significance but it was fuzzy math.

I watched some thing where people were sliding gm2 money supply around and matching peaks and troths with Bitcoin. Really rudimentary stuff. But I was like huh, it does look like btc lags gm2 but it was obvi not directly corelate.

I started thinking about how scarce assets go up in value first when there is inflation; inflation is a result of M2 creation. I wonder if I can sharpen up S2F and prove to myself it is the legit driver of BTC value.

Then when I got a bump on my first try I started tinkering around with lag because M2 doesnt create inflation overnight. Then finding the best lag. Then plotting r2 value over different lag times. Once I optimized GM2 lag I was like we'll what about lag on S2F. That tightening shouldn't be felt overnight either.

As you can see once I start digging into something I can't stop. Messed with weighting and smoothing and lag and optimized each. I think I could get it even tighter if I used daily pricing instead of weekly. But .97 is very high and it probably would still round to .97 no matter what.

Had to share because I thought it was cool and I thought it was weird that optimized smoothing and lag all were fibs.

Bitcoin S2F Validation — The S2FGM2 Model

Quantifying Bitcoin’s Liquidity Premium & Validating S2F as Fundamental Value

---

TL;DR

Bitcoin is prestine collateral that absorbs global fiat liquidity.

The S2F model explains Bitcoin’s long-term value, but short-term market noise often buries its signal. By introducing a liquidity premium using smoothed, lagged global M2 delta (GM2), we clean up that noise and reveal the truth:

> Stock-to-Flow is the fundamental driver of Bitcoin’s valuation.

With this model, we can project BTC’s price across time with statistical confidence (R² ≈ 0.965). The risk/reward becomes violently asymmetrical:

→ Massive upside

→ Near-zero long-term downside

There is simply no better place to allocate your time, energy, or capital than into the Bitcoin ecosystem.

-------‐-----------------------------------------------------------------------------------------------

1. Introduction: The Broken Compass

The Stock-to-Flow model introduced by PlanB in 2019 changed how the world saw Bitcoin. It made one thing clear: scarcity drives value. But like all simple truths, the signal got lost in the volatility of liquidity cycles, macro shocks, and human panic.

Critics said S2F failed.

They were wrong.

It wasn’t wrong — it was incomplete.

S2F gives you the shape of Bitcoin’s valuation curve. But price moves along that curve based on the available liquidity in the system. Without accounting for this, S2F’s predictive power breaks down during expansion and contraction phases.

Enter: Global M2 Delta — the missing variable.

---

2. Methodology: Smoothing Out the Noise

To construct a predictive model, we merged S2F with global M2 liquidity trends. Here's how:

a. S2F Input

Stock: Total BTC supply over time

Flow: 52-week rolling average of newly mined BTC

S2F Ratio: Smoothed for realism by using this style for flow, then lagged 13 weeks (markets digest scarcity slowly)

b. Liquidity Premium (GM2)

We calculate the weekly change in global M2

Apply logarithmic weighting to normalize the impact of extreme events

Smooth with a 26-week rolling average

Lag 13 weeks to reflect transmission delay between liquidity and asset valuation

c. Price Input

Weekly HLOC average (high, low, open, close) used for modeling correlation to S2F + GM2 conditions

Final output is implied market cap, which we divide by BTC supply to project price

---

3. The Equation

Final model structure:

BTC_Price = 10 ^ ( 7.11513 + 2.72284 * LOG10(S2F rolling 52 week) + 0.03603 * Smoothed_Lagged_GM2) / Stock

Translated:

S2F defines the price gravity.

GM2 adds or subtracts energy (liquidity premium).

Price drifts around the gravity curve, but the model shows exactly where it should be.

---

4. Model Results

R² ≈ 0.965

Works across all Bitcoin cycles. When delta off of predicted price is charted the real dollars off of predicted has stayed fairly stable at extremes. As BTC's value has risen the % the real price deviates from predicted has shrunk dramatically. This shows that the market are maturing and the model is becoming more accurate with time.

The modle captures both the exponential long-term growth and the chaotic interhalvening price runs.

Behavior at +2SD are due to massive surges in s2f coupled with GM2 liquidity. (think Q4 2017, Q4 2020)

Behavior at -2SD is rare and violently reverts upward (like a beach ball being released underwater)

---

5. Fibonacci Lags & Market Psychology

The weirdest thing? The model optimizes at Fibonacci-style lags and smoothing windows:

8, 13, 26, 52 weeks

Multiples of 13 (the trader’s Fibonacci)

These lags give the highest R². They were not picked at random or on a hunch.

We believe this may reflect:

-Investor psychology cycles

-Miner selling rhythms

-Liquidity digestion times baked into market behavior

-Natural financial oscillations that humans unconsciously follow? To me it does not fell random.

---

6. Conclusion

Bitcoin is a pristine collateral that absorbs FIAT liquidity. This model — the S2FGM2 Equation — validates Stock-to-Flow as the primary fundamental force behind BTC’s valuation, and introduces the GM2 liquidity premium as a way to make sense of market noise.

What remains is clarity.

With this tool, we can now project Bitcoin’s price with confidence, cycle over cycle. The risk/reward profile is unmatched. Your long-term downside? Practically zero. Your upside? Infinite (as S2F approaces infinity) and asymmetric.

***There is no better place to invest your time, capital, or attention than in the Bitcoin ecosystem.***

---

"Markets are messy. Bitcoin isn't. Liquidity comes and goes. Scarcity stays."

~jason the original & Gabbie, 2025

Not gonna lie, thought I was going to get some love on this / told I was a total idiot. Over .96 R^2 is not easy to do with anything. Basically proves that S2F drives BTC's engine. The fact that I optimized weights and lags with a million regressions and they amazingly all line up with years and quarters and weeks. It is almost like an incite into human psychology.

No one has come up with an R^2 for BTC over .95. The fact that it is based on S2F and you can project out forever and get tight 8 week out projections every month after M2 global money supply is reported. I mean PlanB's shit don't touch this. He gets a high R^2 using other scarce assets market caps and S2F's trying to gleam incite. If you put them all together you get the group doing this. BTC contributes but isn't the bell of the ball. This is all based off BTC S2F and Gooberments and Central Banks debasing FIAT.

Thought we would do some numbers today. Was excited to be called a retard. Oh well, here is my projection overlaid with M2G out to May 31st with 1st and 2nd Standard deviations. You'all can blow me. Not you nostr:nprofile1qyv8wumn8ghj7enfd36x2u3wdehhxarj9emkjmn99uq3jamnwvaz7tmvd9nksarwd9hxwun9d3shjtnrdakj7qpqvxz5ja46rffch8076xcalx6zu4mqy7gwjd2vtxy3heanwy7mvd7qv0l7c4 , you're cool! 🤣

TL;DR

TL;DR

→ Is Bitcoin's price rise (NGU technology) baked into its DNA?

→ Is it just macro liquidity chasing a speculative asset?

It's a little bit of both!!!

.........................................................................................................................................

I ran the numbers. I tortured the data. I optimized for truth.

R² = 0.964823

That means ~96.5% of Bitcoin's price behavior can be explained by just two things:

Stock-to-Flow (hardwired supply schedule)

Global M2 Liquidity

People love to argue whether Bitcoin's price rises are inevitable or just lucky timing.

I asked a better question:

How close can I come to proving Bitcoin's NGU is hardwired?

What I did:

Started with classic Stock-to-Flow (S2F) → supply-driven scarcity

Shifted from BTC price to Market Cap → better reflection of total valuation

Realized market psychology lags reality → applied a 8-week lag to changes in Global M2

Weighted M2 changes using log1p → big liquidity spikes aren’t linearly felt

Smoothed M2 over 26 weeks → humans digest slowly, FOMO and fear fade over ~half a year

S2F calculated using a 52-week rolling flow → captures true market-perceived scarcity

Lagged S2F by 13 weeks → market digests halvenings slower than Twitter does

The Result:

R² = 0.964823

That means:

~96.5% of Bitcoin's price behavior is explained by S2F and lagged liquidity.

Not speculation.

Not vibes.

Not hopium.

Math. Yeah I probably lost the plot, AMA! 🤣 😂

Sort of counter intuitive, huh? You'd think with the insane hash power and difficulty you wouldn't see blocks go in a few seconds anymore or blocks take an hour but still happens with the same regularity. It is all relative. Yeah it's exponentially harder to find the block but also exponentially more hashpower. Shot pattern doesn't tighten.

I found 819556 had 37 to about 2 hours ago. It was probably a small pool that screwed up their tx selection logic. If it was the big pools playing games to clog the mempool and extract fees they would be doing it for a bunch of their blocks in a row. The miner did not embed an identifier so it it hard to say for sure.

Satoshi didn’t create Bitcoin.

He discovered Element 0 — the first and only monetary particle.

It has all the attributes of a perfect commodity:

Scarce like gold

Durable like metal

Immutable like time

But it fixes every flaw that let gold be captured by banks and governments.

✅ Zero weight

✅ No storage cost

✅ No borders

✅ No counterparty

✅ Teleports at the speed of light

✅ Supply: 21,000,000. Fixed. Forever.

Bitcoin didn’t emerge from economics.

It was unearthed from the raw fabric of information physics — like the electron of value.

Gold was corrupted. Fiat was printed.

But Bitcoin is incorruptible. Unstoppable. Untouchable.

This is the monetary Big Bang.

There is no “next Bitcoin.”

There is only before... and after.

Any idea what going on with price action. Got a little upsie downsie there after 4pm

Originally I was joking when I said that BTC rally will not resume until ETH/BTC crashes to new all-time lows. Now it is starting to make sense. ETH/BTC is circling the toilet bowl. Maybe when it hits ATLs all the dipshits will wake up and dump whatever value that is left in their shitcoins into BTC and start the next leg up. It would be nice to get rid of the trash once and for all.

Really no technical support stopping it from going down there. The get ready for the brown shit breakdown. Thats a new term i made up as the antonym for bluesky breakout.

Saylor, Saylor who can I turn to

(867-5309)

For the price of a dime I can always turn to you

(967-5309)

He could probably accomplish all he needs with 7.32 billion. Just a million market buy every half second from 11pm til 12.o1 AM

I called Saylor. Told him at 9pm 31 march put in a market buy on coinbase and buy the entire sell side of the book. Watch shorts get wrecked. Do it a gain at 10pm. At 11pm buy 1 million at market every half second for an hour and 1 min.

Pump the price to wherever it goes probably 5 to 10 million.

Then sit back and wait til MSTR earnings call when they report FASB accounting.

Market closes low end 5mil. MSTR reports earnings. $5mil x 500,000 BTC. $2.5 trillion quarterly profit and the world changes over night.

FASB (Financial Accounting Standards Board) recently changed its accounting rules for Bitcoin (BTC), which has major implications for companies holding BTC, like MicroStrategy (MSTR).

Old FASB Rules (Pre-2024)

BTC was classified as an intangible asset (like goodwill or trademarks).

Companies had to impair BTC holdings if the price dropped below purchase price, meaning they had to report a loss.

If BTC’s price went back up, they could not mark it up as a gain on the balance sheet—gains were only recognized when BTC was sold.

New FASB Rules (Starting 2024)

BTC is now treated as a fair value asset, meaning companies must mark it up or down every quarter based on market price.

Gains and losses from BTC price changes are reported in earnings—even if the company doesn’t sell.

Why This Matters for Earnings & Stock Prices

Companies like MicroStrategy (MSTR), Tesla, and Block will now report Bitcoin gains as earnings each quarter if BTC goes up.

Investors will see higher earnings on financial statements, which can attract more institutional investment.

MSTR, as a leveraged Bitcoin play, benefits massively because its stock value is closely tied to BTC price.

"For a Dude on NOSTR" Explanation

If someone on NOSTR is saying BTC going up "counts as earnings now," they mean that companies holding Bitcoin—like MicroStrategy—will report Bitcoin price increases as part of their official earnings instead of just an asset revaluation on the balance sheet. This change makes BTC gains more visible and impactful for stock valuations.